Editor's Note: This article comes fromBabbitt Information (ID: bitcoin8btc)Editor's Note: This article comes from

Babbitt Information (ID: bitcoin8btc)

Babbitt Information (ID: bitcoin8btc)

, Author: Teddy Woodward, Compiler: Overnight Porridge, published with permission.

Note: This article is an exclusive interview with Alan, the co-founder of Cover, which briefly explains the situation of Cover.

Q: Can you talk about your background and the projects you are currently working on?

I'm Alan, co-founder of Cover Protocol.

I got into crypto during the 2017 bull market, learning how to write code to create arbitrage and market making bots. But when I started college, I stayed away from cryptocurrencies and focused on my studies. However, this year, due to the continuation of the epidemic, everything needs to be done online, I started to return to the field of encryption, mainly focusing on DeFi, because I began to realize the potential of decentralized finance and its advantages over traditional finance. From there, we started creating Cover.

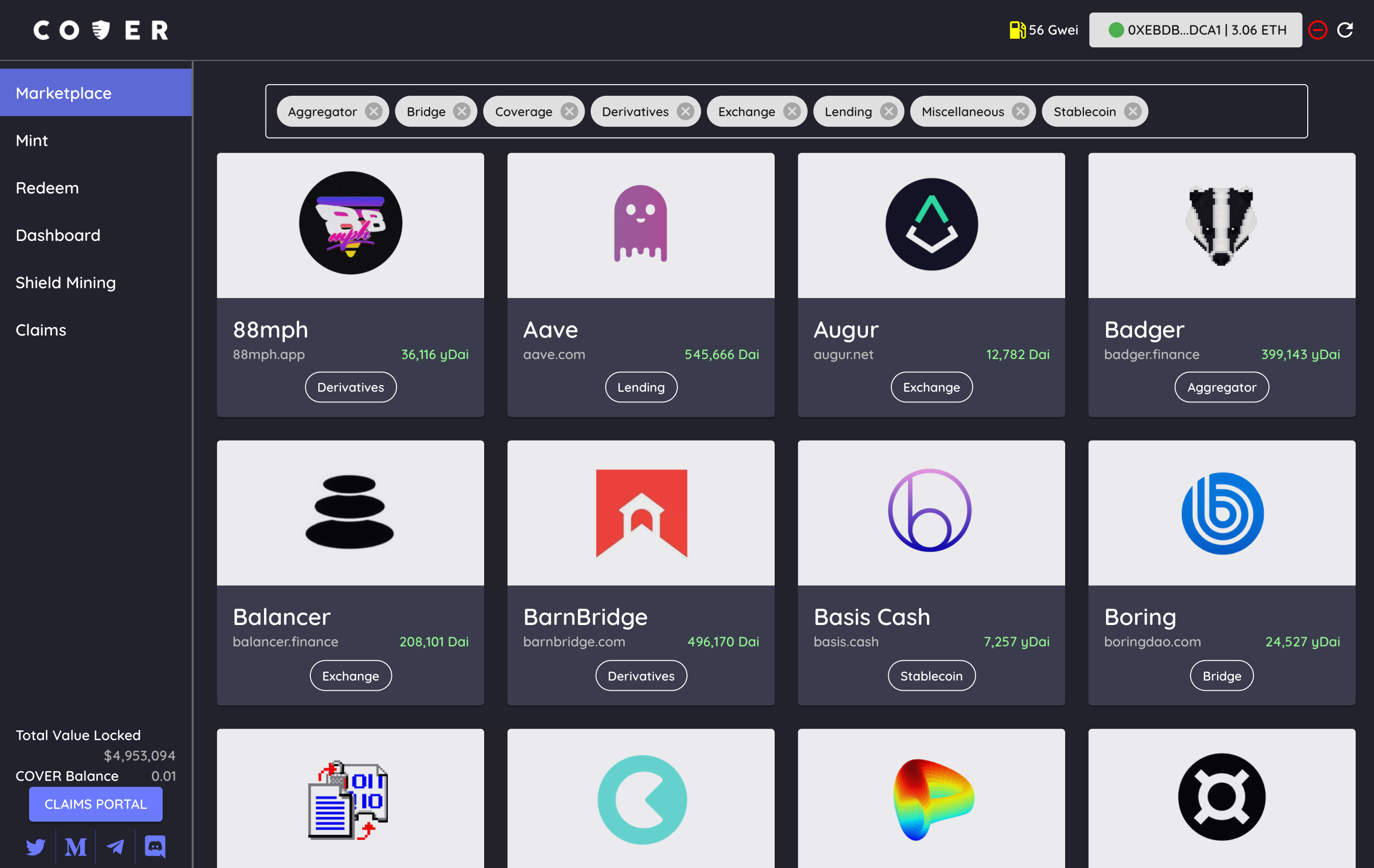

Cover Protocol is a peer-to-peer insurance marketplace utilizing ERC-20 fungible tokens for permissionless and KYC (know your customer)-free insurance. Through our model, users can pledge collateral to produce CLAIM tokens (which can be redeemed if an attack occurs) and NOCLAIM tokens (which can be redeemed if no attack occurs).

The model works like a prediction market, relying entirely on market-determined premiums. Users who want to avoid the risk of attack can purchase CLAIM tokens, while those who believe that the underlying protocol is safe can purchase NOCLAIM tokens. Simply put, the Cover protocol allows users to bet on the security of the underlying protocol.

Q: Is there any story behind creating Cover?

In the summer of 2020, I was appalled by the abundance of assault and run-and-run scams and the lack of insurance options. There are random forks of popular protocols on an almost daily basis, many of which turn out to be scams, taking away millions of users’ funds. At that time, I really wanted to create a competitive insurance provider that solved many potential problems that existed at the time: KYC, non-transferable tokens, NFTs, etc.

After seeing Kryptocucumber and crypto_pumpkin, we decided to create a fully decentralized, permissionless insurance protocol to solve these fundamental problems. The Cover Agreement addresses all of the issues affecting other insurance providers. We do not require any KYC, our insurance is fungible and tradable.

Just a few days after our mainnet went live, about $20 million was stolen from Pickle Finance. Luckily, we support Pickle Insurance and start the claims process right away. The COVER community quickly came together to pass the snapshot vote, our Claims Validity Committee quickly accepted the result, and we started paying Pickle CLAIM token holders. This proves that our model is effective and we are able to not only quickly but also accurately decide the claim outcome.

