Editor's Note: This article comes fromChatting with William (ID: William1913), Author: William Chen, reproduced by Odaily with authorization.

Editor's Note: This article comes fromChatting with William (ID: William1913)

Chatting with William (ID: William1913), Author: William Chen, reproduced by Odaily with authorization.I have written a lot of grayscale. Everyone should be clear about the mechanism and various rules of grayscale. I will introduce more today. Friends who don’t know it can watch a video I made before:【William】Three minutes to understand the biggest myth of Bitcoin--Grayscale

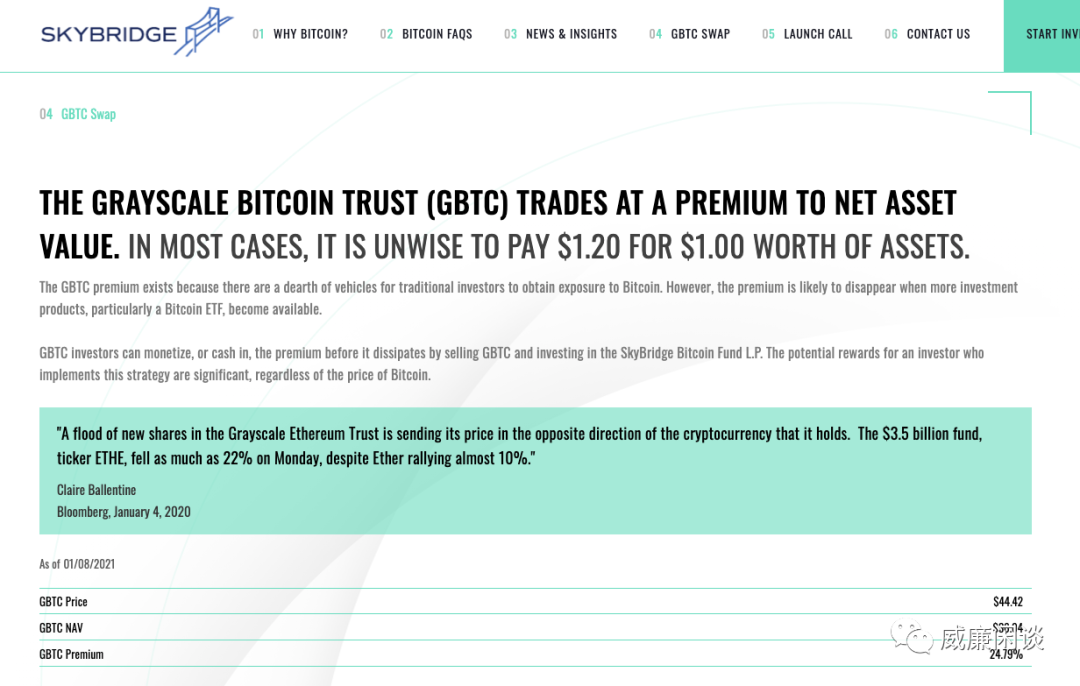

In short, Grayscale’s Bitcoin trust fund GBTC has a long-term premium, which is accepted and agreed by everyone.

Based on the closing price of GBTC last week, there is a premium of more than 20%. Because of the existence of this premium, Grayscale has provided a steady stream of buying orders for the Bitcoin market. At present, they have held 600,000 Bitcoins. Because the fund has been suspended recently, the Bitcoin position has not increased for a while up.Since there is a long-term premium, there must be people who are interested in this premium. Canceling the premium and making the price more reasonable is what every participant in an efficient market should do.

No, a player with the same halo of compliance and Wall Street background appeared. Yes, it is SKYBRIDGE CAPITA that I mentioned several times before:In addition to being a "traditional" bitcoin investment fund that can absorb investment and help buy bitcoin, they also have a very interesting function: provide GBTC SWAP:

“GRAYSCALE BITCOIN TRUST (GBTC) is trading above NAV. In most cases, it is unwise to spend $1.20 on an asset worth $1.00.The GBTC premium exists because traditional investors lack the tools to invest in Bitcoin. However, this premium may disappear when more investment products, especially bitcoin ETFs, become available.

