On the afternoon of April 22, in order to discuss these issues with everyone, BlockArk & ArkStream Capital and Odaily co-hosted the "Bull Cycle of Long Run Ascending - ArkStream Capital Brand Launch Conference" to analyze the past and future of the encrypted digital currency industry.

On the afternoon of April 22, in order to discuss these issues with everyone, BlockArk & ArkStream Capital and Odaily co-hosted the "Bull Cycle of Long Run Ascending - ArkStream Capital Brand Launch Conference" to analyze the past and future of the encrypted digital currency industry.

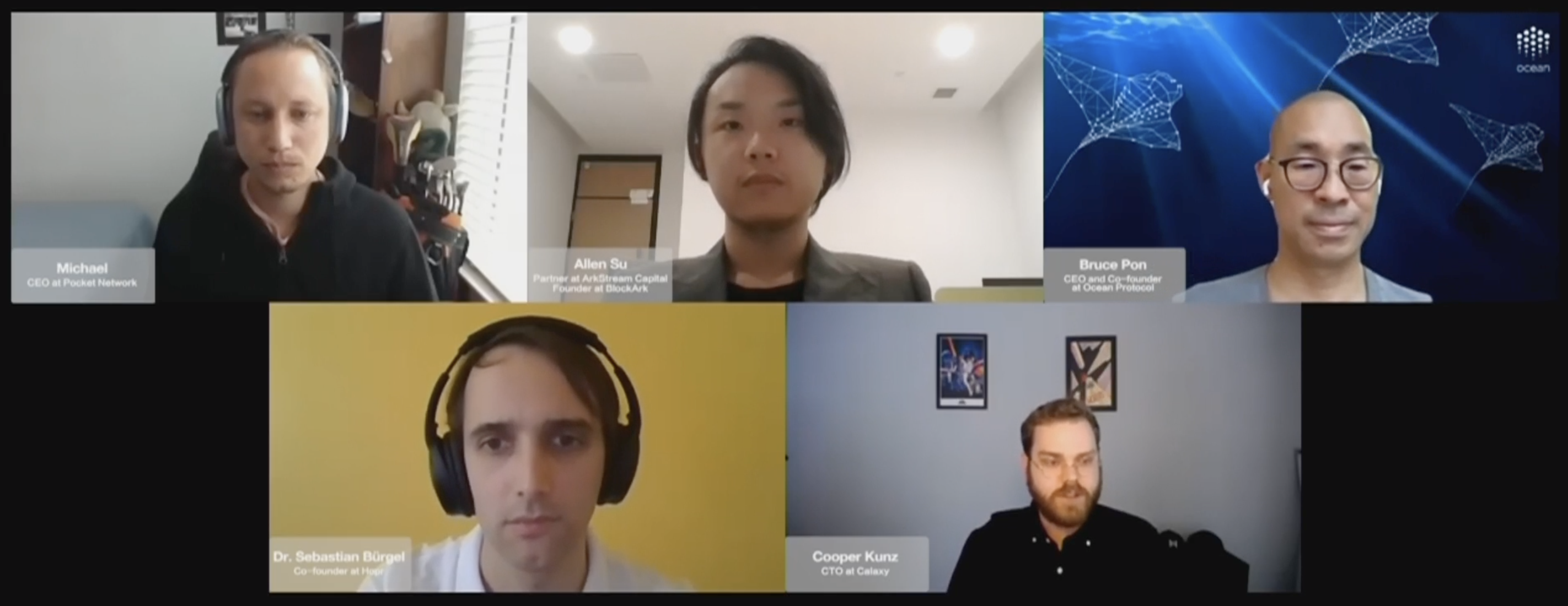

At the "Web3 Unicorn" roundtable, we invited many senior practitioners to chat about the potential and opportunities of the Web3 era. These five guests are: Ocean protocol CEO Bruce Pon, Pocket Network CEO Michael, Dr. Sebastian Bürgel, founder of Hopr, Cooper Kunz, chief technology officer of Calaxy, and Su Ye, partner of ArkStream and founder of BlockArk, the host of this round table.

