What are algorithmic stablecoins?

Before understanding algorithmic stablecoins, we must first know that there are three modes of stablecoins that have emerged at this stage:

Fiat stable currency (eg: USDT)

Cryptocurrency-collateralized stablecoins (example: Dai)

Algorithmic Stablecoins (Example: Basis)

These three models also reflect the path of stablecoins from "connecting the legal currency world" to "encrypted native coinage".

There should be very few users in the currency circle who have never used stablecoins, but traditional stablecoins such as USDT and Dai are essentially controlled by centralized institutions, and the value generated by the wide application of these stablecoins is only captured by a few people.

If a stable currency can be widely used and the dividends generated can be obtained by their holders, then such a stable currency is no longer just a tool but an investment project with great value. Algorithmic stablecoins certainly have this possibility.

secondary title

Algorithmic Stablecoin Operating Mechanism

AMPL

AMPL is a first-generation algorithmic stablecoin. As the first-generation algorithmic stablecoin, the operating mode of AMPL is a relatively simple and crude elastic supply token: by increasing or decreasing the number of tokens held by users, the target price is maintained at around $1. This mechanism of ensuring token price stability by adjusting supply is called rebase.

The specific operation of AMPL daily total adjustment:

If the AMPL transaction price is higher than the target price by more than 5%: the amount of AMPL held in the wallet will increase after the rebase; (the total amount will increase)

If the trading price of AMPL is between -5% and +5% of the target price: no rebase will be performed on that day;

If the AMPL transaction price is lower than the target price -5% or less: the AMPL holdings in the wallet will decrease after the rebase. (total amount decreases)

However, this model also has disadvantages, and it is difficult to complete the regulation of a single elastic mechanism.

ESD

The difference between ESD mode and AMPL can be summarized in two points:

1. Through the weighted average price (TWAP) algorithm, the price of the oracle machine is not easy to be manipulated, and the market is adjusted more smoothly.

2. The mechanism of debt and coupons is added, which is relatively more complicated. The essence is to encourage users to actively adjust through incentives.

When the ESD price is lower than the anchor price (1USDC):

The ESD protocol issues debt, which token holders can purchase. ESD will issue Coupon (coupons), and ESD holders will get coupons by destroying ESD. There is a discount for buying coupons, and as the debt increases, the discount increases, which will incentivize token holders to burn more ESD and buy coupons, thereby reducing the token supply and increasing the token price. When the future ESD price is higher than the target price (1USDC), more ESD can be redeemed with coupons. However, it should be noted that Coupon (coupon) has an expiration date set, and the coupon will expire after 90 epochs, which is equivalent to 30 days. Failure to complete the exchange within the validity period will result in a loss.

When the ESD price is higher than the anchor price (1USDC):

Users can choose to pledge their ESD to have the opportunity to obtain more newly issued ESD rewards, which can be understood as passively obtaining income by participating in liquidity mining. In this way, the price of ESD can be reduced due to the increase of ESD circulation.

Obviously, under this mechanism, ESD will encourage arbitrageurs to carry out arbitrage. When the ESD is higher than the targeted price, users can passively earn income by staking their ESD; when the ESD is lower than the targeted price, users can purchase coupons at a discounted price, and have the opportunity to obtain more ESD in the future. Of course, buying coupons is also risky and not suitable for everyone. Therefore, the ESD mode is more complicated and more suitable for professional players to carry out arbitrage.

