Recently, DeFi hotspots have followed one after another. For the underlying chains, Ethereum-compatible chains such as Solana, and Ethereum’s second-layer networks such as Matic have also attracted attention.

Among these projects, Solana believes that its advantage is that it can effectively avoid the pain points of some Layer 2 networks, and provide a better experience for applications such as on-chain games, real-time communication, and fast transfers that require high performance and frequent operations.

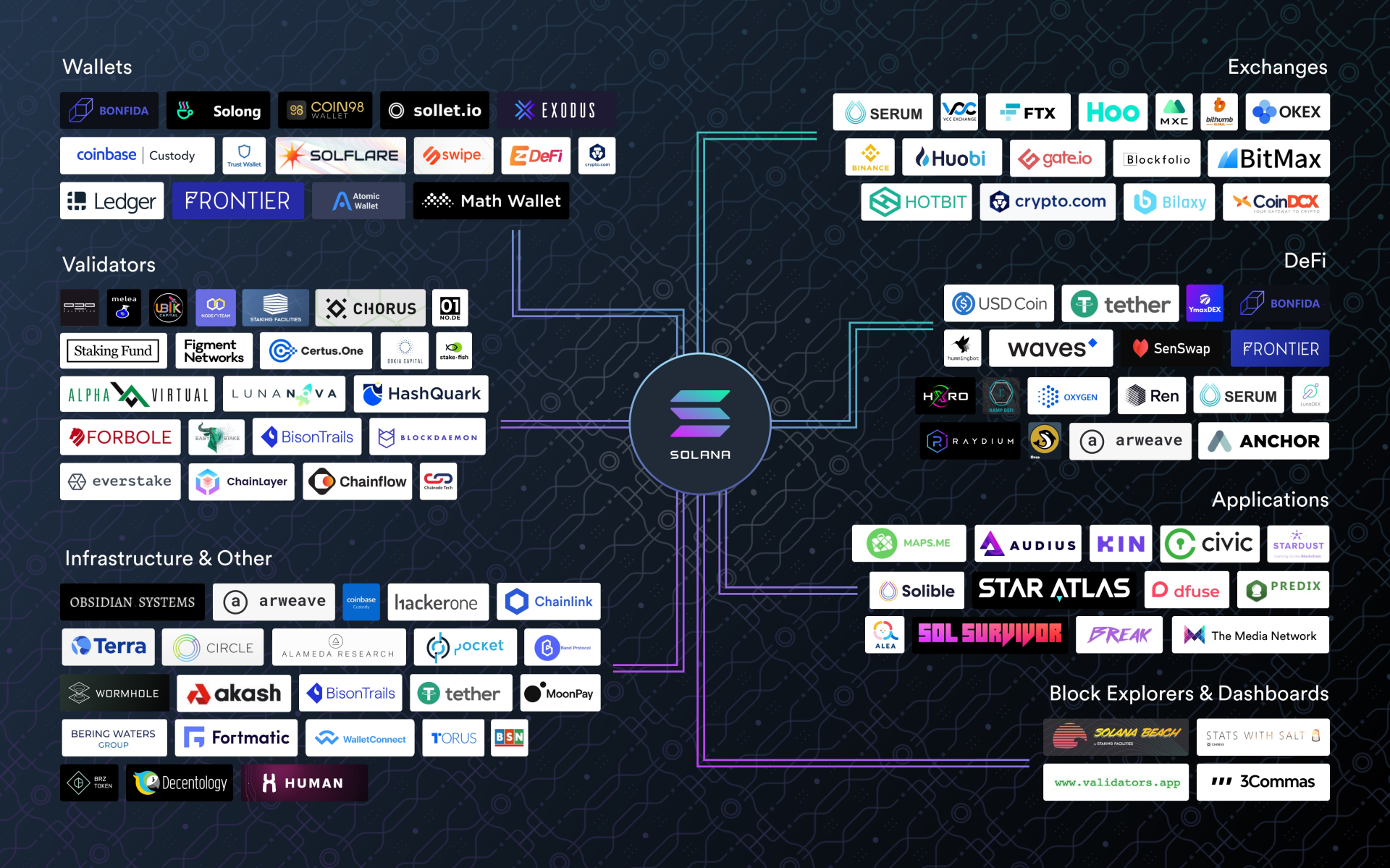

In addition to performance, Solana also has a developer-friendly development environment and ecological composability, which is a cost-effective choice for new projects and new players. At present, Audius, Kin, Maps.me and other applications with huge users have joined the Solana ecosystem.

