Editor's Note: This article comes fromChatting with William (ID: William1913), Author: William Chen, reproduced by Odaily with authorization.

Editor's Note: This article comes from

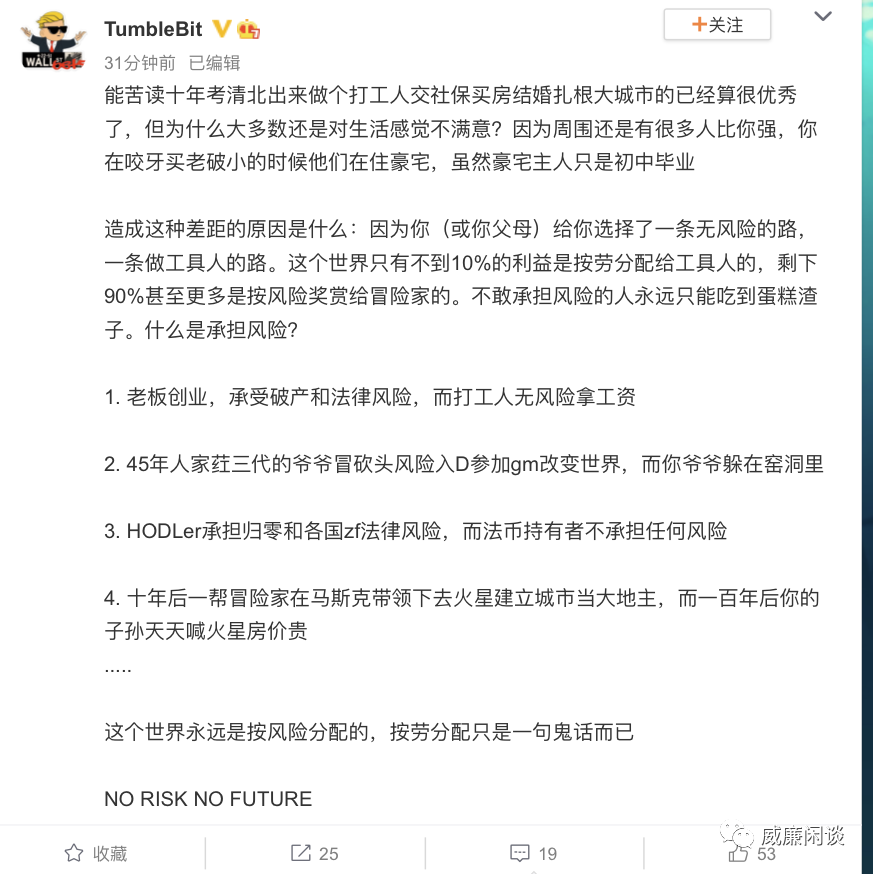

Chatting with William (ID: William1913)Chatting with William (ID: William1913), Author: William Chen, reproduced by Odaily with authorization.At the beginning of the article, I shared a Weibo, which is also the source of the title:I think this point of view is great, and I believe many people have also felt it. Why do you work so hard and live so hard?Maybe it's because you have been too stable along the way, and there is no risk. And those comparison objects of your "good life" may all come here in a bloody storm, but you can't see their past, but only their present.Then of course you feel that you have worked harder than them.-- Can spending more time make more money?I have talked about a point of view before, which is why most people want to do short-term operation and speculation, because many people feel that they should "work hard and get rich".

The general logic is "I should make more money if I speculate for a few hours a day, watch the market for a few hours, and study for a few hours", rather than "I buy it, just lie down, and I can make a fortune." Although everyone keeps saying "I just want to lie down and make a fortune", to be honest, most people can't lie down at all.

The subconscious in the bones is terrible.So we often say "investment is very anti-human", this is one of the reasons. Most of the time, your efforts are useful, but not very useful. Most people's investment success, if he attributes it to his personal efforts, then he must be talking nonsense.Many lucky people always like to brag about their hard work, knowledge and wisdom when they brag later, but is this really the case?In short, efforts are not worth mentioning in the face of risks.So why do you feel that it is easier for many people to make money in the currency circle than in other markets? Because you naturally take a lot of risks here, the exchanges you play may disappear directly, your coins in the smart contract may also be hacked and stolen, and the coins you put in your wallet may also be caught by phishing, or even You may be called to drink tea after buying coins...Such a big risk is worth the higher reward we demand.When I was studying investment, there was a term I liked very much, called "risk compensation". Of course, its professional interpretation is not the same as the literal meaning that everyone understands, but what I like about it is the literal meaning, which is the compensation that the market gives you after you take risks.For any investment, many people know that it depends on the "odds", that is, if you lose, how much will you lose? If you win, how much will you win? What is the probability of winning? An overall value is what we call the "odds" of this investment.Everyone in the investment circle has to adapt to one thing, that is, "winning rate" is far less important than "odds".You may win all the time, but once you lose, you lose everything. This is the winning rate but not the odds. Many people seem to have a low winning rate. They invest in many projects and lose money, or they keep stopping losses when they do many transactions. However, as long as a project is successful or a transaction is successful, they can gain a lot. Investment with low winning rate.

