The explosion of DeFi has brought about a brand new competition landscape for public chains.

After going through the early stage of valuation based on imagination alone, the development of the ecology has become the first indicator to judge the value of the public chain network. The success of the Ethereum DeFi ecosystem has given all the new generation of public chains a textbook example. While trying to open up interoperability with Ethereum and undertake the value overflow of the former ecosystem, the latecomers are also actively implementing various incentives. Cultivate your own ecology.

However, whether it is welcoming project migration from other ecologies, or supporting the development of their own ecological projects, what most of the new generation of public chains are doing at the level of ecological construction at this stage is still copying Ethereum, that is, building a chain native to the encrypted world upper ecosystem.

Although under the support of higher performance, there is also infinite room for imagination based on the prosperity of the new bottom layer, but it has to be admitted that the number of players who have embarked on this road is not a small number and is still growing, and many of them have solid team skills , Star projects with strong capital background, the competition is becoming increasingly fierce.

secondary title

Algorand in another way

Algorand is a public chain project initiated in 2017 by MIT professor and Turing Award winner Professor Silvio Micali. In June 2019, Algorand officially launched its main network. With the support of top-level academic background and creative token issuance model (Algorand is the first project to introduce the Dutch auction mechanism into the mainstream vision of the currency circle), Algorand once became the market of that summer The hottest item.

However, since then Algorand seems to have entered a "relative dormant period" that lasted nearly two years, and the market volume has gradually weakened compared to the beginning of the mainnet launch. As the public chain competition is entering a new chapter, with curiosity about what Algorand is doing now and what it will do in the future, Odaily contacted Summer Miao, head of the Asia-Pacific community of the Algorand Foundation. It was through Summer's introduction that we realized , Different from the “inward growth” of other public chains, Algorand chose to move towards a completely different “outward growth” path.

Before talking about the direction, it is necessary to determine the starting point of Algorand - since its inception, Algorand has been positioned as a "financial public chain", but the meaning of "finance" here is not limited to the current major public chains that are competing to deploy "DeFi" (Decentralized Finance). In the official roadmap, Algorand created a broader term FutureFi (future finance) for its vision. Specifically, what Algorand wants to do is to link the blockchain and the traditional world and promote the mainstream of blockchain technology Adoption, and finally build a next-generation financial public chain that can serve the real business world.

Looking back at the development work records of Algorand in the past two years, it can be seen that the project has been steadily advancing towards the vision of FutureFi. Now, with the completion of the necessary infrastructure construction such as smart contract functions, Algorand has gradually stepped out footsteps.

Summer said that Algorand currently has more than 750 partners on the chain, and the use cases cover securities issuance, international financial derivatives, financial stable coins, real estate, decentralized exchanges, copyright management and even national digital currency applications and other aspects. Below, some typical examples are given.

At the end of March, the Italian Association of Authors and Editors SIAE (Società Italiana degli Autori ed Editori), founded in 1883, chose to manage the rights of more than 95,000 authors in the form of NFT based on Algorand.

In early April, global real estate equity marketplace Vesta Equity announced that it would use the Algorand blockchain as the basis for its modern solutions for residential real estate financing. Vesta will leverage Algorand to build tools and marketplaces that connect real estate investors and homeowners directly, eliminating middlemen and enabling seamless transactions.

In late April, Simetria, the Israeli digital securities exchange that is about to pass regulatory approval, announced a partnership with Algorand. Simetria hopes to leverage Algorand's blockchain technology to revolutionize market infrastructure through its innovative digital stock exchange.

In early May, Yieldly, a DeFi project on the Algorand chain, announced that it will launch the first IDO on the Algorand chain on the TrustSwap platform. Yieldly has targeted an initial user base of 15 million and has begun onboarding Algorand wallet partners with 6 million users. They have also signed cooperation agreements with game publishers and e-sports agencies, and will provide products to more than 9 million users.

As for the national digital currency use case mentioned earlier - the first government-backed Marshall Islands digital currency, SOV, will be issued based on Algorand technology. In order to get rid of the control of the US dollar and strive for economic sovereignty and independence, the Marshall Islands has long begun to explore the issuance of sovereign cryptocurrencies. After long-term research and exploration, the Marshall Islands has taken a fancy to Algorand's high speed, scalability, security, compliance capabilities, and the transaction finality required by the national digital currency. In the future, SOV will circulate in the country together with the US dollar.

……

There are still many cases of internal and external links like this, and they have exploded intensively in the past two or three months. It can be seen that the FutureFi advocated by Algorand is not just talk.

The currency circle is in the craziest bull market in the history of the industry, and the total market capitalization of the cryptocurrency market has also exceeded the $2 trillion mark for the first time in this round of bull market. Compared with the traditional financial world, this number is obviously too small. If the previous comparison target is replaced by DeFi, the gap will be even greater.