secondary title

The following is the AMA essence organized by Odaily, enjoy~

Odaily: First of all, I would like to ask Chris to briefly introduce himself.

Chris:Heyy, hello everyone! Thanks a lot to Odaily for hosting this event, you can call me Chris :)

Graduated from UCLA with a bachelor's degree, entered the blockchain "rabbit hole" in 2017 and couldn't extricate himself, engaged in various businesses such as investment, exchange, and startup. I joined the Solana team last year, and I have seen Solana's rocket-like growth in just a few months. Today, I am honored to introduce our project and share some of the latest progress. In my spare time, I like to collect interesting pictures on memes and twitter, so I will try my best to combine pictures and texts in the following answers. OdailyQ1: Solana is famous for its high performance, and has also attracted early projects such as Kin and Audius to settle in. We often hear that the mechanism of Solana is very innovative. Can you tell us in a simple way, what are the main innovative technologies of Solana, and how to achieve high efficiency and low cost?

OdailyQ1: Solana is famous for its high performance, and has also attracted early projects such as Kin and Audius to settle in. We often hear that the mechanism of Solana is very innovative. Can you tell us in a simple way, what are the main innovative technologies of Solana, and how to achieve high efficiency and low cost?

Chris:Developed by teams from Fortune 500 companies such as Qualcomm, Intel, Google, and Dropbox, Solana is a high-performance public chain. At present, the highest can reach 60,000 TPS, the handling fee of each transaction is less than 0.00001 US dollars, the block confirmation time is 400ms, and there are more than 500 global verification nodes.