Basis

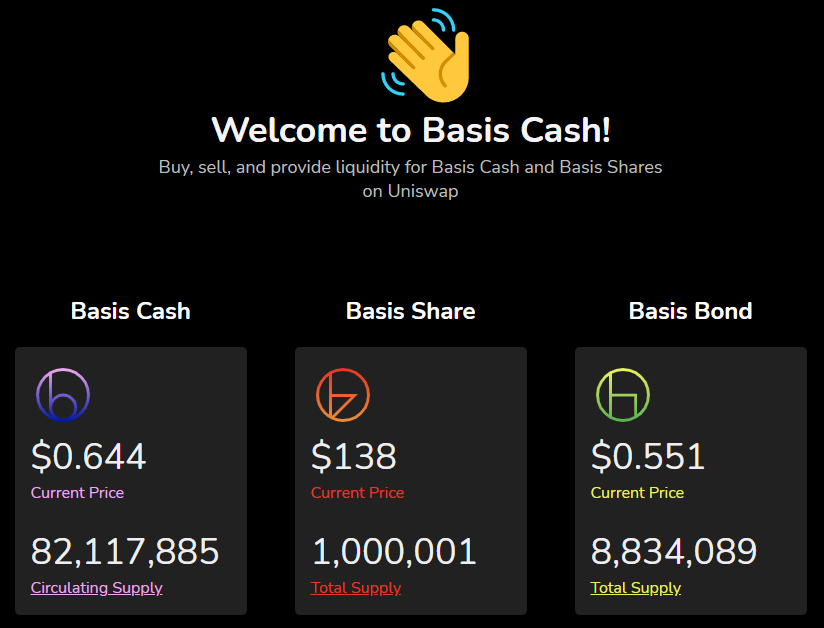

Different from ESD, the Basis protocol contains a total of three tokens, including:

BAC (Basic Cash) - stable currency, equivalent to 1 US dollar.

BAB (Basic Bond) - equivalent to a bond,

BAS (Basic Share) - Equivalent to shares of the Federal Reserve, that is, stocks with voting rights and dividend rights. People who own BAS are equivalent to shareholders.

To put it simply, Basis can be understood as a central bank, BAC is the currency issued by the central bank; BAS is the stock held by the shareholders of the central bank, which needs to bear systemic risks and obtain systematic benefits; BAB is a bond, which is equivalent to the bond of the central bank.

BAC is an algorithmic stable currency, and the significance of the existence of BAS and BAB is to maintain the price of BAC at $1.

If compared with the ESD agreement, BAS is equivalent to the "ESD in pledge" in the ESD agreement, and can obtain newly issued stable currency rewards; BAB is equivalent to the "Coupon" in the ESD agreement, and has the opportunity to obtain premium income.

BAS and BAB are important tools to achieve BAC stability. So how exactly does it work?

If BAC is less than $1:

This means that there is too much currency supply in the market, so BAB is sold to users through an algorithm to reduce market liquidity: users can use BAC to buy BAB at a certain discount (when the price of BAC rises back above $1, the user will Convert BAB to BAC at a ratio of 1:1 to earn premium income), thereby reducing the number of BAC in circulation and promoting the price of BAC.

It is worth noting that, unlike Coupon coupons in ESD, which are only valid for 30 days, BAB has no time limit when used. If BAC is higher than $1:

When the BAC price exceeds $1, the agreement will first allow BAB to be redeemed, thereby issuing additional BAC. After repaying the debt, if the price of BAC is still higher than $1, BAC will continue to issue more, and this part will be distributed to BAS pledgers and Basis treasury. Holders of BAB can use BAB to exchange for BAC, which comes from the treasury. In other words, the newly added BAC will first meet the exchange needs of BAB holders, and then be issued to BAS holders. The current BAC issuance is basically issued to BAS pledgers.

Although the operating mechanism of Basis Cash is relatively complicated, objectively speaking, it is easier to be integrated by other DeFi protocols than AMPL. However, although the current algorithmic stablecoins are sought after, they are not stable, and instead are used more as a means of speculation. This is not conducive to the long-term development of algorithmic stablecoins, and also runs counter to its original design intention.

I want to completely offset the price control brought by centralized institutions through algorithms, but I don’t have enough market recognition to maintain my own price stability. By giving arbitrage space to the cold start of the model, most of the users who enter are to obtain The excess returns of the early "spirit of sudden wealth", rather than the real use of algorithmic stablecoins as payment tools or value storage tools.

If the demand for the stablecoin shrinks or encounters a crisis of confidence, the algorithmic bank will have to issue more stocks and bonds, which will be converted into a supply of more money in the future, and then enter a death spiral.

The encryption market advocates innovation, and the algorithmic stablecoin tries to formulate an economy's monetary policy. Its innovation is comparable to the crisis. On the way to achieve the original intention, it coexists with speculation and other behaviors. Perhaps the social experimentation of algorithmic stablecoins will take longer. Due to the launch of BAS, there are many imitation disks appearing at this stage, but it is well known that none of the sons can win the father's project, such as (BCH->BTC/YFII-YFI, etc.).

Therefore, the position of the stablecoin at this stage is on the verge of reform and opening up, and since then, in a sense, it has yet to be paid attention to by speculators.