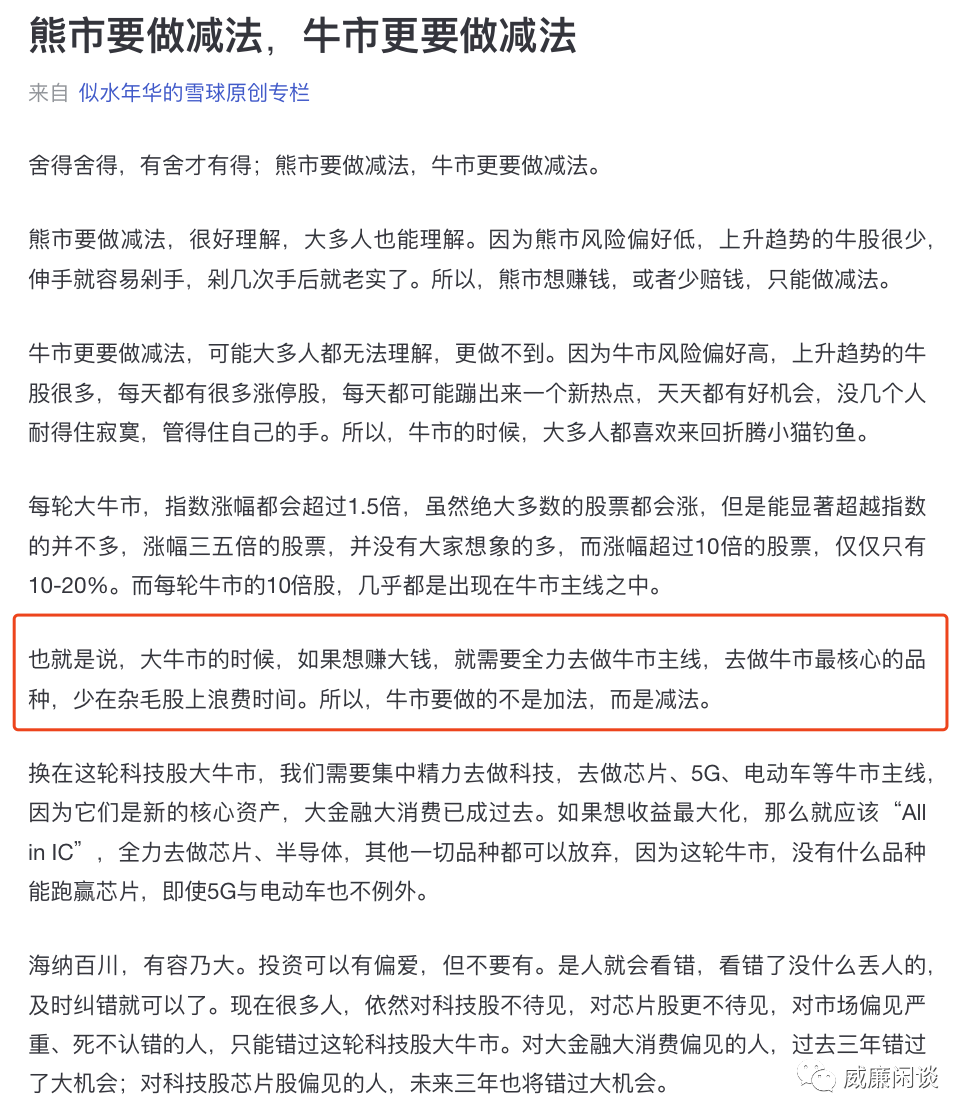

Behind odds, the most important thing is risk control. When many people make an investment, they often misestimate the possible risks, which leads to the ultimate failure of the investment.Only by looking for the odds and calculating the maximum risk that you can bear, can you clearly know what kind of investment you are making and target the target.(However, it seems that the bull market is really suitable for closing your eyes... just be happy and be happy)Speaking of the bull market, here is an episode of a certain stock market tycoon's views on the bull market:(Interlude ends, let's continue chatting)Recently, many people are unable to extricate themselves from the pain of being out of defi. In fact, I don’t think it is necessary. Many people say that XX currency outperforms Bitcoin, which is normal. It is common sense that the risk is high and the return is high. The odds of many new coins are higher than Bitcoin. Of course, the risk is much higher than Bitcoin. It is a trade-off. up.You shouldn't be able to tell which currency is less risky than Bitcoin, right? Therefore, when the risks are generally high, it is normal for some coins with high odds to appear, so what is the anxiety?In this market, you must be constantly running short, or in the entire investment world, you must be constantly running short, because you cannot have the legendary "infinite bullets" and you will not have unlimited energy.The money that many people can make, or the ability to control cognition and risk, is just two or three targets.There is a saying that is very good: "It doesn't make any sense to be optimistic if you dare not bet heavily."Many people like to say things like "I was very optimistic about xxx at the time, but unfortunately I didn't get in the car", which is actually meaningless, because if you are really optimistic, you should be very eager to get in the car when you are optimistic.This is really optimistic. Just like when I saw through the essence of Bitcoin back then, it wasn't the price of Bitcoin that bothered me, but the fact that my number of coins was too small.That is, if you are really optimistic about an investment product, but you don’t have the urge to fill it up, then you must be not optimistic enough, or you are not confident enough in yourself.When you are very optimistic and think that the odds are sufficient, you should consider whether you can bear the possible risks. If the risks are okay and the odds are sufficient, then this investment is worth investing heavily in.Think clearly, instead of just following someone's yell.So back to the issue of Takong, for "other coins", there must be emotions of Takong, after all, watching others get rich is always one of the most painful things for human beings. But there is really no need to worry about it all the time. It does not belong to the money you earn. If you care too much, your mentality will collapse.--Give yourself a soul torture:When you feel sad, are you jealous when you see other people making money, or are you really regretful because you missed a good project?If you really feel that you have missed a good project, if the current price allows you to buy it, would you buy it? How much will you buy? What is the target price?"Jealousy" is one of the seven deadly sins, and it is a very bad thing. I suggest that you don't feel itchy when you see others getting rich, because people in this world are getting rich every day.If you zoom in to all markets, A-shares have a daily limit, Hong Kong stocks and even Tencent have risen by dozens of points these days, not to mention US stocks have been bullish for more than ten years...