There was such a piece of news last month that the total value of assets locked in DeFi protocols on major public chains exceeded the $100 billion mark for the first time, but the $100 billion volume is only equivalent to the 40th largest bank in the United States (ranked by assets) ), between Silicon Valley Bank ($97 billion in assets) and BBVA USA ($103 billion in assets).

secondary title

What are the advantages of Algorand in undertaking the trillion-dollar traditional financial world?

Wanting to take over the trillion-dollar traditional financial world is easy to say, but not easy to do. Now that Algorand can see this road and has made certain achievements, other competitors will naturally not turn a blind eye. So where is Algorand's competitive advantage?

After further discussions with Summer, we have tentative answers to this question. Taken together, the advantages of Algorand can be roughly summarized in the following four dimensions:

Advantage 1: different teams

The founder of Algorand is Professor Silvio Micali, a professor at MIT and winner of the Turing Award. Under the leadership of Professor Silvio, Algorand has formed a core team with prominent members from academia and business circles. Among them, the current Algorand consultantPaul MilgromOn October 12 last year, he won the Nobel Prize in Economics for his improvement of auction theory and innovation of auction form.

Sitting on strong academic and traditional industry resources, Algorand has credibility and influence that other projects in the traditional financial world cannot match, which has become one of the unique advantages of Algorand's outward development.

Advantage 2: Balance of performance and decentralization

Serving real business use cases has long been the long-cherished wish of all public chains, but due to performance limitations, the current relatively mature public chain systems are still unable to support this vision well for the time being.

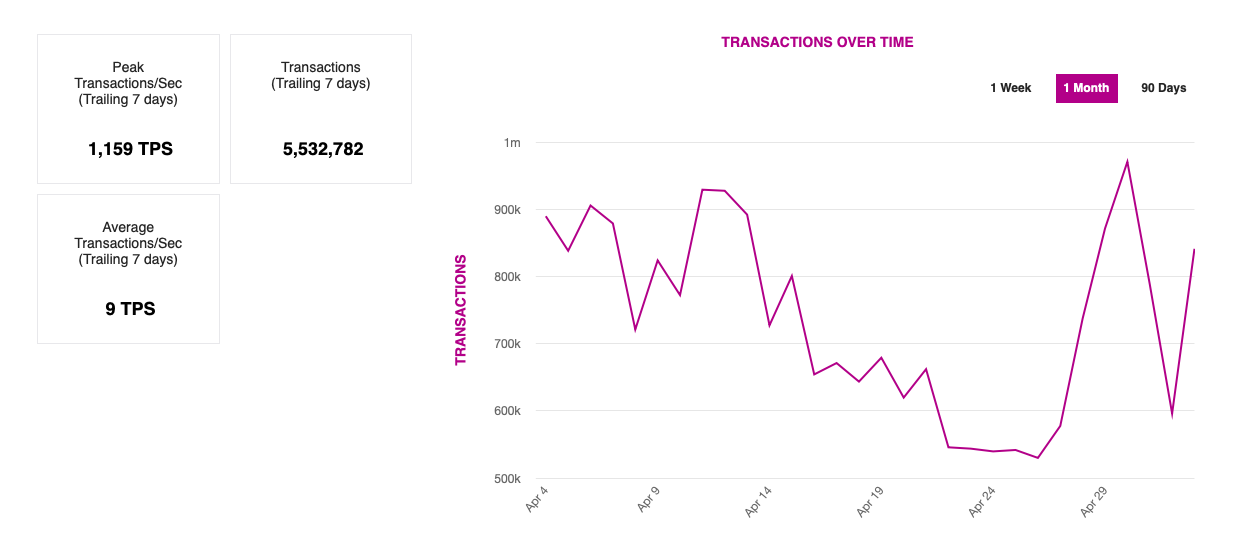

Like most new-generation public chains, Algorand has significantly improved performance compared with old public chains such as Bitcoin and Ethereum.Algorand MetricsThe data shows that the current real-time TPS of the Algorand network can reach 1159. Performance optimization is still ongoing. Professor Silvio said in December last year that Algorand's block confirmation time will be shortened from 4.5 seconds to 2.5 seconds in 2021, and the final TPS will also increase from 1,000 to 46,000.

Just looking at performance cannot fully demonstrate the advantages of Algorand in the new generation of public chains. It should be noted that one of the core demands of finance is security, which imposes strict decentralization requirements on the public chains designed to carry the future financial industry. At present, although some public chains on the market have excellent performance, they belong to the Proof-of-Authority (PoA) mechanism with centralized disputes in terms of consensus. This type of public chain is still normal when the network carrying value is limited. However, when the value carried by the network exceeds the network governance token itself, the risk of nodes doing evil will be greatly increased.

