In the post-public chain competition era, Algorand is fully equipped. The blockchain industry is developing rapidly, what makes Algorand stand out? With the continuous rotation of outlets, what adjustments have Algorand made to its development goals and focus at this stage? Why did SIAE, the Italian Association of Authors and Editors founded in 1883, choose Algorand to manage authors' rights in the form of NFT?

We are very pleased to invite Summer Miao, head of the Asia-Pacific community of the Algorand Foundation, and Zhu Haichao, head of ecological development in the Asia-Pacific region, to share with you!

The following is the transcript of the community interview, organized by Odaily:

Summer: Hello everyone, I am Summer from the Algorand Foundation, and I am mainly responsible for the marketing and community work of the Algorand Foundation in Asia.

Zhu Haichao: Hello everyone, I am Xiao Zhu from Algorand, mainly engaged in the developer community. Developer friends are welcome to contact me and join the ecology to earn Algo.

· Team contact email: wechat-channel@algorand.foundation

Q1: Please briefly introduce the Algorand project and the main founders of the team.

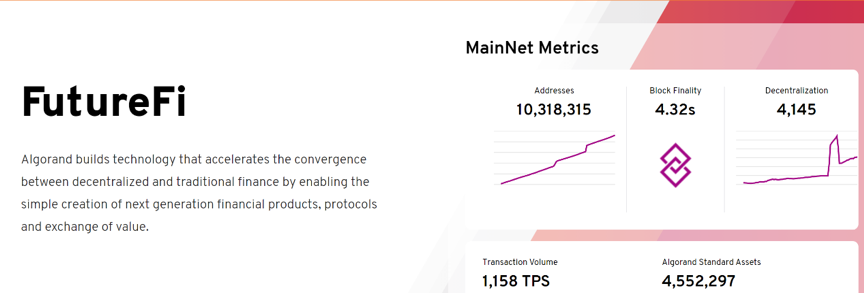

Summerofficial websiteofficial websiteFriends, you can see the eye-catching characters FutureFi (Future Finance).

Algorand is building the technology that drives Future Finance (FutureFi). The developed blockchain infrastructure can provide the interoperability and capacity needed to handle large-scale transactions for DeFi, financial institutions and governments to smoothly transition to FutureFi. The technology of choice for more than 500 global businesses.

Under the leadership of Professor Silvio, the Algorand team is mainly composed of members from academia and business circles. Most of the R&D team members come from well-known universities such as MIT and IBM and international giants; the operation team is led by a group of people who have made achievements in the financial and entrepreneurial circles.

Also worth noting that one of the Algorand advisors,Paul MilgromReceived the Nobel Prize in Economics on October 12, 2020, for improving auction theory and inventing new auction formats.

We have strong academic and traditional industry resources, so the Algorand project has excellent technical strength, executive operation capabilities, and what other blockchain projects do not have - credibility and influence in traditional industries. This has also become the unique advantage of Algorand in the financial field.

Q2: Algorand was very popular when it was launched in 2019, but it seemed to be quiet for a while after that. Please talk about what important achievements Algorand has achieved in the past two years?

Summer: Compared with the frenzied atmosphere when it was just launched, I think that after the mainnet launch, Algorand has entered an important stage of steady development and expansion.

The mainnet was launched in June 2019, and it took Algorand half a year to improve other functions such as smart contracts on the chain; in 2020, we mainly completed the construction of infrastructure, and formed marketing and operation teams in various regions of the world.

It has been less than two years since the mainnet was launched. As a high-performance and stable third-generation blockchain, Algorand has been highly recognized globally for its unique Layer-1 functions, advanced smart contracts and low transaction costs.

Technology and infrastructure:

On March 31 this year, the number of Algorand network accounts has exceeded 10 million! (Algorand block explorer) At the same time, Algorand still conducts regular protocol upgrades to lead the development of technology and adapt to the needs of the industry.

For a real-time view of Algorand's scale, velocity, adoption, number of nodes, and more, head over to the Algorand Developer Portal's Algorand MetricsView the corresponding data on the website.

