On April 28, the "Vitality 2021-Blockchain Ecological Industry Cloud Summit" hosted by Odaily was successfully held. This Cloud Summit invites blockchain industry leaders, representatives of high-quality enterprises, leading guests in the mining industry, and top project parties to discuss industry changes, link technology applications, and explore a richer imagination in the encrypted world.(Click here to access video replay)

In the afternoon session of the summit, Nigel, head of Perpetual China, made a keynote sharing. He said: The average daily transaction volume of the perpetual agreement platform has firmly occupied the top five positions in the Ethereum ecosystem. Looking back at the transaction volume in the past 7 days, it is found that the transaction volume of the platform in just one week exceeded 1 billion US dollars, which is equivalent to one-sixth of the transaction volume in the past three months. Yesterday, the transaction volume of the platform was 120 million. If we put our data into the protocol transaction volume ranking on Ethereum, Perpetual has become the fifth place after Uniswap, Curve, Sushiswap and 1inch. Therefore, a trend began to become clear—on-chain derivatives agreements began to challenge the market share of spot trading agreements. I personally think that the Perpetual protocol is currently in the first echelon of the derivatives track in terms of product strength and data performance. In addition, Perpetual Protocol is developing the V2 version, which will greatly enhance the trading experience.

The following is the full text of Nigel’s sharing, organized by Odaily:

Hello everyone, I am Nigel, the head of the Perpetual Protocol in China. I am very happy to come to the Odaily2021 vitality event today. I will explain the basic mechanism and latest progress of the Perpetual Protocol to you.

Perpetual Protocol is a decentralized perpetual contract derivatives agreement on the chain. It launched the main network on December 15 last year. This project was launched at the end of 2019 and early 2020. In the half a year before the launch, we have received help from many institutions, media and friends from all walks of life. Our investment institutions include Binance Labs, Three Arrows Capital, CMS, Alameda Research and Multicoin Capital, etc. Our cooperative institutions include Delphi Digital and Jump Trading wait.

Perpetual Protocol is a protocol that runs on the xDAI sidechain. The reason why we chose Up star as the sidechain we deployed before the launch was that we had already felt that the network fee of the entire Ethereum was going to rise, so We deploy it on xDai, because the transaction speed of xDAI is relatively fast, and its network fee is relatively low, so users only need to pay the transaction fee to the Perpetual perpetual transaction itself, without paying the network fee. Because the network fee is paid by us for the user.

On the perpetual agreement exchange, you can set up a leverage of up to 10 times to trade any assets and targets. When we ran the testnet last summer, we received a lot of attention from the media and various institutions, and many friends helped us do research write an essay. Because we were the first to introduce the AMM mechanism into derivatives and created the VAMM mechanism, many derivatives on the chain are now using the AMM derivative mechanism. We are a VAMM mechanism, and its biggest advantage is that no real path is required, and all liquidity is virtual.

After going online, BSC gave us great support and issued BEP-20 PERP on BSC. Next, we will use this advantage to cooperate with the top DeFi protocols on BSC, including Swap lending and other protocols, to make BEP-20 PERP 20 PERP Token produces better combination. The Graph is also an important partner of ours. Through them, data indexing work, such as the opening data, liquidation data and closing position data of the entire platform history, can be queried through this graph platform, which provides a lot of convenience for developers.

Chainlink is also our very good partner, providing index price quotations for our platform, because any asset needs to be traded with two prices, one is the index price, which comes from the original reserve price. The other is the marked price, which is the price generated by the asset on the platform through the user's real transaction. We will calculate a funding rate based on the difference between the index price and the mark price. In the final result, users with more positions need to pay funding fees to users with fewer total positions. For example, at the time of settlement every hour, in ETH There are more than 1 million orders and 900,000 empty orders in the market, and the more than 1 million orders need to pay a certain funding rate to the 900,000 empty orders. For the specific method of funding rate, you can go to our document page to check it.

Nexus Mutal is our insurance partner. When using the perpetual contract, everyone can actively purchase insurance to protect their assets in the warehouse.

