With its established and powerful ecological empire, Ethereum stands out in the blockchain world. Recently, Bitcoin, which took over from Bitcoin, stepped on the accelerator and soared, and the price even hit a new high, and the entire currency circle was crazy about it.

According to non-small data, as of 17:00 on May 9, Ethereum hit a peak of $3,982, an increase of 433% this year, far exceeding the 106% increase of Bitcoin during the same period.

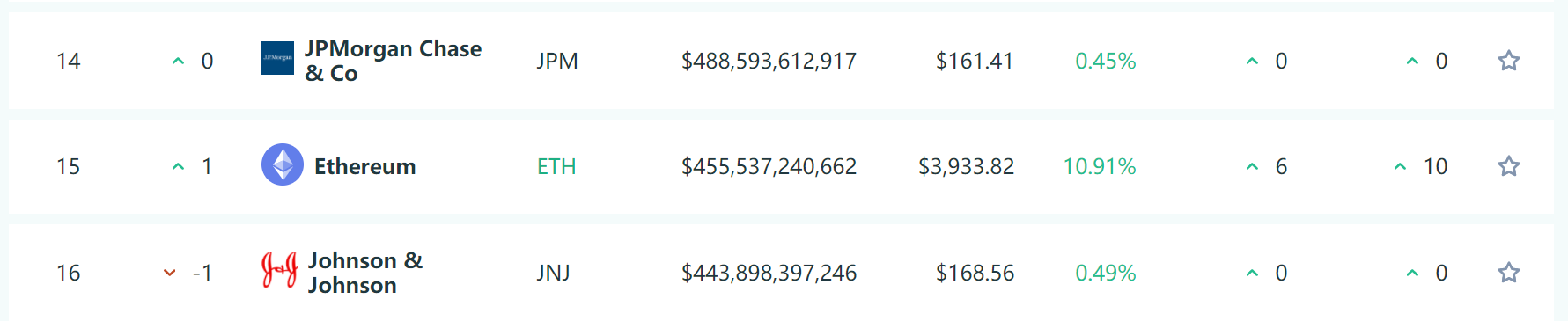

As the price of Ethereum continues to rise, its market value has also increased significantly. According to Asset Dash data, the current price of Ethereum is 3930 US dollars, and the current market value is about 455.5 billion US dollars. The global asset market value ranks 15th, surpassing Johnson & Johnson.

At the same time, as the world's largest Bitcoin investment fund, Grayscale is regarded by investors in the secondary market as a benchmark for crypto asset investment. Since the current bull market, its holdings of Ethereum have continued to increase. As of May 6, Grayscale announced that the total value of encrypted assets under its management has reached nearly 52 billion US dollars. In addition, according to Grayscale’s official Twitter, it currently holds more than 3 million Ethereum, worth more than $11 billion.

secondary title

Ethereum steps on the gas pedal and soars

As the second largest encrypted asset by market value, Ethereum has performed well in the encrypted asset market recently, which can be described as both fame and fortune.

According to Google Trends data, from May 3rd to 8th, the global search popularity of the keyword "Ethereum" broke through the level at the beginning of 2018, hitting a record high, and the search trend popularity reached 100. It is worth noting that the Google Trends popularity score represents the search popularity compared to the highest point in the specified area and within the specified time, and 100 means the highest popularity. This shows the heat of the market.

In the big correction from April 14th to 25th, Bitcoin fell from $64,800 to $47,000, a drop of more than 27%, and many altcoins were cut in half. On the other hand, Ethereum not only has a small decline but also hits new highs repeatedly, which can be described as a double sky of ice and fire.

Specifically, on April 18, Ethereum began to attack from a low of $1,940, and reached a peak of $3,982 on May 9, a maximum increase of more than 105% from the lowest point on April 18. During the same period, the lowest point of Bitcoin occurred on April 25, which was $47,000, and it rose to $59,488 on May 9, with a maximum increase of 26%.

An industry analyst believes that the strong rise in the price of Ethereum is both unexpected and reasonable. According to Santiment data, since January this year, the number of Ethereum giant whales has been surging, and the number of users with more than 10,000 Ethereum has also reached a record high. On April 26, the number of wallets holding more than 10,000 Ethereum reached 1,311.

"Recently, investors have been buying Ethereum at low prices." A senior player in the currency circle said that in the face of the astonishing rise, Ethereum has successfully captured the "hearts" of many investors.

Recently, Mark Cuban, owner of the NBA Dallas Mavericks, spoke at the Ethereal Virtual Summit, saying that the current bear market for encrypted assets has not yet come, and due to the hot DeFi market, encrypted assets will still maintain an upward trend. He also believes that the future potential of Ethereum is greater than that of Bitcoin, because Ethereum has more application scenarios than Bitcoin, and the Bitcoin derivatives market is too large, which will be a high-risk hidden danger when the price falls back.

On April 23, Jiang Zhuoer, CEO of LeBit Mining Pool, posted on his Weibo that Bitcoin represents "currency freedom", while Ethereum represents "currency freedom + contract freedom". He believes that, except for economic behaviors involving entities, a large number of economic behaviors are equal to "currency + contract", especially financial behaviors. From ICO to DeFi to NFT, Ethereum has derived a large number of innovations in history, and will continue to develop more innovations in the future. In Jiang Zhuoer's view, "currency freedom + contract freedom" can derive all things.

secondary title

Ecological value identity or already formed

"In the context of Ethereum's continuous record highs, it is leading a group of encrypted assets to the climax of the bull market." Analyst Tina said that Ethereum took over Bitcoin and continued the bull market, which brought surprises to the encryption market.

It has to be said that Ethereum seems to be under the spotlight at present, which is too eye-catching.

