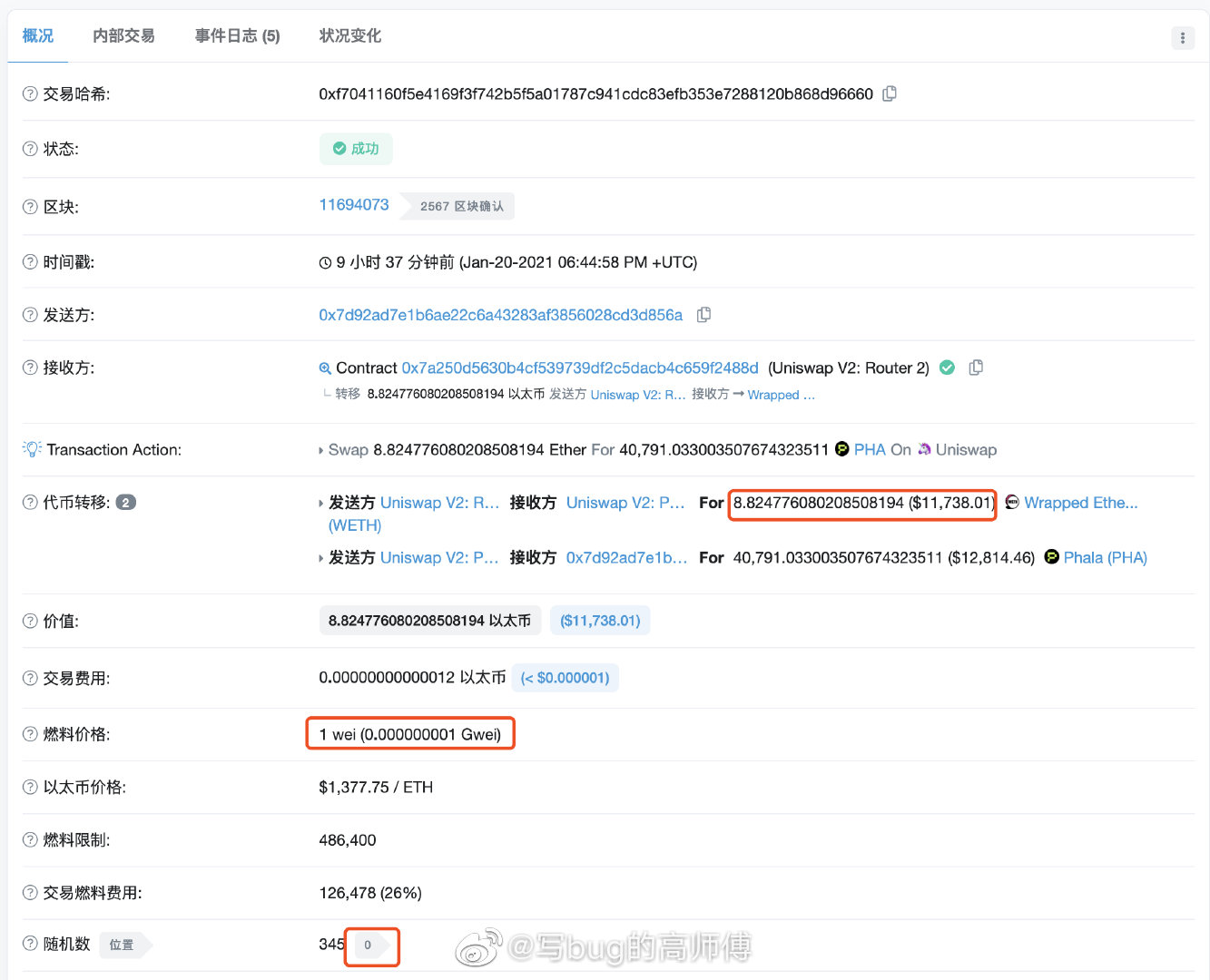

Today, Gao Jin, the founder of YFII, posted on Weibo, saying: "A certain mining pool ended up trapping people in person? Two 1wei's caught one 125gwei's, no martial arts. The single profit is 0.12 eth, and this account continues Caught in the middle..." aroused heated discussions among the onlookers.

