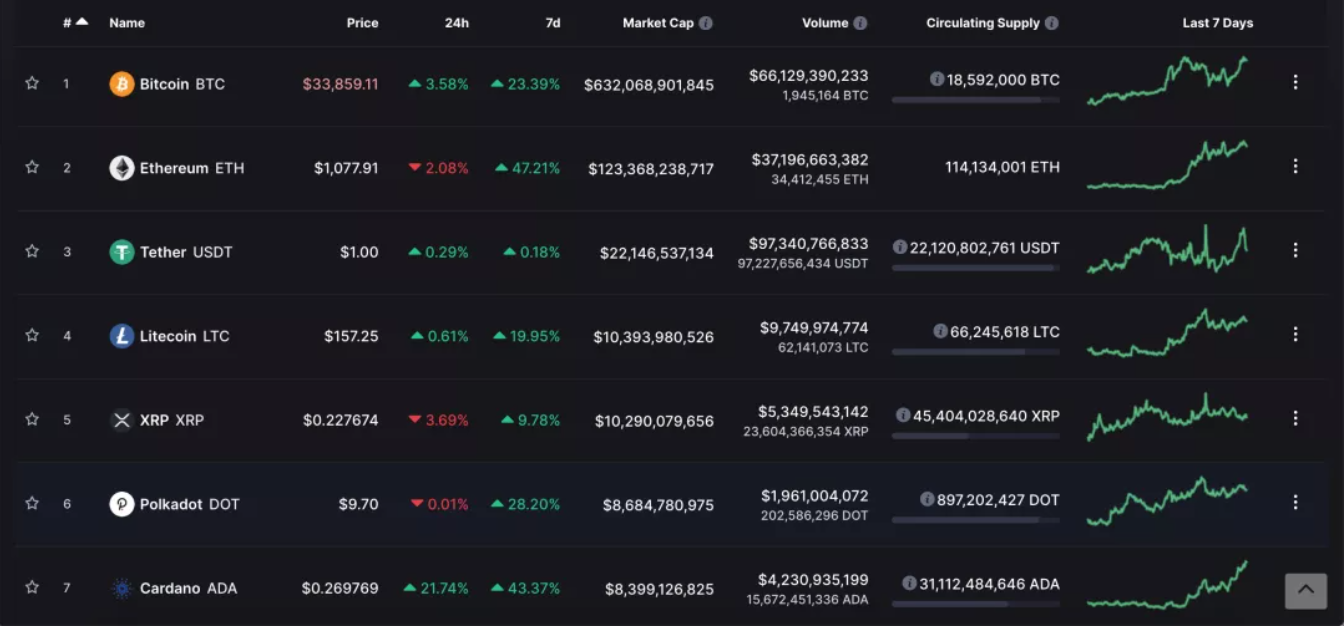

During the New Year's Day, BTC rose in the short term, breaking through the $30,000 mark strongly, once approaching $35,000, and hitting a record high. At the same time, ETH also broke through the integer mark of 1,000 US dollars, and even rushed above 1,100 US dollars, setting a new high since February 2018.

And just one day later, the market took a sharp turn for the worse. The price of BTC fell from a record high, briefly fell below $30,000, and hit a minimum of $27,777, and then began to rebound. As of writing, the price was quoted at $31,741. Rapid rises and falls are typical characteristics of a bull market, and investors need to be cautious.

Recently, the encrypted assets that the market pays the most attention to include XRP and DOT, and XRP we wrote in the previous article"Ripple encounters SEC "sniper", will Ripple XRP return to zero? "There are analysis, and as the Polkadot parachain slot auction is approaching, the rise of DOT has also attracted the attention of the market. Last week, the price of DOT continued to break through. According to CMC data, the market value of Polkadot has surpassed that of BCH, ranking sixth, reaching 8.6 billion US dollars.

Parachain Auctions Become a Hot Spot in 2021

On December 23, 2020, the Polkadot parachain test network Recoco V1 was launched and officially launched, which brought the parachain slot auction one step forward.

