In recent days, from DOGE rising 1,000% in two days, to Musk's platform, Bitcoin has risen 20% within a day, which can be described as a good show.

DeFi, which stands on the trend, is not far behind. Its leading projects have come out of a strong rise one after another. UNI, AAVE, SUSHI, etc. have repeatedly set new highs. The DeFi sector has once again attracted the attention of the market.

According to TokenInsight data, as of 18:00 on January 31, the total lock-up volume of the DeFi ecosystem has risen to 37.97 billion US dollars. In addition, the number of protocols with more than $1 billion in locked positions on Ethereum has reached 10.

With the continuous influx of assets on the chain, it is expected that DeFi will continue to be extremely popular this year. Not long ago, Messari CEO Ryan Selkis tweeted that DeFi is crazy, and this is the fastest growing real innovation I have seen since entering the encryption industry. He believes that from 2009 to 2015, it was about building the infrastructure of Bitcoin and its connection with the "real world"; from 2015 to 2019, it was about the connection of the Ethereum network infrastructure; after 2020, most of it was DeFi.

first level title

The rise is "sultry", and safety is worrying

In 2020, the sudden emergence of DeFi has detonated the market. In 2021, this craze is likely to intensify.

According to TokenInsight data, the total lock-up volume of the DeFi ecosystem has exceeded US$22 billion by the end of the year from less than US$800 million at the beginning of 2020, with a growth rate of more than 2650%. The total market value of DeFi projects reached 19.6 billion US dollars, a 12-fold increase. And by 2021, the momentum of the influx of encrypted assets into DeFi will continue to increase rather than decrease. As of 18:00 on January 31, the total lock-up volume of the DeFi ecosystem has risen to 37.97 billion US dollars.

DappRadar data also shows that in 2020, there will be 106 new DeFi DApps on Ethereum, accounting for 44.54% of the total new additions in that year; 132 new DeFi DApps outside of Ethereum, accounting for 55.46% of the total new additions.

However, under the outbreak of DeFi, it seems to be a chaotic Warring States era. Tens of billions of dollars of virtual currency assets are locked in these DeFi projects, which is undoubtedly a piece of fat for hackers.