Michael, Su Ye, Bruce

Sebastian、Cooper

During the discussion, Sebastian first talked about his views on the long bulls in this round.

He said that he heard a saying in the last bull market that "the next bull market will be the last", which seems to imply that the bull market will become huge and will continue forever. Sebastian also said that he is not too interested in the economic significance of the bull market.

"What I'm interested in is actually people [whether] using web3 technology. The last bull market (in terms of price) also reached this peak, but it was crazy, and what we were doing was ridiculous. But now The time has come, this is the last time web3 technology has entered a bull market cycle, we are reaching a certain stage where we can see the shadow of web3 everywhere. Now we have reached the critical moment when web3 technology becomes mainstream, and it will continue to exist from then on. We are now are at the stage of introducing this to a broad audience."

Changniu is a short-to-medium-term dimension. From a longer-term perspective, and even the development of the entire industry, what stage are we currently in?

Cooper believes that as far as technology is concerned, we are coming out of the trough of disillusionment in the entire market and quickly shifting to the slope of enlightenment. Every day you can hear some Amazon and Apple employees turning to the encryption field. Then they'll say I just left Apple to work full-time on cryptocurrency. “It all makes me super optimistic and excited about the industry.”

"But in terms of overall market sentiment, we're probably closer to the peak of this inflated expectation, at least as far as Dogecoin is concerned, it's still $50 billion in market cap, not that I don't like these, they're great, but they're really worth it $50 billion? I'm not sure." Cooper's view is quite dialectical.

In the end, he concluded: "So it's actually hard to say, the crypto industry will be at different stages from different angles, and it's hard for us to separate the bullish market sentiment from our actual technical situation."

Bruce put forward an optimistic view by comparing the Internet and the encrypted digital currency industry.

Bruce believes that after the emergence of the Internet, it has attracted 6 billion people to participate in the Internet. Such a scale of users is unique in human history. Today’s cryptocurrency has 100 times more developers than when the Internet started, and it is built on the infrastructure and scale of the Internet, which is something that the first generation of the Internet did not have (conditions). Now, you can use the blockchain to connect global capital and start a company anywhere on the planet, so the encryption field can flourish.

Of course, such a speed of development may be accompanied by some transformation pains. Bruce continued: "We may have inflated in 2017, and then went through the trough of disillusionment. Entities enter this new world. We’re going to see a lot of traditional companies go through a painful phase and then make a bigger leap.”

Michael describes the new world of Web3 as he sees it.

Michael believes that the characteristic of Web3 is coordination, the ability to coordinate people's innovation, funding and human resources on a global scale. I may not know who they are, where they come from or similar issues, but I am willing to work with them. “We’re going to see a protocol or a DAO that manages a poorly functioning city for the next decade, and we’re going to see this digital world collide with the real world in a meaningful way, which is A very powerful thing."

"You can also watch the live broadcast, enjoy~Original link"You can also watch the live broadcast, enjoy~

—————————

Su Ye: Welcome to the ArkStream Capital brand launch event. Today we are very honored to invite some well-known practitioners, let them briefly introduce themselves below.

Bruce Pon:Hello everyone, I am Bruce Pon, one of the founders of Ocean Protocol.

I have been in the blockchain field since 2013. We have successively studied NFTs, decentralized databases, and now Ocean Protocol, and are committed to combining data, AI, and blockchain.

Michael:Hi everyone, I'm Michael O'Rourk and I'm one of the co-founders of Pocket Network. I also came into contact with blockchain and Bitcoin in 2013, and then engaged in iOS development in 2016. I wrote smart contracts with other founders. We really saw the importance of scalable infrastructure for applications, especially in terms of reads, and we thought there would be thousands of blockchains in the world, so we thought of creating Pocket Network. This is a decentralized infrastructure protocol that provides RPC (remote procedure call) access to any blockchain developer, you can think of it as the infrastructure provided by Uniswap, that's the way I can think of to describe it.

