In recent days, encrypted assets have been diving continuously, and the bull market is shaky. For investors, the most concerned question right now is "is the bull still alive?"

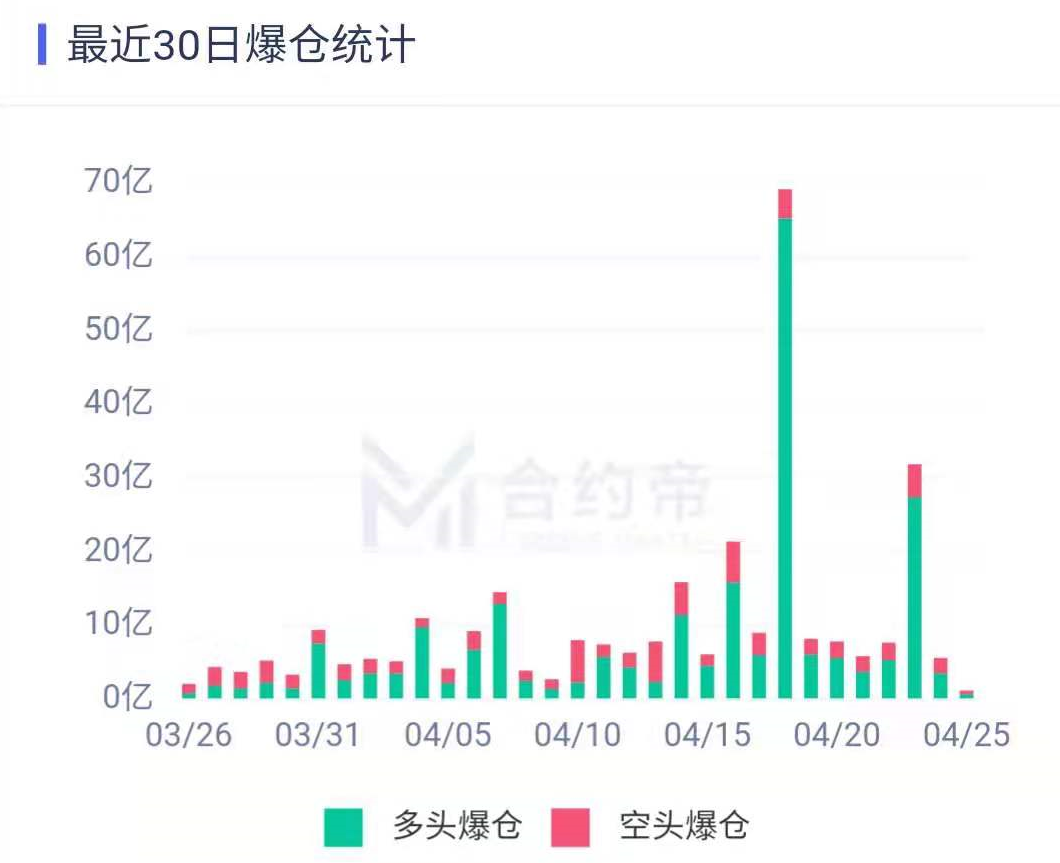

According to the data of Contract Emperor, on April 18, Bitcoin plummeted by more than 10,000 US dollars, the amount of contract liquidation on the entire network exceeded 6.9 billion US dollars, and the number of liquidated accounts reached as many as 500,000; The contract liquidation amount of the entire network exceeded 3.1 billion US dollars.

The sharp drop in the past two days has really made the currency circle miserable, and many investors have suffered heavy losses.

In comparison, the continuous waterfall market that appeared on March 12 and 13 last year had liquidation amounts of US$2.3 billion and US$2.2 billion respectively. Judging from the liquidation of the above two days this year, it seems to be just a small scene.

Some people believe that the Coinbase listing event has overdrawn the bullish sentiment in the market. After a crowd of altcoins danced wildly, a callback is inevitable; others believe that after the currency price reaches a high level, the market is extremely sensitive to any information, especially the US policy attitude Great impact on Bitcoin.

first level title

Encrypted market plummets

Since Bitcoin broke through the high point of the previous round of bull market, the ups and downs of each wave have made people in the currency circle crazy. The difference is that the sudden drop in the market in recent days has caught investors who were immersed in the expectation of skyrocketing by surprise.

Market analysts believe that, first of all, the increase in each band of Bitcoin and the time it takes to rise are gradually shrinking; secondly, the enthusiasm of institutional investors to buy has slowed down and the large-scale sell-off after the listing of Coinbase has sharply increased market risks.

On April 18, the contract liquidation amount of the entire network set a new record for the largest single-day liquidation amount in history, becoming a major event in the encryption market.

Analyst Tina said that in the successive surges of Bitcoin and Ethereum, investors have become "greedy" and are too optimistic in the short term. Therefore, they have insufficient understanding of the market risk of a sharp turnaround.

According to Shanghai Securities News, excessive market leverage is the main reason for the violent volatility in the cryptocurrency market. In addition, the uncertainty of regulatory policies in various countries also brings risks to the encryption market.

Kevin, a market researcher at the BMEX Contract Research Institute, said that there are three main reasons for the sharp drop of Bitcoin on April 18: First, a major safety accident occurred in a coal mine in Changji Hui Autonomous Prefecture, Xinjiang on April 10. After the accident, the local cryptocurrency mining farms in Xinjiang had to conduct a large-scale power outage to cooperate with security investigations; mentioned that cryptocurrencies need stronger regulatory rules; third, on the first day of Coinbase’s listing, its CEO Brian Armstrong (Brian Armstrong) sold 291.8 million US dollars of stock. The company's CFO sold more than $99 million worth of stock.