A few days ago, Fred Wilson, an investor of well-known Internet companies such as Twitter and co-founder of Union Square Fund, said that in the past twelve years, the vast majority of encrypted blockchain networks were mainly based on buying, holding, and speculation. The supply side of the blockchain network provides funding, but ethereum and some blockchain networks are changing the status quo, you need ethereum to do things on the ethereum network, such as buying domain names like me, P2P finance, buying art products, horse racing games, etc. The more people buy Ethereum, the faster the demand side will grow, and the value of Ethereum will become higher and higher.

However, he also reminded readers that there may also be a new wave of speculation now, but I think the demand side has taken off for now.

Not long ago, a report by JP Morgan recognized the value of Ethereum. Ethereum has significantly outperformed Bitcoin since early April, the report said. First, Ethereum’s liquidity is more elastic. Liquidity shocks in the encrypted derivatives market have caused huge liquidations. During the shocks, the Bitcoin futures market was far more affected than the Ethereum futures market. During the market recovery phase, the depth of Ethereum transactions recovered rapidly; secondly, the Ethereum spot turnover rate It is much higher than that of Bitcoin, which also means that the long position of Ethereum is more inclined to hold spot rather than futures and perpetual contracts; third, the transaction activity of the Ethereum network shows the abundance of activities on its chain, including continuous development DeFi and other fields in the ecology.

According to JPMorgan, there is a big difference between Ethereum and Bitcoin. Bitcoin is more of an encrypted commodity than a currency and is linked to gold as a store of value asset. Ethereum is the backbone of the cryptocurrency eco-economy and acts as a medium of exchange in the ecology.

In an interview with the media, William, the chief researcher of the OKEx Research Institute, attributed the skyrocketing Ethereum to two points.

First, the blockchain network is different from ordinary networks. The encrypted digital tokens issued by the blockchain network protocol layer are the basis for the normal operation of all distributed applications, and are used as Gas fuel fees, collateral, investment and financing, etc. Taking DeFi as an example, since the eruption in June last year, the amount of Ethereum locked in DeFi protocols has grown exponentially, and the prosperity of DeFi has directly driven the market demand for Ethereum, thereby driving up its price.

It is worth mentioning that a few days ago, a paper published by the Federal Reserve Bank of St. Louis in the United States conducted an in-depth study of the expansion of DeFi and its role in Ethereum. The article believes that DeFi may lead to a paradigm shift in the financial industry and may help to establish a more robust, open and transparent financial infrastructure.

secondary title

Technological evolution has become a key factor in the counterattack

In view of Ethereum getting rid of Bitcoin and stepping out of the independent market, industry insiders believe that this indicates that the ecology on Ethereum has matured, and its own currency price has formed a resonance with the development of the ecology.

In the face of the soaring price of Ethereum, some fans said that the market value of Ethereum has been ranked second for a long time, but Ethereum has a more ambitious goal of becoming the supporting platform and underlying structure of the entire encryption world. Therefore, its market value surpasses Bitcoin. possible.

Opponent Canadian businessman and TV personality Kevin O'Leary said in an interview with CNBC that Ethereum will always be second to Bitcoin despite its all-time high price. O'Leary said ethereum is more likely to be used as a "tracking and payment system," but it's currently too expensive. He also added, “Bitcoin will always be gold and Ethereum will always be silver.”

In fact, as a public blockchain platform for "cryptocurrency and decentralized applications", the Ethereum smart contract function has greatly changed the blockchain world. It allows anyone to build and use blockchain technology based on Ethereum. running decentralized applications.

In the long run, Ethereum 2.0 will gradually solve transaction congestion and high transaction fees, and the currency issuance mechanism will lead to deflation. However, there is still a long way to go to fully realize the overall plan of the Ethereum 2.0 roadmap.

"Right now, the Ethereum 1.0 and Ethereum 2.0 beacon chains are in a parallel state, and the interaction can only be to deposit 32 Ethereum in the pledge contract. Up to now, there have been more than 100,000 verifiers. These 100,000 verifiers A new consensus on POS is being formed." Yao Xiang, the initiator of the Shanghai Frontier Technology Symposium, said in an event that the Berlin hard fork introduced a new EIP in April, and the London hard fork will be ushered in in July. Shanghai hard fork. The Ethereum core team is considering merging Ethereum 1.0 and Ethereum 2.0 in the Shanghai hard fork. At present, the Ethereum core team is mainly focusing on the merger of Ethereum 1.0 and Ethereum 2.0.

Last month, the founder of Ethereum "V God" (Vitalik Buterin) said in a speech on the transfer of the Ethereum consensus mechanism to PoS that as the merger approaches, the roadmap has become more pragmatic in many ways, and people expect The long-awaited upgrade is "optimistically estimated" to be completed by the end of this year.

However, according to Wu said blockchain reports, industry veterans generally believe that the procrastination style of Ethereum developers makes it impossible to end POW by the end of the year and complete the conversion to POS. Previously, the industry generally believed that the conversion would take place from the middle to the end of 2022 at the earliest.

It is worth mentioning that under the PoS consensus mechanism, the time for the Ethereum network to generate a block is reduced to 12 seconds, and the average waiting time for sending a transaction will be reduced to 6 seconds. Industry analysts believe that the design of the PoS light client protocol is more sophisticated, which makes the browser built-in light client and the mobile PoS light client wallet more feasible, reducing the dependence on centralized service providers.

Earlier, Ethereum protocol researcher Justin Drake introduced the concept of Ethereum 3.0, which will be an important plan for Ethereum to resist the threat of quantum computing.

It is undeniable that Ethereum is currently one of the most dazzling wealth-creation machines in the global encrypted assets, and on the way to gradually realize Ethereum 2.0, it will take time to test whether this myth of wealth creation can continue.