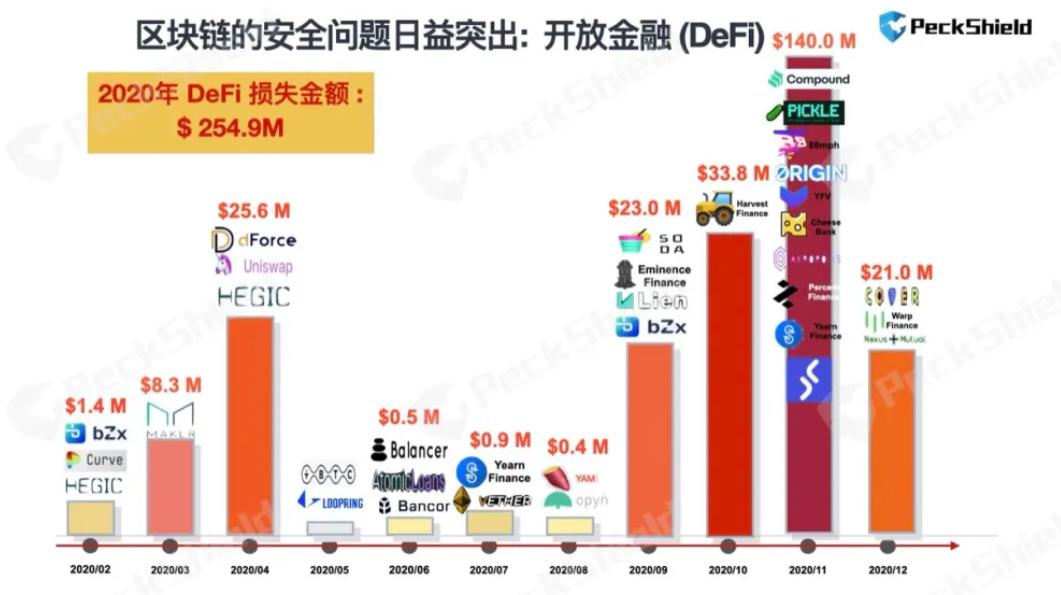

According to the "Paydun 2020 Annual Digital Currency Anti-Money Laundering Report", there have been 60 DeFi attacks and losses of more than 250 million US dollars. Among them, at least 10 were flash loan attacks, including multiple DeFi projects such as bZx, Balancer, Harvest, Akropolis, CheeseBank, ValueDeFi, and OriginProtocol were attacked, and at least 5 were reentrant attacks, including Uniswap, Lendf.Me, Sushiswap, Akropolis, Origin Protocol. Among them, in October 2020, the loss of DeFi attacks reached 33.8 million US dollars, which was the month with the most losses caused by DeFi attacks in the whole year; in November, there were 10 DeFi attacks, which was the month with the highest attack frequency in the whole year.

It can be seen that the current DeFi projects are walking on eggshells. In view of the current security situation of DeFi, Paidun suggested that, on the one hand, a comprehensive and professional smart contract security audit should be conducted before going online to check for various known vulnerabilities; Business logic loopholes to avoid cross-contract logic compatibility loopholes.

first level title

Ethereum is the only one, and latecomers are flocking to it

Although Ethereum has led the trend of DeFi, from the perspective of development trends, major public chains and leading exchanges have proposed their own solutions to problems such as insufficient assets and high handling fees.

Among the public chains, the DeFi projects on Polkadot and EOS are very rich. The former has outstanding performance on DEX, aggregator and other tracks, and the latter has gradually grown from the "spinach" game to DEX. Competitiveness.

Among the exchanges, especially the three major exchanges have built their own DeFi zones and deeply participated in the construction of the DeFi ecosystem.

In terms of Binance, the Binance Smart Chain (BSC) was officially launched in September 2020, and then announced to provide $100 million in funding to support developers. As of January 12, 2021, there are currently more than 100 projects using the Binance Smart Chain. Including liquidity mining Swap, wallet, NFT, oracle, decentralized identity, payment, etc.

In terms of Huobi, on December 21, 2020, the Huobi ecological chain Heco was officially launched, and a Heco ecological special fund was also established to focus on supporting high-quality projects such as DEX, lending, oracles, cross-chain solutions, and insurance on the Huobi ecological platform .

In terms of OKEx, OEC is positioned as a high-performance decentralized trading public chain. Unlike BSC and Heco, OEC’s original assets on the chain do not use OKB, but a new original asset OKT has been issued. Cross-chain gateways and DEX products have been launched.

Analysts believe that the leading position of Ethereum as a smart contract platform is currently difficult to shake, and due to the rising gas fees of Ethereum, the extension of DeFi has become inevitable. At the same time, Ethereum 2.0 has brought new breakthroughs and unlimited imagination.

"DeFi has formed a rich industry ecology, and will have an impact on the old financial structure in the future." OKEx CEO Jay Hao tweeted that DeFi, as a new thing, still has many problems, such as the performance bottleneck of the underlying public chain. Liquidation risk, adverse selection in project homogeneity, asset loss caused by contract loopholes, etc.

first level title

The first month ushered in a "good start", and the fundamentals continued to improve

"At the end of 2021, 60% of the top 30 currencies will be DeFi projects." On January 29, Du Jun, co-founder of Huobi and founding partner of Node Capital, said in Moments.

The industry is optimistic about the future prospects of DeFi, and actively deploying DeFi is the mainstream voice. Industry analysts also believe that with the gradual improvement of Ethereum 2.0, it is expected to boost the wings of the DeFi ecosystem and reduce high gas costs.