Ecological aspect:

At present, there are more than 500 partners on the Algorand chain, covering various aspects such as securities issuance, international financial derivatives, financial stable coins, real estate, decentralized exchanges and even national digital currency applications. The latest highlights of the Algorand ecosystem applications include:

· SIAE issued more than 4 million NFTs for more than 95,000 creators based on Algorand

· Curv joins hands with Algorand to promote the security construction of institutional digital assets

Q3: The blockchain industry is developing rapidly, and the outlets are constantly changing. Has Algorand’s positioning been adjusted compared to before? If so, what are the current development goals and focus?

Summer: Algorand's positioning has always been a financial public chain, and this general direction has not changed. This year we particularly emphasized the concept of "future finance". Compared with CeFi, DeFi is a broader development direction.

At present, Algorand will invest relatively large resources in the subdivision of payment and stable currency, and is committed to the development of stable currency assets and DeFi applications on Algorand.

Starting this year, our goal is to gradually decentralize the functions of the foundation, from the role of management to the role of execution, and hand over the rights of governance to the community; the development of the developer community and ecological applications that are currently being done will be decentralized lay the foundation for governance.

Q4: The concept of NFT is particularly hot. Recently, the Italian Society of Authors and Editors (Società Italiana degli Autori ed Editori, SIAE), founded in 1883, chose Algorand to manage the rights of more than 95,000 authors in the form of NFT. In terms of NFT, what layout do we have? Why did SIAE choose Algorand?

SummerThis articleThis article, understand the background of this NFT cooperation.

It is no humility to say that Algorand is the platform of choice for NFT publishers. The key factors that differentiate Algorand from other traditional blockchains are the simplicity of NFT creation; very low transaction fees; and high-speed security. And more importantly, the use of the optimal CPU is in line with the concept of carbon neutrality.

Developers can easily issue NFTs with Algorand Standard Assets (ASA), and users can also create or operate ASA in smart contracts through more advanced functions. All assets on Algorand have their own native asset IDs and support atomic swaps, enabling NFT issuers and buyers to complete transactions directly on the chain without market intermediary guarantees.

Both the fungible and non-fungible tokens supported by Layer-1 can be set to a restricted mode, which allows issuers to comply with regulatory requirements and issue in compliance. For example, this feature is very helpful for real estate NFTs and digital ownership registries.

The properties of Algorand's low-cost transactions and near-instant block certainty are very important for NFT to represent in-game items, because players need fast transactions with low fees.

In addition, the entire Algorand ecosystem is very flexible and built with the future in mind. Building NFTs on Algorand means benefiting from an infrastructure full of customizable options and unique features. These are the reasons why SIAE prefers Algorand.

Q5: Outside of SIAE, Algorand has always cooperated closely with traditional fields. Unlike many public chains and projects, they are all developed in the encryption market, but they are not well-known outside the circle and lack use cases. Can you briefly introduce the cooperation cases of Algorand in different traditional fields? After that, we consider how to expand in the traditional market and the blockchain market?

Summer: Yes, Algorand has been committed to helping the traditional financial industry to transform its business. As mentioned just now, we have more than 500 partners on the chain, covering various aspects such as securities issuance, international financial derivatives, financial stable coins, real estate, decentralized exchanges and even national digital currency applications.

For detailed information about our use cases on the chain, you can refer to the official websiteUse Casespage:

Here are two examples: one is the national digital currency use case - the first government-backed Marshall Islands digital currency will be issued based on Algorand technology. (SOV official website)

Located in the central Pacific Ocean, the Marshall Islands are known as "Little Hawaii". Due to historical reasons, the Marshall Islands has never established an independent economic system, and has always used the US dollar. The issuance and regulation of the US dollar are all determined by the United States, and the Marshall Islands have no right to speak.

In order to strive for the independence of economic sovereignty, Marshall began to explore the possibility of issuing a sovereign cryptocurrency. After long-term research and exploration, the Marshall Islands chose Algorand for its high speed, scalability, security, ability to effectively implement the required compliance controls, and the transaction finality required by the national digital currency . After issuance, SOV will be co-circulated in the country with US dollars.

