On August 2, 2018, Apple won the world's first crown with a market value exceeding one trillion US dollars. After more than two years, a new story is unfolding in the encryption market. On the evening of February 19, 2021, Bitcoin continued to soar, and its market value successfully passed the $1 trillion mark.

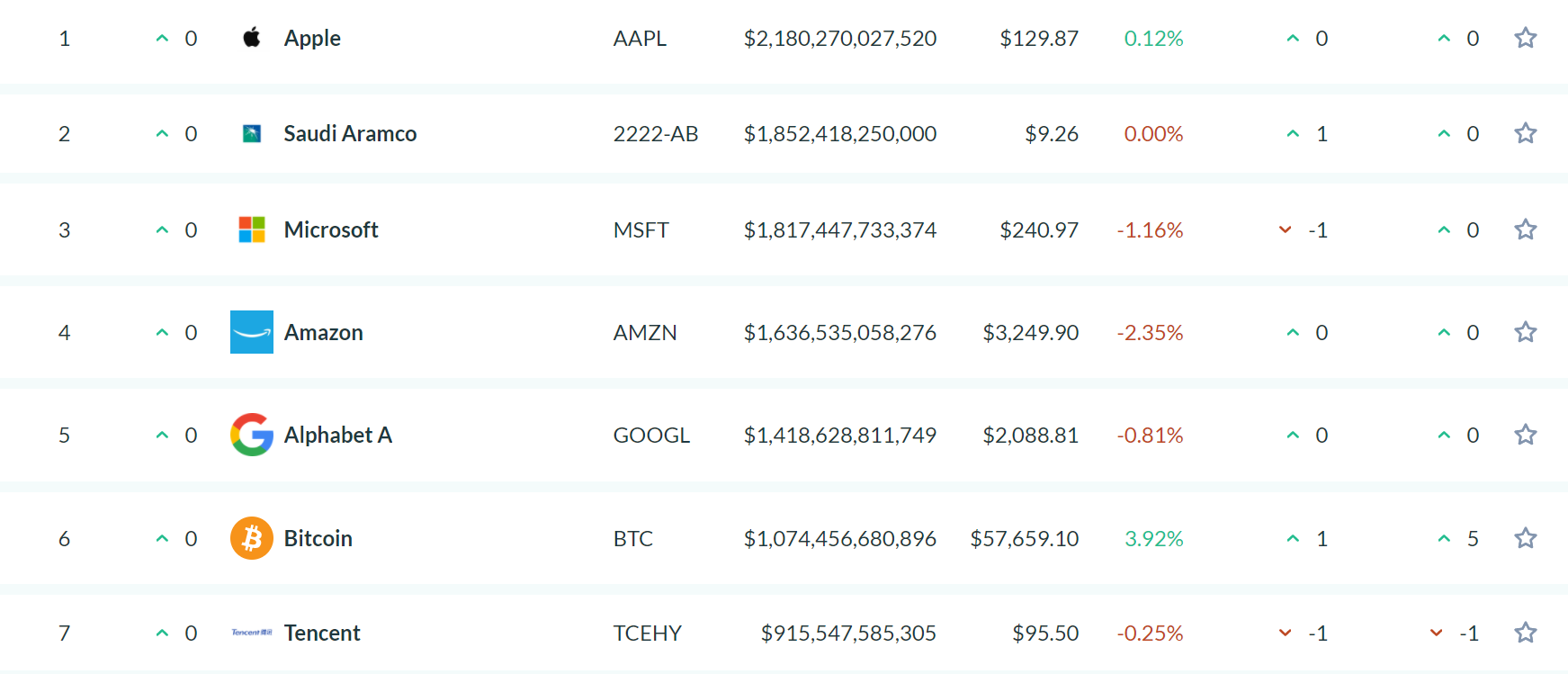

According to Asset Dash data, as of 19:00 on February 21, 2021, the current price of Bitcoin is approximately US$57,600, with a market value of US$1.07 trillion, ranking sixth in the global asset market value ranking, ahead of Tencent. At the same time, the number of encrypted assets included in CoinMarketCap is 8532, and the total market value has reached 1.7 trillion US dollars.

On February 21, CCTV Finance reported that as the price of Bitcoin has been rising, more and more companies have begun to publicly announce that they will use Bitcoin as an asset allocation. Some institutional analysts believe that Tesla made nearly US$1 billion in book profits through Bitcoin last month, which has exceeded the income from selling electric vehicles last year.