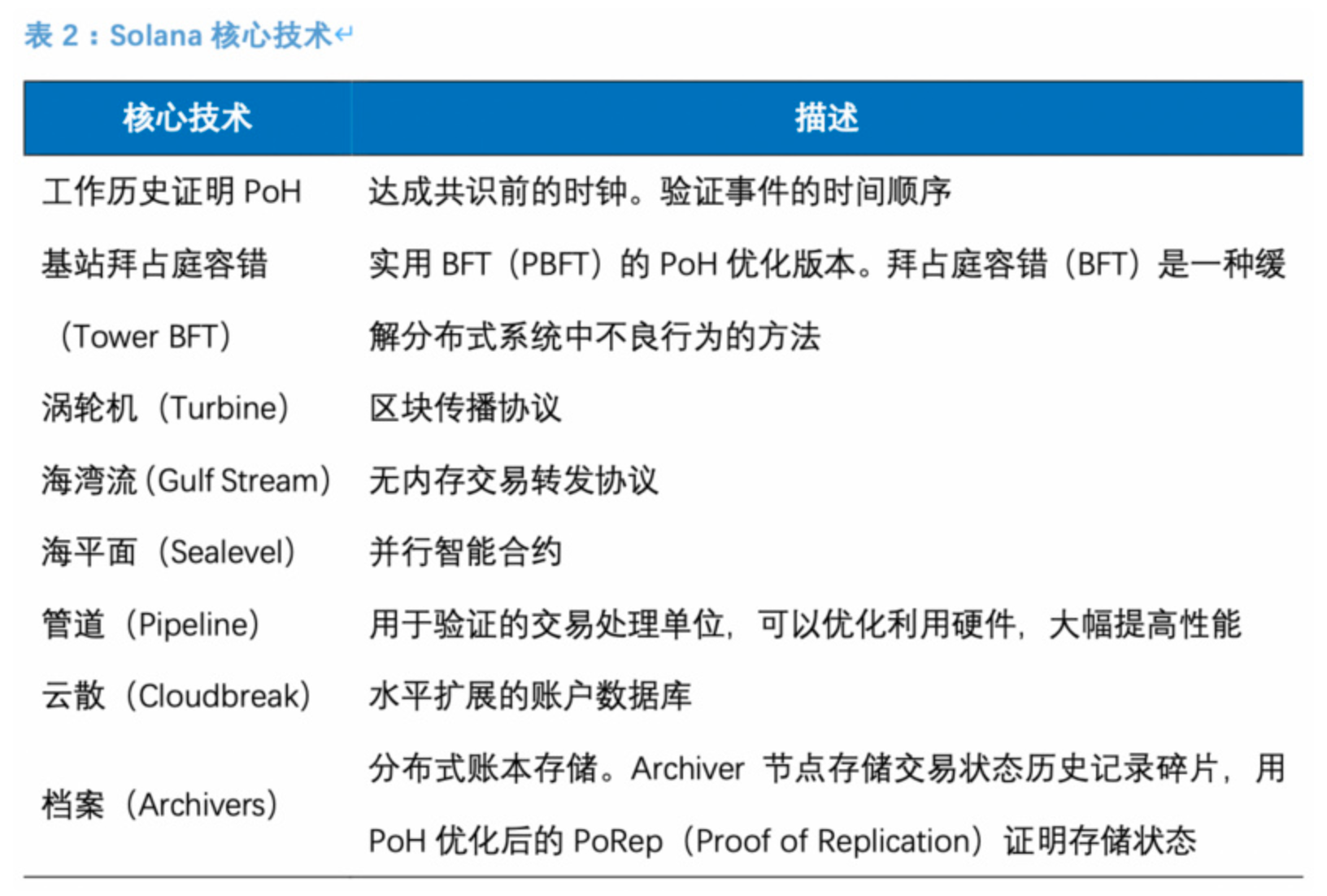

In terms of technological innovation, Solana proves PoH through work history, base station Byzantine fault tolerance, turbine (block propagation protocol), Gulf Stream (memoryless transaction forwarding protocol), sea level (parallel smart contract), pipeline (verification transaction), cloud dispersion ( Horizontal expansion account database), and archives (distributed ledger storage) and other 8 technologies to solve the impossible triangle problem.

The core of which is Proof of History, which you can understand as a pre-consensus clock. Within an agreed time frame, nodes in the network can continue to process transactions with POH, because they can trust the order and timing of transaction information before reaching consensus.

For example, in PoW, you can think of Bitcoin as a clock that ticks every 10 minutes, and the Bitcoin blockchain needs to reach a consensus in about 10 minutes to agree on the order in which messages are processed. During these 10 minutes, the network did not make any progress. Solana uses the Verifiable Delay Function to quickly rotate through the verification node at a speed of 400 milliseconds to perform the same Sha256 operation. This greatly improves the block generation speed and network efficiency.

click the linkclick the linkread it. For specific innovations, you can also pay attention to the Solana public account orOfficial website blogTo learn more.

OdailyQ2: Performance is a common criterion for evaluating public chains, but on the other hand, the positioning of public chains is also very important. We can say that Solana has achieved the ultimate in performance, so in terms of positioning, which areas/applications do you think Solana pays more attention to?

Solana is positioned as an Internet-level blockchain (Web-Scale blockchain), aiming to build the infrastructure of Web3.0.

In the past period of time, the field of DeFi (decentralized finance) has been particularly popular. I personally think that the blockchain industry is still in its early stages, and there will be more unprecedented DeFi scenarios in the future, which are worth exploring by practitioners. Insufficient underlying performance of Ethereum has caused the gas cost to soar recently. Although the latest proposal is full of excitement, this problem cannot be solved in the short term. Therefore, Solana, which is fast, cheap, and decentralized at the same time, is undoubtedly the best choice for DeFi , our ecology has recently released two very distinctive DEXs (Raydium and Orca).

In addition to DeFi, Solana is also suitable for all types of applications (including communication, games, NFT, etc.). Recently one of our partners, Audius, also announced that it will port the content management system from the Ethereum sidechain operated by the POA network to the Solana blockchain. Audius is similar to popular music players like Pandora or Spotify, but the Audius platform allows artists to set their own terms and allows other developers to use its underlying infrastructure.

In the near future, everyone must have seen the news that more and more large enterprises/investment institutions are embracing the blockchain. This is a very good situation. Solana will continue to improve various development tools and infrastructure to provide the best performance without sacrificing decentralization, and we have a detailed plan to continuously optimize and upgrade according to the hardware's Moore's Law, so that Solana's performance can be unlimited Expand to support large-scale blockchain application scenarios that break the circle.

OdailyQ3: In addition to performance, what do you think is the attractiveness of a public chain? If there is a project party standing in front of you now, how would you attract him to join Solana?

Chris:I think there are also development environments and composability to consider. Jesse Walden of Variant defines composability as "a platform is composable if its existing resources can be used as building blocks and programmed into higher-order applications." Composability is important because it allows Developers can do more with less, which in turn drives faster and composable innovation.

Programmers who develop dapps on Solana can now start building in as little as 15 minutes. Through Decentology's DappStarter platform, developers can create custom dapp source code (including smart contracts, Web UI, unit tests, and server-side APIs, etc.) with just a few mouse clicks.

DappStarter solves a big challenge in the blockchain space: developer tools. Developers who have just entered the blockchain industry are usually faced with the dilemma of learning new programming paradigms and lack of development tools. For this reason, Solana simplifies the process of developing applications with JavaScript and TypeScript, so as to get started with customizing the full-stack source code faster.

For project parties/developers/entrepreneurs who are willing to join the Solana ecology, the Solana Foundation will provide financial and technical resources to the greatest extent possible. Please refer to:

Solana Grant Programhttps://solana.com/grantsand technical documentationhttps://github.com/solana-labs/defi-hackathon 。

Developers can directly learn from our documents and tutorials for different technical modules without restarting the stove, which includes introductory tutorials, SPL tutorials, Serum DeFi modules, wormhole deployment, etc.

OdailyQ4: Community ecology is indeed a very important aspect. We look at the ecological landscape of Solana, which is indeed different from many public chains. Many public chains may list mostly DeFi applications, but you also have some non-Defi applications, such as Star Atlas, Decentolgy, and Human Protocol. I would like to ask What role do they play in our ecology?

Now that I mentioned Decentology just now, let me talk about Human Protocol and my personal favorite: Star Atlas as an "Internet addict".

Star Atlas is a massive Metaverse category mmo universe exploration game incorporating state-of-the-art blockchain, real-time graphics, multiplayer video games and decentralized finance technologies.

Star Atlas is a massive Metaverse category mmo universe exploration game incorporating state-of-the-art blockchain, real-time graphics, multiplayer video games and decentralized finance technologies.

image descriptionhttps://staratlas.com/to know more information.

Star Atlas race: Usturs

OdailyQ5: Isn’t staking mining popular now? I heard that your income is quite high. Can you introduce it to us?

Chris:Solana switched on network inflation rewards in early February. Among them, ordinary currency holders can obtain certain rewards while maintaining network security by entrusting tokens to verification nodes. The following is some basic information of the pledge:

The current annualized rate of return for staking is 16%.

The inflation rate is proposed to be 8% for the first year, gradually decreasing by 15% each year thereafter.

Most inflation tokens are issued as rewards for staking SOL tokens. Anyone holding SOL can stake using a staking-enabled wallet like SolFlare.com.

Inflationary tokens are also issued to validators, who receive a portion of commissions (fees) from staked token holders as a subsidy for transaction processing services and securing the network.

