Regulatory break, or start with Coinbase listing?

本文约4164字,阅读全文需要约17分钟

What's the 'secret' to Coinbase's $65 billion+ valuation?

The word "Coin" used to symbolize coins, and after April 14, this word has a new meaning, namely the stock symbol of Coinbase after listing.

The listing of Coinbase is one of the two keys that can change the structure of the cryptocurrency market in 2021 (the other is the US Bitcoin ETF). Although it is not the first stock in the cryptocurrency market, Canaan Technology and Ebang International have also been listed successively , but compared to mining companies that are more equipment-oriented, it is clear that digital currency trading platforms are more representative of the cryptocurrency market. At present, the entire cryptocurrency market has extremely high expectations for the listing of Coinbase. Not only cryptocurrency investors are eager to break the circle, but institutional investors also want to test the regulatory situation, and even competitors are also eager for Coinbase to perform well after listing. Good, and by the way, increase the value of your own platform.

According to the latest reference price given by Nasdaq, the reference price of Coinbase’s stock price is US$250, with a total valuation of more than US$65 billion. This valuation makes Coinbase’s price-earnings ratio reach 180 times, which is extremely rare in traditional industries .However, according to the nature of the industry in which Coinbase operates, it cannot be directly measured by the standards of other industries among listed companies. If you insist on comparison, Tesla, which is also in the "future" industry track, is the most ideal comparison object. Tesla's price-to-earnings ratio has reached as high as 1320 times.At present, various cryptocurrencies are performing well, especially Bitcoin, which has reached new highs in the past two days, which will directly promote the stock price of Coinbase after listing. Big upside.01 The proud statistics of the Coinbase platform

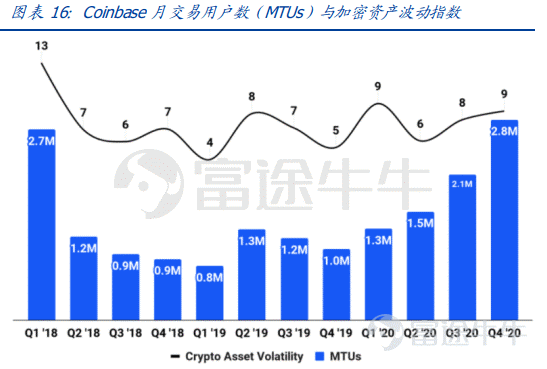

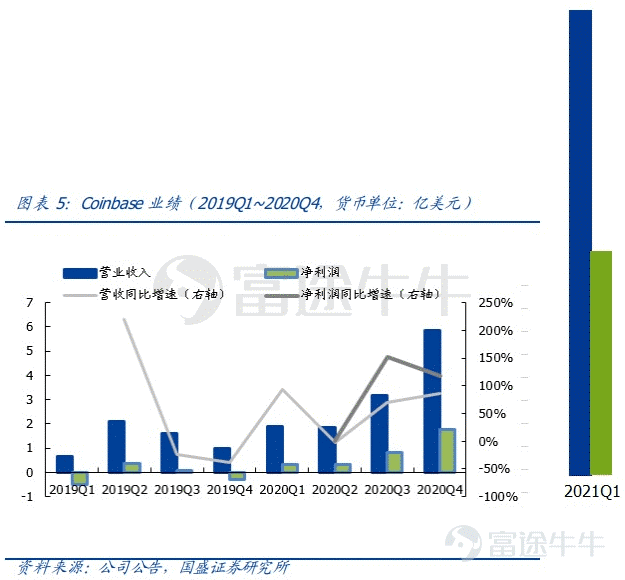

In the past year, the cryptocurrency market has developed rapidly, and the price of cryptocurrencies has performed very well. Bitcoin has risen by 700%, leading the cryptocurrency market out of an unprecedented bull market. Against this background of development, on April 6, Coinbase released its financial report for the first quarter of 2021 and its full-year forecast.The superiority of Coinbase's financial report for the first quarter of 2021 is reflected in institutional users, institutional revenue/profit, and transaction volume.1. User. As of the first quarter ended March 31, the number of certified users on the platform totaled 56 million, and the number of monthly transaction users (MTUs) in the first quarter was 6.1 million, a year-on-year increase of 369% and a quarter-on-quarter increase of 117%. The monthly trading users of 7 million, 5.5 million, and 4 million are the three levels of the capitalization level of the encryption market in 2021, which will affect the revenue level of the platform. 2. Revenue/Profit. In terms of revenue, 2021 Q1 revenue jumped from US$190.6 million in the same period last year to approximately US$1.8 billion, and net profit increased from US$31.9 million to between US$730 million and US$800 million. In 2020, Coinbase's revenue was only US$1.3 billion, and its net profit was US$300 million. In other words, Coinbase's net profit in the first quarter has reached at least twice that of last year's annual profit. According to this ratio, Coinbase's full-year revenue in 2021 will reach $12.2 billion.

