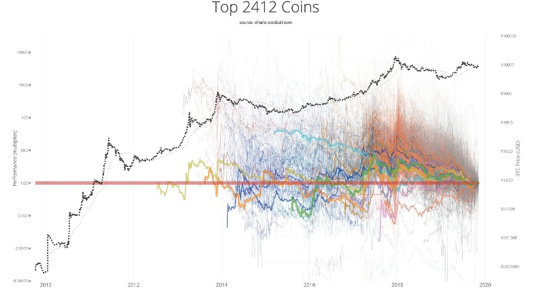

There are already opinions in the market that compare the development of the current encrypted digital currency with the early days of the Internet. Cryptocurrency investors are also taking full advantage of the various trading and investment opportunities available today. The current bull market in cryptocurrencies clearly offers plenty of such profit-making opportunities. Both traders and investors are reaping the development dividends of this nascent industry. Looking back on the investment experience of the Internet, one of the hot spots in the market now is to discover the Amazon in encrypted digital currency. Investing in cryptocurrencies like this can pay off like investing in Amazon early on. So, among the thousands of encrypted digital currencies now, which one or several encrypted digital currencies will become the Amazon of encrypted digital currencies?

In my opinion, Bitcoin is clearly the best candidate. In its 12-year history, its consistent growth has outpaced all other cryptocurrencies. Thousands of other cryptocurrencies were created, developed, and then disappeared. Only Bitcoin is still going strong and is now making new all-time highs. Most importantly, Bitcoin is gaining general acceptance in the market, including institutions. Morgan Stanley can be said to fully endorse Bitcoin. It is investing in the largest encrypted digital currency exchange in South Korea, investing in major encrypted digital currency service organizations in the United States, and will soon provide encrypted digital currency related services to its wealth customers. Goldman Sachs will also soon offer services related to cryptocurrencies to its wealth management clients. Chase JP Morgan's research view began to endorse Bitcoin. Insurance companies such as Mass Mutual and New York Life, the most conservative financial institutions in the financial industry, have begun to invest in Bitcoin. It can be said that the views of these financial institutions have undergone fundamental changes in less than a year. With the participation of these mainstream financial institutions, more assets will flow to Bitcoin. This will definitely drive Bitcoin's long-term growth.

The actions of financial institutions are not solely influenced by market conditions. That is, a financial institution won't see a highly speculative product gain traction and immediately offer services related to it (although this is certainly a major factor). The actions of financial institutions must be based on their understanding before starting. That is to say, these financial institutions fully realized the value of Bitcoin, so they started to take comprehensive actions. If they only recognize the opportunities brought about by the fluctuations in the price of Bitcoin, these institutions can only participate in transaction-related activities, and it is impossible to invest as a company's strategy, and it is impossible to recommend this product to its wealth customers. Therefore, it can be seen from the actions of Morgan Stanley that Morgan Stanley has fully recognized the long-term value of Bitcoin. Similarly, we will soon see the full participation and investment of mainstream financial institutions in Bitcoin this year.

After 12 years of development and the current global currency issuance, Bitcoin is now increasingly recognized as a value storage tool, and it is likely to develop into a reserve currency in the future. Such a judgment has gradually become the consensus of the market. In the process of understanding the market, some personal opinions and books have had a great impact on the industry. MicroStrategy's Michael Saylor is perhaps the most influential figure on this front. He first bought Bitcoin through MicroStrategy, a public company, and had a huge impact on the market. He is also constantly using various media to preach the value of Bitcoin and why it is necessary to hold Bitcoin. He also organized a two-day virtual conference on Bitcoin for U.S. institutions. This meeting was strongly welcomed by the market. His actions and opinions have greatly affected the acceptance of Bitcoin in the US market. In terms of books, "The Price of Tomorrow" has had a very strong impact. The basic point of this book is that the progress of technological application has led to the abundance of products, and the abundance of products has led to the continuous decline of prices. So the world should be a deflationary world. But the current financial system is an inflationary world. This is thus an essential conflict in present society. Such conflicts lead to secondary and tertiary conflicts in society. Some of the current unrest in society can be traced to this fundamental conflict. Bitcoin provides a peaceful means of resolving such conflicts. This book has had a very positive impact on the views on Bitcoin in the market.

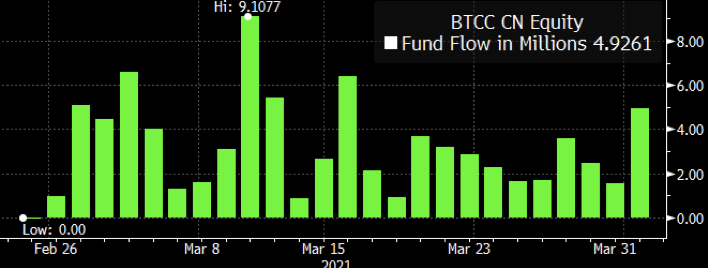

Due to these changes in the views of Bitcoin in the US market, the investment in Bitcoin by individuals and institutions has also undergone substantial changes. The enthusiasm for investing in Bitcoin is arguably unprecedented. A Bitcoin ETF listed in Canada has hit $1 billion in less than a month. This ETF has seen continuous inflows for 25 consecutive days. This is also unprecedented in the history of ETFs. Compared with the size of the Canadian capital market, the size of this ETF far exceeds expectations.