The return/annualization of staked tokens depends on the total amount of SOL staked on the network and the uptime and commission (fee) of that validator.

Validators with higher uptime and lower fees can generate higher returns for staked token holders.

The more tokens staked in the network, the lower the rewards for everyone.

The fewer tokens staked in the network, the higher the rewards for everyone.

After the launch of inflation rewards, the number of verification nodes in the world has rapidly increased from more than 400 to 531, and the total amount of pledged tokens has reached 239 million (the current circulation of tokens is about 264 million). During this process, the Solana network The degree of decentralization has been further improved - pledged users, nodes, and the network have achieved a mutually beneficial and win-win situation.

OdailyQ6: Solana’s two new DEXs, Raydium and Orca, both need to start liquidity mining, but the market is now a bit down, and many DeFi assets are also considered to be bubbles. Do you think this point in time will be a challenge for new DeFi projects? What's so special about these two projects?

Chris:The attention of the market will definitely affect the growth rate of the project in the short term, but this is only a small part. The success or failure of the project often depends on whether it can solve some core pain points and propose substantial innovations for the generalization of the industry. As for the bubble, since the DeFi application of the Solana ecology has not yet fully exploded, compared with the large number of mining/lending and other doll projects in Ethereum, the degree of bubble in the Solana ecology may be the lowest.

Next, I briefly introduce these two projects.

Orca is a people-oriented DEX. First of all, it has several biggest highlights:

Orca proposes a set of user-friendly reasonable price indicators (compared with Coingecko's real-time price), reminding users whether there is currently a high slippage.

Orca is not only an AMM, but also an aggregator. Every time you enter a trade, we offer the best price from Orca or Serum Swap's liquidity pool. You can rest assured that Orca will always provide the best price.

In most AMMs on Ethereum, users often need to open a browser plugin to check their balance. On the left side of the Orca interface, the "Tokens" panel is directly added, and users can easily and intuitively see all the token balances in the wallet.

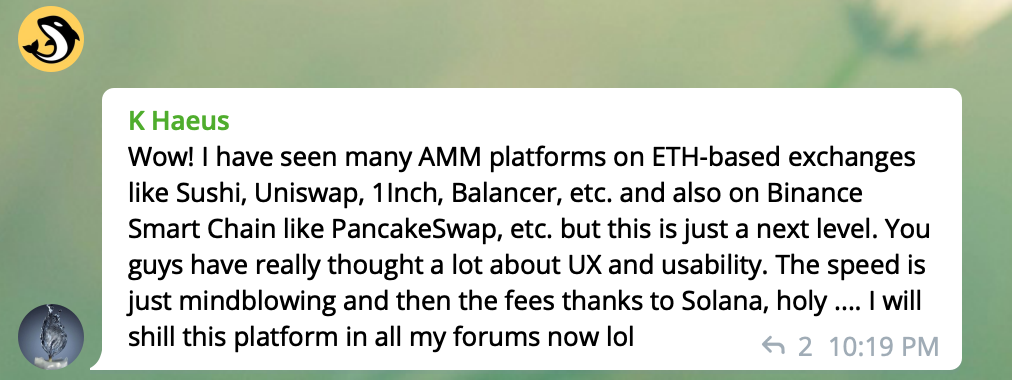

In addition, Orca has received a lot of praise from the community not long after its launch :) Users have expressed their appreciation for its elegant and simple UI and silky smooth trading experience.

Unlike other AMM platforms, Raydium can provide on-chain liquidity to the central limit order book, which means that Raydium users and liquidity pools can access the order flow and liquidity of the entire Serum ecosystem, and vice versa. All these functions are realized by building on Solana.

Unlike other AMM platforms, Raydium can provide on-chain liquidity to the central limit order book, which means that Raydium users and liquidity pools can access the order flow and liquidity of the entire Serum ecosystem, and vice versa. All these functions are realized by building on Solana.

