On April 21st, the cryptocurrency community in the United States had a very closely watched debate about the value of Bitcoin and gold. On the side of Bitcoin is Michael Saylor, on the side of gold is Frank Giustra. Since both of them are very successful entrepreneurs, and the current trend of cryptocurrency in general is rising, their debate has received wide attention. For investors concerned about the relationship between bitcoin and gold, and where each of them may go in the future, this debate is well worth a watch. The debate brings to mind a question oft-asked in the market, whether bitcoin will surpass gold in market capitalization. In my opinion, the market capitalization of Bitcoin will definitely surpass that of gold. And the time to achieve this transcendence is far longer than the market generally expects.

First of all, from the perspective of development momentum, Bitcoin has developed from an application among technical geeks in 2008 to today's market value of one trillion US dollars. Such a development speed far exceeds the time when a currency that appears freely in the usual market is generally accepted. The basic attributes of Bitcoin include a certain amount, easy to carry and spread, can be divided into very small granularity, can be stored forever, obtained fairly, not controlled by any institution or individual, circulated globally and among all users conduct transactions directly. All of these properties make it superior to gold as a store and transfer of value. Another very important point, but often overlooked by the market, is that Bitcoin is the first product of its kind in technology. For a long time, it was running independently. Therefore, it is far superior to other similar products in terms of market communication. Therefore, the value association and various applications of Bitcoin in the market are far superior to other similar products. So today, Bitcoin occupies more than 50% of the market share among all encrypted digital currencies. On the basis of such a market share, Bitcoin occupies an absolute leading position, so it is impossible to be shaken. In other product categories, market developments have demonstrated the importance of this market leadership. For example, Amazon in the e-commerce field, Facebook in the social field, YouTube in the long video field, and TikTok in the short video field, etc. Therefore, in the field of encrypted digital currency, even if there are various imitators of Bitcoin, they will never exceed the market value of Bitcoin.

After 12 years of development, Bitcoin's market value has grown from zero to today's one trillion dollars. Such a development process has not stopped, and it still has a lot of room for development in the future. If we look at the development trend of bitcoin users, such a trend is very obvious. When Bitcoin first appeared, its enthusiasts were just a few technical geeks. The communication field of these geeks is some very professional forums on the Internet. And the acquisition of their bitcoins does not require additional funds other than hardware equipment. After further development, Bitcoin enthusiasts began to appear. They are willing to use funds to buy Bitcoin. Bitcoin thus becomes a collectible, and thus acquires fiat-based pricing. When these enthusiasts began to increase, there appeared trading platforms that provided centralized matching of bitcoin transactions. Individual speculators began to be attracted to participate in the buying and selling of Bitcoin. After March 2020, due to the massive issuance of U.S. dollars, in order to keep their assets from depreciating, institutional users began to buy Bitcoin to hedge the risk of U.S. dollar issuance. At this time, Bitcoin has begun to be considered by institutional users as an asset type for hedging risks. Such a development trend was pushed to a new stage by Michael Saylor and Musk buying Bitcoin. Now more and more institutions are beginning to buy bitcoins to hedge against the risk of additional issuance of US dollars. Therefore, Bitcoin will quickly reach a market value of one trillion U.S. dollars in 2021. 2021 can be said to be the first year when institutional users start buying Bitcoin. This trend will continue in the next few years. The development process of retail users entering Bitcoin will be repeated in the development process of institutional users entering Bitcoin. Therefore, the next few years will still be a bull market for Bitcoin development.

Among the types of users currently buying Bitcoin, there are already hedge funds, family offices, listed companies, pension fund companies and insurance companies. Among the current types of institutions, the collective participation of American insurance companies in particular is more indicative of the long-term value of Bitcoin. Such a participation is still not paid enough attention by the market. This alone could suggest that Bitcoin has a long-term bull market ahead. Among all the potential buyers of Bitcoin, the ultimate institution is of course the central banks of various countries. If some central banks start buying, it will show the market's final acceptance of Bitcoin. But before the central bank starts to buy bitcoin, bitcoin still needs to go through a long period of development before it can become an asset accepted by the central bank. These developments include Bitcoin's market capitalization, volatility, liquidity, and the regularity of Bitcoin's trading market. Judging from the current market development trend of Bitcoin, these conditions will be gradually met. So I think that Bitcoin will develop into an asset recognized and purchased by central banks.

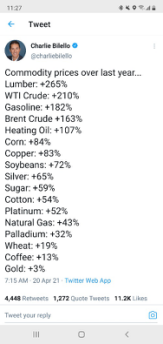

In terms of gold, the market actually has a very contradictory phenomenon in pricing the value of gold. On the one hand, the market price of gold keeps falling. On the other hand, some major central banks started buying and holding gold. As a traditional value-preserving product, when the market is turbulent, gold has been used as a value-preserving product before. For example, during the Weimar Republic, gold holders can thus avoid property losses due to the sharp devaluation of the mark. In the context of the current oversupply of U.S. dollars, buying and holding gold is a traditional hedging strategy. But the market price of gold did not rise. This is an inexplicable phenomenon. If we look at the following data, the uptrend of gold in the last year is the lowest among these products.

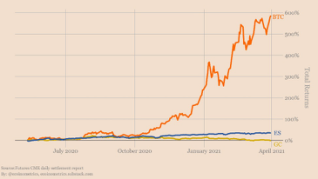

The market is currently pricing in bitcoin and gold. Compared with the two, it is clear that the market is more optimistic about Bitcoin. The chart below shows the comparison of the investment returns of Bitcoin, gold and S&P since the Bitcoin halving in 2020.

The market is currently pricing in bitcoin and gold. Compared with the two, it is clear that the market is more optimistic about Bitcoin. The chart below shows the comparison of the investment returns of Bitcoin, gold and S&P since the Bitcoin halving in 2020.

In my opinion, Bitcoin is superior to gold in terms of value transfer and value preservation properties. As a technical product, currency is also constantly evolving, from banknotes and coins to electronic bookkeeping. Now the emergence of the Internet and blockchain technology has brought about a new and more superior carrier for currency. And the market is accepting this new form of carrier, especially for young people growing up in the digital age, they are more willing to adopt this safe, convenient and free form of value exchange. So it is only a matter of time before the market value of Bitcoin surpasses the market value of gold. And I think this surpassing time is much shorter than the general expectation of the market.