Ethereum (ETH) price was in the green rising against Bitcoin (BTC) on April 22, reaching its highest level since early February. Given the technical breakout of ETH/BTC, traders are starting to expect a strong rally in the foreseeable future.

During the first two weeks of April, ETH outperformed Binance Smart Chain’s native token, Binance Coin (BNB).

BNB is gaining momentum against Ethereum due to ETH’s high transaction fees and high user activity on Binance Smart Chain.

However, over the past few days, ETH price has started to gain ground against Bitcoin and BNB respectively.

ETH and Altcoins dominate gains

image description

ETH/BTC 4-Hour Price Chart (KuCoin) Chart by TradingView.com

One of the main reasons for the recovery of the altcoin market is because of the impact of the listing of Coinbase.

Altcoins in general have fallen more than BTC. So when Bitcoin started to consolidate and stabilize, altcoins started to rally, fueled by Ethereum and BNB. In addition, after the recovery of the futures market, followed by liquidations of more than 10 billion US dollars in a day, the market's demand for risky assets may also increase. This has seen demand rise simultaneously for ETH, BNB, Dogecoin (DOGE), and many other cryptocurrencies with relatively high trading volumes and valuations.

Some traders said that a breakout of the ETH/BTC pair in the short term could lead to a parabolic rally, especially for altcoins.

A trader who goes by the pseudonym "Crypto Capo" expressed optimism for ETH to break out of BTC. He believes that "ETH/BT will redefine the concept of parabola."

Likewise, NekoZ, a crypto derivatives trader, said that ETH is showing momentum that will likely spread to altcoins.

"Performance so far has been gratifying. This state of affairs should integrate well into the market this week and build momentum for the altcoin rally."

Another well-respected cryptocurrency derivatives trader, Bluntz, said ETH/BTC looked "very crazy" after the massive bottoming out.

Bluntz emphasized that ETH is displaying a double bottom chart, which in technical analysis often points to short-term trend reversals. ETH’s 4h line bottomed out, making the ETH/BTC pair look absolutely insane again, the biggest bottoming out in a long time.

image description

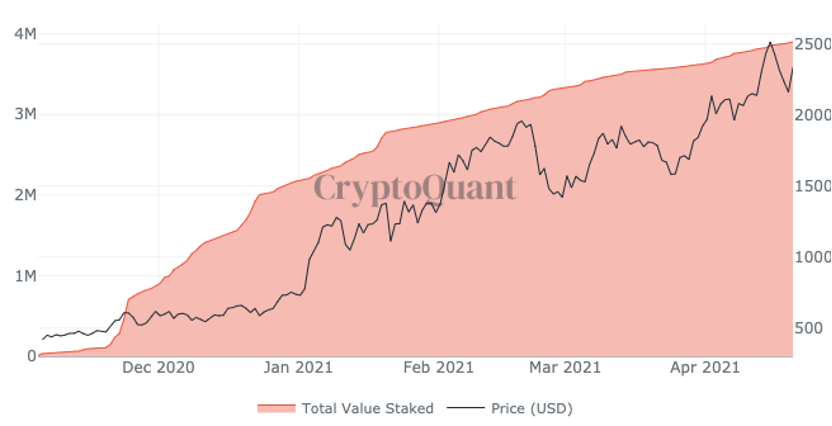

Total ETH deposits Source: CryptoQuant

According to CryptoQuant, the amount of ETH collateralized in ETH 2.0 smart contracts is increasing.

This reduces the circulating supply of ETH on exchanges, which will put upward pressure on the price of ETH.

The increase in fees, which can be verified by on-chain data, also shows that activity on the ethereum chain continues to increase despite fees being already high.

Ethereum and investor Aftab Hossain stated:

“Ethereum/DeFi has been focused on infrastructure, BSC can replicate and centralize to speed up transfers, and has the incentive to focus on integrated UX, I think cheaper L2 tx can scale, and can carry out key smart contract wallets Innovation."

Binance Smart Chain and other layers have been strong against Ethereum, but the release of Eth2 and Layer 2 solutions may make Ethereum more attractive to retail investors in the coming months.