Editor's Note: This article comes fromBabbitt Information (ID: bitcoin8btc), by Kyle, published with permission.

Editor's Note: This article comes from

Babbitt Information (ID: bitcoin8btc)

Babbitt Information (ID: bitcoin8btc)

, by Kyle, published with permission.

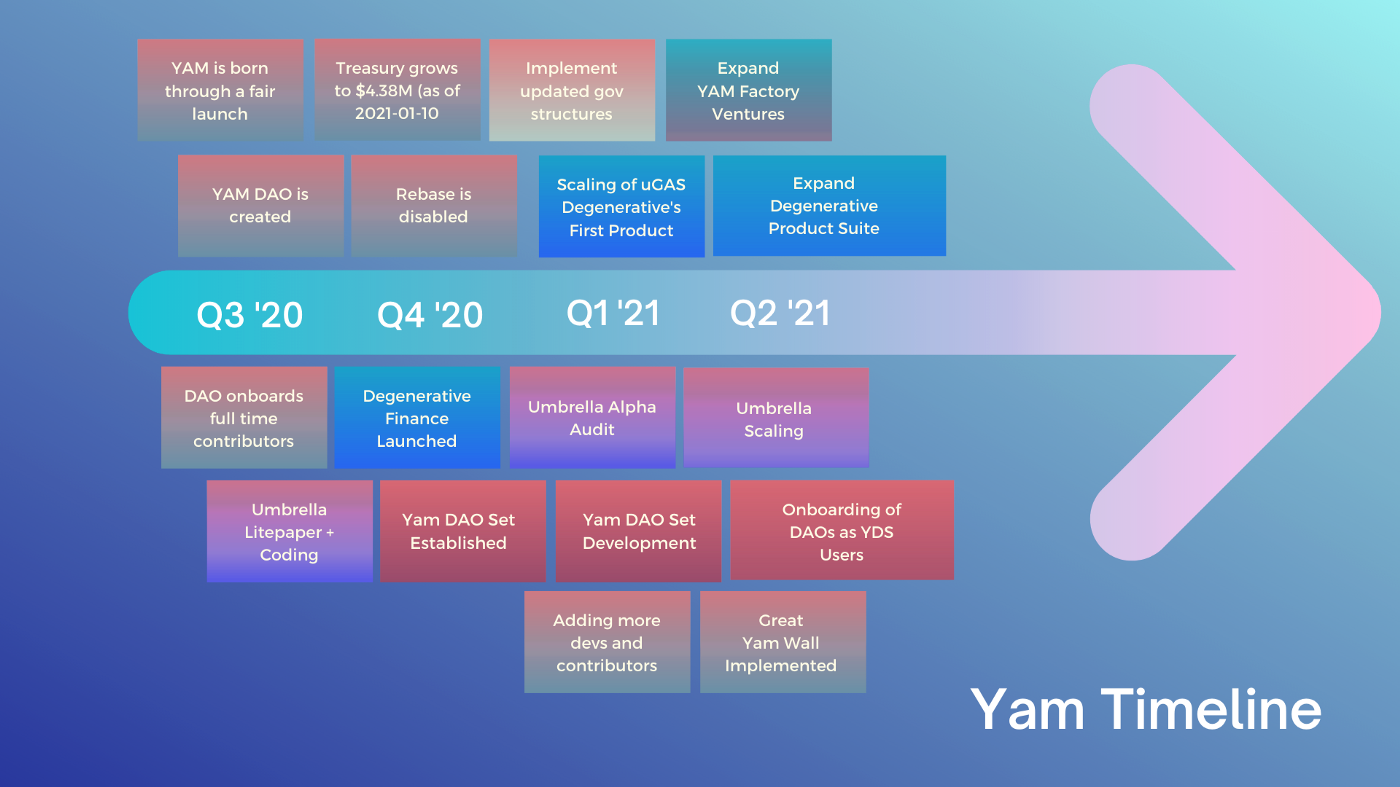

"The initiator of the liquid mining wave, the DeFi project Yam Finance (YAM) pointed out in the release of the 2021 development roadmap that it plans to cooperate with TokenSets in January 2021 to launch the investment product Yam DAO Set for DAO users and retail users ( YDS), which can charge management fees for the assets under management, thereby generating additional income for the Yam ecosystem; the insurance agreement Umbrella Protocol will be audited by Peckshield in mid-January, after which the Yam team will begin to design and build Beta products; It will launch its decentralized product incubator Yam Factory in 2021, allowing teams who want to build products within the Yam ecosystem to apply to Yam DAO for funding, technical support, and marketing and design support; YDS will start actively managing the Yam treasury in 2021."

No matter where in the world you are reading this, there is no doubt that 2020 will be a year we all remember. But if there's one thing we're proud of in 2020, it's this:

In 2020, Yam Finance (sweet potato) was launched!

Rebasing:

Like all other project launches, we have experienced a roller coaster, the community activity has reached amazing heights, and we have also experienced freezing points. Through it all, we learn, grow and develop. But most of all - we are still here and looking forward to 2021!

Yam has come a long way since its initial release on August 11, 2020. Our community has seen important developments including Yam sponsored product launches, treasury mobilization, enhanced governance features, disabled rebase functionality, and more. We are particularly excited about the development of the Umbrella Protocol, Yam DAO Set, and Degenerative Finance.

This is an exciting time for Yam, during which we have transformed from a well-funded DAO to a mature ecosystem with a variety of innovative and interoperable products including DeFi protection, investment products and synthetic assets system.

Here is a quick recap of the key developments in Yam Finance in 2020:

At launch, Yam Finance’s native token, YAM, was freely and fairly distributed to users providing liquidity through farming contracts.

YAM begins its rebasing phase to help fund the community-managed Treasury. While the rebasing accomplished its goals, over time the community determined that this rebasing mechanism created unintended friction that was unnecessary for a governance token. The community officially voted to disable the rebase function after learning that other methods could be used to fund the Treasury in the future.https://medium.com/yam-finance/degenerative-finance-ugas-explained-458bedbc2f17

product:

protocol:

In 2020, Yam Finance's first product, Degenerative Finance, was launched through cooperation with UMA and the Yam community. Degenerative seeks to be a set of innovative synthetic assets based on the UMA contract agreement. The first of these synthetic assets is uGAS, which allows users to hedge and speculate on gas prices.

More information on Degenerative.Finance and uGAS can be found here:

In the last year, Yam also carried out the conception and protocol development of the second product Umbrella, which will provide DeFi users with hacker attack and bug protection. In 2020, Umbrella released the Alpha community test, which will be formally reviewed in January 2021.

Treasury:

protocol:

The community also voted to allow incentivists to use staked SLP tokens for SUSHI liquidity mining as a form of Treasury income.https://medium.com/yam-finance/yam-treasury-quarterly-update-9964a3ca5864

Governance:

Additionally, the community voted and approved a proposal called the "Great YAM Wall," which would use a portion of Treasury funds to establish a protective floor price mechanism for YAM.

2020 has been a bumper year for Yam Finance Treasury. Through the rebasing mechanism, asset purchases, liquidity farming and other investments, the Treasury asset size has reached 4.3 million US dollars (as of 2021-01-10)!

Learn more about Treasury:

Governance:

Yam Finance has achieved two major governance achievements during 2020.

The first is the development of a new Governor contract that allows decentralized compensation of core and part-time contributors to the YAM community using the Treasury. This gives the community a greater ability to align the core team with the long-term vision of the project and start recruiting more developers and team members more aggressively.

organize:

organize

The Yam community has accomplished a lot in its first 6 months, and there's even more to come in Spring 2021! If so far, you should understand the development trend of Yam Finance and its product ecosystem.

product

organize

As the Yam ecosystem grows, so will the development needs of the community. We are happy to share that 5 more developers are undergoing testing and necessary due diligence before starting work on Yam's existing and future products. Yam is always looking for skilled and innovative developers to work with us. Any interested groups should join the Yam Discord community!

secondary title

Umbrella

product

Yam DAO Set is expected to be launched in January 2021, and it is the first investment product that Yam cooperates with TokenSets.

Also known as YDS, the Yam DAO Set will have built-in functionality to charge management fees to "assets under management". YDS is a market-oriented product that will be used to attract retail users and DAOs with funds as asset management customers, thereby generating additional income for the Yam ecosystem.

Next, YDS will implement three steps: The first is to use Yam Treasury funds to operate YDS as a proof-of-function case study. The second is DAO clients looking to attract YDS as their preferred money management provider. The third step is to attract individual retail users.

Umbrella is Yam Finance’s DeFi protection protocol that enables users to gain protection against breaches, hacks, and other malicious events in exchange for a premium. The protocol also allows users to earn rewards for providing protection through the protocol. It has the ability to create and secure metapools without permission on any DeFi protocol.

The alpha version of Umbrella has started testing with a deposit limit of $1000 for the initial test pool. The next step is an audit by Peckshield, which is scheduled for mid-January and continues with internal cap deposit testing.

In addition, the Yam team will start designing and building the product interface for the Beta product release after the review.

Discussions are ongoing on two important Umbrella topics:

1) What arbitration standard will Umbrella use to verify claims?

2) Does Umbrella need its own subDAO token for governance, and will having a token bring more value to the Yam ecosystem?

As mentioned above, Degenerative Finance is a DeFi synthetic asset suite built from UGAS futures by Yam in cooperation with UMA Project. This is an exciting product category that encompasses speculative and hedging use cases that no existing DeFi platform currently offers. Additionally, the UMA project provides mining rewards for developers working on its infrastructure, allowing Yam to start monetizing the product line immediately.

protocol

Yam plans to expand the number and variety of synthetic assets offered through the Degenerative Finance platform in 2021. Synthetic techniques currently being discussed range from tracking the amount of BTC to transacting across borders with impermanent losses.