2. Revenue/Profit. In terms of revenue, 2021 Q1 revenue jumped from US$190.6 million in the same period last year to approximately US$1.8 billion, and net profit increased from US$31.9 million to between US$730 million and US$800 million. In 2020, Coinbase's revenue was only US$1.3 billion, and its net profit was US$300 million. In other words, Coinbase's net profit in the first quarter has reached at least twice that of last year's annual profit. According to this ratio, Coinbase's full-year revenue in 2021 will reach $12.2 billion. 3. Trading volume. In terms of transaction volume, the 2021 Q1 transaction volume is US$335 billion, while the Coinbase encrypted asset transaction volume in 2020 is US$193 billion. The transaction volume in the first quarter has reached 1.5 times that of last year.The above three data reflect how rapidly Coinbase has grown after entering 2021, which is also the main reason why major institutions have continuously increased the valuation of Coinbase after its listing.The main support of Coinbase's later performance is inseparable from its stable ecology.At present, Coinbase's business types mainly include two major parts. One is transaction services, which are the main source of revenue, accounting for more than 80% of total revenue. The second category is the subscription and service product category.Transaction service classes include:1. Payment and collection (user transfer within the platform).2. Investment. BTC and ETH respectively accounted for 55% of Coinbase's overall trading volume. This data may reflect that Coinbase's single dependence is too heavy, but it is actually the key to Coinbase's listing, which we will talk about later.In addition, companies currently investing through the Coinbase platform include MicroStrategy, which holds the most coins, Tesla, a world-renowned company, Meitu, the first Hong Kong-listed company to hold Bitcoin, and many other corporate institutions. In terms of institutional business, Coinbase currently dominates pack of heroes.3. Consumption. For example, Coinbase has cooperated with Visa to launch the debit card Coinbase Card, and the underlying asset is the user's encrypted assets in Coinbase. British users can support Visa's European merchant consumption.

3. Trading volume. In terms of transaction volume, the 2021 Q1 transaction volume is US$335 billion, while the Coinbase encrypted asset transaction volume in 2020 is US$193 billion. The transaction volume in the first quarter has reached 1.5 times that of last year.The above three data reflect how rapidly Coinbase has grown after entering 2021, which is also the main reason why major institutions have continuously increased the valuation of Coinbase after its listing.The main support of Coinbase's later performance is inseparable from its stable ecology.At present, Coinbase's business types mainly include two major parts. One is transaction services, which are the main source of revenue, accounting for more than 80% of total revenue. The second category is the subscription and service product category.Transaction service classes include:1. Payment and collection (user transfer within the platform).2. Investment. BTC and ETH respectively accounted for 55% of Coinbase's overall trading volume. This data may reflect that Coinbase's single dependence is too heavy, but it is actually the key to Coinbase's listing, which we will talk about later.In addition, companies currently investing through the Coinbase platform include MicroStrategy, which holds the most coins, Tesla, a world-renowned company, Meitu, the first Hong Kong-listed company to hold Bitcoin, and many other corporate institutions. In terms of institutional business, Coinbase currently dominates pack of heroes.3. Consumption. For example, Coinbase has cooperated with Visa to launch the debit card Coinbase Card, and the underlying asset is the user's encrypted assets in Coinbase. British users can support Visa's European merchant consumption.02 Impact after listing

The reason why the market has such expectations for the listing of Coinbase is mainly due to the huge radiation impact of the listing of Coinbase, which involves many competitors, currency prices and even the entire cryptocurrency market.

