Editor's Note: This article comes fromChatting with William (ID: William1913), Author: William Chen, reproduced by Odaily with authorization.

Editor's Note: This article comes from

Chatting with William (ID: William1913)

Chatting with William (ID: William1913), Author: William Chen, reproduced by Odaily with authorization.312/313 in 2020 and 222/223 in 2021 are all days worth remembering, and they are all days of very violent market deleveraging.The liquidation of futures contracts on the market alone cost tens of billions, sending away more than 500,000 little brothers.

Counting the ones that are not counted and the spot meat, I estimate that in the past two days alone, millions of investors have left the extremely risky market of Bitcoin.Hey, let's go all the way, I hope they can use lighter words when they scold Bitcoin for deceiving people in the future, and don't scold them too harshly.Yesterday, not only the long leverage of the exchange was blown up, but also the leverage of on-site lending was blown up.The liquidation volume of DeFi loans also broke through 100 million US dollars, creating a new historical record:Moreover, the leverage liquidation of DeFi is basically the liquidation of "lending leverage". Even "niche lending" such as DeFi, which accounts for a small proportion of the entire lending market, has exploded with a leverage of more than one billion US dollars, which is enough to show that in the overall encryption The amount of liquidated positions in the currency lending market should be even more impressive, and there should be a scale of tens of billions of RMB.Therefore, the scale of leverage cleared in the past two days should be at the level of 100 billion (rmb).Is it the first time in the history of cryptocurrency that this level of leverage has been violently liquidated?

It has to be said that with the rise of Bitcoin all the way, the bullish sentiment of all people is too strong, and every leverage is fully charged, then the market will come to a turning point one day and the leverage will be cleared.Deleveraging, a healthy market certainly does not allow most people to make money, so generally there are too many people in the same direction, and problems are prone to occur.It's just that you have seen the most violent deleveraging method.

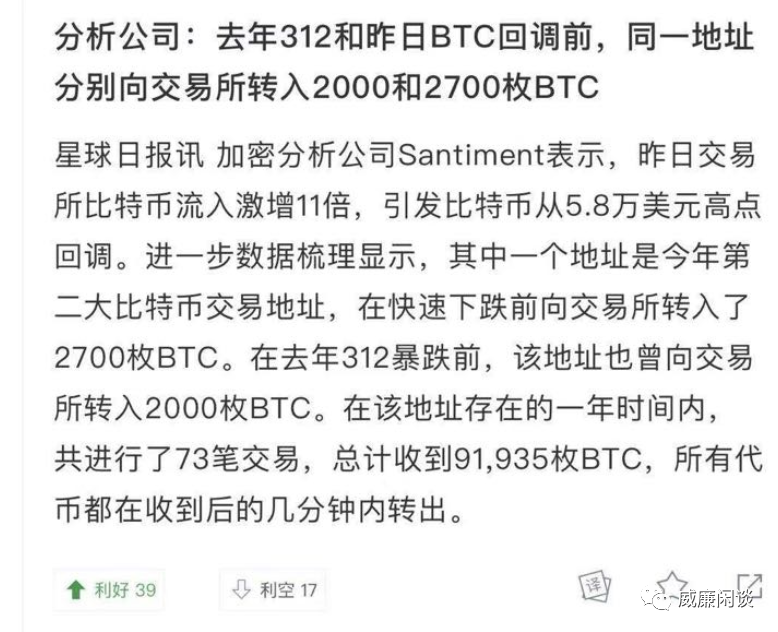

I found that many people like to look for bad positions when they fall, especially like to look for this kind of "who and who smashed the market":Are you so unsure about the depth of Bitcoin? If two thousand bitcoins can smash the market like this, then there is no need to do this market, go home and raise pigs.If you insist on finding the reason, it is better to look for the general environment, which is more reasonable. After all, the US stock market also fell sharply yesterday:The general environment is not good, and the general environment will take the blame.

However, I think this round of downward adjustment of the global "bubble assets" is really good. It is equivalent to the fact that many people predicted that some adjustment risks that may exist in the beginning of this year will be released in these two days in advance, and there is no need to wait until the cruel March. .If this is the worst of the year, then I'd say it's nothing more than that.

In addition, in fact, the report that was misread yesterday is actually a positive, and it can temporarily save Usdt from the risk of being punished by Lao Mei. This lawsuit has been fought for two years, and it is a very good ending to pay the money:Very good, I guess they will take advantage of this benefit to print more u to help consolidate the bottom of Bitcoin price.The most interesting thing about this round of decline is the birth of such interesting graphs, that is, the decline the day before yesterday was not that good, but yesterday’s decline really resembles the Tesla logo:I declare that this round of "Tesla Bottom" is officially established, and we will protect Ma Bencong's laughter together. (Don't slap your face after posting)In short, no matter how violent the storm is, it is time to bear it. Can't you see the rainbow after the rain if you survive it?