From the block information, it can be seen that the two transactions with a gas fee of 1 wei mentioned by Gao Jin "clamped" a transaction with a gas fee of 125 Gwei, and the arbitrage was simply and rudely completed. After the address query, the "evil" mining pool mentioned in the article that packaged the two transactions before and after is UU Pool, which accounts for about 1.7% of the current total computing power of the entire Ethereum network.

secondary title

From being abused by Bots to being abused by mining pools, Leek said it was miserable

If you are an investor who often uses DEX transactions, you must also feel deeply about the pain of being "caught" in the dark forest of Ethereum.

The so-called "clamped" means being Front Running (preemptive transaction). According to the Mempool packaging mechanism, generally speaking, miners sort and package according to the gas price given by the transaction. In DeFi products, the order in which transactions are packaged profoundly affects their economic benefits.

For example, in Uniswap, for the same two buy orders for a certain trading pair, the transaction that is executed first will get more tokens. When an investor executes a transaction with a relatively high amount, a large slippage setting, and a low Gas setting, it is easy to encounter the situation of being "caught", and the Bot will send two transactions with a higher Gas value at the same time. Buying ahead of you, and selling right after your order, investors are "sandwiched" in the middle, completing an arbitrage behavior of buying low and selling high, which can be said to be "risk-free" to profit. Many traders may have never noticed, but have been being fished silently.

However, trading bots are common arbitrage tools after all, and bots do not succeed every time. There are also some other bots that restrict this type of bots. We have gradually become accustomed to the spiral iteration of new products.However, "the mining pool will end in person" is very uncomfortable, because the order of transactions determines the distribution of profits, and the miners have the right to decide the order of transactions. This is definitely called a "dimensionality reduction blow".

Generally speaking, miners can arrange the order of transactions arbitrarily, and can even directly pack a transaction into a block without broadcasting the transaction. That is to say, as long as blocks can be produced, the order of transactions is in the hands of the mining pool, and such arbitrage can be said to be costless. This is exactly what UU Pool does, which is simple and rude, directly packaging arbitrage transactions.

secondary title

Will mining pool arbitrage become clear and routine?

The UU Pool for this arbitrage is not a very high-ranking mining pool, and the block production rate is limited. It was also discovered because the inversion of Gas fee and the price difference are clear at a glance, but we can't help but wonder if other larger mining pools have similar behaviors, but we haven't found it? And, from a different perspective, does this count as "doing evil"?

Some people even said, will mining pool arbitrage be made public in the future? Mining itself is also a profit-seeking behavior. Is it okay to distribute profits to miners according to computing power?

In fact, in today's era of prosperous DeFi, we have also seen a lot of research on MEV (Miner Extractable Value), that is, "miners can directly extract the value as profit from smart contracts." Includes regular profits from transaction fees and block rewards, as well as unconventional profits from miners through transaction reorganization, transaction insertion, and transaction censorship.

We have to admit that the mining of miners in the Layer 1 era and the smart contract era have actually undergone many changes. Simply think about it, the portraits of Bitcoin miners and Ethereum miners are quite different.

Our inherent thinking is that miners should get paid from block rewards, while traders can profit flexibly from trading strategies, but now, with the prosperity and development of Ethereum, has the role of miners changed, and they can use their own advantages in the network? position to extract additional value from innovative products?

From the perspective of ordinary traders and ecological participants, Odaily believes that the answer is no.

It is also very simple, because we all expect that the encrypted world is a place that is more open, fair, open, and transparent than the reality, but as the game of power on Ethereum is becoming more and more open, we can't help but feel a little confused, who is formulating rule? Who is restricting power? Who is drawing the bottom line for the profit game?

What fascinates many ordinary investors about DeFi is that it is a "fair" game, and opportunities are paramount. Although the big players still call the wind and rain, entrepreneurs and ordinary people also have many bottom-up "counterattack" opportunities, and the checks and balances of power in the ecology Definitely a science,Reference article:

Reference article:

Ethereum's Dark Forest