Curve has a rough operation interface like Windows 95, special market positioning, exquisite token design, and no moisture lockup.

Structure of this article:

Structure of this article:

Trading Depth: Excellent

Detailed explanation of CRV pledge: query link and related data

CRV daily pledge amount query

CRV overall pledge amount query

CRV lock and pledge operation experience: veCRV

veCRV annualized rate of return query

veCRV annualized rate of return query

Voting weight (that is, the ratio of the number of pledged CRV) query analysis

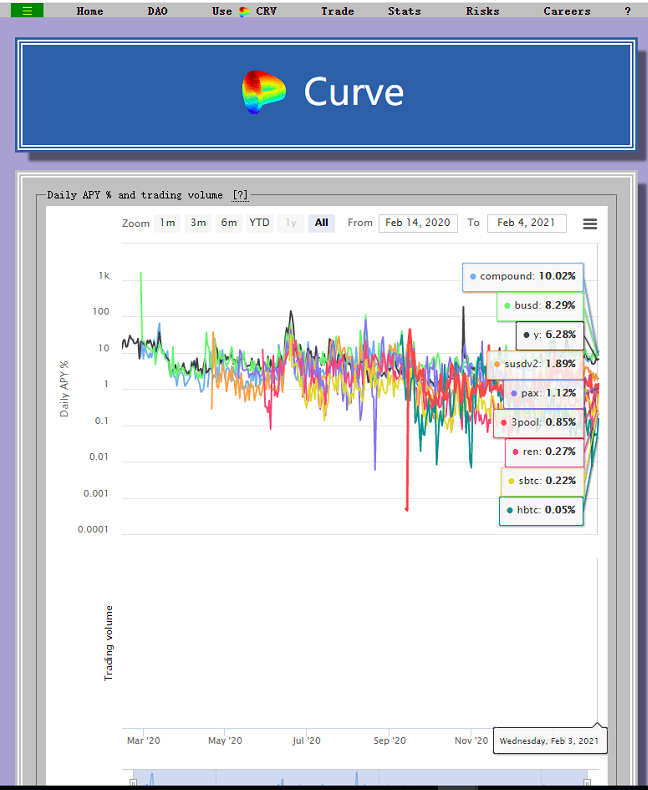

APY query of different currency liquidity pools

Inquiry about currency listing information of various institutions: proposal

secondary title

Summarize

Trading Depth: Excellent

https://www.curve.fi/

10 million DAI is exchanged for 10000549USDC, such a slippage Uniswap and Sushiswap cannot do it. Basically, after your funds reach the level of one million US dollars or more than ten million US dollars, there is a high probability that Curve will be used. Currently, ETH gas fees are relatively high. Small funds do not favor the stable currency exchange service provided by Curve. In the future, after the development of layer2 or ETH2.0, the gas fee will be reduced, which will also bring greater market space to Curve.Detailed explanation of CRV pledge: query link and related dataOf the 210 million CRV in circulation, 42.47% are locked and pledged, and the average lock time is about 3.6 years. The following will expand.https://dao.curve.fi/dailylocks

Taking February 2 as an example, the locked position was 1.678 million.https://dao.curve.fi/locker

This data is very powerful. On the evening of February 4, 2021, the locked volume reached 91 million CRV, accounting for 42.47% of all circulation. (According to my observation, the data on February 1st was only 89.7 million, and the average lock-up time was 3.61 years). Now the lock-up time is 3.63 years, and the average lock-up time of more than 3 years is terrifying. The longer the lock-up time, the more rewards the more voting rights will be given, and the pledge time of more than 3 years proves the user's confidence in the Curve platform.The gas fee shown in the figure above is 102.46U, which is not very friendly to retail investors.Why are some people willing to lock positions for so long? Because the voting rights obtained at different times are different, the above picture is pledged for 6 months. If it is 4 years, veCRV can be seen in the following picture:

10,000 USDT is locked for four years, and the veCRV is 9999.84.

https://www.curve.fi/useCRV

veCRV holders have an annualized return of 8.41% (data as of February 4, 2021)https://dao.curve.fi/gaugeweight

It can be seen that the voting rights of major projects are also the proportion of CRV locked positions. In order to ensure that one's own stable currency (such as Gusd) or packaged currency (such as WBTC, HBTC) exists in the Curve liquidity pool for a long time, and attract more users to enter the relevant LP, it is necessary to continuously purchase and lock CRV. The essence of CRV economic governance is that it is necessary to lock up positions to obtain relevant rights and interests.Locking CRV has at least four rewards or rights:The first layer of rewards: lock CRV to get 50% of the transaction fees of nearly 30 pools.The second layer of rewards: platform tokens of related platforms, such as BOR and SNX.The third layer of rewards: CRV lock-up itself annualized rate of return.The fourth layer of rewards: It is also the most critical rights and interests for institutions, locking CRV to obtain voting rights.image description

https://www.curve.fi/dailystats

https://www.curve.fi/dailystats

image description

https://gov.curve.fi/

https://gov.curve.fi/t/scip-10-adding-a-metapool-for-bbtc-binance-btc/1080

For example, this is Binance's BBTC proposal. The project party needs to apply to the platform very formally, which is the three-party check and balance rule of the Curve platform, the project party, and the community. It needs to be voted to be listed, and institutions themselves often buy CRV and pledge to obtain a large amount of veCRV to be able to get on the currency. Although the community votes, they must have some veCRV stability.After the currency is listed, the project party (or called the partner, the project party here includes: investment institutions, exchanges, etc.) will generally provide platform currency rewards to attract users to come and ensure sufficient LP scale. There is trading depth. The more CRV circulates in the future, the lower the proportion of veCRV you will own, so you have to continue to buy CRV and continue to lock the position. Circulation decreases.In the future, many related coins (such as BCH, LTC and other mainstream coins) will continue to be listed on Curve, and the demand for CRV will be even greater.TVL: $3.5 billion (without moisture)

The annual rate of Curve is not high, but it is stable. Various institutions tend to choose Curve to optimize their configuration. Almost every pool has a TVL (total lock-up volume) of more than US$100 million, and the lock-up volume of 26 pools on February 4 was US$3.5 billion. (shown as 28 pools on February 5).What is the moisture in the locked positions of DEX such as Uniswap, Sushiswap, 1inch, etc.? Because when its TVL is calculated, there are BTC, ETH, USDT, and USDT, and there are many counterfeit coins, and counterfeit coins and currencies with a lot of bubbles will also be reflected in the TVL. Almost all assets on Curve are important encrypted assets, such as USDC, GUSD, PAX, USDN and other stable coins, such as ETH, BTC related mapping coins. existhttps://www.curve.fi/The picture above is from the data site coingeko

Remarks: The overall circulation of CRV can also be directly calculated from the official website mentioned above (https://dao.curve.fi/locker, CRV overall pledge amount query), 91 million CRV locked positions ÷ circulation accounted for 42.47% =214 million CRV, consistent with Coingecko data.It can be considered that in terms of TVL, the real TVL value of Curve may be higher than that of Uniswap and all Swaps currently on the market.Transaction volume and other data can be queried from DuneAnalytics. Take the transaction volume as an example as follows:Summarize

Curve is a platform with steady development. Today, when DEX platform tokens are skyrocketing, the market value of Curve is currently underestimated.Remarks: Most of the picture data in this article was collected on February 4, 2021 (yesterday), which does not affect value analysis and logical judgment. At the time of writing, the circulating market value of CRV was $590 million.https://www.curve.fi/dailystats