After experiencing the crazy increase in 2020 and the stimulation of DeFi demand, stablecoins have entered a new stage of development. Whether in the encrypted world or in cross-border payments, stablecoins are playing an increasingly important role.

From the perspective of the types of stablecoins, there are mainly three types: the first one is the anchored fiat currency stablecoins represented by USDT and USDC, which appeared the earliest and had the largest market share. Supervision and credit guarantee are better.

The second is the asset-backed stablecoin represented by DAI, which has achieved decentralization to a certain extent, but there are also debt settlement problems such as over-collateralization.

The third is the unsecured algorithmic stablecoin. The advantage is that it does not require collateral and has stronger decentralization attributes. However, it is more dependent on continuous growth and cannot liquidate debts once it collapses.

Recently, a new class of algorithmic stablecoins has emerged, such as Frax, Continuous ESD, and Fei Protocol.

Fei Protocol supports the creation of a decentralized, scalable and fair stablecoin based on Ethereum. Its founder is Joey Santoro. He got the name inspiration from the famous stone currency (FEI) on Yap Island, hoping that FEI can have a stable Simplicity, simplicity and universality. Previously, Fei Labs had completed financing of US$19 million, with investors including Coinbase Ventures, Framework Ventures and other institutions.

Fei Protocol was launched at 04:01 Beijing time on March 23, and the Genesis will last for three days. Users participating in the genesis of the Fei Protocol protocol can put their ETH into the pool. The total amount of ETH will determine the amount of FEI generated during the genesis, which in turn will affect the amount of FEI received by users.

Fei's two core concepts are Protocol Controlled Value (PCV) and Direct Incentives.

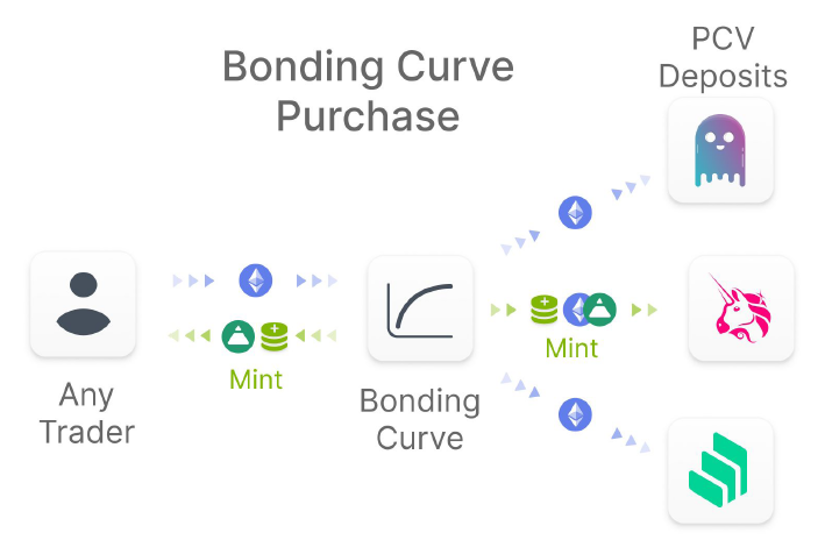

Different from DeFi's TVL (Total Value Locked), Fei Protocol saves the received ETH as the asset value (PCV) controlled by the protocol. Fei Protocol deploys PCV to create a liquid secondary market, where users can FEI is sold as ETH in this secondary market. The ETH invested by users will be sent to Uniswap as liquidity to form an ETH-FEI pair to support the early stability of FEI.

In the traditional DeFi protocol, users can obtain corresponding DeFi token distribution rewards after depositing assets, and users can withdraw the deposited assets at any time. In order to control liquidity and reduce the problem of giant whales withdrawing assets in extreme events, the Fei protocol directly owns the assets that are completely "locked" in the DeFi protocol. PCV will give DeFi protocols more flexibility to engage in non-profit activities and align with the long-term goals of the project.

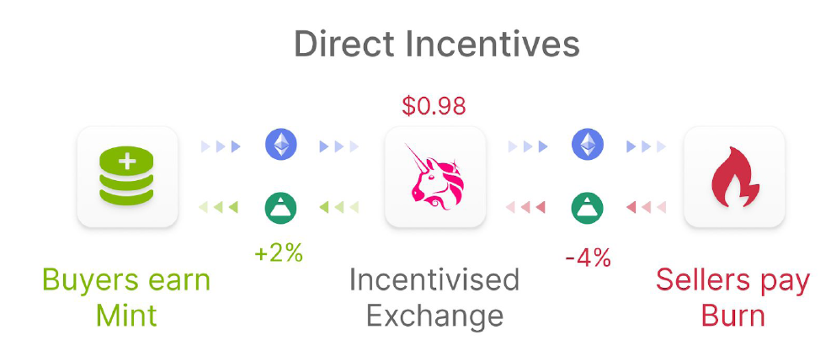

According to the description of the white paper, "direct incentive" refers to:"Directly incentivizing stablecoins means that both trading activities and the use of stablecoins are incentivized, and rewards and punishments will push the price towards the anchoring direction. Generally, this will include at least one incentivized exchange at the center. All other exchanges and secondary markets can arbitrage with Incentive Exchange. This helps maintain the anchor of the entire ecosystem."

Fei Protocol promotes the achievement of the anchor target (1 USD) through direct price rewards and punishments for both the buyer mint and the seller burn under the premise of combining currency prices. Through the bonding curve design, a strong incentive mechanism can be formed for minting FEI (you can buy 1 dollar for less than 1 dollar), and because the bonding curve is one-way, a strong reserve fund can be formed. The supply of FEI is determined according to the needs of users, and there is no upper limit. It will enter circulation in the form of sales according to the bonding curve.

Because of this, Fei Protocol can use the relationship between supply and demand to promote price stability near the anchor target.

As an innovative algorithmic stablecoin, the future development of FEI depends on whether it can be integrated in the entire DeFi and promoted on other platforms after it achieves stability.