This article comes fromZycrypto, by Olivia Brooke

Odaily Translator | Nian Yin Si Tang

Odaily Translator | Nian Yin Si Tang

HSBC is the latest bank to sound the alarm on bitcoin — the bank recently blocked its clients from buying MicroStrategy stock (MSTR) on its online trading platform HSBC InvestDirect (HIDC).

There are reports that the company has banned users from trading products related to cryptocurrencies such as Bitcoin.

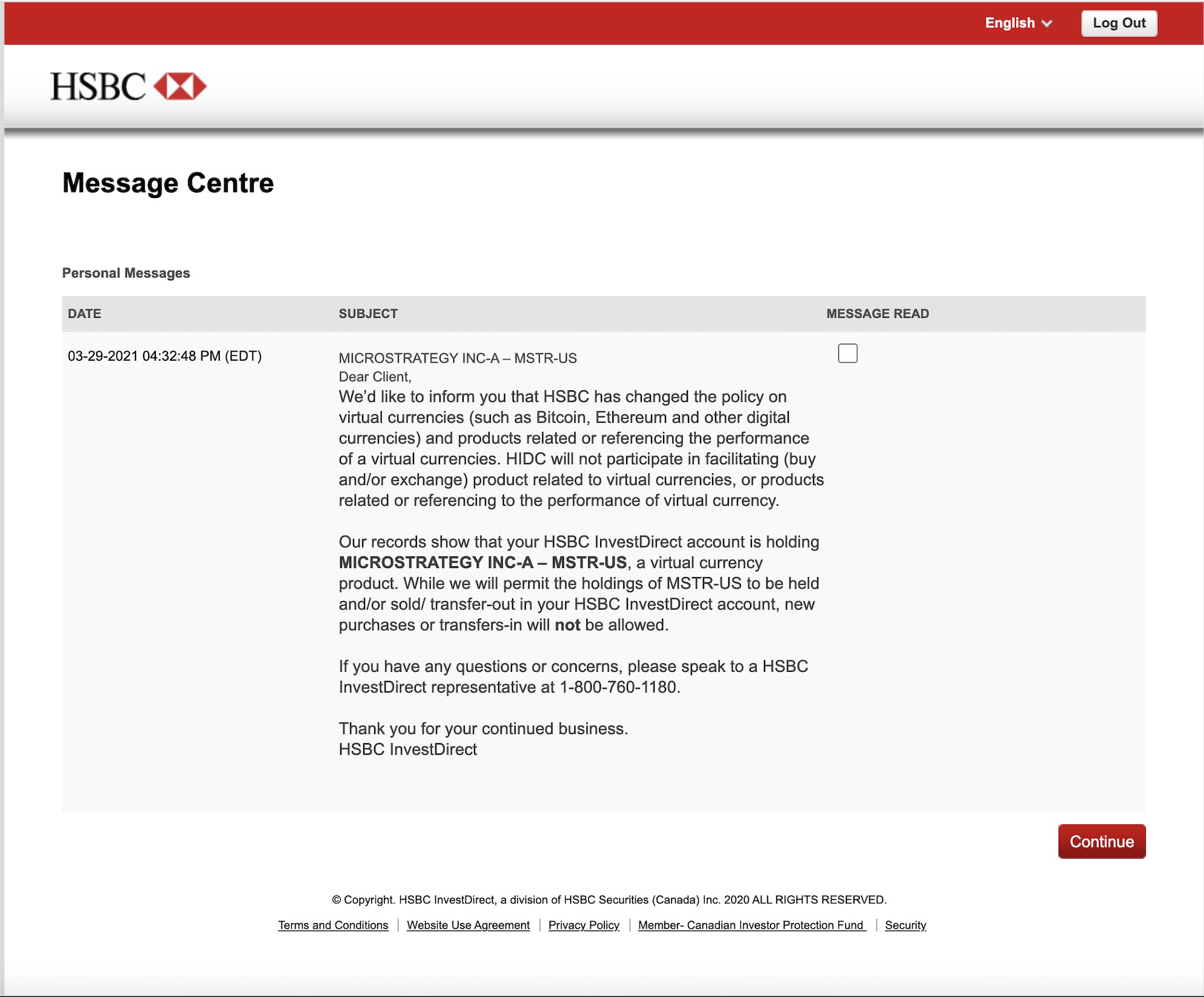

According to an email disclosed by a customer of HSBC, the bank updated users on changes in its policies regarding digital currencies such as Bitcoin and Ethereum. The email has been circulating online since then. According to the email, HSBC has changed its policy on virtual currencies (such as Bitcoin, Ethereum and other digital currencies) and products related to or referring to the performance of virtual currencies. HSBC stated that it will not participate in the promotion (purchase or exchange) of products related to virtual currencies, or products related to the performance of virtual currencies.

Meanwhile, HSBC has instructed users who already own MicroStrategy shares not to purchase additional shares.

MicroStrategy, a business intelligence and software company, added Bitcoin to its balance sheet for the first time in August 2020 and has been adding to its holdings of Bitcoin since then. As of April 5, 2021, MicroStrategy purchased approximately $2.226 billion in Bitcoin 91,579 bitcoins, with an average price of approximately $24,311 per bitcoin.

The blacklisting of MicroStrategy is the latest in HSBC's recent anti-crypto campaign. Earlier this year, HSBC also reportedly blocked customers from transferring profits from crypto exchanges to their bank accounts.

The email disclosed that clients’ crypto holdings were indeed being tracked, adding that clients’ MSTR holdings were visible.

"Records show that your (HDIC) holds MICROSTRATEGY INC-A — MSTR-US, a virtual currency product...new purchases or transfers will not be permitted," the email states.

Users of the bank took to Twitter to express displeasure at the bank's restrictions on their accounts. Some believe that HSBC's move has "no legal support" and has crossed the line because it does not support the free market.

This is not the bank's first move to limit the use of cryptocurrencies on its platform.

Back in January, the British bank HSBC had started refusing to process transactions from cryptocurrency exchanges. British cryptocurrency traders and investors can no longer move their funds from digital asset exchanges to HSBC. Meanwhile, a number of UK banks have also taken action to prevent their customers from buying crypto assets using debit or credit cards.

As the bank pursues its latest move against MicroStrategy, crypto users are concerned about the future actions of other traditional financial platforms dealing with digital currencies. “All these companies could be in this situation for holding bitcoin. This is the antithesis of the 'free market',” one Twitter user said.

Ironically, for others like Tesla (TSLA), Square, and Hot 8 Mining, there may be no need to panic just yet. These companies are still listed on the HIDC trade index, even though they, like MicroStrategy, have invested heavily in Bitcoin.At the same time, some see this as an indirect way for governments to crack down on Bitcoin. This topic has recently been sparked in the bitcoin communitylively discussion