The listing of Coinbase is one of the big events in the field of encrypted assets in 2021. On March 18, Coinbase chose Reddit for a three-day "roadshow" before listing, and its direct listing plan will be completed in April.

From the fringe to the mainstream, as the first "quasi" listed company in the U.S. stock market with the main business of encrypted asset trading, Coinbase has brought a legal and compliant "regular army" model to the encrypted asset trading market. The industry has injected a shot in the arm and has attracted the attention of the market.

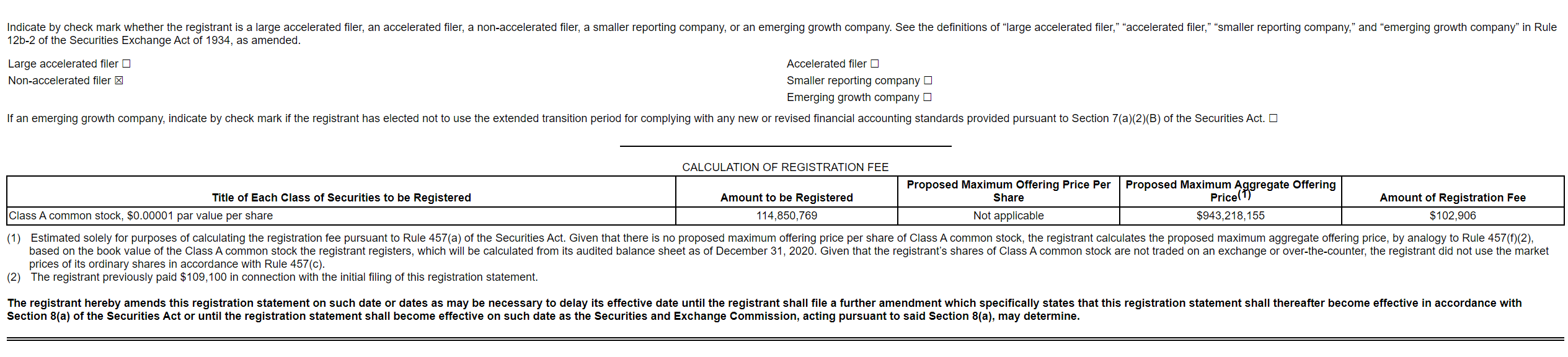

According to the disclosure documents of the U.S. Securities and Exchange Commission (SEC), as of December 31, 2020, Coinbase had 21,035,491 Class A common shares issued and 164,950,620 Class B common shares issued, plus 114,850,769 issued public shares. Class A ordinary shares, a total of 300,836,880 shares, if calculated based on the weighted transaction price of Class A shares in the first quarter of non-public transactions of $343.58, the market value of Coinbase’s non-public trading market reached nearly 115.7 billion U.S. dollars.

Although Coinbase previously stated that the market activities before the IPO could not accurately reflect the price situation after the listing of the stock, some people are still optimistic that the market value of Coinbase will exceed 100 billion U.S. dollars.

first level title

Coinbase ushers in a bright moment

As Coinbase is about to become the world's first encrypted asset exchange to land in the traditional capital market, Coinbase ushered in its own bright moment.

Founded in 2012, Coinbase is one of the earliest encrypted digital currency exchanges in the world and the largest encrypted currency trading platform in the United States. At the same time, under the US regulatory system, the development of Coinbase has been quite satisfactory.

Some insiders said that Coinbase has compliance licenses from more than 40 states in the United States, including BitLicense licenses and MSB licenses. Its compliance development is impressive, and it also proposes higher KYC and AML access for registered users standard.

Gu Yanxi, a researcher of blockchain and encrypted digital assets, wrote that due to Coinbase’s compliant operation and regulatory approval, it is far ahead of other similar companies in merging into the mainstream financial field. On the one hand, this mode of operation enables it to obtain business from institutions that hold large amounts of funds.

At the same time, compared with the three major exchanges in the Chinese-speaking area, Coinbase seems to be out of the group. First, it does not launch a platform currency; second, it does not have derivatives transactions; third, it does not have an exchange public chain. In addition, there are relatively few coins listed on Coinbase. In addition to the spot product line, Coinbase is also keen on encrypted asset storage and custody, digital wallet, investment and other businesses to help the incubation of the industrial chain.