For some digital currency trading platforms that also want to go public, Coinbase is equivalent to a "pathfinder" role. For example, KRAKEN, another top bitcoin trading platform, was approved for listing on Coinbase, and there was news that it might consider listing in 2022, while others such as BlockFi, MicoBT, Gemini, eToro, Bitfury, etc. have reported IPO news.Of course, the listing of Coinbase has also had a major impact on these major trading platforms, mainly reflected in the rise of platform coins. The logic of the market is that if Coinbase can have such a high valuation when it goes public, does Binance, which is said to be bigger than Coinbase, deserve a higher valuation?Another point that cannot be ignored is DEX (decentralized trading platform). Although most of the current DEXs have a high threshold for use and are not as convenient as CEX (centralized trading platform), their balance and decentralization are very important to centralized trading platforms. For trading platforms, it is a "dimension reduction blow", and the current utilization rate and transaction volume of DEX are gradually increasing, and may not always lag behind CEX, and the listing of Coinbase will also bring more attention to DEX.One of the market's concerns about the listing of Coinbase is that the current digital currency trading platform business situation is too dependent on the price of cryptocurrencies, especially the rise and fall of Bitcoin. This is indeed the downside of Coinbase.But you might as well think about it, will the listing of Coinbase bring positive feedback to the cryptocurrency market?When Coinbase goes public, the excellent financial report and the "abnormal" rate of return will make investors crazy, but when the potential of Coinbase after the listing is gradually realized, more and more investors will look for the next "Coinbase", and The best place is naturally the cryptocurrency market. Coinbase is just the first fruit brewed from the soil of the cryptocurrency market. There will be more fruits waiting for traditional investors to pick, and it will also usher in the cryptocurrency market. Great attention, and this will be fed back to the currency price.03 Coinbase's future market positioning

1. The place where high-quality cryptocurrency is launched.Coinbase is an old-fashioned trading platform. It has also established a good reputation and reputation in the encryption field. It has a wider audience and a larger flow than other trading platforms. When the new currency is launched, it is bound to receive more users focus on.And when Coinbase goes public, the influence of the aura of "the only listed digital currency trading platform" is unique, and the effect of the "Coinbase effect" will only be strengthened at that time.2. The listing benchmark of the digital currency trading platformEven the most compliant Coinbase was once fined by the SEC on the eve of listing because of the fraudulent trading volume a few years ago, and even delayed the listing time. For other digital currency trading platforms, the warning line is even more ineffective It is everywhere, and after Coinbase is listed, other trading platforms can directly "copy homework".It is worth noting that not everyone can copy this "job", and choosing to go public may also mean giving up many benefits.Take Coinbase as an example. At present, Coinbase has no contract business, and its main source of income comes from the investment of BTC and ETH. This has caused Coinbase to lose a large number of contract markets, and also lost a large number of users who love contract transactions. The main reason is that BTC and ETH ETH is a non-securities certificate that has been recognized by the SEC, and if the contract business is involved, the huge amount of liquidation on the platform will also attract questions from the regulatory authorities.This is the "sorrow" behind Coinbase. Originally, Coinbase could increase its business volume to a higher level, but in order to finally go public, it had to abandon any business with regulatory crisis. This also shows the gold content of Coinbase's data.Even so, in the absence of other successful examples, Coinase remains the only reference point for other exchanges trying to successfully list.3. The regulatory buffer zone of the cryptocurrency marketSooner or later, the cryptocurrency market will face a head-to-head confrontation with regulators, and the most watched "battlefield" is the United States.Some time ago, Coinbase, Fidelity, and Square jointly established a cryptocurrency innovation council with a group of cryptocurrency companies. One of the expectations of the establishment of the council is to find a better way to face regulation. Of the middle, Coinbase is undoubtedly the most emblematic.For these companies, it is very important to better deal with regulation, because most of these companies provide investment services for Bitcoin, own Bitcoin or have a foothold in the Bitcoin market. There are unfriendly or aggressive behaviors in the market. Among these companies, they may lose part of their assets at least, or die directly at worst.So far, the attitude of the U.S. regulators to the cryptocurrency market is not friendly, especially the remarks of US Treasury Secretary Yellen have repeatedly caused a severe setback to the cryptocurrency market, and the Cryptocurrency Council headed by Coinbase will be in the next Played a major role in the deal.When Coinbase is listed, it is equivalent to straddling the traditional financial market and the cryptocurrency market. At the regulatory level, strive for a more reasonable position.At present, the most concerned issue in the cryptocurrency market for the listing of Coinbase is whether it will have a positive impact on the industry. As mentioned earlier, the listing of Coinbase is a new chapter in the cryptocurrency market and an important channel to introduce traditional financial investors. If it is finally reflected in the price, the imagination space can be infinitely expanded.

The important significance of the listing of Coinbase is that it can play a positive guiding role in supervision, so that the traditional capital market can see the high profitability of the digital currency trading platform, see the high return of the cryptocurrency market, and introduce more traditional capital, thus triggering Regulatory thinking, has the cryptocurrency market become an indispensable part of the financial market? The regulation of the cryptocurrency market is broken, or it may start from the listing of Coinbase.