In the encryption market, the short-term market price cannot reflect the value of the public chain well, but it can provoke the nerves of countless investors.

In the blockchain world, the public chain has the reputation of "the jewel in the crown". Under the spirit of its decentralized consensus, it has always been the asset allocation and focus area of investors in the currency circle.

At the peak of the last round of bull market, a chain reaction was triggered around the performance bottleneck of the Ethereum network, and many latecomers claimed that its innovation was revolutionary. Therefore, in the first half of 2018, the public chain showed a "blowout" development. In the following two years, as the encryption market entered a bearish state, some public chain projects fell from the altar and failed to recover after a setback, and some public chain projects worked hard and worked hard.

In December 2020 and January 2021, as Bitcoin and Ethereum surpassed the highs of the previous round of bull market respectively, a new round of bull market was confirmed, and the upward space was fully opened.

first level title

Ethereum finally nirvana

As an existence second only to Bitcoin in the blockchain world, Ethereum is in a class of its own with its technological innovation and huge ecology. Because of this, it has always been able to stir up the crypto market.

However, Ethereum has experienced various obstacles and obstacles along the way. In 2018, the "ICO" bubble burst, and project parties "panic-sold" one after another. Ethereum also fell from a high of 1422USDT, and fell into a long night since then.

On December 1 last year, Ethereum ETH2.0 ushered in the moment of launch. At 20 o'clock that night, the much-watched ETH 2.0 beacon chain genesis block was officially launched. According to its plan, the upgrade route of the ETH network is roughly divided into three steps, namely the PoS beacon chain, multi-sharding and state execution. Currently, only the first step of the upgrade has been completed.

In 2020, Ethereum finally turned around with DeFi. On January 19 this year, Ethereum broke through its historical high, and has continued to hit new historical highs in the past few days. As of the press time of the Nuclear Finance APP, the current highest price of Ethereum has risen to 1764USDT.

It is worth mentioning that the popularity of DeFi has also brought happiness troubles to the Ethereum network. According to Tokenview data, on February 5, the total fee on the Ethereum chain reached 12827.06 ETH, the average price of Gas per day was 150 GWei, and the average transaction fee for a single transaction was US$24.7, which was the highest level in the past two years. The number of Ethereum transactions to be confirmed has exceeded 200,000.

Industry analysts believe that with the increasing utilization of the Ethereum network and the explosion of DeFi protocols, the fees on the Ethereum chain will continue to rise.

On the same day, Webster Ratings tweeted that the high gas cost of Ethereum is getting more and more serious. If it is based on Ethereum now, then Layer 2 should be the top priority. If the current ETH price doubles without any major upgrades, then it will It may lead to the failure of Ethereum-based DeFi, because most people will not be able to afford these fees. Layer 2 solves this problem by bundling multiple transactions together, distributing fees among users. If a solution to Ethereum's fee problem is not launched in the next 6 months or so, many of Ethereum's main competitors, such as Cardano, Polkadot, Cosmos, and others will start launching their own DeFi DApps, thereby cannibalizing much of ETH. large market share.

Nevertheless, the industry is optimistic about the future prospects of Ethereum.

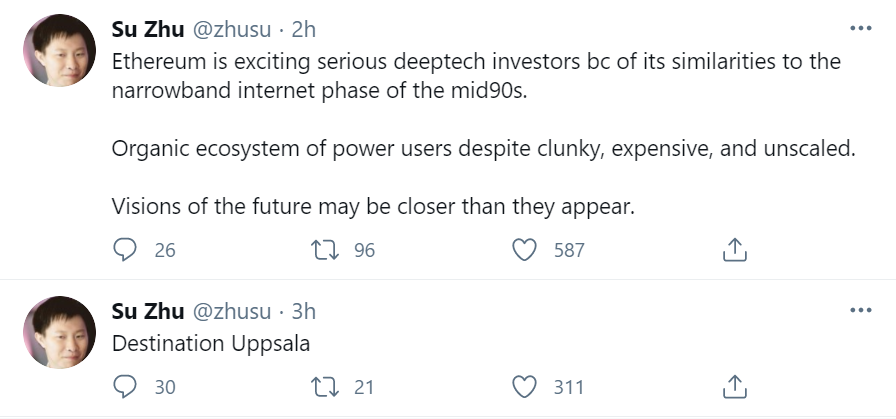

On February 6th, Su Zhu, CEO of Three Arrows Capital, tweeted that Ethereum has similarities to the narrowband Internet stage in the mid-90s, which excited serious deeptech investors. Despite being bulky, expensive, and small in size, the ecosystem of powerful users is still strong, and the vision of the future may be realized sooner than imagined.

