This article comes fromMediumThis article comes from

, the original author: YIELD App, compiled by Odaily translator Katie Ku.

In a space that has only grown significantly in the past 12 months, it is almost inopportune to announce a new feature in DeFi that is completely game-changing.

From liquidity supply to Layer 2 expansion, and the new basic situation of NFT, it can be said that V3 has changed a lot.

secondary title

The Evolutionary Journey of the Pioneers

The V2 launch in May 2020 cemented Uniswap’s position as the leading DEX and contributed to the huge growth of DeFi this summer. V2 introduces the now popular user-led liquidity model, allowing platform users to deposit ERC-20 tokens into liquidity pools to earn transaction fees and liquidity provider (LPs) tokens with further utility. In turn, these pools provide liquidity for transactions, enabling the entire platform to operate without market makers or order books.

secondary title

Customized Efficient Liquidity

Uniswap now accounts for about 20% of the DEX market, with a recent daily trading volume exceeding $2 billion. However, Uniswap is not satisfied with its current achievements. It has created V3, which is more impactful than previous iterations, pushing automatic market makers in a new direction, while solving many of their most current problems. Outstanding issues.

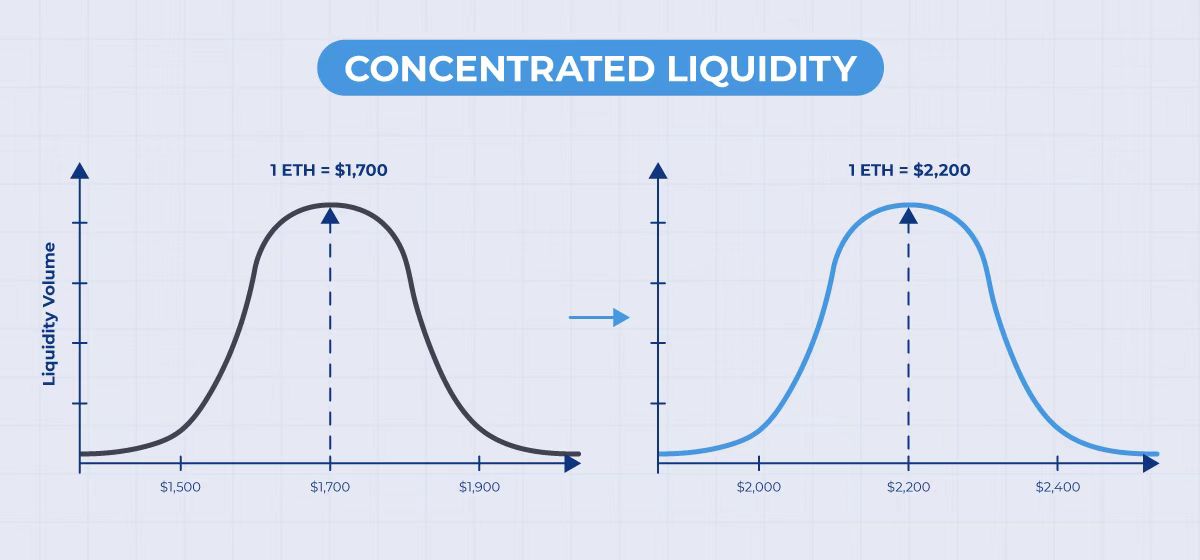

The first is what V3 calls "centralized liquidity". Centralized liquidity allows liquidity providers (LPs) to choose exactly the price range at which they want to provide liquidity, rather than systematically spreading assets across one pool, across all possible price ranges. This in turn creates a sort of CEX-like order book, while also limiting the much-feared increased risk of temporary losses. V3 is not an order book model. V3 introduces a "price scale" (tick) for automatic market makers. Liquidity providers can deploy assets in different price ranges according to market conditions, and this will not change the automatic market maker at all. The mode of operation of market makers.