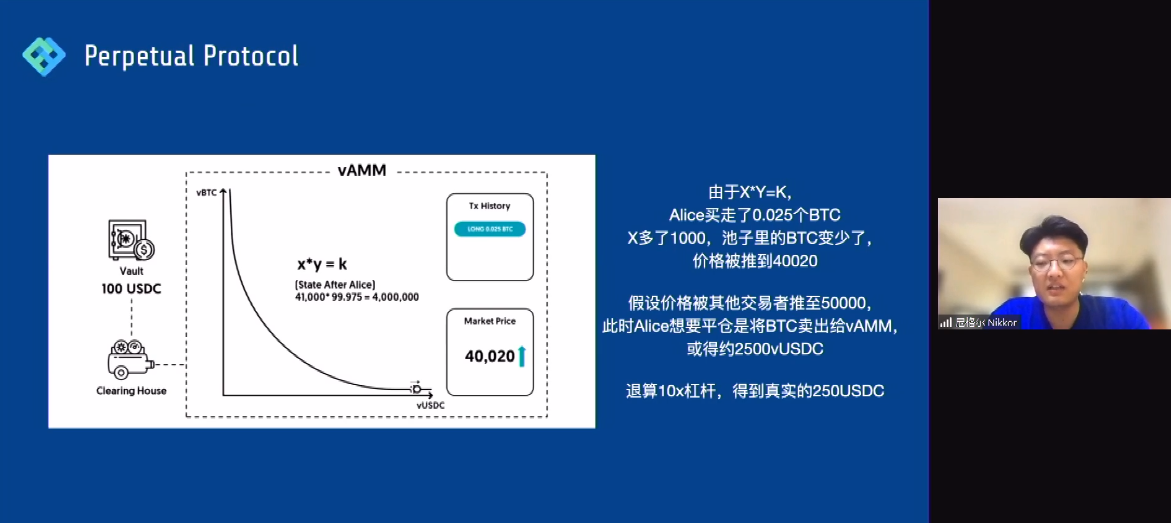

VAMM is more complicated, and it introduces many key components. If Alice wants to use 100 USDC to leverage 10 times to open long BTC, USDC enters the Clearing House, and the next step is after he enters the Clearing House, Clearing House will mint the virtual USDC according to the 10 times leverage it wants. 1000 VUSDC enters the virtual VAMM liquidity pool, but there is no real liquidity in this pool, so because of this curve, we will conduct price discovery in the transaction, so when Alice goes to put vUSDC into the pool, he In fact, I took the BTC into my own hands. At this time, the BTC in the pool decreased, but the USDC increased. Then suppose that the price of the entire BTC market is pushed up to 50,000 after a while, and at this time Alice wants to close the position, he will sell his BTC, and then exchange it for USDC. He may have 1,000 USDC, but he may After turning into 2,500 vUSDC, and then refunding his 10 times leverage, he will get the real 25,000 USDC, and he will get a profit of 150 USDC. This is a basic operating mechanism.

Of course, there are many details and key components, such as how to store users’ assets, how we clear and settle these assets in Clearing House, and we also have an Insurance Fund mechanism to ensure the security of the platform. At the same time, the insurance fund mechanism is also combined with our staking mechanism.

In the next part, I would like to share with you some recent developments of the Perpetual Protocol. When it was launched on December 15, we only had two markets, BTC and ETH. Now, 1 or 2 new trading pairs are launched every week. Up to now, there have been 13 transactions were correct.

You may be more curious about why you are a protocol based on the ETH ecology, how can you introduce assets like BTC and DOT that are not ERC20 standards? In fact, it is because our liquidity is virtual, so as long as our partner Chainlink can If a certain asset feeds the price to the agreement, then we can trade the subject of the price feed on the platform. In fact, we can understand it as an index and trade this index. Then the day before yesterday, we also just launched the multilingual function, which will promote our global user acquisition, and then we will attract more users in China to participate in our agreement. At the end of March, we launched a very critical function. Now holders of PERP tokens can participate in staking. The recent staking income is quite high.