On the day of April 23, Bitcoin began to fall in the early morning and continued until 16:00. Many analysts said that investor sentiment in the currency circle has reached a very pessimistic level.

"Bitcoin's dive again may be related to the U.S. tax increase plan." In Tina's view, U.S. investors face the risk of capital gains tax due to U.S. President Biden's plan to nearly double the capital gains tax for the rich.

On April 21, Gemini officially tweeted that according to its report, 14% of Americans are crypto investors. That means 21.2 million U.S. adults own crypto assets, and other studies estimate the number to be even higher.

first level title

China and the United States release the signal of policy "turning point"

"The upsurge in Bitcoin stems from global inflation expectations." Sun Lijian Riqin, director of the Financial Research Center of Fudan University, said that on the whole, there are three issues behind the increased regulation of Bitcoin by central banks and the recent "roller coaster" of Bitcoin. Attention.

He believes that, first, the central banks of various countries have announced to strengthen the management of encrypted digital assets such as Bitcoin, which is also because the market’s pursuit of Bitcoin has swallowed up the effectiveness of monetary policies of various countries in supporting the real economy to a certain extent; second, The U.S. Treasury Department’s announcement that it will crack down on financial institutions’ use of cryptocurrencies to launder money may be due to the consideration of consolidating the international status of the US dollar; " demand.

It is undeniable that Bitcoin regulatory policy is an important factor affecting its footsteps.

From the perspective of the United States, efforts are being made to collect taxes and fees on encrypted asset users. On April 21, Senator Rob Portman of Ohio wanted to clarify the tax policy of encrypted assets in the proposed bill. Portman said in an interview that he hopes to introduce a bill with bipartisan support after the next congressional recess to address the non-payment of taxes by many users of crypto assets in the United States. Portman said MPs "haven't finalized a bill" and were "still gathering information on the issue". However, he claimed that there is bipartisan interest in closing the cryptocurrency tax gap.

It is worth mentioning that, on April 25, according to media reports, in response to U.S. investors facing capital gains tax, Cardano founder Charles Hoskinso warned that the Biden administration’s plan to increase capital gains tax may not bode well for the encrypted asset market .

Hoskinso pointed out that if the current government decides to impose additional taxes on capital gains, the crypto asset market could collapse. Additionally, Hoskinso revealed that he would be personally affected by the proposed tax increase. In previous news, Biden announced that he plans to impose a capital gains tax of up to 43.4% on the rich.

At the same time, the country has also released the latest developments in the regulation of Bitcoin and stablecoins.

According to a report by Xinhua News Agency on April 18, Li Bo, deputy governor of the People's Bank of China, said at the sub-forum of the Boao Forum for Asia that the People's Bank of China is studying the regulatory rules for Bitcoin and stablecoins. In the future, if any stable currency wants to become a widely used payment tool, it must be subject to the same strict supervision as financial institutions such as banks or quasi-banks.

first level title

The market outlook is "two days of ice and fire"

After the continuous sharp drop, there are currently two completely different voices in the market: one is bullish and the other is bearish.

The Nuclear Finance APP has noticed that analysts have very different views on the next market trend, with both long and short sides holding their own opinions and not giving in to each other.

Tina believes that the bull market is not over yet, and this kind of large-scale correction is suppressing profit taking, so as to reserve potential energy for a better rise. Analyst Jason, however, disagrees. He said that from a morphological point of view, the trend of Bitcoin has changed from long to short, and there is no major bottom at present, and it is necessary to prepare for the early end of the bull market.

This is true inside the currency circle, and it is also true outside the currency circle.

On April 20, a new report from Bloomberg showed that the decline in commodity prices and U.S. Treasury yields is likely to persist due to the persistent effects of deflation. The deflationary outlook could be a blow to some crypto-asset investors who view bitcoin as a hedge against inflation and currency debasement.

In addition, Liu Shengjun, director of the State Financial Reform Research Institute, pointed out at an event that Bitcoin is a utopia and has now entered the final stage of the "self-entertainment" bubble.

Bill Miller, founder of the hedge fund Miller Value Partners, said in an interview that although Bitcoin has recently approached the level of $65,000, he believes that Bitcoin is not in a bubble and that this is now the beginning of mainstream Bitcoin. He expects more upside due to changes in supply and demand. Miller noted that Bitcoin’s pullback is normal, as volatility is the price investors have to pay for the cryptocurrency’s outperformance.

According to TheDailyHodl news, Cynthia Lummis, a member of the U.S. Senate of Wyoming and a Bitcoin advocate, said that Bitcoin is a reliable store of value that has attracted the attention of mainstream investors. In the interview, he cited the Coinbase listing and Tesla's $1.5 billion investment in Bitcoin as proof that Bitcoin is gaining widespread adoption.

At the same time, former CIA director Michael Morrell believes that the limited use of Bitcoin in illegal activities is decreasing. He said there was growing evidence that illicit users were switching from bitcoin to more anonymous crypto assets, whose public availability and verifiability made it unsuitable for criminal activity.

On April 24, the Louisiana House of Representatives passed a bill praising Bitcoin and its anonymous creator Satoshi Nakamoto for “contributing to economic security.” Bitcoin has the potential to replace gold as the new reserve asset, the bill said. The bill also mentions that Bitcoin is the first decentralized trillion-dollar asset, protecting people from global currency debasement. State lawmakers are encouraging state and local governments to consider how they can benefit from the new technology.