Despite the impact of the epidemic, the cryptocurrency market still achieved a perfect end to 2020.

On December 31, CCTV Finance Weibo reported that Bitcoin has risen wildly this year, with a cumulative increase of more than 300% during the year. Not only has it reached the $20,000 mark for the first time in history, but it has also continued to rise. As of 15:00 on January 3, 2021, Bitcoin has broken through $34,700.

CCTV Finance also stated that if calculated based on the intraday high of 29,700 on the 31st, the bitcoin purchased for 1 yuan 10 years ago has already earned more than 11.8 million yuan. If you invest 1,000 yuan, you will earn 11.8 billion yuan.

According to the official Twitter of Grayscale, as of December 31, the total asset management scale of Grayscale exceeded 20 billion US dollars, reaching 20.2 billion US dollars. Previously, Grayscale CEO Barry Silbert tweeted that you all obviously want Grayscale’s total assets under management (AUM) to reach $20 billion in 2020, so let me do it.

As such, that wish has been successfully fulfilled.

first level title

Can Bitcoin go up to the sky?

On the first day of the new year, Blockstream CEO Adam Back tweeted that 2021 looks like a very interesting year for Bitcoin supporters. Go forward bravely and make progress every day.

Sure enough, at the beginning of the new year, Bitcoin ushered in a wave of soaring. As of 15:00 on January 3, the highest surge was 34,762 US dollars. The currency circle is boiling again, and thinks this is a good sign.

In fact, it is common knowledge that the industry is generally optimistic about the market of Bitcoin in 2021.

Interestingly, Bitcoin has entered a deflationary state due to continued institutional buying. Xu Kun, chief strategy officer of OKEx, said in an interview with the media a few days ago that this round of rise in Bitcoin was driven by the entry of overseas institutional investors. In her view, as a large number of institutions for the purpose of asset allocation began to "hoard coins", Bitcoin has actually entered a state of deflation.

Du Jun, the co-founder of Huobi, recently talked about why institutions choose to "explode" Bitcoin now, saying that it is mainly affected by the following two factors: First, the opening and stability of cryptocurrency compliance investment channels. Before this year, the market There are almost no compliant channels for investing in cryptocurrencies on the Internet, especially in the Asian market. It is still difficult for investors to purchase cryptocurrencies in compliance. This year, Grayscale has made a good attempt. Its compliant Bitcoin GBTC has opened up a compliance channel for institutional investors to deploy cryptocurrencies; the second is the wealth creation effect of the market. Institutional investors, like retail investors, will also be attracted to enter the market by the wealth effect of cryptocurrencies.

On January 1, data analyst Coin98 Analytics pointed out that the number of bitcoins purchased by Grayscale in December 2020 was almost three times the number of bitcoins that joined the market that month. Grayscale’s assets under management (AUM) totaled 72,950 BTC ($2.132 billion) in the last month. During the same period, miners produced only 28,112 BTC ($821.7 million), accounting for 38.5% of Grayscale’s purchases.

The data points to what many are calling bitcoin's ongoing liquidity crunch, with big buyers absorbing all available supply and removing it from circulation, sending it into cold storage for long-term holding.

According to the Nuclear Finance APP, in addition to the Bitcoin Trust Fund (GBTC) managed by Grayscale Fund, in 2020, a number of investment institutions and listed companies, including the US software giant MicroStrategy, mobile payment giant Square and Galaxy Digital, have chosen to allocate Bitcoin. currency.

According to the statistics of the Bitcoin Treasuries website, as of 17:00 on January 3, 2021, 28 listed companies and investment institutions around the world have been recorded, with a total of 11,551,618 bitcoins publicly held. Calculated at $34,500 per coin, the current value is about $39.7 billion .

Therefore, analysts believe that it is expected that more investment institutions, listed companies, and high-net-worth individuals will enter the ranks of investing in Bitcoin in 2021.

On December 31, 2020, Peter Johnson, the head of Jump Capital, published ten predictions for the development of the encryption market in 2021. Among them, he said that institutional investors will start to generate FOMO sentiment; central banks are expected to start buying bitcoin in 2021; corporate treasurers will ignore bitcoin for short-term cash management; and bitcoin ETFs will be approved.

first level title

Can Ethereum break its previous high?

Recently, Weiss Ratings analysts Juan Villaverde and Bruce Ng jointly published an article stating that Ethereum has risen by 469% in 2020, while Bitcoin has risen by 281%. The implication is that it is obvious that the performance of the Ethereum market is optimistic.