Q: What is the process of making a Cover agreement?

The Cover Protocol beta took about 2 months, and a few more weeks for beta testing before finally launching on mainnet. During our development, we witnessed more protocols being stolen or proven to be outright scams, which made us realize how much DeFi needs a way for users to easily buy insurance. As Cover Protocol is an insurance provider, the safety and security of our own protocol is our top priority. Both PeckShield and Arcadia Group audit all our smart contracts, we ensure the infrastructure is very simple and straightforward, this allows us to implement many sanity checks, preventing more complex contract issues from arising.

Despite multiple audits by reputable auditing firms, a small bug in our rewards contract went unnoticed by everyone and was eventually exploited, resulting in infinite coinage. Contracts of our core protocol were not affected by this attack, but tokens were. While we are deeply saddened by this, we have learned from this costly mistake and from now on our future deployments will be subject to multiple audits by large corporations, multiple code reviews, and targeting vague edge cases Do more intensive unit testing.

Q: What is your business model like?

Our business model includes redemption fees when covTokens are redeemed. In this way, the network is self-sustaining and generates income, and COVER token holders can then vote on the use of these fees (such as buyback or distribution to token holders, etc.).

Our target market is people who are hesitant to deposit money in a risky protocol without some form of risk protection, and those who simply want to speculate on the security of the protocol. Our model allows these two audiences to coexist so they can help each other with fair insurance pricing.

Q: How do you see the current regulatory environment?

In today’s environment, it’s increasingly evident that cryptocurrencies have started to gain more exposure and the attention of governments around the world.

However, this increased attention is a double-edged sword. Governments such as the United States are cracking down on the regulatory nature of certain crypto assets, which is surprising, but only reinforces the need for decentralized finance. In my opinion, the reason why governments are getting more concerned and cracking down on cryptocurrencies is because DeFi poses a very real threat to traditional finance. DeFi eliminates bloatware, inefficiencies, and middlemen by providing a fully transparent, decentralized, and peer-to-peer platform, making financial tools accessible to all.

Q: What are your future goals?