The next step for Dgenerative Finance will be to improve the user interface of uGAS, start to conceive and develop other synthetic products, and establish the Dgenerative product line.

Yam is actively looking for developers interested in working with us on amazing dgenerative synthetic assets.

protocol

Treasury

From a macro perspective, Yam Finance will finally launch its decentralized product accelerator Yam Factory this year.

The Yam Factory is a protocol studio or incubator that allows teams looking to build products within the Yam ecosystem to apply to the Yam DAO for funding, technical support, and marketing/design support. These partnerships aim to create value for all parties involved and expand the variety of connected DeFi Lego toys available to users within the Yam product ecosystem.

In addition to the Yam Factory, 2021 will see an on-chain proposal to approve the implementation of governance for The Great Yam Wall.

governance

This year, Treasury will continue to grow through product revenue, yield farming strategies, strategic asset investments, and more.

In addition, YDS will actively manage Yam's Treasury starting in 2021. Using on-chain governance, Yam has assigned specific guardrails to the Set Portfolio Manager to manage the Set, allowing the community to maintain trustless decentralization, but within a more flexible and reactive framework.

The next steps for YDS to manage Treasury include completing the trader user interface, testing contracts, and executing on-chain governance proposals to fund the Set.

governance

The job of managing a DAO is never done! We anticipate that more community engagement and governance engagement will be required in 2021 as the Yam product continues to evolve and build on past achievements.

The community is currently discussing the governance process of the DAO and all are invited to participate. Join our Discord!

The rebase feature is disabled. Yam is no longer a rebase asset

protocol:

Degenerative.Finance launched the uGas synthetic token.

Introducing Umbrella Alpha Version

Treasury revenue rises to $3.5 million

protocol:

Treasury:

ETH/YAM Treasury Purchase on Sushiswap

12,500 YAM weekly liquidity rewards

Great YAM Wall concept with durable features approved

Governance:

1% of all inflows are injected directly into Gitcoin grants

Buy ETH + DPI for INDEX liquidity mining

Allocate YAM/ETH LP tokens for SUSHI liquidity mining

Governance:

LP can participate in governance through incentive mechanism

Create a new Governor compensation contract

organize:

Approved mission statement and brand pillars

Implement on-chain infrastructure for contributor compensation

Yam DAO Set - Investment Product

Next step:

Status: In development - launch planned for January 2021

Priority: Medium

Brief: YDS will have built-in functionality to charge management fees for "assets under management". YDS will be a marketable product, and we can attract other DAOs with Treasury and retail users, thereby bringing additional revenue to the Yam ecosystem.

Umbrella

Next step:

Operate YDS with Treasury funds to prove its functionality

Attract retail users

Next step:

Status: Alpha version launched

Priority: Advanced

What it is: Umbrella is a DeFi protection protocol that allows users to be rewarded for providing protection or receive protection in exchange for insurance premiums. It features permissionless metapool creation and protection for any DeFi protocol.

Degenerative Finance

Next step:

Schedule a Peckshield Security Audit

Beta release after review

Next step:

Status: activated

Priority: Advanced

Brief: Yam will utilize UMA's financial contracts and DVM to create an on-chain indicator derivatives suite starting with uGas futures. uGas futures are now available on Degenerative.Finance. This is an exciting product category with speculative and hedging use cases not currently offered by any existing DeFi platform. Additionally, UMA offers developer mining rewards for those developing on its infrastructure, allowing Yam to start monetizing the product line immediately. This is a direct collaboration with the UMA team where we will take over the initial development of the gas futures contract.

Yam Factory

Next step:

Improve the UI of uGas

Build a broader product line

Next step:

Status: Conceptualization stage

Introduction: Yam Factory is a protocol studio or incubator. Teams wanting to produce products can apply to receive funding and technical/marketing/design support from the Yam ecosystem. This partnership is designed to create value for all parties involved.

protocol:

Great YAM Wall

Next step:

Create a framework for how the Factory works

protocol:

Next step:

Status: under development

Treasury:

Priority: low

Introduction: Great YAM Wall is a mechanism to create a YAM price floor by keeping the market value above the YAM Treasury value. Here's a similar result for "Ragequit". This will directly defend the price of Yam when it falls, and drive up the price of Yam Treasury as it grows. Great YAM Wall uses treasury funds to buy YAM on the open market, increasing the market cap to achieve balance.

Next step:

Yam DAO Set —Treasury Management

Next step:

Status: under development

Priority: high

Next step:

Governance:

test

in conclusion:

Execute on-chain proposals to raise funds for Set

Governance: