High gas fees and network congestion have always been the primary problems plaguing Ethereum. ETH2.0 has a long way to go. Ethereum expansion has become the most urgent need to be solved at the moment. The battle for Layer 2 expansion on Ethereum has also become the current focus.

Recently, Vitalik Buterin, the founder of Ethereum, visited the domestic community and explained the latest progress of Layer 2 and Rollup in the form of live video broadcast, and said in the live broadcast: "Now the short-term solution to the expansion problem really does not need 2.0, but Rollup. It can be seen that Layer 2 will be a popular sector for Ethereum expansion in 2021, and it is very worth looking forward to. In this regard, this article will mainly focus on the main solutions of Ethereum Layer 2 and take stock of some projects worthy of our attention.

About Ethereum Layer 2

Simply put, Layer2 is a scalability solution created to alleviate the plight of Layer1. In order to build a good blockchain ecosystem, we need to do something in the architecture to balance the needs of security, decentralization and scalability. Layer 2 platforms and protocols reduce the burden on the base layer (root chain) Data processing, by transferring part of the data processing of the main chain to Layer 2, thereby enhancing the scalability of the entire blockchain network.

It should be noted that many public chains can do Layer 2, not to say that only Ethereum has Layer 2. The real Layer 2 of Ethereum is simply to migrate computing and data storage to the sub-chain, and hand over the settlement to the expansion network of the Ethereum main network. The former and the latter are in a symbiotic relationship.

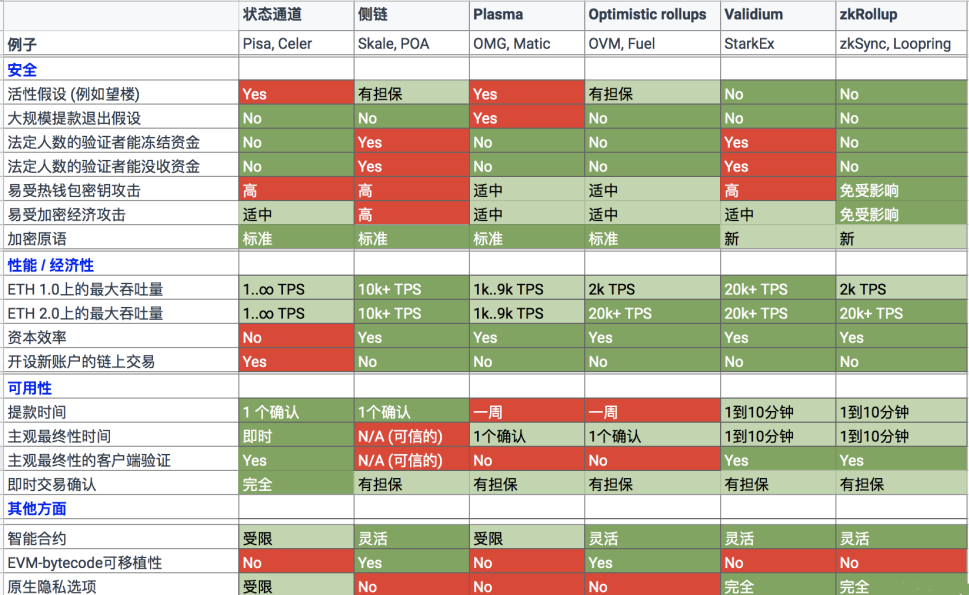

There are various trade-offs between different Layer 2 schemes. They differ in various aspects such as security, performance, usability, etc. These differences are enough to have a profound impact on their future. For investors, these differences are also an important basis for selecting projects. Furthermore, these differences also lead to their possible applicability to different use cases and scenarios in the future. The current Layer 2 mainly includes the following categories: Plasma, Sidechain, State Channels, Rollup (mainly divided into Optimistic rollup and ZK rollup), Vadium.

Alexa Gluchowski summarized the performance of the main Layer 2 solutions in the following table, and compared the different technical paths of these Layer 2:

In the long run, the Rollup series has higher security and more sustainability, which is a promising technical direction. V God also favors the Rollup expansion plan, and has raised his expectations for the Rollup expansion plan many times. From the recent domestic community live broadcasts that V God participated in, it can be seen that Rollup may become the focus of this year's Ethereum expansion.

What are the projects worthy of attention?

Several Rollup projects that V God often mentions include ZKSync (Matter Labs), Loopring, Optimism, and Arbitrum. In theory, these solutions can expand TPS to thousands of levels under the current Ethereum main network, while trying not to sacrifice decentralization and security attributes, so they are known as the best expansion solutions.

Let's take a look at these Rollup projects that may shine in 2021 one by one.

Loopring is the first Ethereum Layer 2 project to adopt the ZK rollup expansion solution, and has achieved remarkable results. V God directly expressed his optimism for the Loopring project in a recent domestic live broadcast. According to statistics from duneanalytics, the current value of assets locked in Loopring's second-tier network is close to 210 million US dollars, of which more than half of the assets are blue-chip assets such as ETH, USDT, and WBTC.

The Loopring protocol uses zkSNARKs technology to place the main calculations outside the chain, while the Ethereum chain is mainly responsible for the verification work, ensuring high throughput, low cost and high security. The DEX based on the Loopring protocol can carry 2025 transactions per second on the Ethereum main network under the premise of ensuring the absolute security of user assets, and the cost of each transaction is theoretically less than 0.001 RMB, which includes the gas fee of Ethereum and the cost of generating zero-knowledge proofs off-chain. Compared with the current transaction fees that easily exceed tens of RMB, it is extremely cheap.

ZKSync (Matter Labs) has attracted a lot of attention recently, one of the reasons is that it has just completed its A round of financing, led by Union Square Ventures (USV), and Matter Labs’ previous investors Placeholder, 1kx and Dragonfly continued to participate This round of financing. It is reported that ZKSync’s valuation in this round of financing is as high as 120 million US dollars.

ZkSync from Matter Labs, the main network has been launched, but has not yet provided a general solution. On October 10 last year, Matter Labs cooperated with Curve, a DeFi protocol that focuses on stable exchanges, and launched the zkSync L2 smart contract test network, named Zinc Alef. The Zinc programming language is not Turing complete and still has some limitations. Matter Labs said it will continue to improve Zinc to become a Turing-complete language. At present, the functions supported by ZKSync are relatively simple, and the only interactive operations are deposit, transfer, withdrawal, and Cruve interaction on the Rinkeby test network.

The last thing worth mentioning is the Arbitrum solution created by Offchain Labs. The implementation used is an ORU implementation similar to Optimism, and it is still in the testing stage. Although Optimistic Rollup and zk Rollup have received more attention, from the current point of view, after all, the Layer2 track is still in the early stage, and Arbitrum Rollup cannot be ignored.

Arbitrum's mechanics are manipulated directly with the EVM. The application can run the code directly on Arbitrum. The advantage of the Arbitrum method is that it can support more VMs, EVM can be supported now, and more programming languages can be supported later. But the disadvantage is that Arbitrum's mechanism is more complicated and requires more code, so this method may have more security risks.

With the completion of various seed project financing this year, a competition around the expansion of Ethereum Layer 2 has become fierce. The issuance of tokens has also become the biggest bargaining chip in this war. Among them, Loopring has demonstrated the attractiveness of the second-layer network liquidity mining, while ZKSync (Matter Labs), Optimism, Arbitrum and other projects that have not yet issued tokens, Once the token issuance plan is officially announced, it will inevitably trigger an influx of users and funds.

This article only represents the personal views of encrypted notebooks and does not constitute any investment opinions or suggestions

This article only represents the personal views of encrypted notebooks and does not constitute any investment opinions or suggestions