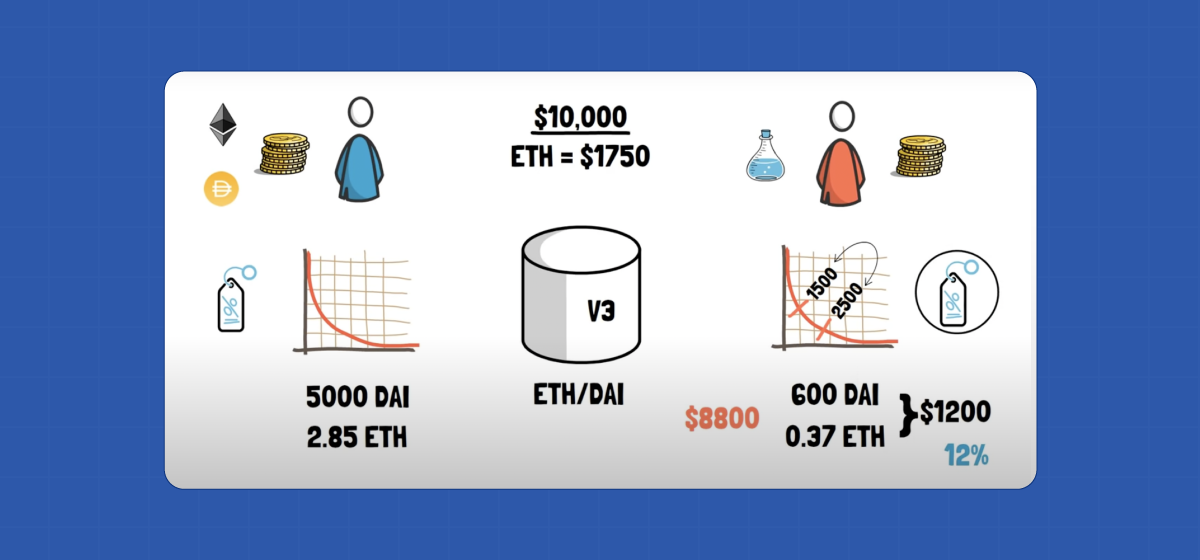

The image below is taken from Finetmatics’ video on Uniswap V3, showing how it works in V2 and V3 ETH-DAI liquidity pools.

secondary title

less loss, more opportunity

Other user-friendly features of V3 will give liquidity providers the option to deploy their funds across multiple fee ranges from a pool, allowing them to take advantage of multiple pricing opportunities. They can also choose their fee level, from 0.05% for building markets for less volatile assets like stablecoins, to 1% for less common trading pairs.

secondary title

complex market making

Importantly, all of these operations can use one of the main innovations of DeFi, namely NFT. Instead of being distributed as fungible ERC-20 tokens by liquidity provider positions, they will be represented by non-fungible ERC-721 tokens. This will also help expand the potential for advanced market-making strategies in V3, as well as increase secondary trading opportunities.

secondary title

Bringing DeFi into the Mainstream

The last of the major innovations of V3 is the release on the Layer 2 protocol Optimisim after V3 is planned to be deployed (expected in July 2021). While the development team says that lower gas fees will be a sign of the innovation that V3 will bring, moving to a nearly free Layer 2 protocol will really change the pricing game for DEXs.

While Layer 2 protocols like Polygon/Matic, xDai, and Loopring have been getting a lot of attention lately, moving one of DeFi’s largest and best-known exchanges to Layer 2 could give the movement a big boost. This, in turn, could scale Ethereum and thus the DeFi ecosystem exponentially, allowing a new wave of scale and innovation to emerge that could truly begin to pose a threat to traditional finance.

Within the cryptocurrency space, the incredible capital efficiencies that V3 will bring should significantly reduce transaction slippage, which will pave the way for execution times that some large centralized exchanges will compete with. Combined with the ability to set range limit orders, this could prompt some movement between the cryptocurrency's two largest market segments.

All of these factors can make V3 a disruptive force that can not only change the way DeFi works, but also the shape and direction of the entire cryptocurrency industry.https://www.odaily.com/post/5166120

The market is changing, and you are welcome to refer to our previous Uniswap V3 articles: