During the recent sharp decline in encrypted digital currencies, I conducted a small questionnaire survey in the Bihu community to understand the buying and selling of Bitcoin by community users during this period. Among the respondents who found the survey responses, more increased their Bitcoin holdings during this period. I think that for the product of Bitcoin, long-term steady accumulation is the best investment strategy. Of course, if there are users who are good at short-term trading operations, then adopting a trading strategy is also a feasible strategy. But for the vast majority of investors, I think it is the best holding strategy to use fixed investment for long-term purchase.

The current adjustment is clearly the result of excessive speculation and the application of a large amount of leverage in the cryptocurrency market. The fundamentals of the development of the so-called cryptocurrency market have not changed. As the absolute leader in encrypted digital currency, Bitcoin will continue to maintain its leading position in the entire encrypted digital currency industry.

In the short term, Bitcoin is a virtual commodity, and the market demand for it is also in line with the general trend of general commodity demand. Commodities are currently rising, so the rise in Bitcoin prices is in line with the current general trend.

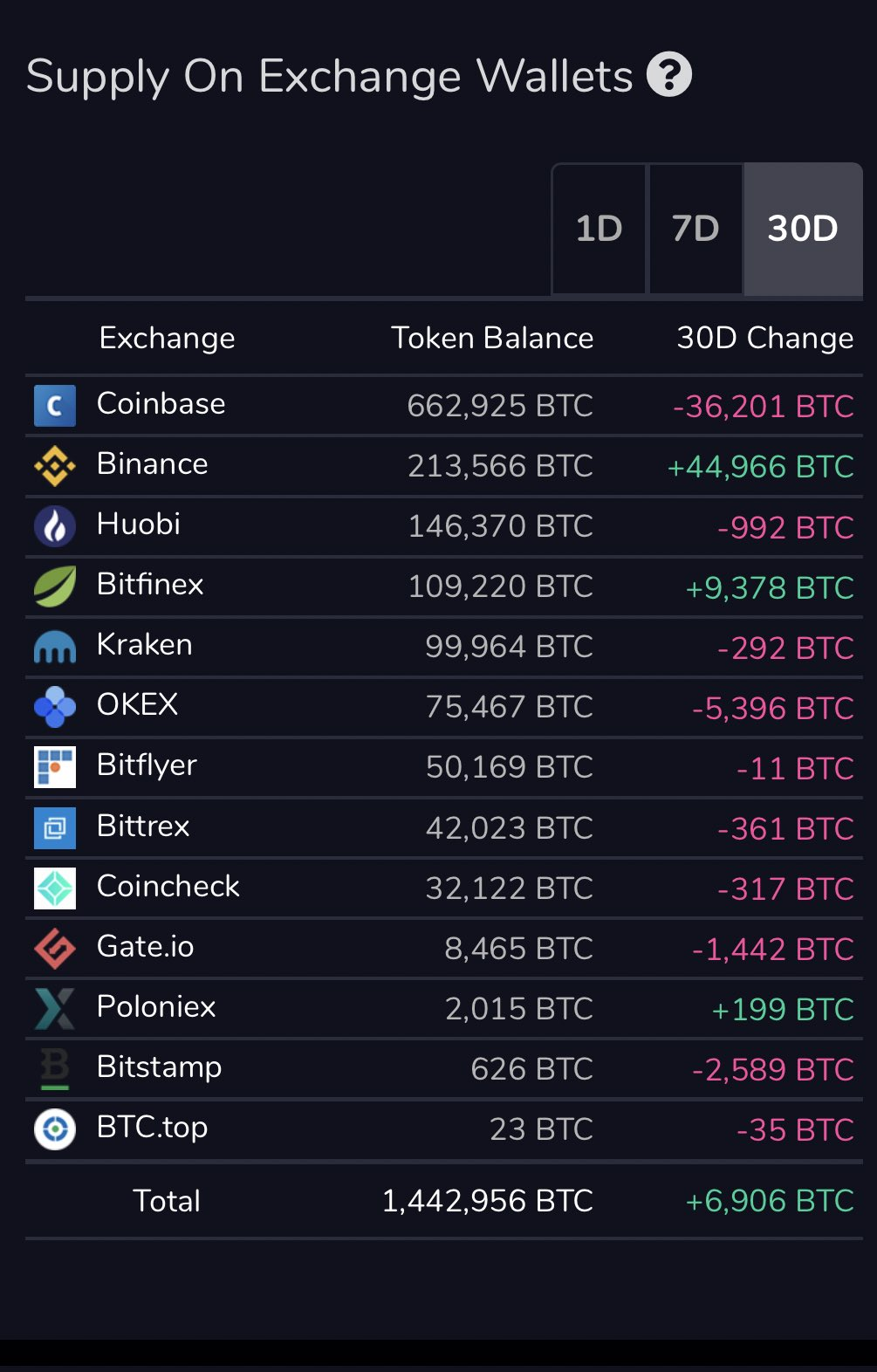

In the current stage of adjustment, although the overall market has fallen sharply, some buying behavior in the market is still very obvious. We can see from the table below that Coinbase users are buying in large quantities and sending them out of Coinbase. Obviously these users are buying bitcoins for long-term holding purposes.

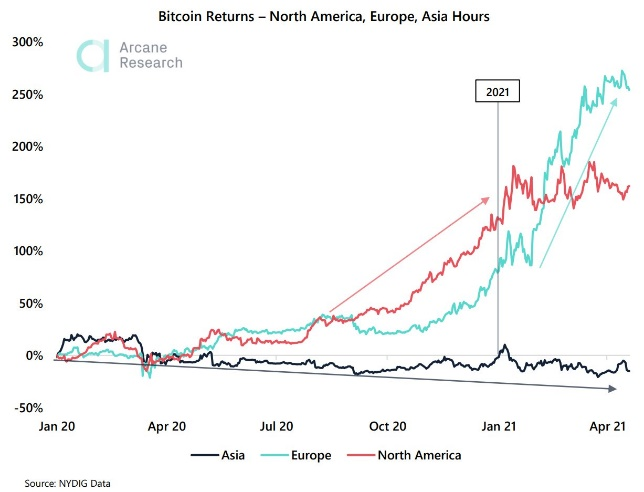

However, users on some other exchanges saw a large number of sell-offs. If we compare such a trend with recent buying and selling trends, we can see the profitability of buying and selling Bitcoins for users in different regions.

The buying and selling of Bitcoin shows that holders have different views on Bitcoin. Obviously, most of the forces in the market still use Bitcoin as a trading product. This can be seen from the recent sharp drop in the market and the large application of leverage. But another user group adopts the strategy of buying and holding for a long time. I think that for most investors, holding Bitcoin for a long time can get the biggest benefit of Bitcoin. This has been explained in my previous series of articles.