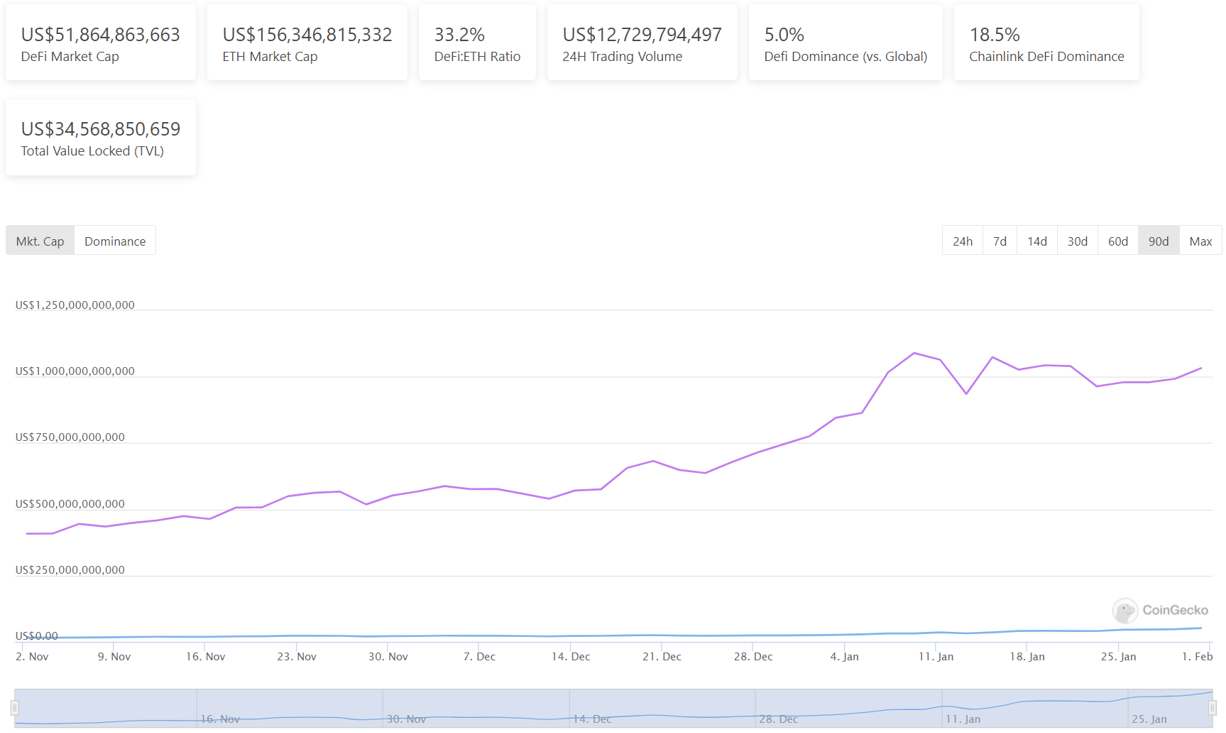

Coingecko data shows that as of 6:00 on January 31, the total market value of the top 100 DeFi tokens by market value was 51.86 billion US dollars, while the market value of Ethereum was 156.3 billion US dollars during the same period, and the total market value of DeFi was about 33.2% of the market value of Ethereum. Among them, Chainlink has the highest market value among DeFi projects, reaching US$9.51 billion, accounting for 18.3% of the total market value of the top 100 DeFi tokens.

At the same time, after entering 2021, DeFi tokens have shown an astonishing increase, and UNI, AAVE, SUSHI, etc. have repeatedly set new highs, which once again ignited the enthusiasm of investors.

For example, UNI, the governance token of the decentralized exchange Uniswap, broke through $15 for a short time on January 27, and climbed to a new high in the past two days. Dollar. Non-small data show that since 2021, UNI has increased by 386%.

"DeFi is expected to grow to 10 times its current size in 2021." Diginex CEO Richard Byworth previously said that as Bitcoin enters an "institutional bull market", we will once again witness the development and growth of DeFi, and its assets may grow by 10 times. times.

In response to Robinhood's suspension of GME and other stock transactions, Compound founder Robert Leshner commented on Twitter that it is time for investors, regulators and lawmakers to understand and embrace DeFi. He believes that this has sounded a wake-up call for us to create a fair, transparent and autonomous financial market.

Analysts believe that the current fundamentals of DeFi continue to improve. On the one hand, DeFi has stepped out of the barbaric era, and it is difficult for simple and rough clone projects to succeed; on the other hand, old projects continue to introduce new ones, such as Uniswap and Sushiswap. new proposals and structures.

According to Du Jun, the current DeFi development process has only passed the 1.0 stage, and the rise of subdivisions such as insurance and synthetic assets has just opened the door for DeFi development. With the arrival of the DeFi 2.0 stage, the DeFi protocol still has a long way to go in terms of technological innovation and economic model.