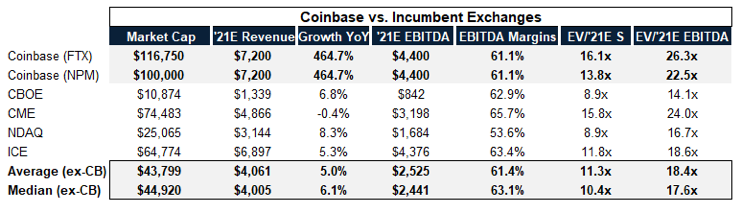

Coinbase just released its Q1 2021 numbers. Its total revenue for the first quarter was $1.8 billion, up from $1.3 billion for all of last year. Profits could reach $800 million. The number of registered users was 56 million, an increase of 13 million from the end of last year. The first quarter of 2021 has been a stellar quarter for Coinbase. It has already expected this quarter's performance, so it chose to list on April 14, a few days after the release of this quarter's data. The Coinbase listing has now been estimated to have a market capitalization of $100 billion. Coinbase has surpassed mainstream exchanges in the United States in some key data. It can be seen that the development of encrypted digital finance in the US market is surpassing mainstream finance.

secondary title

First, it will promote supervision to regulate and encourage the development of this industry

secondary title

Second, it will promote the acceptance of encrypted digital currency

secondary title

3. It will promote the growth of the number of encrypted digital currency users

secondary title

Fourth, it will promote encrypted digital finance to become a mainstream financial institution faster

Although Coinbase has the current huge revenue and profit scale, and it is also in the field of encrypted digital financial transactions, it is still not a mainstream financial institution in the US financial market. The licenses it holds are currency payment licenses issued by various states. The mainstream stock exchanges hold US national licenses. The same is true in the banking industry. Some third-party payment companies with a large number of users also hold currency payment licenses issued by various states. Companies such as Google Pay, Facebook Pay, and Apple Pay still hold currency payment licenses issued by various states. The listing of Coinbase is conducive to promoting the further integration of these technology companies into the mainstream financial market in the United States. Now the Office of the Comptroller of the Currency is offering banking licenses only for payment services. If this license is officially launched, then Coinbase and PayPal are likely to be the first companies to obtain these licenses. Therefore, financial technology companies will further integrate into the mainstream financial market in the United States.

In terms of capital markets, national-level digital asset exchanges have now been established around the world. The most typical representative in this regard is the Swiss digital asset exchange. Now Singapore's largest commercial bank, DBS Bank, is also establishing a digital asset exchange. Therefore, national digital asset exchanges are a global trend. Under the leadership of the new SEC Chairman Gensler, the United States is also likely to launch a license for digital asset exchanges soon. Then Coinbase is also very likely to become one of the first institutions to obtain this license. So what is likely to happen in the future is that Coinbase provides services in the modern financial industry and the securities industry at the same time. And this is a business that current financial institutions cannot do. Of course, the premise of this is that the US regulations need to make great changes. In view of the development of the application of blockchain in the financial field, the corresponding regulation will certainly make necessary changes to encourage innovation in this area. So Coinbase is in a very favorable position to be a beneficiary of these changes.