The encryption market in 2021 ushered in an epic carnival. BTC's strong breakthrough of 60,000 US dollars, the DeFi ecology and the cross-chain ecology represented by Polkadot have also performed brilliantly in the market. With many opportunities, asset management allocation has become the most important thing for investors.

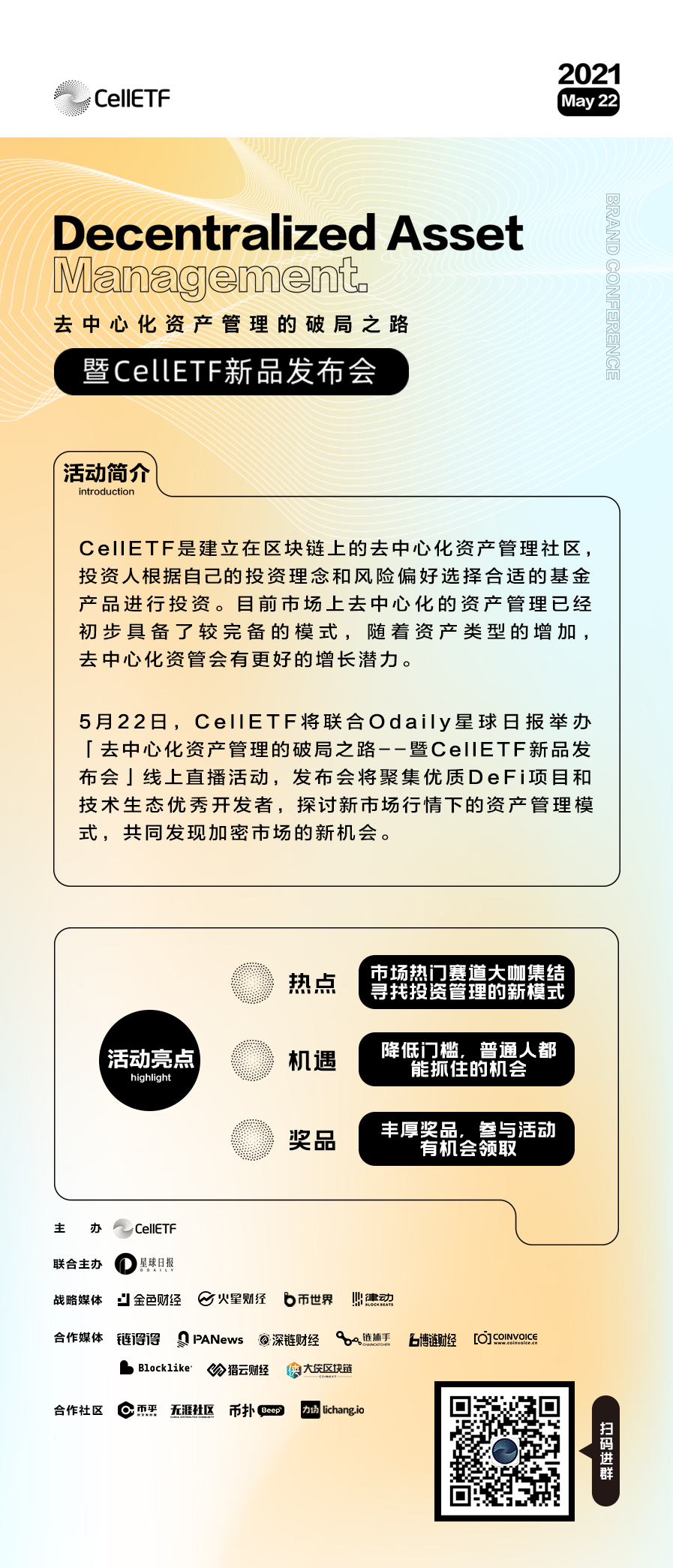

On May 22, CellETF and Odaily co-hosted"The Breakthrough of Decentralized Asset Management--CellETF New Product Launch Conference"secondary title

The road to breaking through decentralized asset management

Since the vigorous rise of the DeFi boom, we have witnessed great changes in the development of finance on the road to decentralization. DeFi applications represented by DEX, derivatives, lending, etc. have opened up a huge space in the encrypted financial market, but the decentralization of asset management However, it is far from reaching a development speed sufficient to match the market volume. With the continuous development of the market and the prosperity of the application ecology, decentralized asset management will become a field with great development potential.

CellETF is a decentralized asset management community built on the blockchain. CellETF team members and community members jointly build funds with various investment strategies. Investors choose appropriate fund products for investment according to their own investment philosophy and risk preference.

The investment research team and fund managers are all from European and American hedge funds and domestic top private equity fund teams. They have previously managed hundreds of millions of dollars in private equity funds in the traditional financial field. In addition to rich experience in traditional financial investment, they also have unique blockchain technology. investment logic.

At present, the mobile terminal can access CellETF through imToken wallet and Huobi wallet, while the PC terminal can access by connecting Metamask wallet.

At present, the mobile terminal can access CellETF through imToken wallet and Huobi wallet, while the PC terminal can access by connecting Metamask wallet.

Compared with the underlying financial facilities of decentralized finance, the CellETF fund management agreement belongs to the top-level DeFi Lego. The CellETF fund management agreement must first solve the investment problem of how investors enter the blockchain field, and then once the fund portfolio is configured with encrypted assets, the fund can use income aggregation agreements such as Yearn to enhance income, and at the same time take measures such as pledge , lending and liquidity mining and other strategies, and adjust strategies according to market changes.

Facing the ever-changing market, CellETF is constantly adjusting its own decentralized asset management business. In the future, the CellETF community can provide investors with a full asset portfolio including encrypted assets and traditional assets.

Follow the official account [CellETF Information], get 10,000 pizzas for free, and get eCell worth about [50U], join the live broadcast group and multiple benefits are waiting for you!