According to data from OKLink, as of 14:00 on February 5, the total lock-up volume of DeFi protocols on Ethereum was about 45.37 billion US dollars.

first level title

The old public chain is in a downturn

Compared with the Phoenix Nirvana of Ethereum, more established public chains are not so lucky. Analyst Tina believes that this round of bull market has further accelerated the decline of old public chains, and some public chain projects have even disappeared. "Currently, the old public chains are full of difficulties. On the one hand, the ecological development is slow and the aura fades; on the other hand, they are gradually 'abandoned' by investors, and the contradiction between ideals and reality has intensified." She said.

Among them, EOS is the most disappointing to investors. At the beginning of its birth, EOS was sitting on a property of 4 billion U.S. dollars, and claimed to be "Blockchain 3.0", but it was far from expectations.

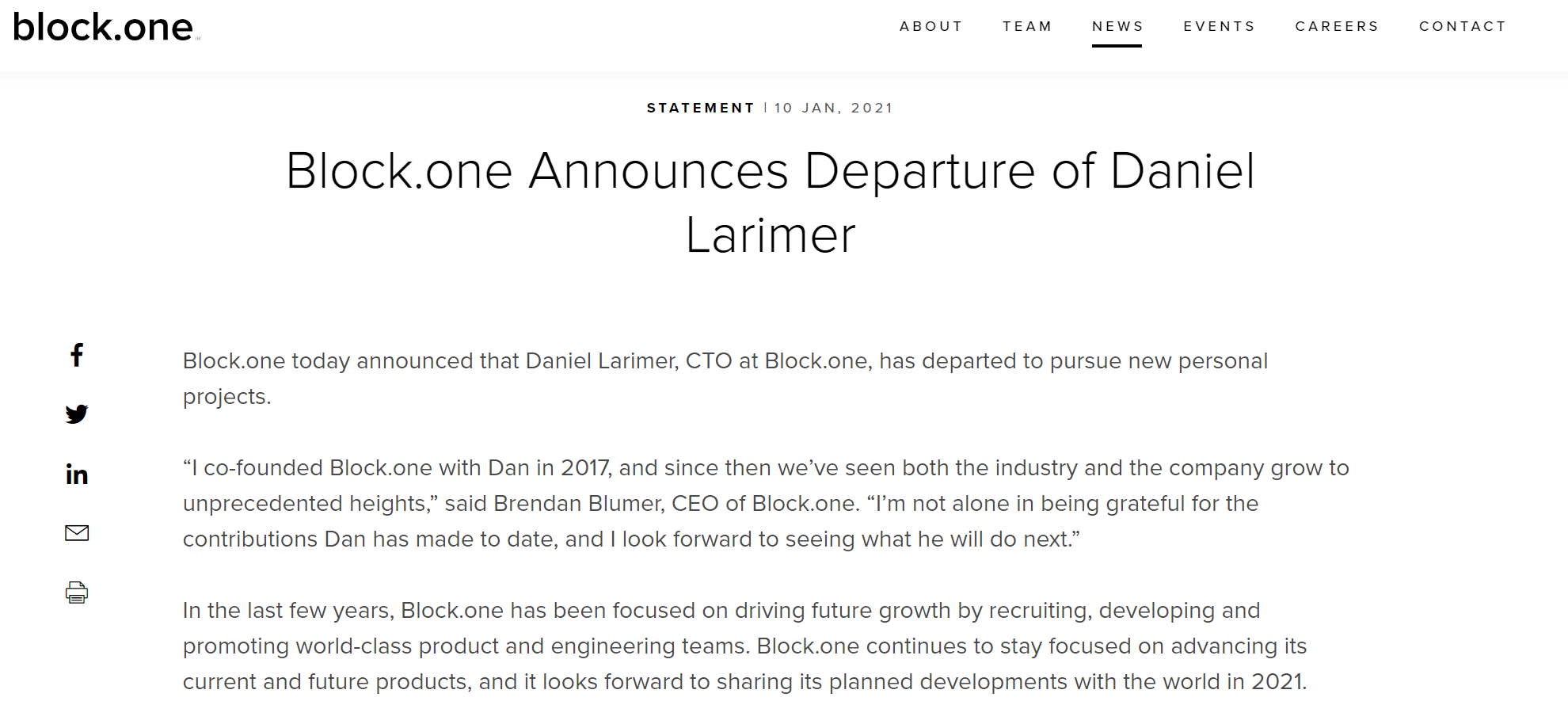

On January 10, Block.one’s official website announced that Block.one’s Chief Technology Officer BM (Daniel Larimer) had left to pursue a new personal project. And BM's exodus has also become the biggest melon in the currency circle in the first year.