Algorand achieves a good balance between decentralization and high performance. By introducing a verifiable random function (VRF), Algorand aims at the "impossible triangle" of the blockchain (performance, decentralization, security, etc.). trade-offs) propose their ownproblem solving ideas。

Decentralized Governance ProposalDecentralized Governance Proposal, plans to transfer the decision-making power of the remaining ecological resources currently entrusted to the foundation (a total of 3.2 billion ALGO) to the community. As the deployment of this proposal moves forward, the future of the Algorand ecosystem will be fully entrusted to participants committed to the Algorand network and its vision.

Advantage 3: Network design adapted to the needs of the financial industry

This advantage is perhaps the most unique highlight of Algorand compared to other public chains.

Algorand, which is positioned as a "financial public chain", has been regularly upgrading its protocol according to changes in the industry's needs since the launch of its own network. After two years of iterative adjustments, it can be said that the current Algorand is far more advanced than other competitors in many details Adapt to the financial industry.

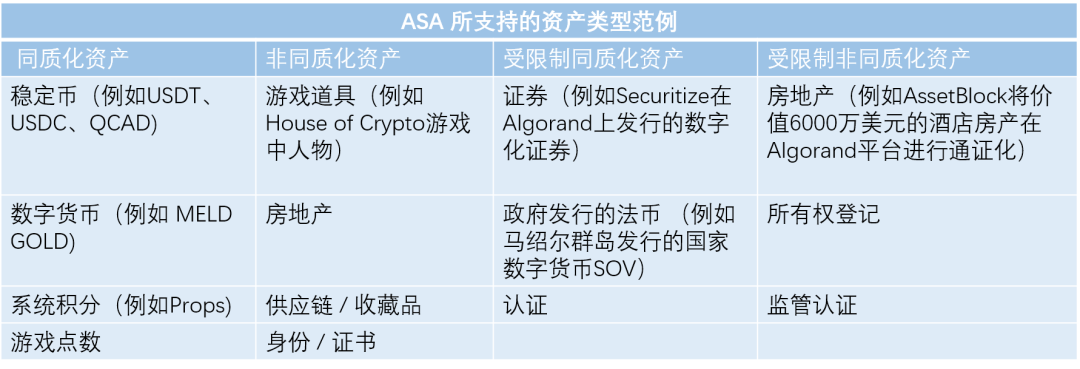

To illustrate with a typical example, similar to Ethereum’s ERC 20 standard, developers in the Algorand ecosystem can also easily issue common tokens (FTs) or non-homogeneous tokens following the Algorand Standard Asset (ASA) (NFTs). The difference is that considering that the traditional financial industry often has higher compliance requirements, Algorand allows developers to set a restricted mode when issuing tokens, thereby helping projects comply with regulatory requirements and achieve compliant issuance.

The so-called restricted mode tokens refer to tokens that can only be sent to specific accounts in the Algorand network. The restrictions can depend on geographic location, specific groups, or other parameters. For projects that intend to issue security tokens, legal digital currencies, or regional real estate NFTs based on Algorand, the restricted model will be very useful.

Advantage 4: Ecological support

The focus of public chain competition is leaning toward ecology, and Algorand has long noticed this trend.

In April last year, in order to reward those Algorand-based application development projects, Algorand announced the launch of a "development incentive plan" with a total amount of up to 250 million ALGOs. Based on the current market price of $1.5, the total value of this incentive plan will be as high as 3.7 One hundred million U.S. dollars. As of this writing, Algorand's development incentive program has completed 137 grants.

As the popularity of NFT continues to rise in recent days, Algorand has reached a cooperation with the investment institution Borderless Capital to launch a $10 million fund for the NFT field.aNFT.FundEcological Development Fund.

In addition to financial support, Algorand has also given strong support to the project side in terms of development tools. Taking contract development as an example, Algorand's partner Reach provides a high-level smart contract language and a dedicated compiler for project parties wishing to enter the ecosystem, which is said to significantly lower the barriers to development based on Algorand. Previously, Reach introduced DEX Balancer, the head of the Ethereum ecosystem, into the Algorand ecosystem as the first batch of users of the language.

secondary title

Refuse to roll in, sail to a new blue ocean

"Whether the public chain track has entered the Red Sea stage", along with the evolution of the focus of track competition, this question has been frequently mentioned by the market recently. Before wrapping up our chat with Summer, we asked Summer about this one last time.

Summer’s answer is that compared to a few years ago, the old public chains are now leading the way, and the emerging public chains are emerging one after another. From this perspective, it does look like the Red Sea. However, if you take a closer look at it, you can find that the public chain track has entered a more pragmatic ecological and application development stage, and there are many subdivided tracks in this stage. Take the financial field where Algorand is located as an example. In fact, there is still a huge potential space to be tapped in the field. From this perspective, the public chain track can be said to be still a blue ocean.

As Summer said, when the competition of public chains entered a new stage, Algorand did not continue to cling to the inside of the encryption world like other public chains, but turned its attention to external financial markets with greater potential space and relatively less competition. world.

Towards this new blue ocean, Algorand has set sail.