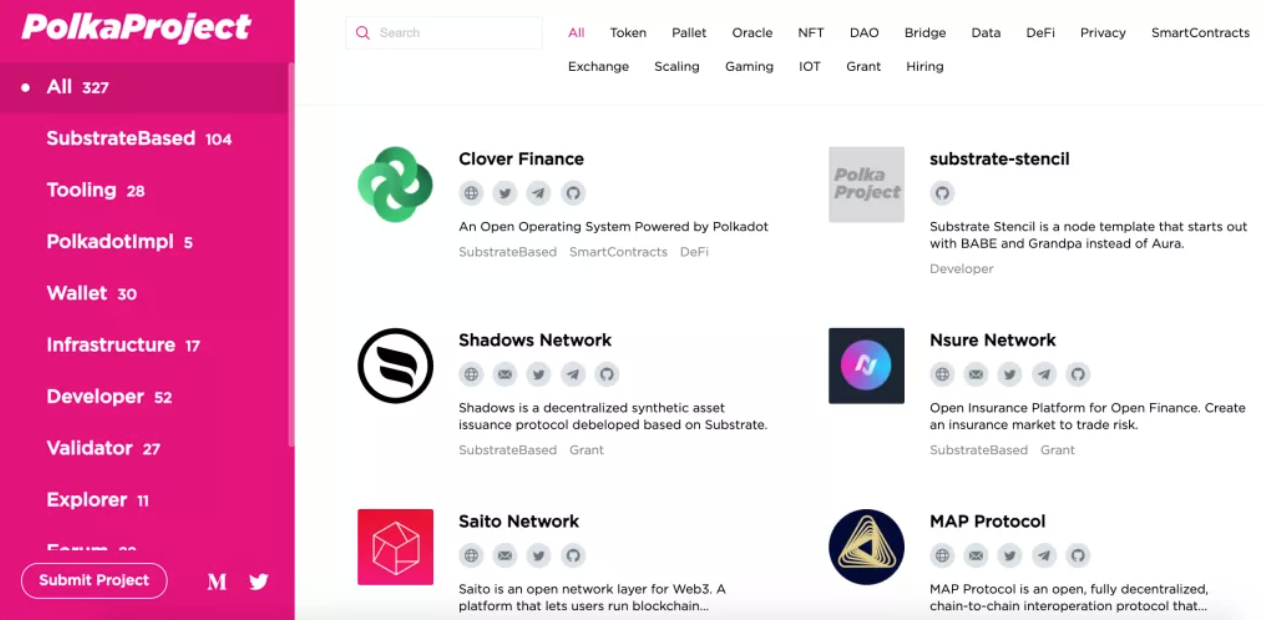

At the end of 2020, Polkadot founder Gavin Wood summarized Polkadot’s achievements in 2020: more than 200 Polkadot ecological projects, the Ethereum/Bitcoin cross-chain bridge will be launched soon, etc. In addition, last week the decentralized exchange Bancor also announced to join the Polkadot ecosystem. As Polkadot's first parachain slot auction approaches, Polkadot's fundamentals may usher in more positives.

It can be said that the Polkadot parachain slot auction is a big event for users in the currency circle, for Polkadot itself, and for other blockchain networks.

For Polkadot itself, this means the beginning of Polkadot's ecological construction. Although according to official data, there are currently more than 325 projects based on the Substract framework, covering stable coins, games, DeFi, DApps, tools and other fields, but strictly speaking, these do not constitute a real Polkadot ecology. Because Substract has the function of issuing chains with one click, it is very easy to produce a chain on Polkadot, but there is no guarantee that these chains are valuable. Therefore, in order to become a real ecological member of Polkadot, it is necessary to become a parallel link into Polkadot's main chain, that is, the relay chain, by bidding for slots.

Due to the limited network resources, Polkadot has designed 100 slots for parachains. Among them, 80% of the slots will be distributed to the market for auction, and 20% of the slots will be reserved for projects supported by the Web3 Foundation. So the competition is still fierce.

In fact, the parachain slot auction is only the first step in Polkadot’s ecological construction. Because Polkadot is the platform that carries the blockchain, the auction of the parachain only represents the layout of the blockchain layer. In the future, the blockchain needs to carry enough applications or smart contracts for users to use directly.

How will it affect currency holders?

We know that the project party needs to mortgage DOT when bidding. The Polkadot Parachain Slot Auction designed the initial parachain crowdfunding IPO plan, allowing the project to borrow from the outside world, that is, through a series of incentives to attract more DOT holders to lock more DOT tokens to themselves. This also provides DOT holders with a wealth of investment options. After the lease period ends, all DOTs participating in the auction will be refunded.

Polkadot's parachain slots are only rented and not sold. Project parties can bid for four lease periods, one lease period is 6 months, and one or more lease periods can be bid at a time, and the lease can be renewed after the lease expires.

As of writing, the price of DOT is about 9.4 US dollars, and the circulation is 1 billion, so the market value of Polkadot is 9.4 billion US dollars. According to Polkadot's system design, there may be 15-20%, that is, DOT worth about 1.4-1.9 billion U.S. dollars will participate in the parachain auction lockup. If calculated according to the annualized income of 15% and the lease period of 2 years, it will be 420-570 million US dollars. Assuming that 15 slots are auctioned each year according to the official calculation, the annualized cost of each slot allocated to users is 28-85.5 million US dollars. And this is only interest, not including the cost of DOT locked. The project party that can afford this fee must be strong, and as the auction approaches, the demand for DOT pledges will become more and more strong, which will constitute a heavy positive for the price of DOT.

This article only represents the personal views of encrypted notebooks and does not constitute any investment opinions or suggestions.

This article only represents the personal views of encrypted notebooks and does not constitute any investment opinions or suggestions.