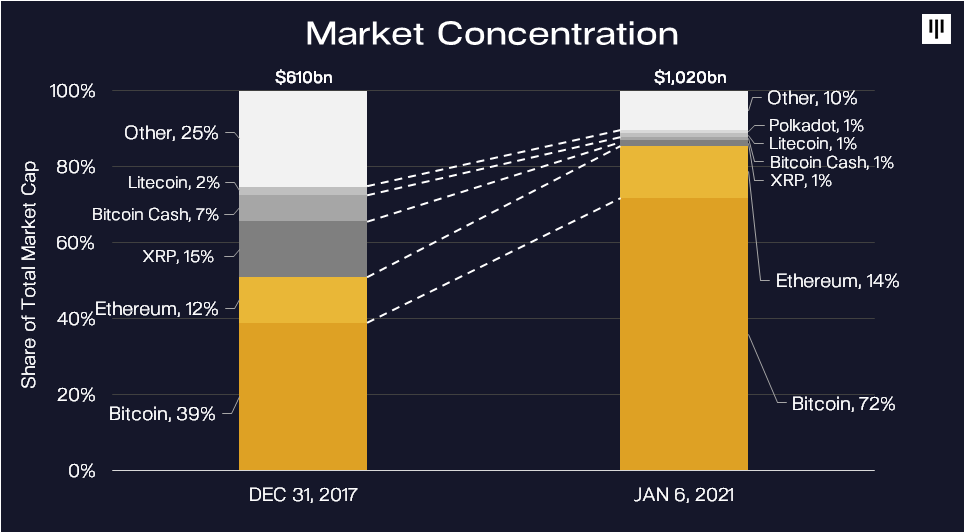

image description

secondary title

bitcoin

secondary title

Ethereum

Bitcoin is unique, it belongs to another world, and a bridge is needed between it and the real world, and this bridge is Ethereum. Ethereum is still an undervalued digital asset because we don't know how much money in the real world will pour into the other world this year. The launch of Ethereum is a watershed in the financial field. Bitcoin is digital gold, but Ethereum is a financial technology. Decentralized exchange funds on Ethereum have grown by more than 100 times in the last year. Ethereum now has higher daily transaction fees than Bitcoin. On top of that, Ethereum is used as collateral in many DeFi applications. As the bull market continues, it should come as no surprise that people will be exchanging some of their Bitcoin earnings for Ethereum. Additionally, the launch of CME Ethereum futures legitimizes Ethereum as an asset that institutional investors can own, effectively an asset allocation option for them. As more and more holders stake their ETH in Ethereum 2.0, the selling pressure on ETH has decreased. What will the price of Ethereum be in the future? let us wait and see.

secondary title

Dogecoin Ascension

Is Dogecoin a joke? Is the dollar a joke? Is retail investors beating Wall Street a joke?

The anxiety and anger brought by the epidemic to foreigners reached its peak at the end of 2020 and early 2021. This emotion was fully conveyed to Dogecoin. Many foreigners use up to 100 times or even 200 times leverage on Bitmex or other exchanges to save their lives. Being long on doge has made Dogecoin, a garbage coin that often loses chains even when transferring money, has become the protagonist of this year. If this sentiment continues to be successfully exploited by the market, then the market value of Dogecoin may reach the top three this year, becoming second only to The third largest cryptocurrency of Bitcoin and Ethereum, as V God and Martian Musk's favorite meme (cultural mystery) encrypted digital currency, when Dogecoin meets YOLO in 2021, it is a unique existence.

secondary title

DASH,ZEC,XRP,EOS,LTC,BCH,Mana. . . . These old currencies that survived the last round all have a common feature, which is that they cannot break through the previous high. Usually you find in the late stages of a bull market that these coins have wiped out the founders. Of course those with a heart know the meaning of picking up leaks, even if they return to zero, they have to bounce back in the blockchain tide and splash a small wave. But the waves don't change the world, they look beautiful and disappear quickly. Existence is reasonable, let's call them Exsting shit coins for now, don't think too much, it's really just waves~

secondary title

There is no free lunch in the world, even for professionals and programmers, the code loopholes and financial compliance issues of various Defi pools will always exist. After the ICO in 2017, P2P players seem to have found a more concealed and safe means of arbitrage. The continuous increase of TVL (network lock value) is a good thing for Ethereum and XXswap, but I am more curious The question is whether these players will exit en masse if the Fed’s balance sheet no longer grows, triggering a market crash. Right now, we are in the midst of a bull market and the question on many minds is: "When should I get out of the market?" If the Fed sends a strong and clear signal of raising rates and shrinking its balance sheet, then it will be clear when to get out of the carnival up. But as far as the current situation is concerned, raising interest rates means further economic regression, and no one wants to take this risk right away.

secondary title

Technology stocks have performed well, but they will always be a thorn in the side of the US government and a thorn in their flesh. Imposing heavy taxes on the rich in technology stocks is just an appetizer. In the future, the Fed’s credit policy will not support technology stocks. This is the biggest worry of the founders of technology stocks. Technology stocks must be watertight. All in all, any future monetary policy of the US government can be translated into one sentence: Amazon, Tesla, Google, Apple, you are already rich, go away. Will we see Google and Apple adding Bitcoin to their balance sheets in the future? Maybe that day won't be far away.

secondary title

risk warning:

risk warning:

The above opinions are only personal opinions, not as investment advice

The above opinions are only personal opinions, not as investment advice

Mining for Alpha