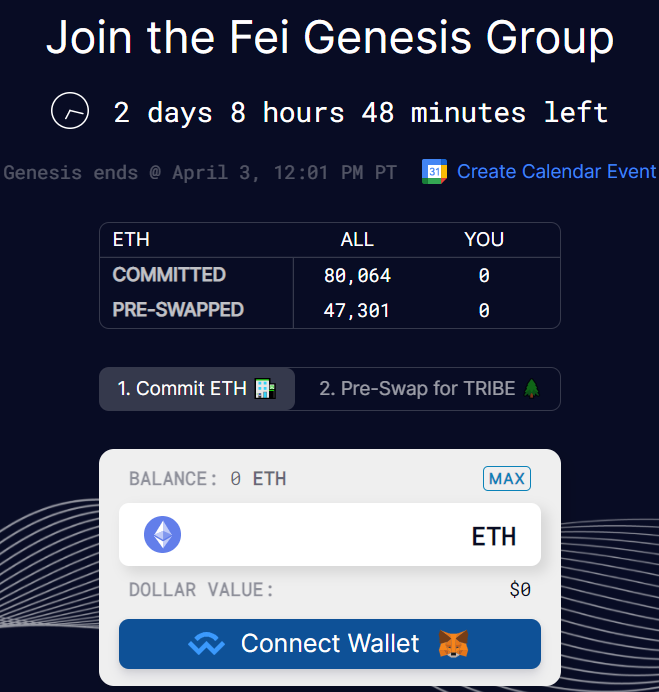

At 3 am on April 1, Beijing time, the decentralized stablecoin protocolFei ProtocolThe three-day Genesis Period (Gensis Group, also known as the Bonding Curve sales period) is officially launched, and the deadline is 3:00 am on April 4th, Beijing time.

According to the official website, as of press time, the project has raised 80,229 ETH, with a current price of about 155 million US dollars. According to news from CoinDesk on March 9,Fei Labs, the entity behind Fei, has raised $19 million from A16Z, Framework Ventures, Coinbase, Ventures, and AngelList founder Naval Ravikant。

According to news from CoinDesk on March 9,Fei Labs, the entity behind Fei, has raised $19 million from A16Z, Framework Ventures, Coinbase, Ventures, and AngelList founder Naval Ravikant。

This is another star project on the stablecoin track in the Defi field after DAI, USDN and SAI. Because the sword refers to the disadvantages of the above-mentioned traditional stablecoins being too centralized, the algorithmic stablecoins are given a certain amount of room for imagination.

secondary title

Anchoring the U.S. dollar by means of an agreement

Fantastic ideas, but no match for reality. In 2020, the algorithmic stable currency projects ESD and Basis Cash lost their stabilization mechanism because they do not have any collateral assets, resulting in violent price fluctuations, far away from the anchor value of 1 US dollar. Taking into account the lessons of the predecessors, Fei's founding team deliberately set the project as a partial mortgage system, and the collateral is ETH.

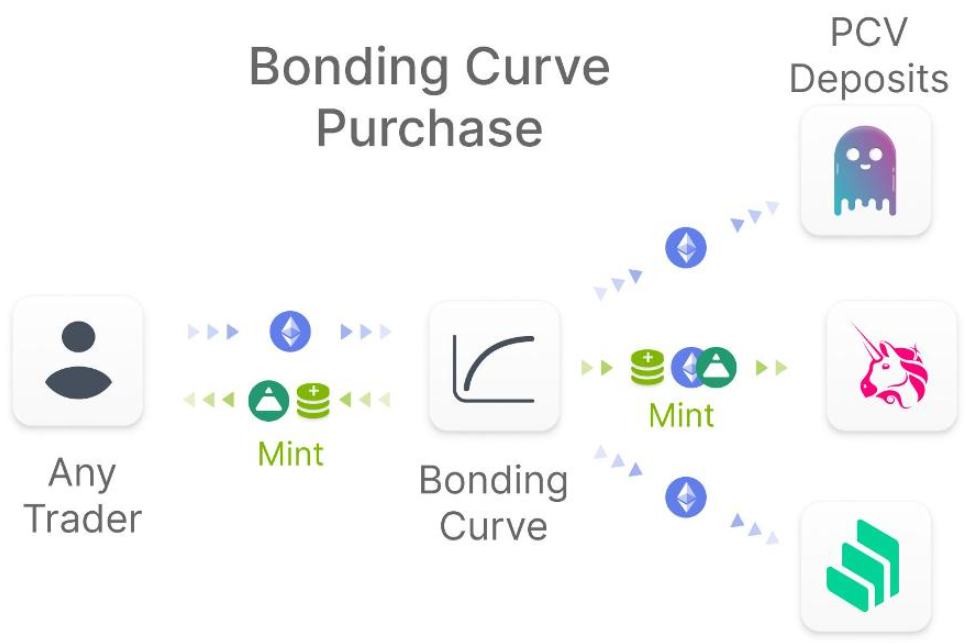

During the genesis period, Fei raised the first batch of ETH through the bonding curve sale, which was used for the reserve fund of the entire agreement. During this period, the project will also adopt the bonding curve sales method,Attracting users to purchase Fei with ETH at a discounted price has fully demonstrated the drainage effect.image description

The Bonding Curve stage in the figure is 3 days from today

secondary title

Keep prices stable and help the market stabilize

PCV can be simply understood as the reserve fund or TVL of the Fei protocol, the main purpose of which is to ensure the stability of Fei.