Sebastian:Hi everyone, I'm Sebastian, the founder of Hopr. I share the same opinion as Bruce and Michael, we all think that 2013 is a year of great significance, and I also came into contact with Bitcoin in this year, but I didn’t do much related things before this theorem appeared, and finally I realized Yes, distributed applications are cool, but to build a web 3.0 stack, we are still missing a lot. So what Hopr is researching is the privacy-first data exchange layer, that is, how to make the conversation between Alice and Bob not be known by various third parties. This is what Hopr Network provides.

Cooper:Hi, I'm Cooper, Chief Technology Officer from Calaxy. My background is in philosophy of computer science and software engineering. In fact, for the first 3 years of my career, I was on the core team of a blockchain adventure game called HashCraft. I then joined the Spencer Dinwiddie team, the Calaxy platform founded by the point guard for the NBA's Brooklyn Nets. At Calaxy, whether you are a professional athlete, musician, artist or celebrity, you can build and monetize your community.

Su Ye: Welcome all the guests again. The theme of our press conference is "Bull Cycle of Long Run". In the previous speech, I mentioned that we believe that the bull market cycle this time will be much longer than before. What do you think about the "long cycle bull market"? ? At what level do you think the narrative innovation of projects in this round of bull market will take place?

Bruce:I think blockchain has set a lot of new records at the moment. In the last upswing cycle, that is, 2017 and 2018, the number of innovative teams at that time was countless. Then about 100 teams broke out in the subsequent market down cycle, and now they have entered the stage of accelerated development, so you can see Coinbase successfully listed, with a market value of up to 100 billion US dollars. I think this innovation is developing at least 100 times faster than the Internet. I think we're going to get a lot of value out of that, which means this bull cycle is going to be a little bit longer than I think we're expecting.

Sebastian:Actually when you asked this question, I remember hearing a phrase in the last bull market that said "the next bull market will be the last", which seems to imply that the bull market will become huge and will continue forever.

Honestly I'm not even that interested in the economics of a bull market, I'm actually interested in people (whether) using web3 technologies. The last bull market (in terms of price) also reached this peak, but I think that was crazy and what we were doing was ridiculous.

But now the time has come, this is the last time web3 technology enters a bull market cycle, we are reaching a stage where we can see the shadow of web3 everywhere. I think we've reached a point where web3 technology becomes mainstream, so it's not just a small signal, but something that's here to stay. We are now at the stage where we are introducing this to a broad audience.

Su Ye: After listening to everyone’s narration, my overall point of view is just like what everyone has said. This time, cryptocurrencies have gone mainstream, and more attention is paid to user adoption and reconstruction of real products rather than the infrastructure level. Then if we compare web2.0 and web3.0, what period do you think the technological maturity of web3.0 is? You can talk about it from the perspective of your own projects and observation of the industry.

(In the Garnet technology development curve, any technology needs to go through five rounds to mature, Technology Trigger technology budding period, Peak of Inflated Expectations expectation inflation period, Trough of Disillusionment fantasy trough, Slope of Enlightment inspired decline and Plateau of Productivity stagnation of output.)

Cooper:As far as technology is concerned, we are coming out of the trough of disillusionment in the overall market and quickly turning the slope of enlightenment, and every day you can hear some Amazon and Apple employees moving to the crypto space. Then they'll say I just left Apple to work full-time on cryptocurrency. It all makes me super optimistic and excited about the industry.

But in terms of overall market sentiment we're probably closer to the peak of this inflated expectations at least as far as dogecoin is concerned it's still a $50 billion market cap not that I don't like these they're great but they're really worth $500 million dollars? I am not sure.

So it's actually hard to say, it's going to be at different stages from different perspectives, and it's hard for us to separate the bullish market sentiment from our actual technical situation.

Bruce:After the emergence of the Internet, it has attracted 6 billion people to participate in the Internet. Such a scale of users is unique in human history.

Today’s cryptocurrency has 100 times more developers than when the Internet started, and it is built on the infrastructure and scale of the Internet, which is something that the first generation of the Internet did not have (conditions). Now, you can use the blockchain to connect global capital and start a company anywhere on the planet. So the crypto space has been able to flourish.