Additionally, liquidity providers are able to earn rewards from transaction fees. The key liquidity pool will use RAY tokens as liquidity incentives. Projects that want to reward users for providing liquidity can also add other reward tokens. When new projects are launched, they can utilize Raydium to create new trading markets and provide them with instant liquidity. In this way, the project can be easily up and running, providing traders with the opportunity to easily purchase tokens.

OdailyQ7: One of the benchmark projects of the Solana ecosystem is the decentralized exchange Serum, and Serum is developed by FTX. The industry also knows that FTX founder SBF has a very close relationship with Solana, and even regards Sam as the spokesperson of Solana. Can you tell us about the relationship between Solana and FTX/Sam/Serum/Alameda Research?

Chris:First, let's do a simple sorting of each item:

Solana is a secure, fast, and high-performance underlying public chain (Layer 1). We aim to provide an open infrastructure for global-scale applications.

Serum is the first DeFi project in the Solana ecosystem and the world's first fully decentralized exchange that supports cross-chain transactions without third-party trust. It was co-founded by Project Serum and other experts in the field of encrypted assets and DeFi. It should also be mentioned that Serum is not developed by FTX, but every member of the Serum community is contributing to the construction of Serum, and Sam is a member of the Serum advisory team. Recently, many projects have been built based on Serum, and the role of Serum has gradually changed to the underlying DEX protocol of the Solana ecosystem. Serum's advisory team can be viewed here:https://projectserum.com/

SBF is the co-founder and CEO of FTX and the founder of Alameda Research. In the 2021 list of the richest people under the age of 30 released by "Forbes", SBF is honored on the list. According to New York magazine, SBF said in an interview recently that its net worth is about 10 billion US dollars.

Alameda Research was established by SBF in 2017 and now has a digital currency quantitative trading company with an asset management scale of more than 100 million US dollars. In less than a year since its establishment, it has become one of the largest liquidity providers and market makers in the digital currency market.

FTX was established in May 2019 and is now ranked No. 4 in the global exchange rankings. It has 90+ contract transactions, index contracts, equity certificates, prediction markets, leveraged tokens, volatility contracts, option products, and automated OTC, etc. It is deeply loved by traders for its low fees, free withdrawal fees, and diversified innovative products. It has developed very rapidly recently. In many people's minds, it already has the strength to completely impact the first-tier exchanges.

As for why Serum and a series of subsequent DeFi applications (Maps.me, Raydium, Oxygen, etc.) choose to build on the Solana blockchain, I think the ultimate reason is the excellent performance of Solana: it is fast, cheap, and can really achieve 50,000 TPS, at the same time, the performance will also expand with the update and iteration of the hardware. It can be said that Solana has "infinite scalability". Therefore, it is no wonder that SBF has stood/called for Solana on multiple occasions.

OdailyQ7: It can be said that the expansion of the second layer of Ethereum is in full swing, and it feels like the whole network is being used to solve this problem. Solana has also proposed its own solution to be compatible with Ethereum and realize two-way cross-chain. Can you introduce it to us and when we expect it to be used?

OdailyQ7: It can be said that the expansion of the second layer of Ethereum is in full swing, and it feels like the whole network is being used to solve this problem. Solana has also proposed its own solution to be compatible with Ethereum and realize two-way cross-chain. Can you introduce it to us and when we expect it to be used?

Chris:Wormhole was developed by Solana in cooperation with Certus.One and is now available online.

Wormhole is a two-way cross-chain bridge between Ethereum and Solana. This bridge allows users and applications to convert ERC20 tokens into Solana's SPL tokens to enrich DeFi application scenarios and improve performance.

Our main "trustless" bridge allows Ethereum's DeFi traders and applications to perform asset conversion on the two chains, and enjoy Solana's high tps and low transfer costs, because wormhole is a two-way bridge, users can also choose to let the value Back to the Ethereum network.

The Solana Foundation invites developers to use Wormhole to create some cross-chain usage scenarios in the hackathon that started on October 28. More than 1,000 registrations and more than 80 complete solutions have been received, and most of the teams are willing to participate in the hackathon after the hackathon. Develop applications on Solana.

OdailyQ9: As a competitor to a certain extent, are you optimistic about the implementation of Layer 2 expansion directly based on Ethereum? If the expansion is relatively successful, will it affect the migration of some good projects, good teams, and even many users and assets to Solana?

Chris:I first combine Multicoin Capital"The Defi Stack"The article talks about the insights on ether expansion:

The first is the State Channel. For example, raiden and connext use state channels and payment channels. The two parties to the transaction lock assets in a smart contract similar to multi-signature. In this channel, the two parties can conduct any number of cost-free capital exchanges. , only when both parties have agreed, the funds in the wallet can be unlocked and transferred, and the only transaction on the chain is implemented, which greatly reduces transaction costs, but this problem is limited by narrow Payment scenarios cannot be used for a wide range of smart contracts.(Multicoin Capital quoted here"The Defi Stack"article)

The second is Optimistic rollups, which are compatible with EVM, they inherit layer 1 network security, can achieve higher throughput (especially across multiple shards), lower latency and lower gas costs, but provide Currency is longer.

Third, Side Chains side chain. Projects like SKALE and Matic are also EVM compatible, have high throughput, low latency, and low gas fees, and provide developers with highly controllable instant deposit/withdrawal capabilities. However, they did not inherit Ethereum's layer 1 security.

As mentioned before: Solana's proof of history and veriable delay function enable this public chain to achieve high scalability on the chain according to the "hardware Moore's Law", and achieve layer 2 performance without sharding.

A high-throughput, low-cost public chain like Solana is more suitable for applications such as on-chain games, real-time communication, and fast transfers that require high performance and frequent operations.

Recently, the encrypted communication application Kin has been migrated to Solana, and Map.me, the world's number one offline map software with nine years of history and more than 140 million cumulative users led by Alameda Research, has also chosen to run on the Solana blockchain.

The positioning of Solana is not an ether killer. We have a different approach to expansion than other projects. At present, it seems that the advantage of Solana is that it can effectively avoid the pain points mentioned above in the layer-2 network, and support some unique application scenarios and functions (such as Serum's decentralized orderbook). I believe that with the growing ecology on the chain and more companies/developers joining our construction, more circle-breaking projects like map.me, Human protocol, and Star Atlas will be born on Solana. The possibility of overtaking.

OdailyQ10: The last question is, does Solana have any important milestones this year, or within 1-2 months, or in the first half of the year? What is the main focus of the current team or community builders?

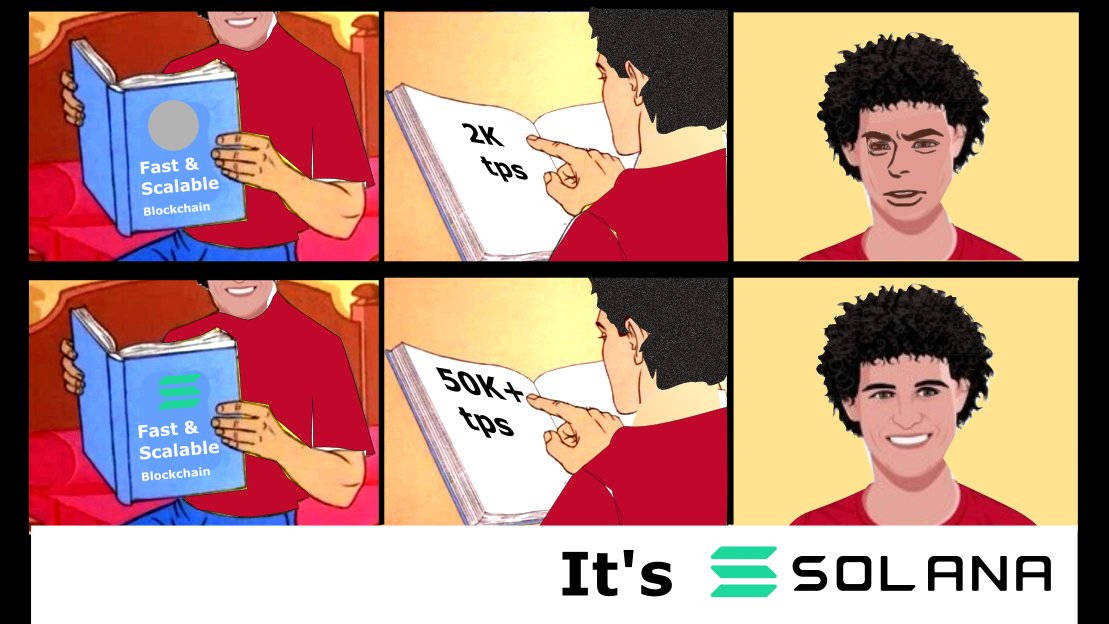

Chris:We are still a few weeks away from the first anniversary of the Solana mainnet launch, which is also a very exciting event for our team. In just one year, the ecology of Solana has also witnessed rocket-like growth. There are more than 100 ecological cooperations including Chainlink, USDC, USDT, Maps.me, Human Protocol and other leading projects. The total transfer volume of Solana has reached 12 billion, the single-day trading volume of Serum Dex once reached $31.37M...

The Defi Hackathon co-organized by Solana and Serum also came to an end today. This event was assisted by leading projects in the industry, and all-star judges were also invited for plastic surgery. On the basis of the previous Wormhole Hackathon, the total prize pool has been expanded to 400,000 US dollars, and a link in which mentors invest in the seed round of leading projects has been added. With the significant increase in the influence of the event and the popularity of Solana, more than 3,000 people signed up for this hackathon. As a member of the ecology, I am very excited about this magnitude of ecological development, and I am also very curious about what new species will appear on Solana and Serum.

Just today, the total market value of USDC exceeded 9 billion US dollars, and the stable currency ecology of Solana ecology, including USDC, USDT, and Terra, will also kick off. As the atomic unit of the DeFi ecosystem, the performance and transfer costs of stablecoins often determine the ceiling of this DeFi Stack. With a TPS higher than Visa mastercard and paypal and a confirmation speed of less than one second, USDC-SPL (USDC Solana) brings developers innovations in performance, scale and cost efficiency, addressing the rapid growth of financial and consumer stability Coin use case. With a Circle account, customers around the world can connect bank accounts and mint, redeem, store, send and receive USDC on Solana.

Question from the audience: The Oxygen project, which recently raised 40 million US dollars and is about to start IEO on FTX and Bitmax, is quite popular. Can you introduce this project in detail?

Chris:In Oxygen, investors will have a variety of application scenarios: First, users can deposit funds and obtain storage interest. At the same time, users can lend assets from the fund pool and pay loan interest to the fund pool.

Compared with traditional finance, Oxygen is extremely efficient in terms of capital efficiency. Users can lend assets and borrow other assets at the same time. In addition to receiving income from lent assets, they can also freely use borrowed assets to increase income.

When the user wants to borrow other assets, the total value of "all assets" in the account can be used as a collateral deposit, and the risk of the user being liquidated or the possibility of a margin call will be reduced. Just like the common combination margin in secondary market transactions, in the same account, investors can use different asset classes for hedging to reduce risks.

In simple terms, users create a fund pool, put assets into the fund pool, mark the assets that can be lent, and the desired interest rate. Once the matching is successful and the borrower is willing to pay the required interest rate, the asset will be lent out. At this time, users who lend to others will earn interest, which is passive income. If necessary, they can also use the funds in the pool. Assets are used as collateral to lend against other assets.

At the same time, Oxygen will also integrate Maps.me, a map application that has just entered the Solana ecosystem. This Internet application that has just completed financing of 50 million US dollars, with its own 140 million registered users, is waiting for the best DeFi application suitable for these new traffic .