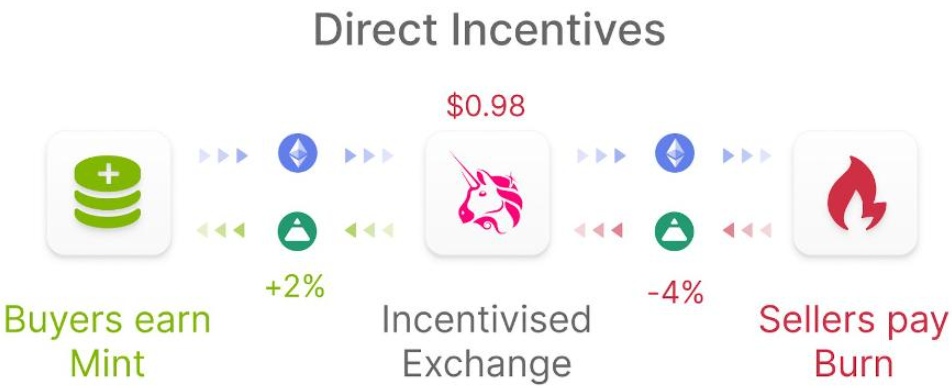

The white paper also mentionsAn auxiliary stabilization method, that is, to adopt the method of "buying rewards and selling penalties" for users to drive users to hold Fei.Users can get 2% rewards when they buy Fei, and 4% will be destroyed if they sell. But this is just a way of adjusting at the tactical level. From a strategic point of view, the authorities still hand over the control of prices to the agreement, and use technical means to enforce the peg between Fei and the U.S. dollar.

secondary title

Users can arbitrage in the secondary market

So, how does Fei, whose currency price is always pegged to the U.S. dollar with small fluctuations, allow users to earn income?

image description

Direct incentives: users can arbitrage on Uniswap

This set of logic seems to be self-consistent, and the profit method is attractive enough, but the risk point is that Fei itself has air attributes, while the ETH injected by users is real money. The life cycle of the gameplay depends on the depth of the pool. If the amount of ETH raised by the project is sufficient, the value of Fei will be more stable. Therefore, Odaily hereby reminds friends who plan to participate to pay attention to the fund deposit data of the project in real time.

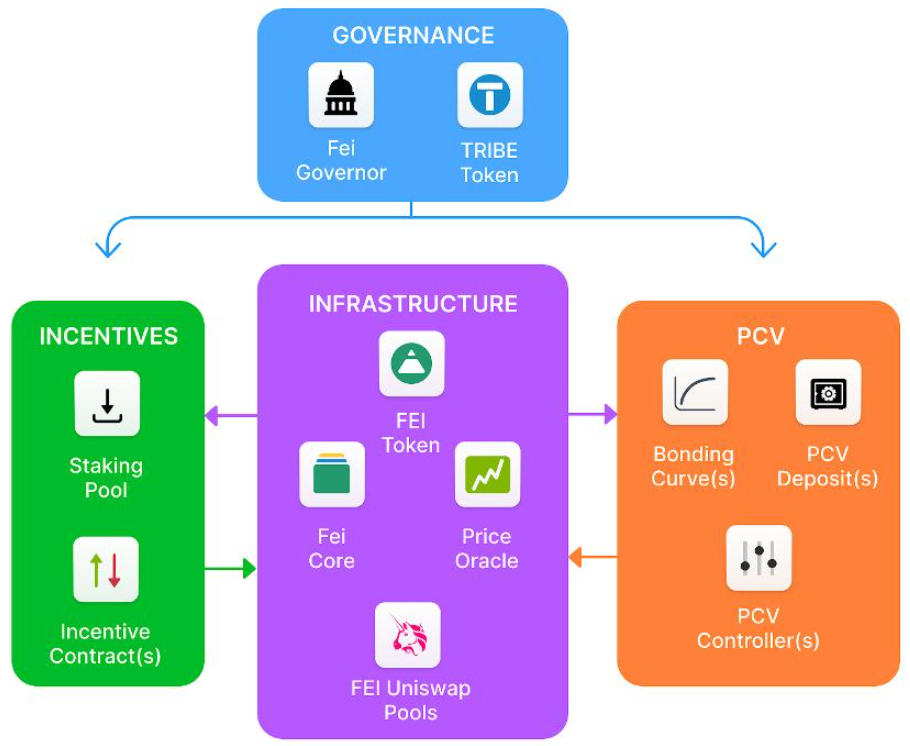

In addition, in addition to the technical route and market-making logic, the official also made some assumptions about the project ecology in the white paper. For example, it is interoperable with projects such as Compound, Yearn, and Aave to give Fei financial management functions and enhance its attractiveness to users. At the same time, on the basis of the stable currency Fei, the government will also issue the governance token TRIBE, which is mainly used for project governance.image description

Party diagram of stablecoins, governance tokens, exchanges and projects

secondary title

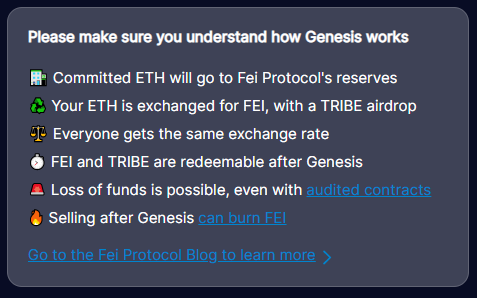

Attached is a description of the mechanism of the creation period of the project

1. The raised ETH will enter Fei’s protocol pool;

2. The user's ETH will be replaced with Fei, and the project airdropped governance currency TRIBE will also be obtained;

3. The exchange rate for each user is the same;

4. After the genesis period ends, Fei and TRIBE can be realized;

5. Even if the contract is audited, funds may be lost;

6. Selling Fei after the genesis period will cause the token itself to burn.