We may have been inflated in 2017 and have experienced a trough of disillusionment since then, the field has been invaded so quickly, we will be ahead of the previous financial system, digital and production innovation system, and government system until these entities enter this new world. We will see many traditional companies go through a painful stage, and then achieve a larger leap.

Su Ye: Thank you Bruce. In fact, the guests we invited today are all old players in the digital currency industry. Almost all of them have experienced the relatively difficult years in the industry in 2018 and 2019, but they have gained a lot of money by persisting until this year. So can everyone tell us about the memorable moments you and your project had during the crypto winter of 2018-2019?

Cooper: Yeah, it's a lot of fun for me. Because I was one of the early team members at HashCraft, Calaxy ended up raising a little over $20 million in 2018 and was in hypergrowth even in a down market, growing our staff from 20 to 60 People, it feels like overnight, you don't know who's on your team, you don't know who's coming in, it's an interesting environment. Then in September 2019, we launched to the public, which was probably the bottom of the whole bear market.

The overall response to Calaxy compared to a few months or a few years ago has been phenomenal, or interest from professional athletes and musicians who just want to learn about crypto and get into it, which in 2018 or 2019 is not going to happen at all, I think "scars are deep" is an apt description, we may have to invent the term for ourselves.

Bruce: Yeah, it sounds like a bunch of guys have been through so many near-death experiences, about 56 weeks into the track, we had about three life-and-death experiences.

The most memorable one was at the beginning of 2019, we were doing a financing, we didn't sell, we were probably on the track two to three months after the financing, we just struggled into the February financing, we raised enough The funds can last until April or May, and we were going to raise another fund, so that the world could start subscribing something at the nick of time, and we did it, and we launched our token on May 20, 2019 Coin, it quickly dropped from 12 cents to 2 cents, and on November 20, 2019, you can buy the entire Ocean Protocol for less than $5 million.

From there we struggled to work our way up and as Sebastian said everyone worked on translating technology into vision and values we just struggled through it was a really good time and people weren't asking us to go anywhere , people don't show up at events as often, and we can really focus on the core technology. In some ways, I think we've all been through that trough of disillusionment, but it also makes us stronger, and if there's another downturn, I think maybe we'll be able to ride it out, and I think given what we've learned from the last crisis With experience, we become very robust and resilient.

Su Ye:Great, now we're all over the bear market. Next let's talk about the product itself.

The first question is about Ocean Protocol and Hopr. In this round of bull market, with the emergence of more and more excellent products, the picture of Web3.0 becomes clearer in our minds. With the rapid growth of the number of users and the amount of data, on-chain data plays an increasingly important role. We would like to invite the two from Ocean Protocol and Hopr to tell us, in the era of Web 3.0, how will the paradigm of users and data be different from the present?

Bruce:Of course, you can own your data. Your credentials, your network traffic, all of these will be in your database, and you will have the ability to allow people to use data on your terms instead of them allowing you.

Sebastian:Self-regulation of data is a huge problem now, and Ocean Protocol is like an important pioneering movement. But I would say what we're going to see or have started to see in this bull cycle is that there are large industry players and regulated players that are also interfaced with these markets, so as individuals we can do a bunch of Want to do, but for these industry players, "compliance with the law" will be a very important thing, in the future we can see how the crazy web3 and the regulated old world work together, especially in terms of privacy , which would be very interesting.

Su Ye: Okay, the next question is about Pocket. We see that in this round of bull market, middleware has made important contributions to the development of the entire industry. Can Michael tell us about the advantages of decentralized middleware services over centralized products? In this new cycle, with the increase of developers and C-end users, what market changes have you discovered?

Michael:I think that decentralized middleware needs to do better in some aspects, whether it is cost, or user experience, or privacy, these middleware solutions need to be really better for them to succeed, so I think that something like Pocket The protocol, which has proven it, we are indeed a hundred times better, and in some cases even cheaper than centralized infrastructure. Because running these peer-to-peer networks of computers, protocols for efficiently sharing resources and distributing data across the globe is very expensive.

Talking about the future of middleware, I think we're going to see a decoupling or disaggregation of the traditional web2 stack in a variety of different verticals, whether it's DNS privacy, or full node storage.