Correspondingly, the price of EOS is weak. According to data from Huobi Global, the high price of EOS occurred on April 29, 2018. Since the beginning of this year, its price high has been 3.9 USDT, which is only 16.9% of the former.

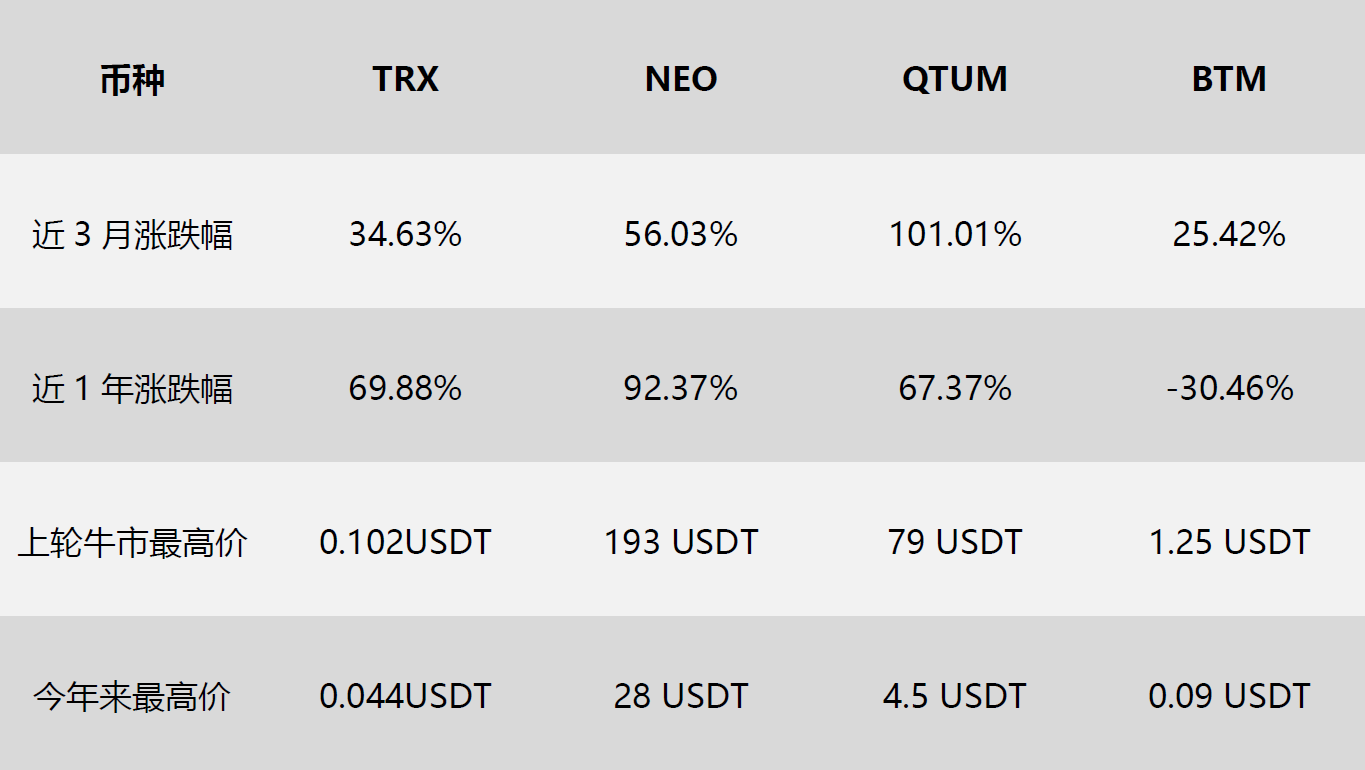

In comparison, the old domestic public chains are not much better. For example, TRX, NEO, QTUM, BTM, etc., as representatives of old domestic public chain tokens, have not ushered in the skyrocketing investors expected due to the current bull market.

From the perspective of stage rise and fall, as of 11:00 on February 7, QTUM has the largest rise and fall in the past three months, reaching 101.01%; among the rise and fall in the past year, NEO has the largest rise, reaching 92.37%. From the comparison of the highest price of the last bull market and the highest price of this year, TRX is 43% of the former, NEO is 14% of the former, QTUM is 5% of the former, and BTM is 7% of the former. This is a bit embarrassing in the face of many tokens that broke through the highs of the previous round of bull market.

