Editor's Note: This article comes fromChatting with William (ID: William1913), Author: William Chen, reproduced by Odaily with authorization.

Editor's Note: This article comes from

Chatting with William (ID: William1913)Chatting with William (ID: William1913)

, Author: William Chen, reproduced by Odaily with authorization.

"The bull market is really uncomfortable. Seeing other people make money is more uncomfortable than losing money yourself. I miss that simple bear market so much. How happy everyone is losing money together."Been seeing jokes like this a lot lately.

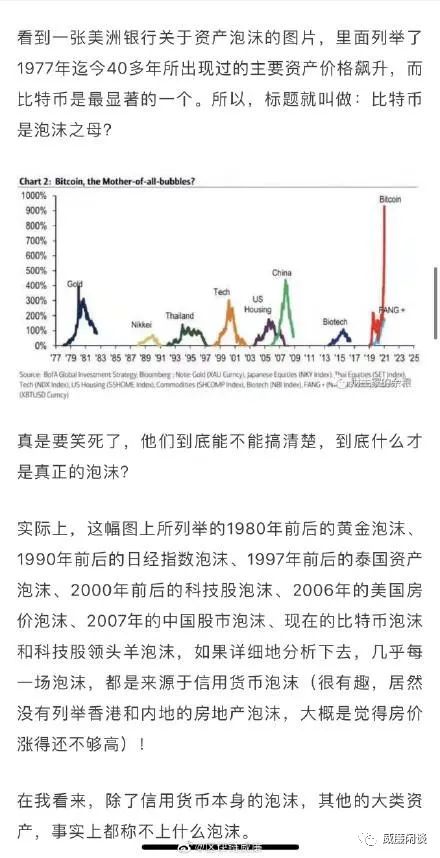

Under such a divided market, I believe that many people are in the same state. They are in a very embarrassing state while watching others make a fortune while being greedy and afraid to get in the car.Why do you want to get in the car? In fact, I don't think those coins are good coins, but I just feel envious of seeing others get rich.Envy is really envy. I am empty, watching others earn double, double, and triple every day, thinking that if I also get a car for 100,000 yuan, I can now buy a Mercedes-Benz. The more I think about it, the more bitter I become.So why dare not get in the car? Quite simply, many people know very well that the coins they play are all bubbles.""XX is all a bubble" is really the reason for many people to miss out on various investments. Facts have proved that most people stop at the bubble label they put on most investments, so they stop.Missed the opportunity to buy a house because "the housing price is too high, it must be a bubble";Because "US stocks have been bullish for more than ten years, it must be a bubble" and missed investing in US stocks;Because "Bitcoin is definitely worthless, the big bubble in historyBecause "DeFi is just a decentralized fund, it must be a bubble" and missed DeFi;

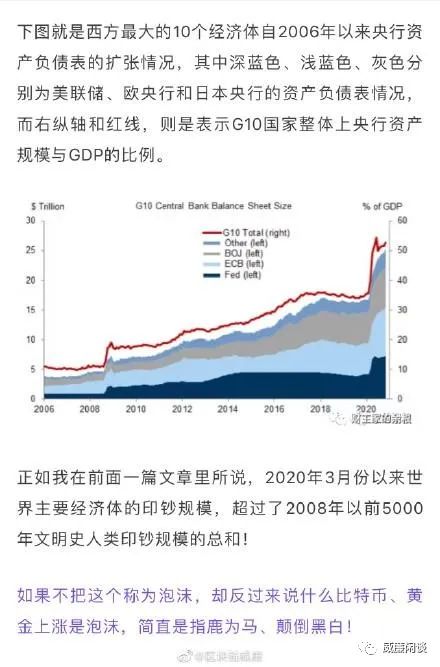

Of course, thinking that everything is a bubble has also helped many people avoid a lot of pitfalls.Beating to death with a stick will of course hit the "bad guys", but it will also accidentally injure the "good guys".Interestingly though, it seems to be rarely heard: "dollar/equal fiat currency" is definitely a bubble.I saw a very interesting article yesterday, share two screenshots:The scolding is very good, and the body and mind are comfortable.So then again, how do we understand bubbles?1. Understand that now is the "bubble era"The era we are in now is an era of unprecedented credit loosening, as the previous screenshot article said:"Since March 2020, the scale of money printing by the world's major economies has exceeded the sum of the scale of human money printing in the 5,000 years of civilization history before 2008."This is a terrible data, and this is an unprecedented era.

Against such a background, it is very natural for us to see big bubbles everywhere on our investment road. Everyone must understand that you must not stop touching it just because "it may be a bubble", because you may be in a situation that does not exist at all. "No bubble" investment era.Just like there were still "camera phones" back then, how can there be phones that can't take pictures now?Do you really dare to touch assets that have not yet bubbled in this year?Share another paragraph from the website:This is an unprecedented era. High-quality investment targets have almost broken all valuation systems and soared all the way. It is okay to say it is a bubble, but it is better to say it is not a bubble.If you must define them as bubbles, you must also respect them.The bigger the bubble, the greater the degree of fanaticism must be behind it, and then the fanaticism must represent a large amount of consensus condensed by greed, so such a target must have research value.You can not touch it, but you can not disrespect it.How does the bull market make money? Apparently hugging the bubble.Every round of bitcoin bull market will produce huge bubbles, and finally the funds will overflow, and the entire market will produce huge bubbles.Why? A consensus has not yet been formed, and greed and fanaticism are preconceived.But what really made many early dividends come true was this enthusiasm.