On January 18, the decentralized trading platform Curve Finance announced the launch of the cross-asset exchange transaction service, which is a new function implemented in cooperation with the synthetic asset protocol Synthetix, which is currently in beta testing.

On the DEX track, Curve Finance has always been among the best. As of writing, its lockup value reached $2.28 billion, ranking second in the DEX category, behind Uniswap and ahead of SushiSwap.

What is Curve's cross-asset exchange?

If you don’t know Curve, you can understand it as a stablecoin version of Uniswap. Curve mainly trades stablecoins linked to the U.S. dollar, such as DAI, USDC, USDT, and sUSD, as well as tokens linked to Bitcoin, such as renBTC, wBTC, and sBTC. currency.

Cross-asset conversions refer to conversions that occur between different types of assets. For example, DAI, USDT, USDC, and PAX are assets of the same type, renBTC, wBTC, and sBTC are assets of the same type, while BTC, ETH, and USD are assets of different types. Therefore, the so-called cross-asset exchange here is the exchange of assets like DAI and wBTC. Users can use DAI or USDC, etc. to directly exchange wBTC, sETH, etc.

The principle of cross-asset exchange transaction

In simple terms, Curve's cross-asset exchange process involves two transactions. Taking DAI to wBTC as an example, first DAI will be converted to sUSD, and then converted to sBTC; secondly, sBTC will be converted to wBTC.

That is, the first transaction is to convert DAI to sBTC. After the user confirms the transaction, they will receive a unique NFT (ERC-721) representing the transaction, and then the transaction will immediately enter a 6-minute settlement period, during which time, do not close the browser. After the Synthetix settlement period, users can complete a second transaction, exchanging sBTC for wBTC, by clicking the “Complete Transaction” button. After confirming the transaction, the user can receive wBTC.