At the same time, investors in the currency circle are full of confidence in the "money scene" of Bitcoin. Crypto analyst Joseph Young said on Twitter that Bitcoin's rally is more sustainable than previous bull market cycles. Because, giant whales are actively buying or hoarding Bitcoin, rather than selling or profiting, which strengthens the basis for Bitcoin's rise.

first level title

Musk's Twitter detonates the market

After entering 2021, Tesla CEO Elon Musk (Elon Musk) took over Grayscale and became the new protagonist of "calling" Bitcoin, which seems to have become the "X factor" for the currency circle to be bullish on Bitcoin.

Judging from his personal experience, it is not only colorful, but also fruitful. Statistics show that Elon Musk, a graduate of economics, is a well-known king of crossovers. From Internet payment, electric vehicles, aerospace and even super high-speed rail...every time he makes a move, he has achieved good results.

According to industry insiders, it can be seen from his entrepreneurial history that he is always indispensable in some important market outlets.

Recently, Elon Musk has frequently expressed his positive personal stance on Bitcoin through Twitter, and boosted Bitcoin's social tweets to an all-time high. In fact, careful people have discovered that in the past few years, he has been closely connected with the encryption market and has deep roots.

On January 29 this year, Elon Musk added the hashtag "#Bitcoin" to his Twitter profile. At the same time, he also said that in retrospect, it was inevitable (In retrospect, it was inevitable).

At 16:00 on the same day, Bitcoin soared by nearly $5,000 in one hour, which aroused heated discussions among investors. "Bitcoin is a good thing, and I am a supporter." On February 1, Elon Musk said that I should have bought Bitcoin 8 years ago, and I was late for this feast.

When F2Pool dug out block 668197 of Bitcoin, it wrote Elon Musk's tweet content "In retrospect, it was inevitable" into this block. This move is believed to have brought Bitcoin’s scarcity and value-storage attributes into play again when the US dollar was issued and global funds were released, and it has attracted the attention and recognition of mainstream investors around the world.

Not long ago, according to a research paper released by Blockchain Research Lab, it assessed that Musk tweeted about cryptocurrencies six times in the past year. Among them, four are related to Dogecoin and two are related to Bitcoin. The study concluded that both the trading volume and spot price of the two cryptoassets involved in the six tweets had an impact.

More importantly, on February 8, according to Bloomberg News, Tesla invested a total of US$1.5 billion in Bitcoin under the new policy. Tesla disclosed in its latest filing with the U.S. Securities and Exchange Commission (SEC) that it has invested a total of $1.5 billion in Bitcoin under this policy and may acquire and hold crypto assets from time to time or over time. In addition, Tesla also stated that it hopes to accept Bitcoin as a payment method for its products on the basis of legal permission in the future.

Immediately afterwards, Bitcoin began to rise "crazily". On February 9, Bitcoin broke through $47,000, setting a record high again. MicroStrategy CEO Michael Saylor said on his Twitter that he congratulated Elon Musk for adding the "#bitcoin" label and Tesla's large investment in encrypted assets, and said that "the whole world will benefit from this move."

first level title

Institutional FOMO is getting stronger

"Elon Musk's Twitter 'calling orders' has immediate results, and a new round of institutional investors will generate FOMO sentiment." Analyst James believes that Elon Musk's behavior is like a fuse, detonating market sentiment.

On February 18th, in an interview with CNBC, Microsoft co-founder Bill Gates revealed that his views on Bitcoin have become neutral. And in May 2018, Bill Gates was harshly critical of Bitcoin, claiming he would short it if he could.

According to news on February 19, MicroStrategy has raised a huge amount of US$1.05 billion for Bitcoin through the sale of convertible bonds. MicroStrategy estimates that the net proceeds from the sale of the bonds will be approximately $1.03 billion, after deducting discounts and commissions from the original purchaser and issuance expenses that MicroStrategy expects to pay, which the company intends to use to acquire additional bitcoin.

Meanwhile, MicroStrategy CEO Michael Saylor tweeted that the migration of store-of-value functions from gold to bonds to stocks to Bitcoin was recently discussed. Gold is antiquated elitist, Bitcoin is egalitarian, progressive, and the ever-expanding hot crypto core on Money Odaily.

In fact, since 2020, many listed companies have chosen to hoard Bitcoin, which has become a new trend. Not long ago, Reuters published an article "Bitcoin's Journey to the Mainstream", saying that Bitcoin, the world's first and most famous cryptocurrency, hit a new high due to the legitimacy of the asset. The interest in it from large U.S. institutions has significantly boosted the price of Bitcoin.