Then there is another relatively important progress recently, which is to break a barrier. Before, people were not very inclined to use ETH’s USDC. The reason for converting to xDai’s standard USDC through the ETH-xDai asset bridge is the comparison of ETH’s network gas fee. High, and now we can transfer USDC to the xDai chain in a lower way. This way is that ERC20 also supports USDC, and then transfer the ERC20 assets to X generation through BSC, and xDai’s USDC can Trade on the Perpetual Protocol with a lower GAS fee. In view of the fact that the current fee is really relatively low, if you have the habit of using contracts and DeFi spot, you can try it.

Then there is the recent data of our platform, which is the part I will focus on sharing with you. Now the average daily transaction volume of the perpetual agreement platform has firmly occupied the top five positions in the Ethereum ecosystem. Looking back at the transaction volume in the past 7 days, it is found that the transaction volume of the platform in just one week exceeded 1 billion US dollars, which is equivalent to one-sixth of the transaction volume in the past three months. Yesterday, the transaction volume of the platform was 120 million. If we put our data into the protocol transaction volume ranking on Ethereum, Perpetual has become the fifth place after Uniswap, Curve, Sushiswap and 1inch. Therefore, a trend began to become clear—on-chain derivatives agreements began to challenge the market share of spot trading agreements. I personally think that the Perpetual protocol is currently in the first echelon of the derivatives track in terms of product strength and data performance. In addition, Perpetual Protocol is developing the V2 version, which will greatly enhance the trading experience.

Let me introduce PERP Token itself again. PERP Token has attracted a lot of attention in the past quarter, and it has also been launched on an exchange. You can find it on Binance, OK and other exchanges. PERP Token has two functions. The first function is governance, with relatively large authority, including unlocking proposals and voting for some foundations and currently unlocked unit Token circulation, as well as unlocking and launching of some new functions, unlocking and launching of new trading pairs and Governance of some important matters. Another function of PERP Token is to make a pledge for the system. The basic logic of the perpetual protocol is that users will pay one-thousandth of a handling fee to the platform for each transaction. It is one-thousandth of $100,000 instead of one-thousandth of $10,000. This is different from mainstream exchanges. 50% of the one-thousandth service fee received will enter the insurance fund pool. The insurance fund pool is the most important part of maintaining the smooth operation of the entire system. Assuming that there is no real liquidity provider based on the VAMM mechanism, in extreme cases only 1 When a user conducts transactions on the platform, if he generates profits, there is actually no counterparty to pay him. At this time, what should be paid to him should be our insurance fund pool, so we need to have one-thousandth of the handling fee. 50%, that is, five ten-thousandths of the handling fee goes into the Insurance Fund to keep the system running smoothly. At the same time, as the Perpetual protocol becomes stronger and the protocol volume gradually increases, the health of PERP will also be improved. The PERP of staking will get 50% of the distribution of the handling fee. In fact, it is also to maintain the stability of the system, because if the money in the Insurance Fund is accidentally emptied, the system has a mechanism that will mint out the total amount PERP, sell it on the secondary market, and sell the money to the Insurance Fund to make it run normally.

In this extreme situation, we have a requirement, hoping that there are not too many PERP Tokens circulating in the market, and they can be sold with us at critical moments, so we need users to staking. This staking itself has caused a reduction in circulation, allowing newly minted tokens to be sold quickly. That's why we give such high rewards to participating Staking users. At the same time, a part of the PERP that has been unlocked and circulated has become an additional reward for them.

The above is the operation and latest progress of the entire PERP Token platform. If you want to know the latest protocol, you can go to our documentation page to have a look, or you can go to the governance forum to participate in governance discussions. Because many of the important progress and development of the protocol are actually discussed from the ideas put forward by everyone in the governance forum. After the discussion, a vote will be held on the Snapshot, and the use and implementation of the proposal will be completed after the vote. So participating in governance is what everyone who pays attention to PERP and uses PERP wants. The content of the document is our entire governance economic model and product operation mechanism. If you are a trader, you can trade on PERP Exchange. You are welcome to scan and follow our official website and public account, and initiate discussions with us.

In addition, our V2 version will further solve the problems that the contract platform may have insufficient depth, or the internal and external price differences are large, and will also introduce more roles in the V2 system to provide users with more and better experiences.

The above is all the content I shared with you today, thank you.