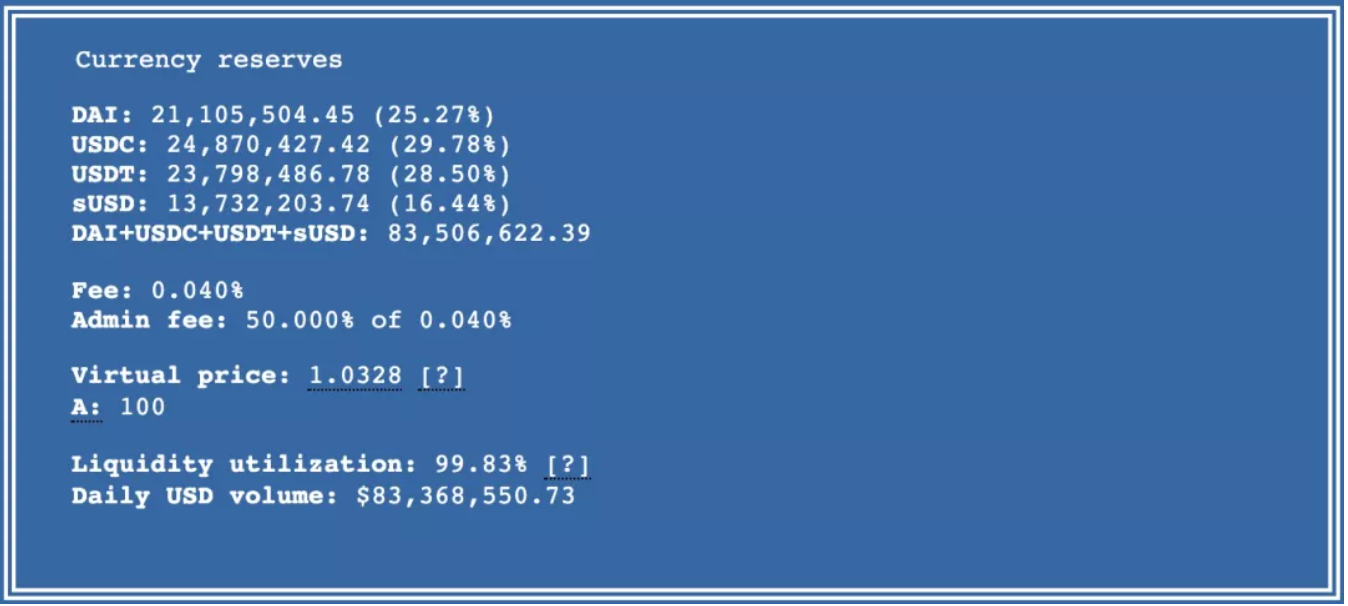

Throughout the process, Synthetix played the role of a bridge (with the help of Synthetix's mortgage synthetic asset model, the exchange of sUSD and sBTC has no slippage), and the reason why this can be achieved is also related to the previous accumulation. Synthetix's synthetic assets already have two pools, sBTC and sUSD, on Curve, and the liquidity of these two pools is not low. The sUSD pool has over $83 million in liquidity, while the sBTC pool has over $250 million in liquidity.

Finally, the exchange of sBTC and wBTC uses Curve’s CFMM, which can achieve extremely low slippage.

Features of cross-asset exchange transactions:

very low slippage

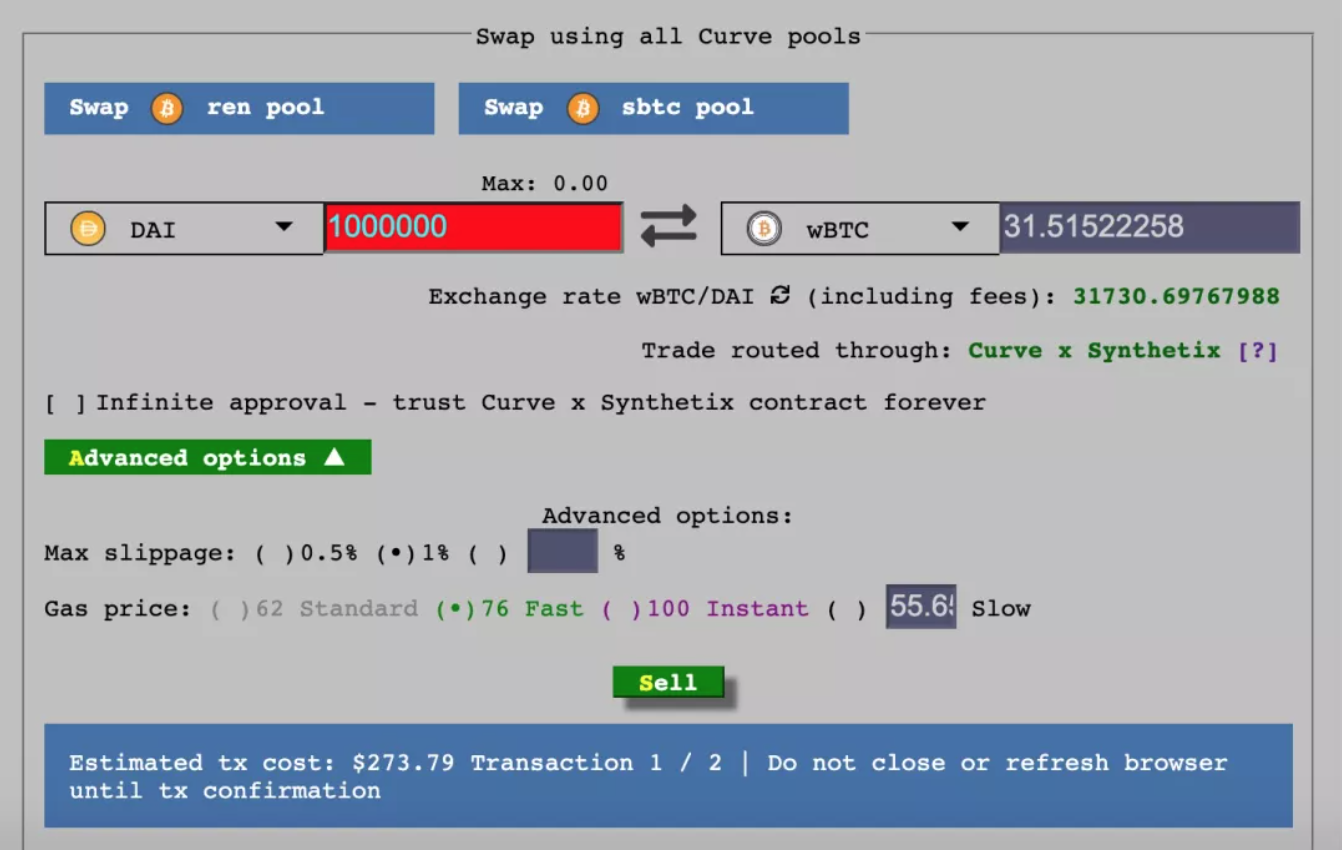

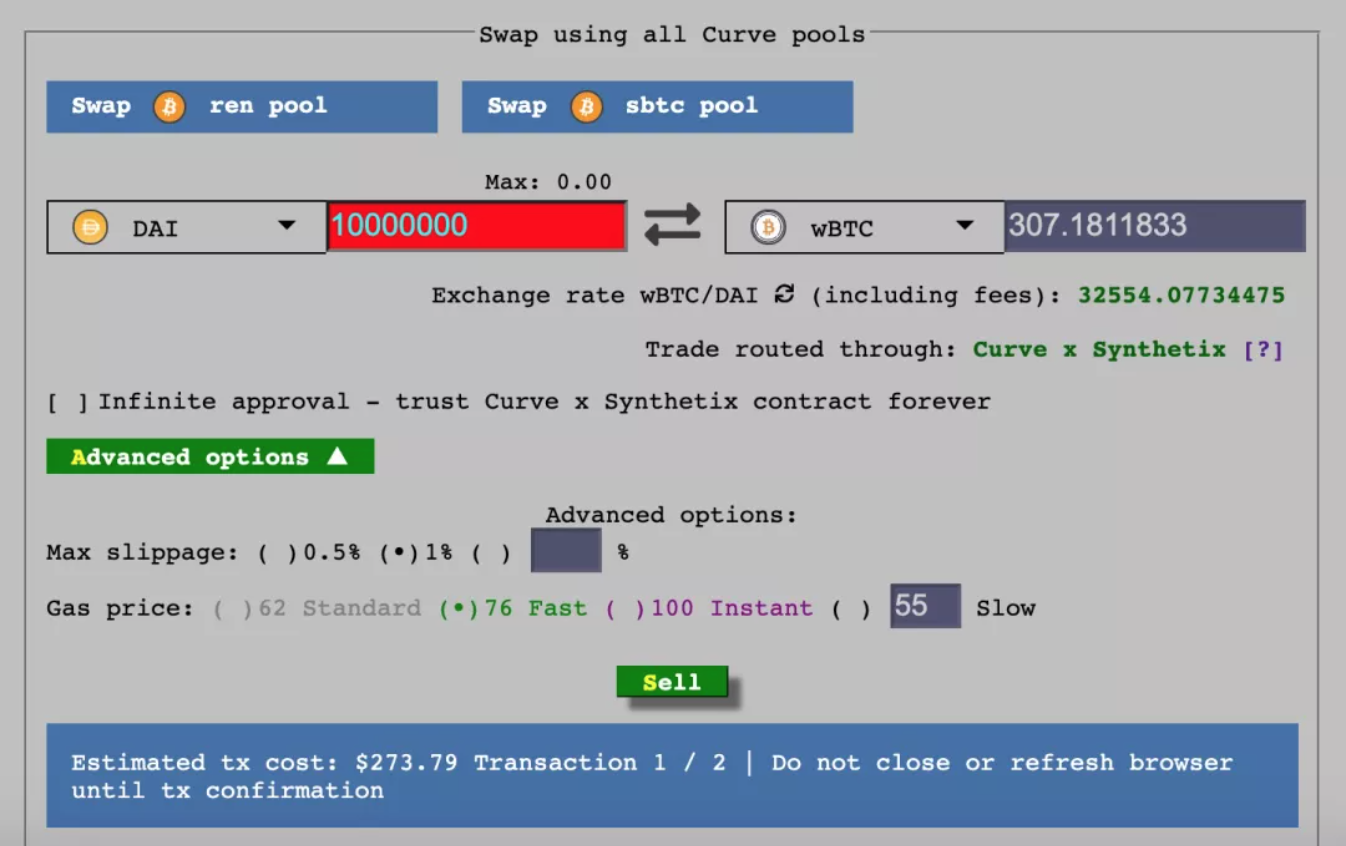

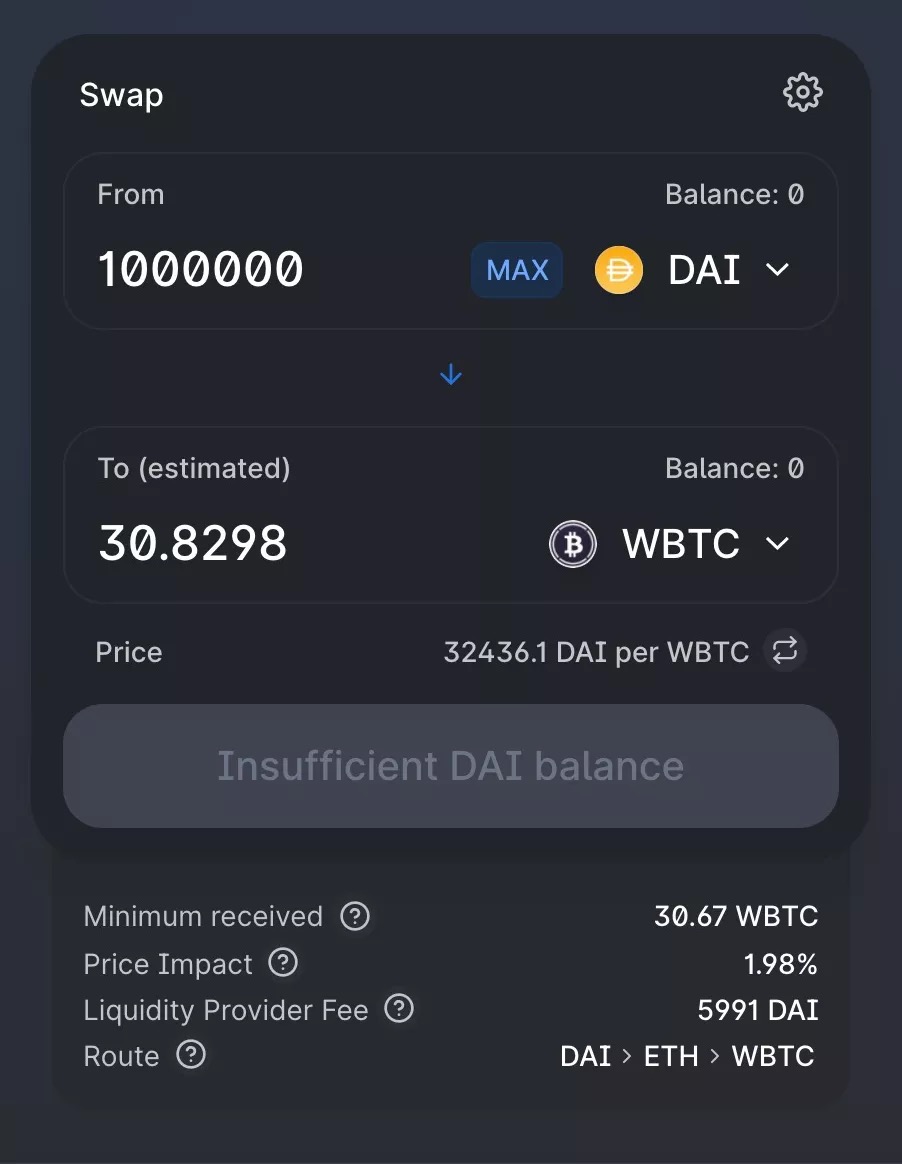

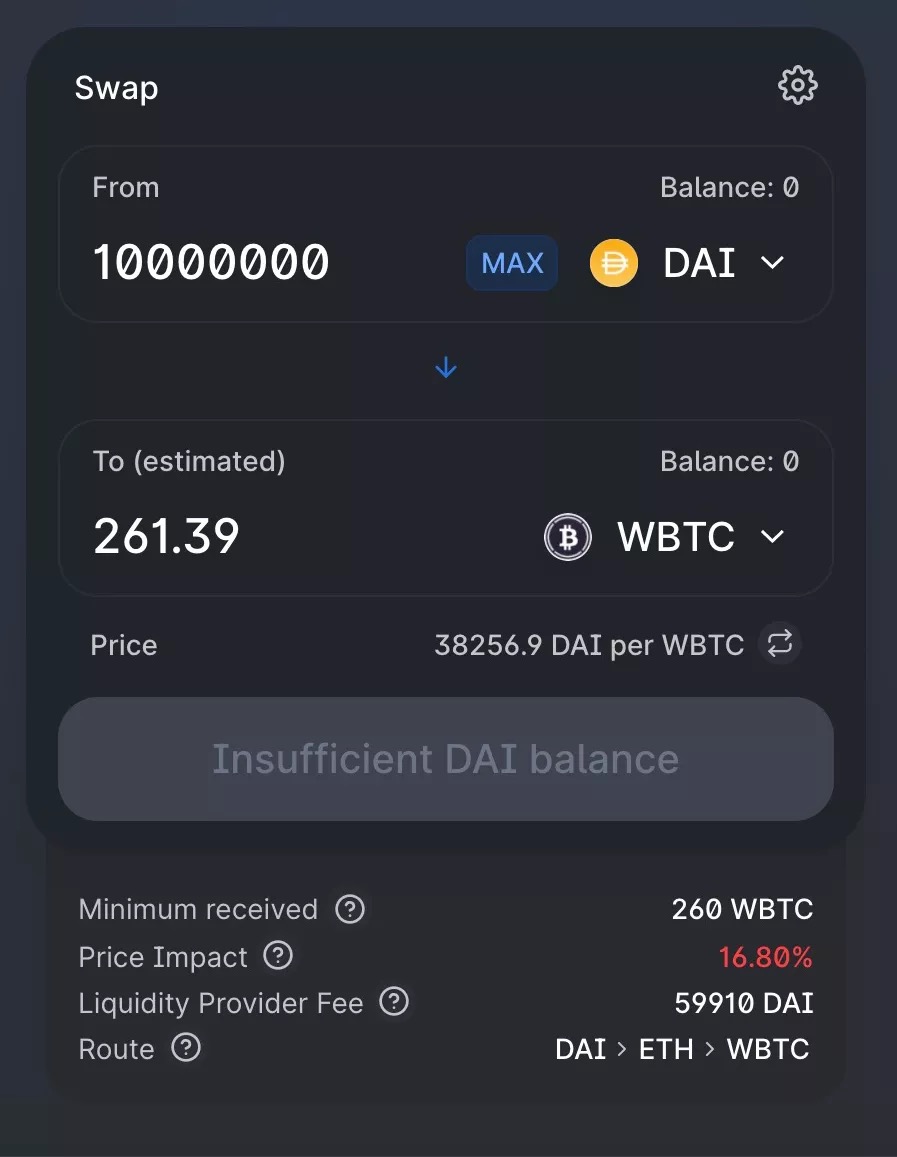

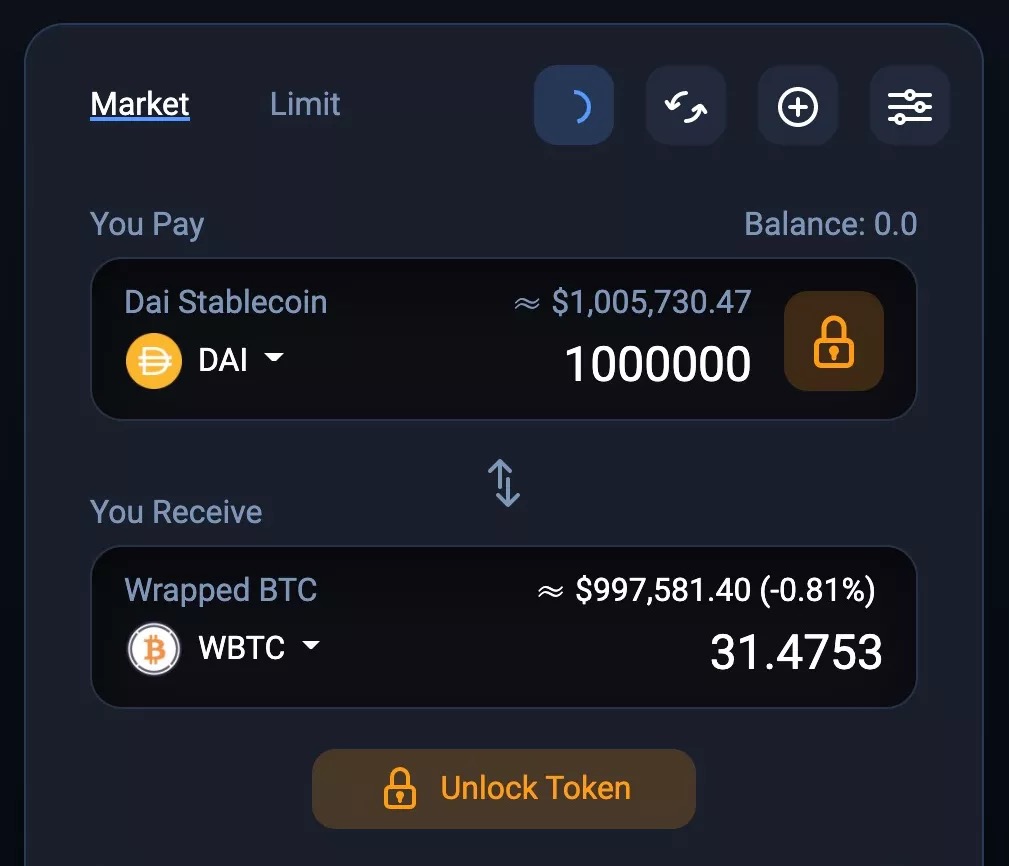

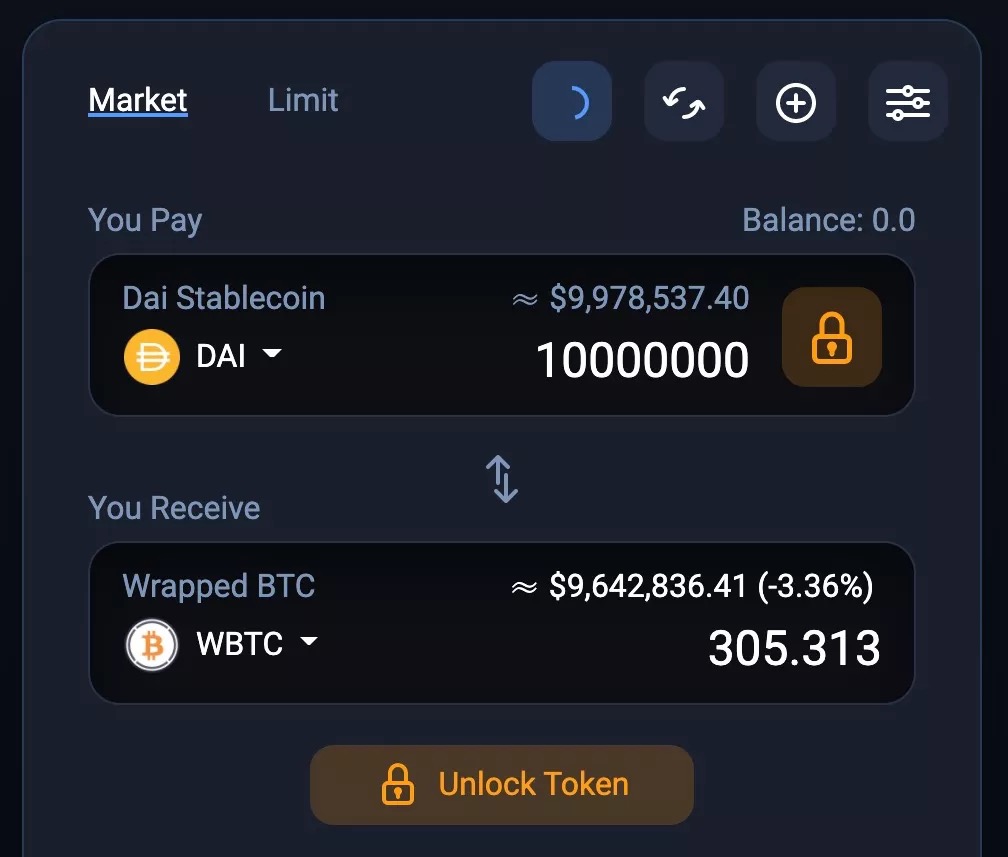

For large amounts of exchange, it is very beneficial to use Curve's cross-asset exchange because of its low slippage. Next, compare the large-amount exchanges of Curve, Uniswap, and 