In the U.S. market, Coinbase, which provides encrypted digital currency transactions, will be listed on April 14. Coinbase generated $1.8 billion in revenue in the first quarter of 2021, surpassing last year's full-year revenue of $1.3 billion. The profit ceiling for the first quarter could be $800 million. Registered users were 56 million, up from 43 million in the previous quarter. With such a growth rate, the scale of revenue and profit far exceeds that of existing stock exchanges. The main trading product of Coinbase is Bitcoin. This shows how popular the market is with Bitcoin. In addition to Coinbase's listing factors, other market behaviors also indicate a high degree of market attention to Bitcoin. Some well-known insurance companies such as Mass Mutual, New York Insurance Company, Liberty Mutual and Starr have begun to jointly develop Bitcoin-based insurance products. Well-known investment banks in the United States have also begun to provide bitcoin-related businesses. The most radical of these was Morgan Stanley. Morgan Stanley is investing heavily in bitcoin's market infrastructure, while also offering bitcoin-related services to its wealth clients. In addition, as of today, 9 applications for the establishment of Bitcoin-based ETFs in the US market have been submitted to the US SEC. These and other developments in the market indicate that the U.S. market is increasingly placing value on Bitcoin.

Among the market's various judgments on the value of Bitcoin, one is to consider it a safe-haven asset. And such a view has its logic.

The rapid increase in the price of Bitcoin can be said to have started in March 2020. The monetary policy implemented by the Federal Reserve to rescue the crisis brought about by the epidemic has led to a large increase in the issuance of US dollars. The additional issuance of U.S. dollars will inevitably lead to the depreciation of the U.S. dollar and the inflated value of all assets priced in U.S. dollars. These assets include real estate and stocks. For institutional investors, they must consider how to deal with the actual depreciation of their own assets brought about by such market developments. They began looking at alternative assets that could hedge against such market risks. Among these alternative assets, the safe-haven value of Bitcoin has gradually been recognized by the market. As this recognition increased, more institutions and individuals began to hold Bitcoin. The safe-haven value of Bitcoin is embodied in the following aspects.

First, Bitcoin was designed as an electronic currency. It is designed to provide a monetary solution to existing fiat currencies. In its design, the total amount of Bitcoin is certain. This avoids the characteristics of additional issuance of legal currency. Moreover, the operation mechanism of Bitcoin is automatic operation, which is not controlled by any institution or individual. The mechanism for determining the total amount of bitcoins and obtaining them is now automatic. In the past 12 years of development, as the transaction of Bitcoin has become more and more common, a direct exchange transaction between Bitcoin and legal tender has been formed. Bitcoin can thus be priced based on various fiat currencies. Bitcoin is now turning into a store of value and payment tool as its usage and transactions become more widespread. Due to the above characteristics, especially the most basic characteristic that the total amount of Bitcoin is fixed, it can avoid such a mechanism of additional issuance of legal currency, thus forming a differentiated competition with legal currency. When there is a problem with the legal currency in the market, the funds in the market will naturally flow to a differentiated competitive product like Bitcoin.

In terms of differentiated competition with fiat currencies, in practice, Bitcoin has increasingly shown its differentiated characteristics. When the currencies of some countries are highly inflated, the local bitcoin transaction volume has increased significantly. This is true in places like Argentina, Türkiye and Nigeria. This shows that the market is accepting Bitcoin as a tool to compete with existing fiat currencies.

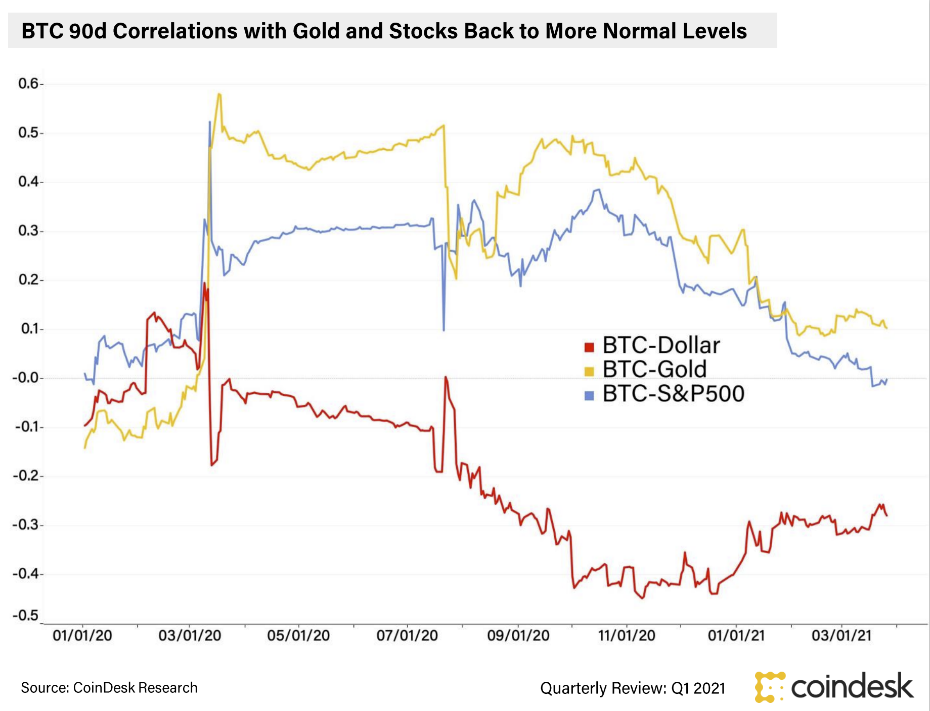

Another basic requirement for a safe-haven asset is its weak correlation with other mainstream assets. The smaller the correlation, the higher its value as a safe-haven asset. According to a recent report by Coindesk, the correlation between Bitcoin and gold and the S&P500 is now increasingly trending towards zero, and it is also beginning to show a negative correlation with the US dollar. Therefore, in terms of correlation with other assets, Bitcoin has more and more safe-haven value.

In the current US market, the continuous issuance of US dollars has caused widespread concerns about the depreciation of the US dollar. Therefore, the natural selection of the market can hedge against the risk of dollar depreciation. The recent increase in market interest in silver and uranium both point to this risk-off trend. Bitcoin has also become the choice of safe-haven assets for some individuals and institutions. The common practice of financial institutions now is to use 0.5%~1% of their assets to hold bitcoins, so as to hedge the market risk of the entire investment portfolio. Of course, for larger and more conservative financial institutions, such as Mass Mutual and Black Rock, the amount of Bitcoin they hold is a smaller proportion of their investment portfolio. At the other extreme of the market, there is also a phenomenon like MicroStrategy CEO Michael Saylor borrowing money to hold a large amount of Bitcoin. At the other extreme, there are naturally a large number of institutional and individual investors who are not optimistic about Bitcoin, and choose gold or some types of bonds as safe-haven assets. Therefore, in the U.S. market, in terms of choosing Bitcoin as a safe-haven asset, users' choices are still on a very extreme continuum. But judging from the current market development in the United States, more and more funds will flow into Bitcoin.