The other is a recently released real estate use case — Vesta Equity, a global home equity market. Through the blockchain technology provided by Algorand, Vesta will establish a direct connection between real estate investors and homeowners through tools and marketplace platforms, eliminating middlemen, so as to achieve seamless transactions. Effectively assist traditional industries to carry out blockchain transformation.

In addition to ecological development, in addition to our 250 million ALGO ecological reward plan and the Algorand accelerator activities carried out in various places, the recently launched $10 million fund for the NFT field——aNFT.Fund, will also become a booster for Algorand's ecological development. Here, related projects are also welcome to contact us. Algorand ecology, waiting for you to join.

Q6: Back to the DeFi that keeps the heat in the circle. Recently, the Ethereum-based DeFi protocol Balancer plans to expand on Algorand. So if the applications on Ethereum are migrated to Algorand in large quantities, what is the migration cost? What are the significant advantages of Algorand to attract developers to migrate?

Summerlast year,

last year,Props Migrating from Ethereum to Algorand, while the transaction volume surged, did not affect the transaction speed on the chain at all.

In addition, our ecological partnersReach A high-level development language has been developed to make the cost of migrating applications from Ethereum to Algorand very low. Balancer was one of their first adopters.

Q7: In April, the Algorand Foundation announced that the multi-chain DeFi data network Unmarshal was selected into the Algorand 250 million ALGO reward plan. What are the criteria for the Algorand Foundation's selection? What else does Algorand do to attract developers? What is the current developer situation on Algorand? Can you provide some specific data?

Summer: The most important indicator is the contribution to the Algorand ecosystem, such as how many users and potential users this application has now. Last year, basically everything that needs to be done in the direction of development tools has been completed. In addition to project rewards, developers can also receive task Bounty, participate in hackathons, and apply for our upcoming Innovation Fund.

The Algorand project has a strong developer community overseas. In contrast, the number of Chinese developers is relatively small. At present, the overall number of developers is about 10,000, mainly concentrated in our Discord, developer forums and other platforms.

Domestic developers are very welcome to join the Algorand ecosystem. Interested developers and friends please contact our classmate Xiao Zhu.

Overseas, we have carried out sufficient marketing promotion, and also carried out various developer activities (online live broadcast, etc.) to attract developers who are interested in the blockchain. In China, we have also held developer meetups, as well as offline hackathons, developer Bounty and Grant and other activities with Algo token incentives. Developers are very welcome to participate~

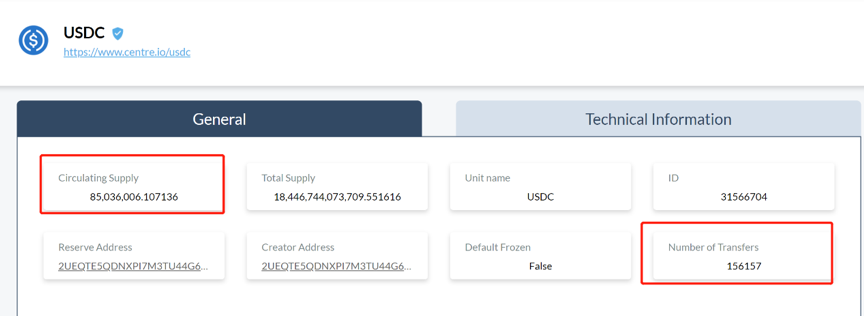

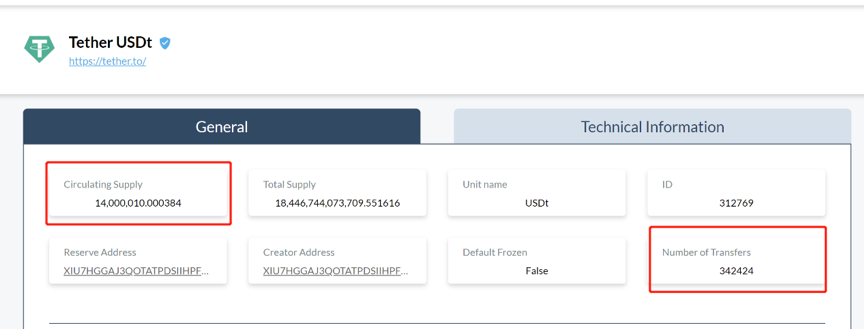

Q8: We are concerned that Algorand is deploying stablecoins. What is the current minting and usage data of USDT and USDC (USDT-ALGO, USDC-ALGO) on the Algorand mainnet?

