secondary title

Bitcoin Natural Law 1: Four Seasons

Bitcoin has four seasons like the earth, and its price is constantly changing from bull to bear with the cycle. According to historical data, the price of Bitcoin at the end of each cycle is ten times that of the previous cycle. Each cycle contains the 4 seasons we are familiar with:

A. A spring full of flowers and fruit

(2013, 2017, 2021)

(2014,2018,2022)

B. Summer of the Dead

C. The autumn of keeping a low profile and developing the foundation

(2011, 2015, 2019)

(2012, 2016, 2020)

secondary title

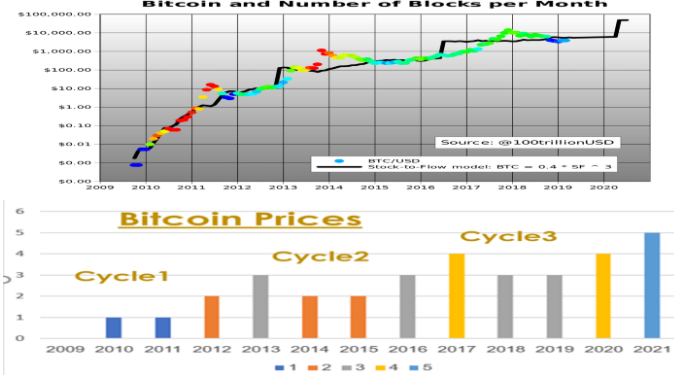

Bitcoin Natural Law 2: Supply and Demand

The famous PlanB model is mainly the S 2 F ratio of stock and flow. But what about Bitcoin supply and demand?

The supply and demand rules that apply to Bitcoin:

A. Metcalfe Criterion - The value of a single network is a quadratic function of the number of connections in the network = ~N²

B. Huber-Hettinga Criterion - The value of a single network is a function of the number of nodes in it.

C. West Criterion - Value of a Single Network as a Function of its Expansion Cost

D. Saab's rule - the value of a single network is a quartic function of the cost of connections in the network = ~N⁴

“It (Bitcoin) has the potential to form a positive positive feedback loop; as users increase, value rises, which may attract more users to take advantage of its growing value.” — Satoshi Nakamoto (Bitcoin white paper author).

secondary title

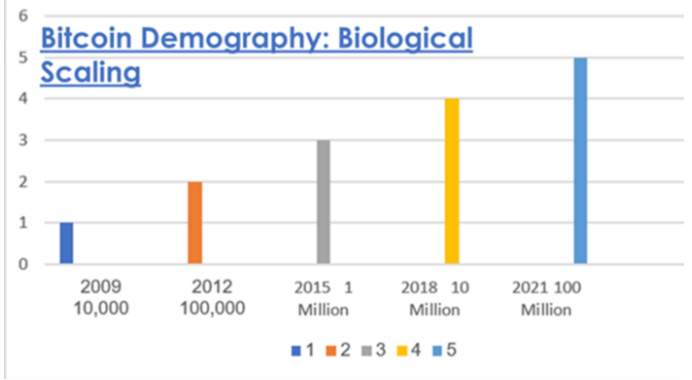

Bitcoin Natural Law Three: Growth

2013〜1,200 $

2017〜20,000 $

2021〜320,000 $

easy to understand.

secondary title

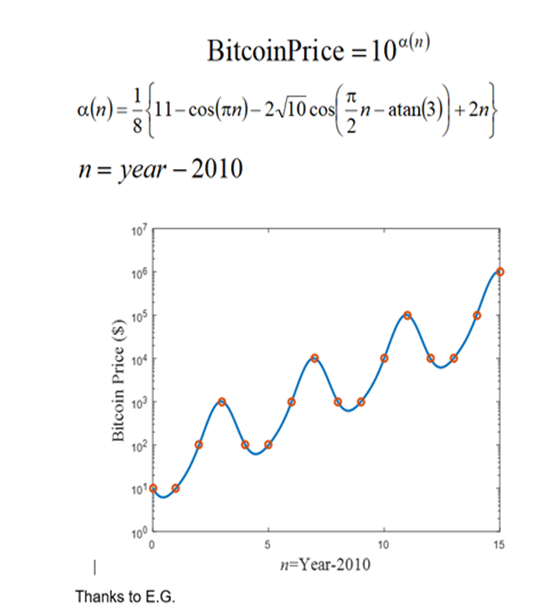

Bitcoin Natural Law Four: Cycle Value

Bitcoin's blockchain is the longest and oldest proof-of-work blockchain in the world, its value is still untapped, it has a lot of potential, let us believe in the power of time.

risk warning:

risk warning:

The above opinions are only personal opinions, not as investment advice

Mining for Alpha