1inch.exchange through actual operations. Assuming that 1 million DAI and 10 million DAI are exchanged for wBTC, the comparison among the three DEXs is as follows:

It can be seen that the slippage of exchanging 1 million DAI and 10 million DAI for wBTC on Uniswap is very large, especially for 10 million DAI, the slippage is as high as 16.8%, so the loss of users is very large. Compared to exchanging on Curve, the loss is more than 40 BTC.

On the transaction aggregation platform 1inch, 1 million DAI can be exchanged for 31.47wBTC, with a slippage of less than 1%; the amount of wBTC that can be exchanged for $10 million in DAI is about 305.31, with a slippage of 3.36%.

While dealing with 7-digit to 8-digit USD transactions on Curve, there is basically no slippage. This is a big impact on the current large-value trading market on the DEX track.

The Gospel of the Giant Whale

However, at the same time, we also need to understand several points that Curve cross-asset exchange is not suitable for small transactions.

summary

summary

At present, after providing cross-asset exchange transaction services, Curve can achieve low-slip exchange between different types of assets, which is very attractive for large-amount transactions. Assuming this feature is more adopted, DEX is expected to surpass CEX in an all-round way.

Moreover, the transaction volume of the Curve protocol is expected to increase significantly, attracting more liquidity and bringing more transaction fees, which is undoubtedly good news for relevant participants. At the same time, the Synthetix protocol as a bridge is also a big beneficiary, and the two are mutually beneficial.

This article only represents the personal views of encrypted notebooks and does not constitute any investment opinions or suggestions.