On March 25, the short-term lowest price of Bitcoin fell to $51,000. This situation has already been foreshadowed:

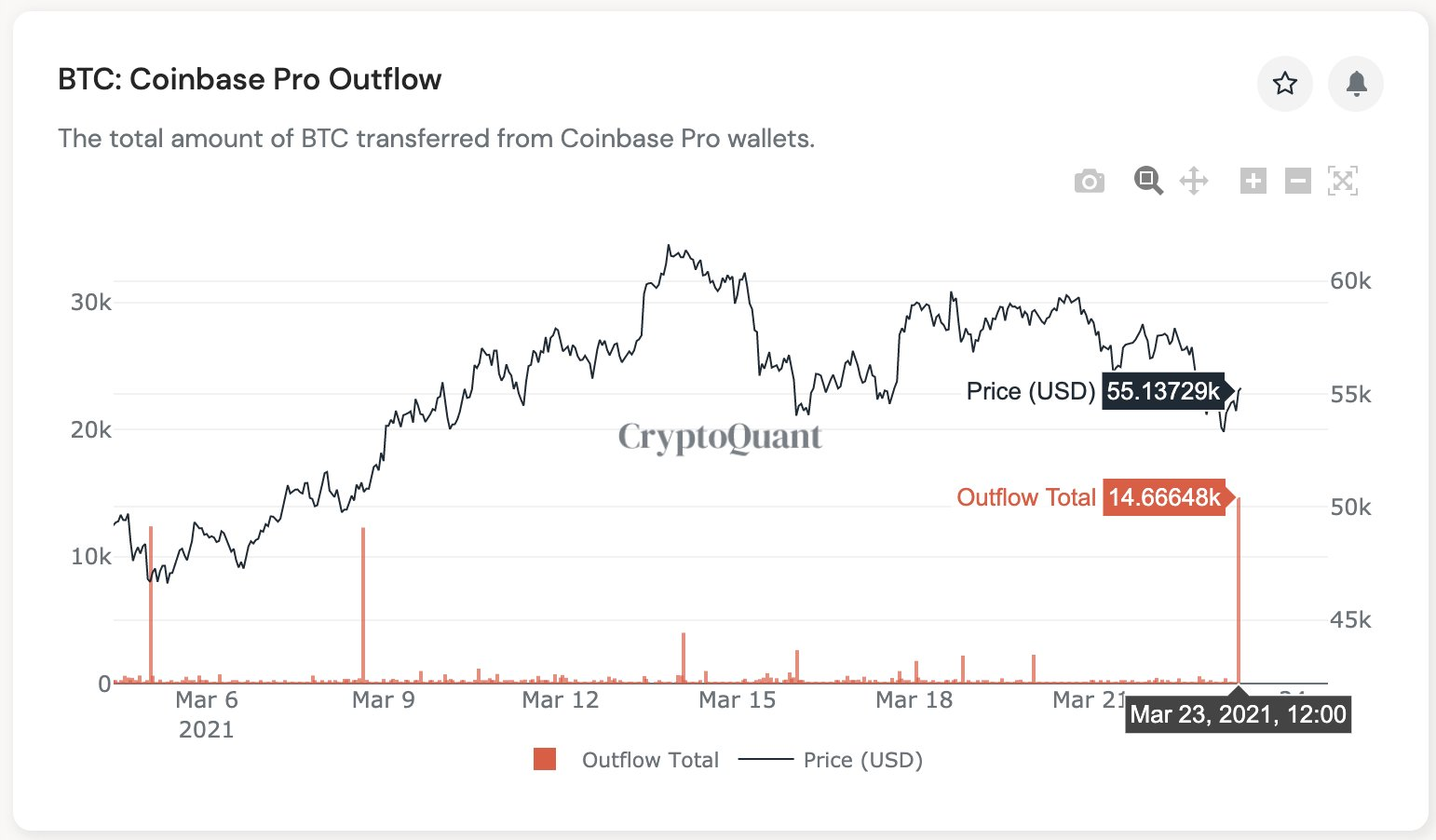

On March 23, the bears managed to push the price of Bitcoin (BTC) down to the $54,000 support level. From the data point of view, various on-chain data show that the Bitcoin giant whale address has begun to slow down the purchase speed and transfer the risk to retail investors.

image description

image description

Source: KuCoin Exchange (Chart by TradingView)

secondary title

Despite a recent pullback, the overall uptrend remains?