On February 25, the S-1 form of Coinbase’s listing application was approved by the US Securities and Exchange Commission, and it will be listed on Nasdaq with the stock trading code COIN. This means that the listing of Coinbase has been finalized, which has become a milestone event in the encrypted asset trading market.

It is worth mentioning that, according to Coinbase, it is weaving a huge encryption ecosystem through extensive self-operated business and investment layout, aiming to provide financial services based on encrypted assets to everyone with a smartphone, becoming Their entry into the world of crypto assets.

On March 17, according to documents disclosed by the US Securities and Exchange Commission, Coinbase registered 114,850,769 shares for a public offering.

With the pace of Coinbase's listing, Coinbase CEO Brian Armstrong's net worth has skyrocketed. Analysts said that based on Coinbase's valuation of more than $100 billion, Brian Armstrong's net worth should be between $7 billion and $15 billion.

On March 2, the "2021 Shimao Hong Kong-Zhuhai-Macao Port City Hurun Global Rich List" released by the Hurun Research Institute showed that 38-year-old Brian Armstrong was on the list with a wealth of 75 billion yuan.

first level title

Favored by institutional investors

In recent years, Bitcoin has received more and more attention from the traditional financial market, and the top digital asset exchanges, as the largest "water senders", have made a lot of money.

According to the S-1 form listing documents submitted by Coinbase to the US SEC, many data and details disclosed in the documents have revealed the family background of this unicorn company. The document shows that Coinbase has users in more than 100 countries around the world, about 43 million certified users, 7,000 institutions and 115,000 ecosystem partners, and its business scope covers investing, spending, saving, earning and using cryptocurrencies.

From its establishment in 2012 to the end of 2020, Coinbase mainly relied on transaction commission income. As of the end of December 2020, Coinbase supports the trading, custody, lending, etc. of more than 90 cryptocurrencies. The total transaction volume of customers on its platform exceeds US$456 billion, and assets worth more than US$90 billion are stored. In addition, the net profit for the whole year of 2020 exceeded 320 million US dollars, accounting for more than 96% of the total revenue.

At the same time, with the arrival of this round of "institutional bull market", institutional investors have become the main force of the Coinbase platform, mainly including hedge funds, listed companies, financial institutions, family businesses, and encrypted asset companies. Data show that in the fourth quarter of 2020, institutional users on the Coinbase platform contributed $57 billion in transaction volume, accounting for 64% of the total transaction volume.

