The author of this article is Barry, a strategy analyst at NewBloc, with 5 years of experience in foreign exchange and gold market trading.

The author of this article is Barry, a strategy analyst at NewBloc, with 5 years of experience in foreign exchange and gold market trading.

Yellen said in February: "In a very low interest rate environment, traditional indicators for assessing debt, such as the debt-to-GDP ratio of 100% is not so important. A "more important indicator" is the federal debt interest payments as a percentage of gross domestic product." That indicator is currently at about 2 percent, the same as it was in 2007 before the Fed started aggressively raising interest rates.

image description

figure 1

figure 1

figure 1

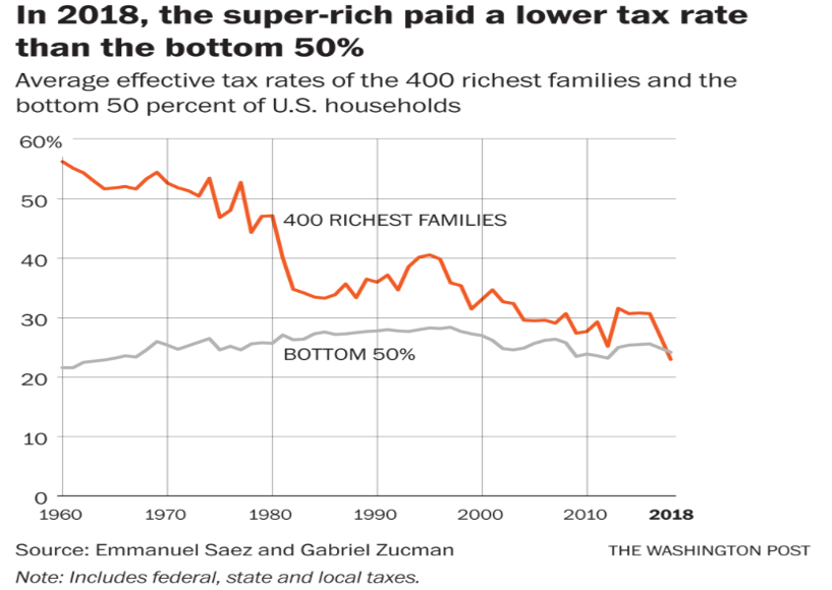

As President-elect Joe Biden prepares to take power, as Bridgewater founder Dalio fears, America will be divided and deeply unequal. Three major forces are forming in the United States: the gap between rich and poor, differences in values, and political divisions. These three forces will lead to conflicts and even civil wars in the United States.

Taxation may be the trigger for all this. The purpose of taxation is to continue the continuation of the debt. However, as the increase in the taxation rate begins to inhibit the economy, the Fed will eventually cooperate with the fiscal to collect wool (MMT) from the world. The rapidly depreciating US dollar has continued to deepen imported inflation. , which in turn would inhibit the implementation of MMT.

According to Bloomberg, citing people familiar with the matter, Biden is planning to substantially increase federal taxes for the first time since 1993 in order to obtain the funds required for the above-mentioned plan. The purpose is to pay for the follow-up infrastructure plan. If the Fed does not pay the bill, it is difficult to use lower interest rates to finance the U.S. finances. If large-scale financing is still carried out through the national bond market, it will lead to a crowding out effect of private investment, which may cause the unemployment rate to rise instead of fall. It is inconsistent with the original intention of the infrastructure plan.

Then the next taxation will have a direct link with the infrastructure plan. If the U.S. government does not break the tax avoidance clauses of the rich and still collects taxes as currently planned, the stimulus of infrastructure construction will have limited boost to the economy, because more people who are taxed are the middle class. The planned taxation measures are as follows:

1. Increase the corporate tax rate from 21% to 28%;

2. Cut tax incentives for limited liability companies, partnerships and other companies (pass-through businesses);

3. Increase the personal income tax rate for people with an annual income of more than 400,000 US dollars;

4. Expand the scope of inheritance tax;

image description

image 3

image 3

It is not easy to break the tax avoidance clause. For the United States, the US dollar is the world currency, and it is necessary to ensure the free circulation of capital. If the tax avoidance clause of the rich is broken and a large amount of taxation is carried out, the capital of the rich will flow out of the United States in large quantities, and the US dollar will be greatly increased. Depreciation will exacerbate the decline of the US dollar as a world currency, but if no tax is imposed, continuing to use the US dollar as a global currency to woo the world will exacerbate the debt problem of the United States itself, and the debt problem will also exacerbate the decline of the US dollar as a world currency. Just as the Triffin Dilemma warns us that the monetary system that relies on sovereign national currencies as international solvency will inevitably fall into the "Triffin Dilemma" and collapse.

In the context of such a huge government debt, those rich people will naturally worry that the government will break the existing tax avoidance clauses to tax them. With such advanced information today, it is even more difficult to avoid government supervision to avoid taxes.

Blockchain-based cryptocurrencies have many properties, with decentralization and anonymity widely sought after. Rich people hope to hide their assets through decentralization and anonymity, aiming to avoid the right of the government to collect taxes. So far, the development direction of cryptocurrency has gradually developed in the direction of hiding assets for the rich. Of course, this is bound to usher in countermeasures from government departments. Due to the high threshold and cumbersome operations of cryptocurrencies, we can see that most of these decentralized cryptocurrencies are traded through centralized exchanges. For supervision, centralized exchanges are easier to supervise. When the authorities want to suppress cryptocurrencies, they will indirectly suppress the field of cryptocurrencies by suppressing centralized exchanges.