While inexperienced traders and those new to the cryptocurrency space may view the recent slide as a sign of a bearish reversal, Cointelegraph Markets analyst Michaël van de Poppe believes , this pullback is a bullish development for Bitcoin.

image description

Source: CryptoQuant

Source: CryptoQuant

image description

image description

Source: Whalemap

Analysts at Jarvis Labs took a slightly different view and advised traders to look at more trades to understand BTC’s daily movements.

According to Jarvis Labs co-founder Ben Lilly, “It’s important to look at which wallets are active in the total traffic.”

image description

image description

Source: Jarvis Labs

image description

image description

Source: Jarvis Labs

secondary title

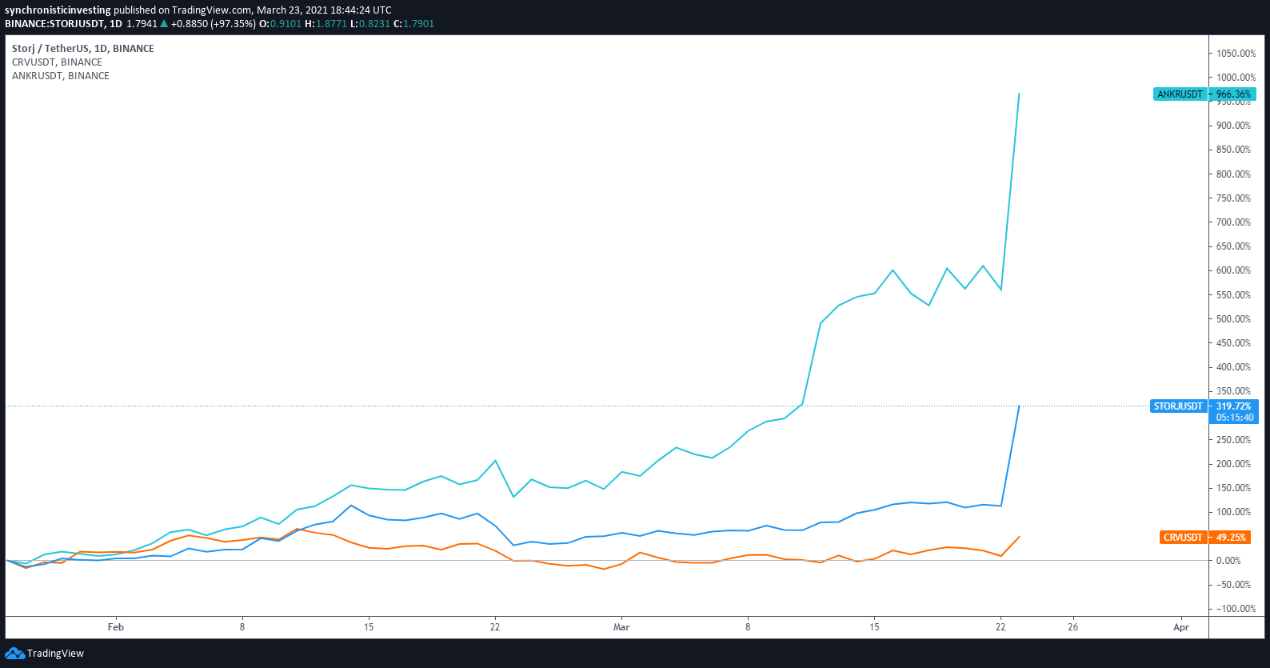

Altcoins start to bounce back amid Bitcoin's drop

image description

image description

Source: TradingView

Theta (THETA) and Theta Fuel (TFUEL) also continued their relentless climb Tuesday, following news that Sierra Ventures, Heuristic Capital, VR Fund and GFR Fund have provided over $100 million in THETA to collective enterprise validator nodes . Following the news, Theta surged 40% to an all-time high of $14.21 and TFUEL jumped 30% to an all-time high of $0.53.

Currently, the entire cryptocurrency market cap stands at $1.6 trillion, with Bitcoin dominance at 59.8%. Until now, due to the small audience and no circuit breaker, digital currency transactions are more often interpreted as speculative transactions. The short-term or long-term sharp rise in the market can help many investors achieve unprecedented success. On the contrary, the 24-hour non-stop trading mechanism also makes the decline Markets could deliver a bigger blow. As a member of the huge digital currency trading torrent, fearing the market, keeping in mind stop profit and stop loss, and a good attitude should be the necessary trading qualities for every investor.

*The opinions expressed here are only the opinions of the author, and are for reading and communication only, and should not be used as investment reference. Every investment and trading move involves risk, so you should do your own research before making a decision.