Summer: For data on USDT USDC on the Algorand chain, you can check the link on the block browser (USDC) and (USDT) to see the latest circulating and trading volumes.

We are also actively promoting the exchange support of USDT and USDC. The current exchange support is as follows:

· Exchanges that have listed USDT on the Algorand chain: Bitfinex, LBank, Hotbit, etc.;

· USDT and USDC on the Algorand chain have been launched at the same time: Kucoin, OKEx, OKCoin, etc.

· USDT and USDC on the Algorand chain will be launched soon: Huobi, etc.

The USDT and USDC on the Algorand chain are safe, fast, and have low transaction costs (0.1AGLO). Everyone is very welcome to use them. You can pay more attention to our Chineseofficial channel, there will be USDT-related activities in the future, you can learn about it in time~

Q9: The public chains are still upgrading their performance this year. At present, many expansion public chains have been launched one after another, such as Polkadot, Solona, NEAR, etc., all have their own bright spots in terms of performance. What are the competitive advantages of Algorand compared with them? The concept of Layer 2 is also very popular recently. Does Algorand have any considerations or plans in this regard?

Summer: Algorand's current performance can fully meet the needs of today's applications. This year, there is also a proposal to increase the speed of block generation that is being tested for feasibility. This improvement mainly comes from the increase in bandwidth, not the upgrade of the algorithm.

an articlean article, is to develop the Clarity language with Blockstack. This programming language will be used on the second layer of Algorand, the main purpose is to improve the user experience of application development.

Q10: Public chain governance is also the most important part of public chain development, and the market is paying more and more attention to the development of DAO. Does Algorand have any experience or plans for governance? In addition, I heard that Algorand will have major actions related to on-chain governance in the near future, can you disclose it?

Summer: The timing of this question is very good, we just released it on Monday"Algorand Decentralized Governance"This is a crucial step on our road to on-chain governance.

The original text is relatively long,Simply pick the key points for everyone:

Algorand chain governance can be simply divided into three parts, investing in Algo, participating in governance voting, and obtaining Algo rewards:

At present, the participation reward adopted by Algorand is what I just said to everyone. Holding coins in the official wallet (Algorand Wallet) will automatically generate interest (currently about 6% per annum) without locking up.

The governance plan on the chain will gradually replace the current participation rewards with governance rewards, which involves the following steps:

1) Hold currency in the wallet 2) Each lock-up period is 3 months 3) Participate in voting 4) Get rewards (according to the number of participants and the number of lock-ups, the annual rate will vary)

At present, the decentralized governance proposal still needs to be voted by global nodes. After the vote is passed, it will be implemented in October.

The current interest-bearing interest will continue until the end of the year, so if you participate in on-chain governance (lock-up) this year, within three months from October, you will getParticipation Rewards + Governance Rewardsdouble reward.

In the lock-up of the governance on the Algorand chain, the coins you lock are all in your own account, and no one else can move them, and there will be no so-called loan pledge. Moreover, you can take it away at any time in the middle (you will only lose the reward eligibility, and there is no other loss).

For more information on on-chain governance, you can read this article in detail. All Algo token holders can participate in governance. After the on-chain governance is enabled, the decision-making power of a total of 3.2 billion Algo resources in the Algorand ecosystem will be transferred to the hands of the community. Everyone can be a decision maker, participate in governance, and get rewards.

Everyone is welcome to participate, more details will also be in the next few months, in ourofficial channelrelease.

Thank you again for your participation, and welcome to continue to pay attention to the latest developments of Algorand and join the Algorand ecosystem.