Twitter and Google have had "rug pulls" on me, they've changed their APIs when competing with centralized services, and that's what we're building on top of these decentralized infrastructure protocols. But decentralized services are very different, we can build on some things and have a say in how they change in the future.

Su Ye: Thank you Michael. It was Cooper's turn to answer the next question. Beginning in 2020, digital currencies and applications have attracted more and more attention from the mainstream public and celebrities, and the explosion of NBA Top shot has pushed this sentiment to a climax. Both NFT and Social Token are new paradigms that have just emerged. I would like to ask Caleb and Cooper, how do you see the future of these two tracks? Starting from the two projects of Efinity and Calaxy, how to bring crypto into mainstream?

Cooper:In 2021, blockchain will truly become mainstream, and many celebrities are talking about blockchain, especially after the popularity of NBA Top Shot.

Calaxy is doing social tokens, which is actually a new paradigm in this space, and the question I get asked a lot is how do you see the future of social tokens, or more specifically, how does Calaxy bring crypto into the mainstream market?

This is a great question. I think everyone is surprised and impressed by the success of Dapper Labs and NBA Top Shot. They not only made people aware of NFTs, but also broke the circle of the entire encryption market and digital assets, which is very beneficial to the market. helpful. Dapper Labs CEO Roham is also a friend of the Calaxy project and is one of our advisors.

The future of social tokens is really interesting, you can issue your own digital assets, customize content for your own community, whether it is actively airdropping tokens to your twitter followers, or as part of a sweepstakes, or for personal events Distributing tokens is the most effective way to incentivize participation.

Professional athletes like Spenser Dinwiddle, after issuing their own personalized cryptocurrency, you can use it to interact and contact him, whether it is video information, getting fitness advice, getting people to sign for certification, it will become a celebrity and an influencer The easiest way for people to interact with their community.

In addition to Spenser, we have many NBA players, NFL players, Grammy Award-winning music, who will launch their own social tokens on Calaxy, and these tokens will be able to be used to directly interact and engage with their fans.

Some people will ask what will be the next explosion after NFT and collectibles. I really think that this kind of social token that directly interacts with fans will be the next optimistic narrative.

Su Ye: It's really surprising to see that this is actually possible in the future. Next comes the last question. In our ArkStream Capital industry report, we mentioned that the Web3.0 world in our mind will be an open world that coexists in parallel with the centralized Web2.0. As the core builds of Web3.0, I believe everyone has their own definition of web3.0. Finally, we would like to ask all the guests, can you give us 1-2 predictions and conjectures about the web3 world?

Michael:yes i think for me the hallmark of web3 is coordination, the ability to coordinate people's innovation, funding and human resources on a global scale, i may not know who they are or where they come from or something like that but i would work with them.

We're going to see a protocol or DAO that manages a poorly functioning city for the next decade, and we're going to see this digital world collide with the real world in a meaningful way, and it's a A very powerful thing.

Cooper:I think it's clear that we're all very excited about web3 and we want to work in the industry and go through these cycles and the headaches that come with it.

I think one of my biggest predictions for the next few years is that we're going to see centralized services move to the decentralized space, and I think once we get the tools and infrastructure in place, in a reasonably tangible and scalable way that the average consumer can understand A way to effectively manage decentralized identities will be a turning point for the industry.

Microsoft has launched a core product around decentralized identity and said they want decentralized identity to be the number one standard in their authentication portfolio, so I think once you have that, all your users will immediately have crypto wallets or public key and private key pair, they will understand how the ecosystem around decentralized identity fits together and can scale very effectively to a mainstream audience. I think overall web3 will reach almost everyone, but most people probably don't even know they're using it, but once we get to web3, it will reach everyone pretty quickly.

Su Ye:Thanks, glad I heard such exciting predictions for the future.

I once heard a saying that in the future, like the blockchain, the boundaries of organizations may not be the country itself, but more like a DAO system, coexisting with each other. This is really amazing, we are all looking forward to the next development, it is a great honor to invite you today, see you next time!