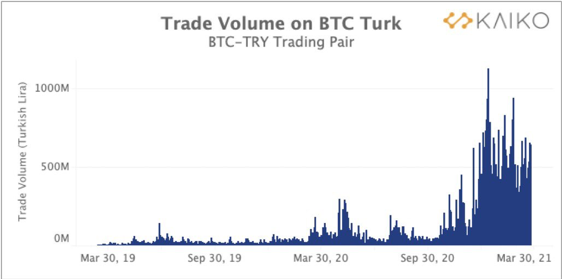

In terms of the application of Bitcoin, Bitcoin is increasingly becoming the base currency. Among the various applications of the blockchain, it can be said that the most basic application of each public chain is the introduction of Bitcoin. This is true no matter in the ecology of Ethereum and Polkadot. In terms of geography, when there is a problem with the currency in any one place, the transaction volume of Bitcoin is bound to rise. Whether in Venezuela, Lebanon or Türkiye. It can be seen that Bitcoin has been used as a safe-haven asset. Therefore, whether it is in the application of encrypted digital currency or in the actual economic environment, the acceptance of Bitcoin is increasing. And such applications have been a long-term growth trend.

In terms of advancing Bitcoin’s market acceptance, the support of major financial payment instruments is massively increasing the number of Bitcoin holders. PayPal, Cash App, and Robinhood all provide bitcoin buying and selling services to retail users. The growth of PayPal and Cash App's Bitcoin holders has also far exceeded expectations. Venmo, another payment tool in the market, also proposed to provide services that support encrypted digital currencies in the next few months. The support of these financial user terminals for Bitcoin has greatly increased the number of Bitcoin holders and provided a more solid foundation for the growth of Bitcoin.

USD-based stablecoins are growing rapidly right now. One of the main uses of stablecoins is the trading of encrypted digital currencies. The current bull market for cryptocurrencies is inseparable from the massive increase in stablecoins. The Diem stablecoin is expected to launch this year. After the Diem stablecoin is launched, one of its main uses must be the trading of Bitcoin. This is bound to bring huge capital flows to Bitcoin. Also, I think the U.S. banking industry is bound to launch a dollar-based stablecoin because they have to. On the one hand, it is in line with the trend of technological development, and on the other hand, it must resist the competition of stable coins like Diem. The large increase in stable coins will definitely bring more traffic to Bitcoin transactions.

Now it seems that the probability of launching a Bitcoin-based ETF in the US market is increasing. These positive factors include the new chairman of the SEC, the development of the encrypted digital currency market, the improvement of the encrypted digital currency custody mechanism, the market popularity of the Canadian Bitcoin ETF, the number of institutions in the US market that proposed to establish a Bitcoin ETF, and the United States Users' strong demand for Bitcoin, and the current circulation of Bitcoin in the US market, all these factors have greatly increased the probability of launching a Bitcoin ETF. At present, the SEC has announced the application of VanEck's Bitcoin ETF. It will make an approval or rejection decision within 45 days (late April or early May). The high probability event is that there will not be only one Bitcoin-based ETF in the US market, but there will be many Bitcoin-based ETFs. If we look at the impact of the launch of a gold ETF on the price of gold, we can easily see the impact of a Bitcoin ETF on the price of Bitcoin.

In the latest event, Coinbase is expected to list for trading on April 15. Its market cap is now estimated at $100 billion. Such a market capitalization scale has surpassed many mainstream financial institutions. Its successful listing will definitely promote a sharp rise in the price of Bitcoin.

In terms of investment views on Bitcoin, there is a view that the price of Bitcoin is now too high, and the number of Bitcoins that can be bought is too small. But this view is a wrong judgment on Bitcoin. For current retail users and future institutional users, the consideration now is to hold Satoshi instead of Bitcoin. One bitcoin is equivalent to one hundred million Satoshi. So no matter how high the price of a bitcoin is now, you can still buy Satoshi with funds. If the price of bitcoin increases by 10 times, the money invested in buying it now will also increase by 10 times, so it is not so important how many bitcoins or satoshis can be purchased.

Another erroneous view on bitcoin investment is that the best investment opportunity for bitcoin has been missed now, and buying bitcoin now is not worth it. But I think it depends on investors' judgment on the future of Bitcoin. If you think that Bitcoin will rise in the future, then the current price of Bitcoin is the lowest point of future prices. If you are not bullish on Bitcoin, then the current price of Bitcoin is its highest point, so there is no need to buy. So the decision to buy or sell depends on the judgment of the future price of Bitcoin, not its current price. A decision related to this point of view is to use the same amount of funds to invest in other products in order to obtain better returns. But if you consider it from the perspective of risk and return, Bitcoin is still the best choice.

Finally, it needs to be specially stated that the opinions in this article are only personal opinions, not investment advice. Investors should make corresponding decisions after their own judgment.