One of the more popular views now is to compare Bitcoin to digital gold. But I think bitcoin is far superior to gold in every way. Another metaphor is to compare Bitcoin to the Amazon of the Internet era. But I think Bitcoin is also far superior to Amazon stock. Bitcoin is a fully distributed, fair, globally accessible, open currency network. Anyone can obtain Bitcoin fairly by participating in mining or buying and selling. There are only 21 million bitcoins in total. Anyone now has the opportunity to earn a portion of these totals. It's similar to how anyone can acquire Amazon stock during Amazon's growth. If you hold it for a long time, you can get the benefits that Bitcoin's future development can generate. The total amount of Bitcoin is limited, that is, the supply is limited. When the market demand maintains a certain or even continues to grow, its unit price will continue to grow. This is determined by the most basic supply and demand relationship in economics. Judging from the current development trend, the acceptance of Bitcoin is growing rapidly around the world. For example, on Monday (April 26th), US time, two very influential news were that Chase Morgan began to provide its users with bitcoin fund services, and the other was that a professional NFL player began to use bitcoin to accept his funds. Full salary payment. Starting from this week, it is the quarterly time for the announcement of the financial reports of listed companies in the United States this quarter. It wouldn't surprise me at all if more public companies announced they were starting to hold Bitcoin.

In the long run, holding Bitcoin is one of the best coping strategies against the current market background of a large amount of oversupply of the US dollar. The trend of dollar oversupply will not stop in the foreseeable future, and the basic elements of Bitcoin's rise therefore continue to exist. For ordinary investors, holding Bitcoin to ensure that their assets are not devalued is therefore the best coping strategy.