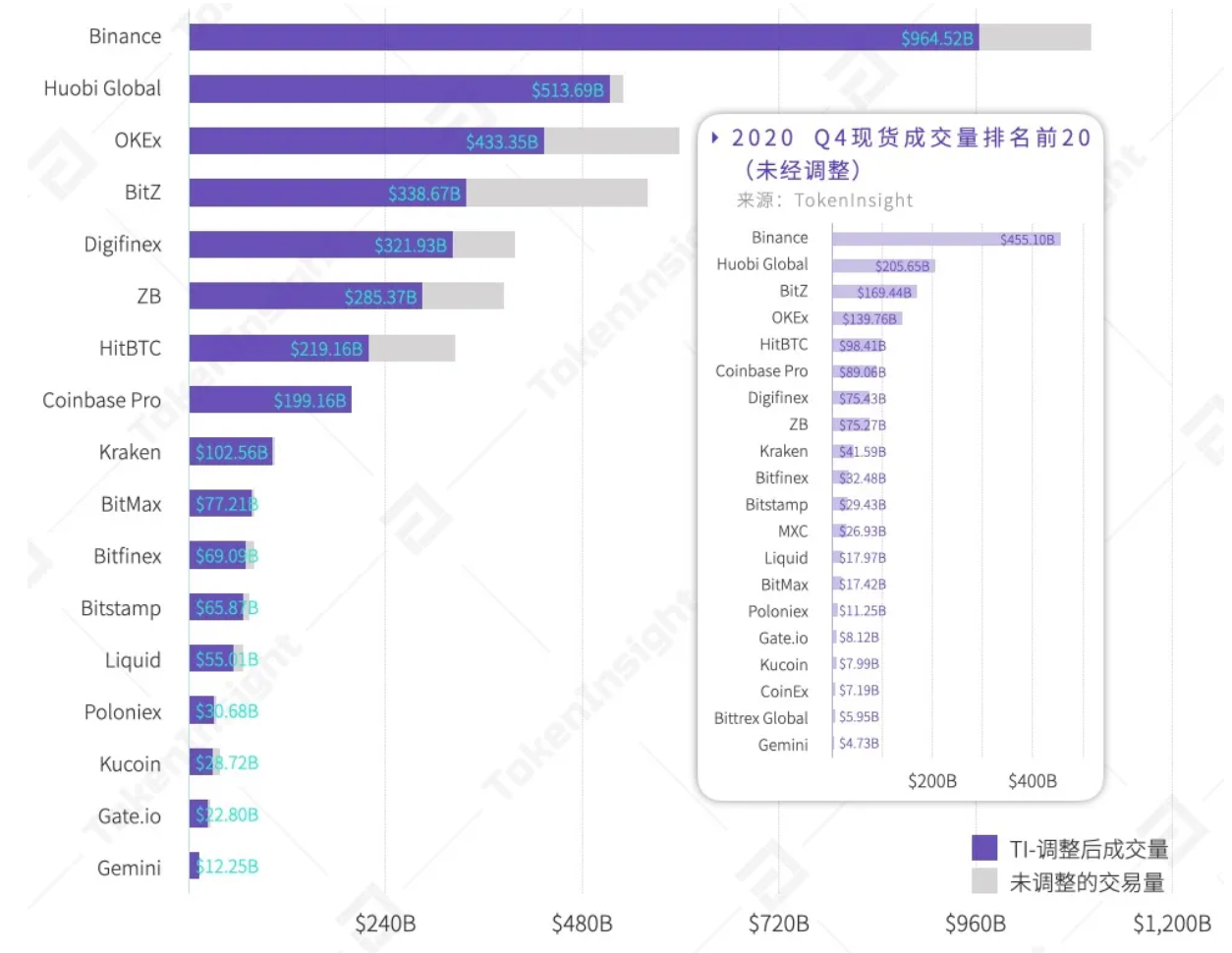

Even so, Coinbase’s spot trading volume does not rank first in the industry. According to data from TokenInsight, in 2020, the spot trading volume of encrypted assets exceeded US$21 trillion. Binance ranked first in spot trading volume, close to US$1 trillion, while Coinbase’s spot trading volume was less than US$200 billion, ranking eighth.