Analysts believe that the public chain track has undergone many rounds of reshuffle, no matter how brilliant it was in the past, it is now showing a declining trend, and it is inevitable to give up the position to the latecomers. He explained that the technical architecture and ecological layout of the old public chains have basically been finalized, and it is very difficult to change them. However, this does not mean that the old public chain will soon withdraw from the stage of history.

first level title

New online celebrity competition

"In the face of the DeFi era, all major public chains should actively embrace new opportunities and new needs." Tina believes that the newly promoted Internet celebrity public chain is becoming a "new star" that attracts user traffic and divides the market cake.

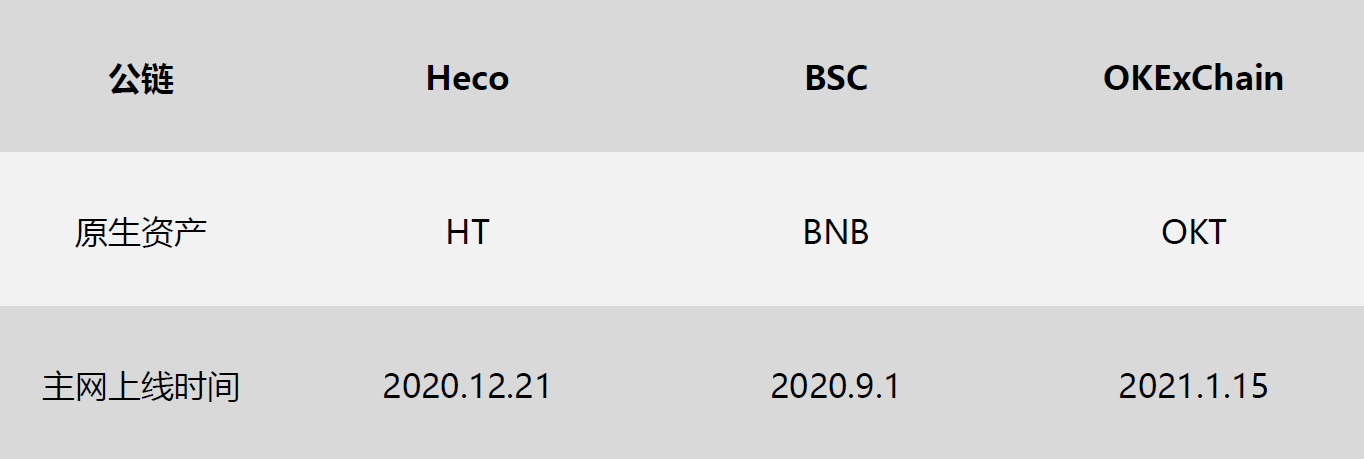

In her opinion, thanks to the bull market environment and the fact that Ethereum 2.0 has not yet been completed, the new public chain has a rare motivation and opportunity to catch up. On the one hand, there are more active public chains with cross-chain concepts such as Polkadot and Cosmos in the market, which have attracted the attention of many currency circles; on the other hand, the public chains launched by leading exchanges have also become important spoilers. Such as Heco, BSC, OEC, etc.

As we all know, each public chain is trying to create an independent blockchain ecology, which makes the public chains become information islands with different technologies, disconnected and independent operations. Ju Jianhua, the founder of Biheli Technology, once said that cross-chain technology helps users directly face native assets and participate in DeFi. At the same time, it can also interconnect chains and chains, assets and assets, which will help blockchain technology to be more effectively applied in the traditional financial industry.

In view of this, cross-chain technology has become a hot direction, which is regarded as the foundation of Wanchain interconnection, and some people even think it is the antidote to drive the free circulation of encrypted assets. However, at present, cross-chain still faces two problems, that is, how to achieve high decentralization at the data level and how to reduce asset circulation costs at the operational level.

In addition, since Binance, Huobi, and OKEx launched their own public chains one after another, the three major exchanges once again met on the same track.

An industry insider who did not want to be named said that the public chain of the exchange is endorsed by the exchange, trying to take advantage of the DeFi ride through its own traffic.

Bizai Research Institute believes that given the lower cost and faster speed of the exchange smart chain, the pull factor of its existing large user base and the firm determination and productivity of developers in the exchange ecosystem can allow it to spread quickly. While the public chain launched by the exchange is unlikely to be an "Ethereum killer", its interoperability with the pioneering smart contract platform, as well as low transaction fees and fast transaction settlement times may make the chain a market-leading DApp The correct elements of the platform.

Next, the exchange public chain may focus on strengthening solutions such as cross-chain bridges to ensure cross-chain transactions and a good bridge between centralized and decentralized finance (CeFi and DeFi), while strengthening security and enabling tools and APIs Easy to adopt. Attract more real use cases and users by building a complete and secure DeFi infrastructure.