On April 4th, the genesis period (Gensis Group, also known as the Bonding Curve sales period) of the algorithmic stablecoin Fei project ended. According to the project’s official website, a total of $960 million worth of ETH (PCV, which can be simply understood as the reserve fund or TVL of the Fei protocol) was raised during the three-day fundraising event, which is an astonishing amount.

At the same time, the project has previously received financing of up to 19 million US dollars from star institutions such as Coinbase, and with the mechanism of "arbitrary mortgage amount + intelligent agreement to control the price", since Fei launched on Uniswap, it should have had this fantastic start. But the playbook didn't go as investors expected.

secondary title

1. There may be uncertainty in PCV

PCV may be the biggest highlight of this project, once in"Fei, the high-profile algorithmic stable currency, what is the wealth creation effect?" "It is mentioned that the most important indicator for evaluating investment returns is the total amount of PCV. When the overall market is stable, the higher the total amount of PCV, the more capital the government can use to stabilize Fei, and the holders of Fei are more optimistic about the asset value, which can form a positive cycle, not to mention the project launch At the beginning, the total amount of PCV has reached 1 billion US dollars.

However, the biggest variable is that users use ETH as collateral to deposit PCV. In a bull market or bear market with violent market fluctuations, the total value of PCV fluctuates, which can easily lead to the price stability of Fei supported by it. sex. Shenyu, co-founder of F2Pool, believes that since the value of assets in Fei Protocol PCV is directly linked to ETH, once a bear market comes, the assets controlled by the protocol may shrink sharply, leaving potential risks for currency price stability. In addition to rational analysis, Shenyu, who participated in the investment project, did not forget to complain in the circle of friends: he couldn't help but enter the market with his principal and escape with his ability.

secondary title

2. Is it too early to use algorithmic agreements to support prices?

There have been a lot of players in the stablecoin track recently, and the underlying logic of these projects is mostly to overcollateralize mainstream coins in order to go long on the value of stablecoins. For example, on MakerDAO, users mortgage their assets and can lend out two-thirds of the stable currency DAI calculated in terms of their US dollar market. After repaying the debt with interest, the mortgage assets can be exchanged and the corresponding DAI can be obtained. This set of logic essentially clarifies the ownership of the user's mortgage assets, which still belong to the user himself, and the platform and the user are directly in the relationship between the debtor and the creditor. In the case of a sharp drop in currency prices, users' psychological expectations are still positive. However, Fei, who focuses on the algorithmic stablecoin price strategy, has completely changed.

In the mechanism set by Fei, the project party exchanges equivalent Fei for the ETH deposited by users, and creates a Fei/ETH fund pool on Uniswaps for users to trade, which is equivalent to creating a space for arbitrage. Of course, the premise of all this is that users cannot use Fei to buy back the invested ETH. In essence, the ownership of this part of ETH has already belonged to the project party. Although this part of ETH has been prepared as PCV to stabilize the currency price, from the perspective of retail investors, once the price of Fei falls, their own losses cannot be recovered.

Although from the perspective of the project side, it is technically possible to withdraw a certain amount of PCV funds in real time to inject liquidity into Fei and stabilize the currency price through algorithmic means, but the changes in human nature are often far beyond the controllable range of technology: collective panic Under the release, the algorithmic intervention mechanism is actually difficult to be effective.

secondary title

3. Speculative users who enter the market in the early stage need to face the reality that Fei’s current application scenarios are limited

also used to be"Fei, the high-profile algorithmic stable currency, what is the wealth creation effect?" "As mentioned in the genesis stage, the project adopts the method of joint curve sales in the creation stage, that is, the discount price below 1 US dollar attracts users to buy Fei with ETH, which has an obvious drainage effect. The amount of capital can be seen a little bit.

Low prices can indeed arouse the impulsive emotions of investors, which is easier to understand in the cryptocurrency market, but behind the impulsiveness is the irrational cognition of investment varieties. Perhaps most users did not face a problem before buying Fei: If arbitrage on Uniswap is not possible in the short term, what are the real application scenarios for Fei, which is far from the recognition of mainstream stablecoins such as USDT and USDC in the market? ?

In this regard, IDEO coLab Ventures investor Dan Elitzer also commented: Fei holders sold tokens because many of them entered a system they did not understand and believed that there was a pure arbitrage opportunity. Given the large initial supply, there is currently not enough natural demand for FEI, hence the selling pressure. "

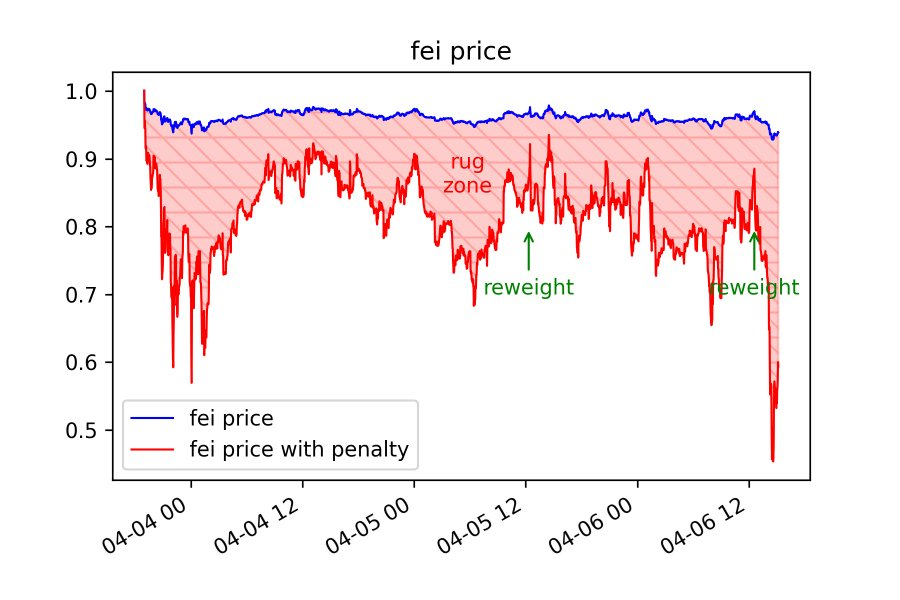

As analyzed by Dan Elitzer, the USD 1 billion worth of Fei on the Uniswap exchange actually corresponds to the total amount of Fei in PCV. In other words, the total amount of Fei has actually reached 2 billion US dollars: 1 billion lock-up volume (PVC) + 1 billion circulating volume (in the Uniswap exchange). Under the huge inflation, the founder Joey Santoro put forward 5 urgent improvement proposals (allowing the sale of Fei on a large scale, increasing rewards, accelerating Reweight, changing contracts, and controlling the burning ratio), and the platform used PVC several times for Reweight (rebalancing ), it seems like a drop in the bucket to return to the currency price of 1 US dollar.

Fei, which originally held high the decentralized stablecoin protocol, was placed high hopes by the market, but due to the influence of market value management, application scenarios, mechanism design and overall environment, it failed in the first battle. Of course, this also reveals various difficulties in the stable currency track.