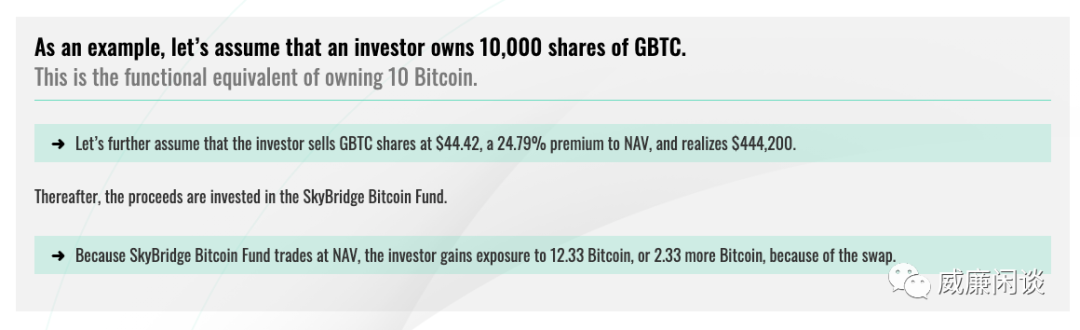

GBTC investors can monetize or cash out the premium before it dissipates by selling GBTC and investing in SkyBridge Bitcoin Fund LP. Regardless of the price of Bitcoin, the potential returns for investors who implement this strategy are enormous. "--Excerpt from the official website of Tianqiao Capital.They think it is stupid and unnecessary to buy GBTC instead of BTC, and smart people should immediately exchange GBTC for BTC or their BTC trust share."For example, suppose an investor owns 10,000 shares of GBTC. This is equivalent to owning 10 Bitcoins.Let us further assume that the investor sells GBTC shares at $44.42, a 24.79% premium to NAV, realizing $444,200.These proceeds are then invested in the SkyBridge Bitcoin Fund.Since the SkyBridge Bitcoin Fund is trading at NAV, the investor gains 12.33 BTC exposure, or an increased exposure of 2.33 BTC, as a result of the swap. "Quite interesting, arithmetic is actually very simple, everyone can do it. Who doesn't know that selling GBTC can get more BTC?

Then gbtc--Tianqiao fund shares, in this process, also buy a bitcoin in the spot market and enter the fund (theoretically).

So if this process can run, then we will see very thick bitcoin spot buying in the next few months, and the surge will come, look forward to it.It is a great thing to convert possible buying orders in any market into real buying orders, buy bitcoins, and promote the price of bitcoins, because the larger the market value of bitcoins, the healthier the overall positive cycle will be. For details, you can see my previous article:

New point of view: The higher the price of Bitcoin, the greater the oddsYesterday, the founder of Tianqiao Capital (former White House spokesperson) made a preview.Everything is about to begin.

At present, their asset management scale has reached 310 million US dollars as previously reported, and this is just the "beginning":In the future, they should also announce their asset management scale in due course, just like Grayscale, and then everyone will be able to calculate their Bitcoin holdings.

Another pie-eating behemoth is coming soon.

In addition, their official website is very "calling" Bitcoin:

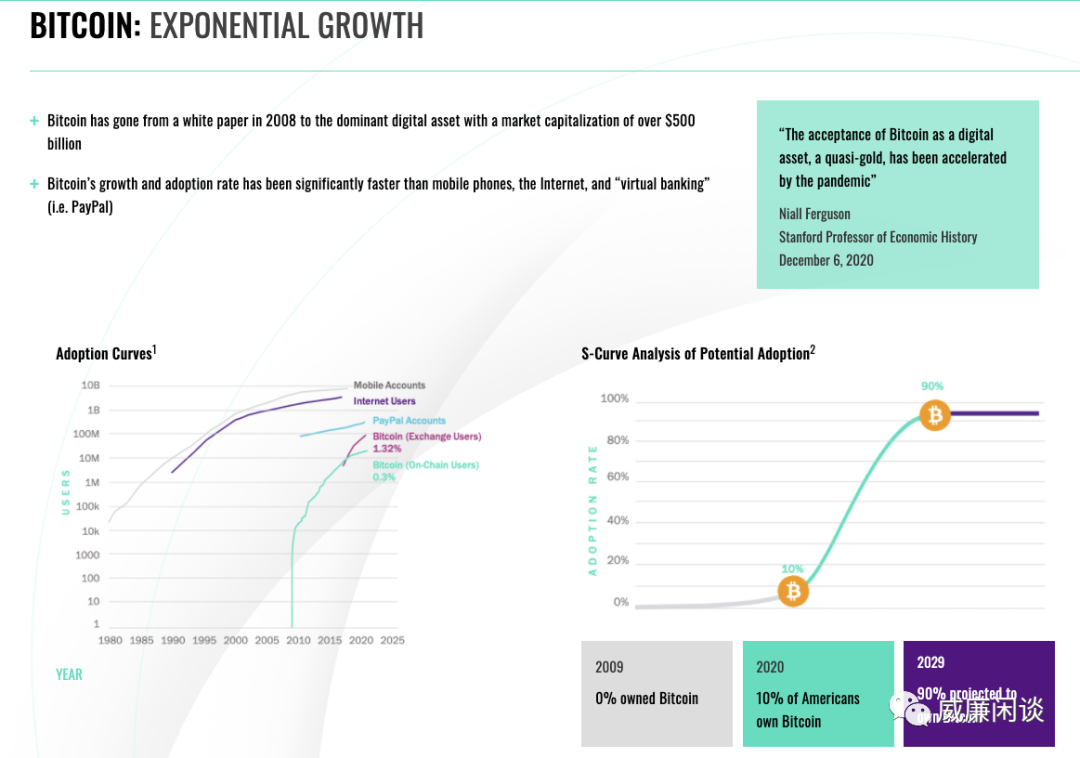

Regarding why they invest in Bitcoin, their logic is very simple:“The story of Bitcoin is simply supply and demand. The supply of Bitcoin grows at about 2.5% per year, while the demand grows faster, and there will be a fixed number of Bitcoins.”

In fact, the logic of investment has always been very simple. What is complicated is human nature.In short, whether it is a compliant fund or gbtc's swap, the public has very high expectations for them.