According to the statistics of Bitcoin Treasury, as of the end of 2020, there are currently 15 listed companies around the world that have purchased and held more than 70,000 BTC on their own, 12 of which are located in the United States or Canada. From the perspective of channels, there are roughly three ways for traditional institutions to participate in Bitcoin in the United States: one is to participate indirectly through Grayscale’s Bitcoin Trust Product (ETP) GBTC; the other is to participate in futures trading through the Chicago Mercantile Exchange (CME); It is directly held through compliant exchanges, large-scale matching of off-site institutions, etc.

On February 20th, according to Grayscale’s official Twitter, as of February 19th, Eastern Time, the total asset management scale of Grayscale exceeded US$42 billion, rising to US$42.4 billion.

In addition, as of 10:00 on February 21st, Bitcoin Treasuries counted and included 40 global listed companies and investment institutions holding Bitcoin, with a total of 1,317,411 Bitcoins publicly held, calculated at 56,400 US dollars per coin, the current value About $74.3 billion.

James believes that after the strong entry of institutional investors, the market has mainly undergone two changes: one is that Bitcoin is flowing from Asia to North America; the other is that Bitcoin is in the process of de-retailization.

first level title

Investors are reluctant to sell

"Bitcoin's market value breaking through 1 trillion US dollars is an important milestone, which once again opened up the imagination of investors." Industry analysts believe that institutional investors are currently showing strong interest in Bitcoin, and latecomers will soon follow suit. Get involved.

In recent days, the saying that "Bitcoin is the next gold mine" has been rampant again in the currency circle. Meltem Demirors, chief strategy officer of CoinShares, said on his twitter, stop pegging bitcoin to gold, the market value of bitcoin will far exceed gold, because this one is a shiny rock in a vault, and the other is magic internet currency.

Some people in the currency circle excitedly said that compared with the highest price of 57,600 US dollars set by bitcoin on February 20, compared with the closing price of gold on the Shanghai Gold Exchange on February 19 at 370 yuan/gram, one bitcoin is equivalent to 1 kilos of gold.

"The most scarce asset in the world is Bitcoin, which is digital gold." On February 9, Michael Saylor said that gold will lose to Bitcoin in the reconfiguration. He believes that once people start thinking that what they want is a non-decentralized storehold of assets, they will realize that bitcoin is better than gold. At that point, all institutional money will flow from gold to Bitcoin.

As the saying goes, what is rare is the most expensive, and "reluctant to sell" is becoming another hot topic in Bitcoin. Anthony Pompliano, founder of Morgan Creek, tweeted that I will not sell my bitcoin to Wall Street.

"Due to the large-scale accumulation of funds by institutions and the skyrocketing of Bitcoin, the holders' 'reluctance to sell' is getting stronger and stronger." James believes that this phenomenon has exacerbated the deflationary nature of Bitcoin, which is similar to the global severe inflation caused by the over-issue of global currencies In comparison, it is not surprising that institutional investors run into the market.

And the latest research from Morgan Stanley shows that Bitcoin liquidity is declining. In their report, they noted that addresses holding more than $1 million worth of bitcoin are increasing, with wallets holding more than 100 bitcoins holding more than 60% of all coins issued.

According to OKLink data, as of 15:00 on February 18, the top ten Bitcoin addresses held a total of 901,900 BTC, accounting for 4.84% of the current Bitcoin supply, an increase of 0.02% month-on-month. The top 1,000 Bitcoin addresses hold a total of 6,209,400 BTC, accounting for 33.33% of the current Bitcoin supply, an increase of 0.05% month-on-month.

Blockchain data analysis company Glassnode said in its latest report that Bitcoin's limited supply suggests further gains for the virtual asset. Bitcoin supply continues to decline as investors increasingly buy and hold for the long term.

Grayscale CEO Michael Sonnenshein predicts that visionary leaders of disruptive companies will realize that the narrative around Bitcoin has shifted from "why" to "why not."

In response to the strong purchasing power of institutional investors, Bloqport, an encryption analysis agency, tweeted on February 14 that in the past 30 days, Grayscale’s increase in Bitcoin holdings was 1.6 times faster than all Bitcoins mined. It can be seen from this.

On February 11, Bitcoin core developer Jimmy Song tweeted that we will soon find out that Bitcoin is the only way to reasonably measure anything in economics.

However, Xinhua News Agency published an article on February 20, "Bitcoin's Rapid Rise Reflects Potential Risks in the Global Financial Market", saying that the global capital market has sufficient liquidity, investors are keen to chase risks, and corporate and institutional investors are starting to buy. Under the circumstances, the price of the cryptocurrency bitcoin has continued to rise sharply this year. Market analysts believe that bitcoin's astonishing rally challenges people's imagination and may herald unusual risks in global financial markets.