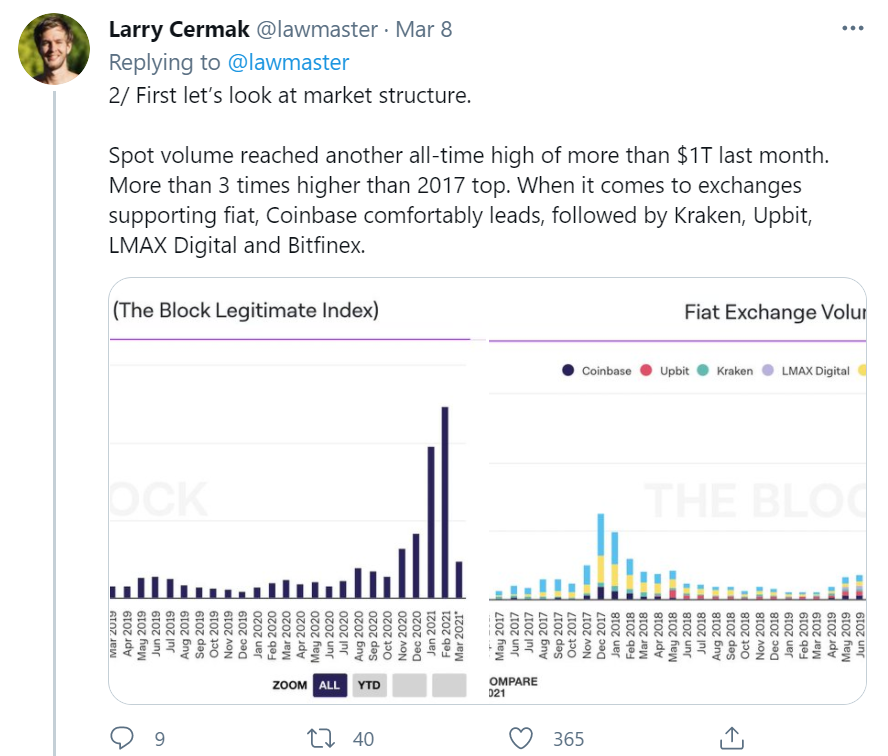

Since the beginning of this year, with the skyrocketing price of Bitcoin and Coinbase’s preparations for listing, its spot trading volume has hit a record high. On March 8, Larry Cermak, director of research at The Block, tweeted that the spot trading volume of encrypted assets hit a record high in February, exceeding $1 trillion, more than three times higher than the highest level in 2017. Among them, among exchanges that support fiat currencies, Coinbase is far ahead in trading volume.

first level title

Encrypted assets "link" traditional financial markets

With the integration of encrypted assets and traditional finance, "linking" traditional financial markets has become an urgent need for encrypted asset trading platforms. At the same time, from a global perspective, the encrypted asset trading market is increasingly subject to strict laws and regulations. Because of this, Coinbase's development path to meet legal and regulatory requirements through listing is considered a wise choice by the industry.

Du Jun, co-founder of Huobi Group, once said that Bitcoin has brought new vitality to the financial system, behind this is the increasing recognition and application of blockchain technology. Du Jun believes that continuously promoting the global compliance process is one of the important measures to deal with the uncertainty of the encrypted asset industry.

"The listing of Coinbase will accelerate the development of encrypted asset finance." Gu Yanxi believes that Bitcoin is a system that operates on a global scale, and these transactions include Bitcoin spot transactions and derivative transactions. Therefore, Bitcoin transactions around the world are Influenced by each other, bitcoin transactions in the US market are therefore also affected by bitcoin transactions outside the United States. However, according to the relevant laws of the United States, bitcoin transactions overseas in the United States do not fully comply with the securities regulations of the United States. Such transactions will affect the trading of Bitcoin in the U.S. market, which in turn will affect the fairness of the U.S. market and the protection of its investors. After the listing of Coinbase, Bitcoin will become more of a trading product and holding asset in the US market. Therefore, this will further break the US regulators to take regulatory measures to ensure the fair trade of Bitcoin.

However, there are many longings, but few successes. The reasons are, first, that the policy process is slow, and it is difficult to make breakthroughs in a prudent regulatory environment; second, related encrypted asset companies have been hovering on the edge of supervision and compliance.

From the perspective of companies in the Chinese-speaking area, Canaan and Ebang International have successfully landed on the US stock market, and Huobi Technology and Ouke Group have landed on the Hong Kong stock market through backdoors. Some analysts predict that in 2021, more mining machine companies, trading platforms, and investment and financing institutions involved in encrypted assets will enter the capital market. However, Binance seems to have little interest in going public. According to previous media reports, Binance founder Zhao Changpeng said on Twitter that Binance has no plans to go public.

An industry insider who did not want to be named believes that the listing of Coinbase is a "watershed" at the regulatory level, which may be the "goodwill" released by the US Securities and Exchange Commission to the encrypted asset trading market. After the successful listing of Coinbase, the encrypted asset trading market is likely to see a wave of listings.

In fact, there are currently quite a few crypto-asset companies seeking to list on the U.S. capital market. Major cryptocurrency exchange Kraken is considering a 2022 listing, according to Fox Business reporter Charles Gasparino. Kraken executives are considering partnering with a special purpose acquisition company (SPAC), or a more traditional IPO. In addition, according to media reports, BlockFi, MicoBT, Gemini, eToro, Bitfury, etc. all have IPO news.