They expressed their belief that Ethereum will continue to bring more benefits to investors in 2021. The reasons are: firstly, Ethereum has the most developers; secondly, ETH transaction volume is stable and growing; thirdly, Bitcoin may not be the king of encryption, but Ethereum is the king of DeFi; fourthly, the DeFi boom has no signs of cooling down; Five is that potential competitors such as Polkadot, Cosmos, Cardano, and Tezos are beginning to fade; six is that no other single blockchain can provide such a wide range of financial options for DeFi investors; seven is that Ethereum may be undervalued by at least 40%.

Furthermore, they predict that Ethereum is a safe bet to return to its previous all-time high in 2021.

On December 16, the Chicago Mercantile Exchange (CME.US) announced that it will launch Ethereum futures products on February 8, 2021, and is currently awaiting regulatory review.

Like bitcoin futures, ethereum futures will be cash-settled based on a reference rate, CME said.

It is understood that in December 2017, CME Group launched the Bitcoin futures contract, breaking the pattern of the encrypted derivatives world. Meanwhile, an average of about 8,560 bitcoin futures contracts are traded per day in 2020, equivalent to about 42,800 bitcoins. In addition, in early 2020, the exchange also launched a Bitcoin options product.

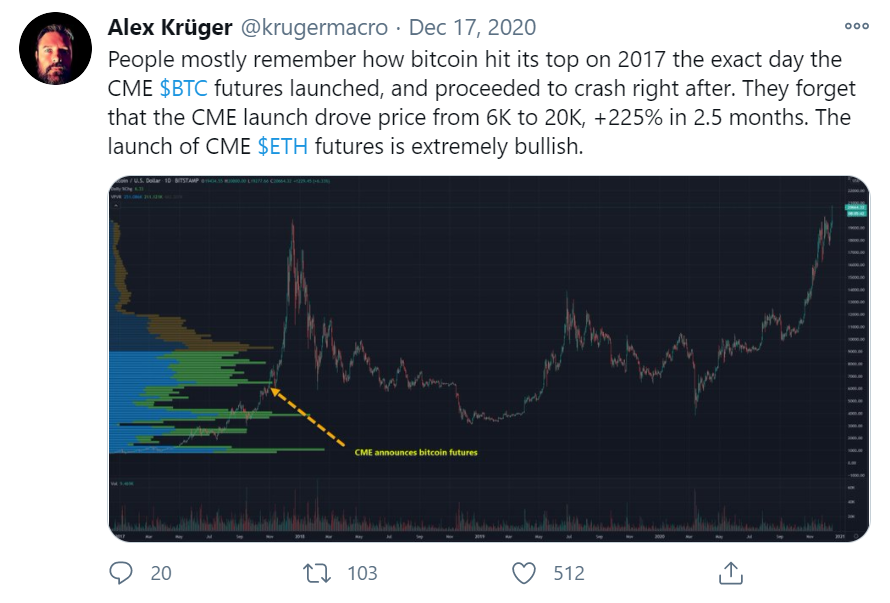

To this end, cryptocurrency analyst Alex Krüger tweeted that people mostly remember how Bitcoin reached its peak on the day CME Bitcoin futures launched in 2017 and then plummeted immediately. But they forget that the launch of Bitcoin futures pushed the price of Bitcoin from $6,000 to $20,000, a 225% increase in two and a half months. Therefore, the Ethereum futures launched by the Chicago Mercantile Exchange are extremely bullish.

In addition, Weibo big V Bitcoin Dashouzi said in his "How to Grasp the Next Opportunities of Ethereum 2.0" that the most important consensus mechanism of Ethereum from 1.0 to 2.0 has changed from POW to POS. Obtained, with the increase of pledged and locked Ethereum, its currency price will also rise accordingly, and the stagnant mining machines will bring new development opportunities to Token under other POW consensus mechanisms, and after the transformation into 2.0 , The scalability, throughput, and security of the Ethereum public main network will be greatly improved, which is undoubtedly a huge benefit for Ethereum.

On December 31, Bitcoin billionaire and Gemini co-founder Tyler Winklevoss tweeted that the price of Ethereum is now $735, which is 51% lower than its all-time high. Meanwhile, Santiment data shows that the number of Ethereum addresses holding at least 10,000 tokens has increased by 39 in the past two months alone.

first level title

The "Back Waves" in 2021

In view of the good performance of the currency market, people have many expectations for the entire cryptocurrency ecosystem in 2021.

A few days ago, DARMA Capital co-founder Andrew Keys made a 16-point prediction for the encryption industry in 2021, that is, in 2020, the world began to understand the intrinsic value of Bitcoin as "digital gold", and we will witness the understanding of Ethereum Same as "Digital Oil"; will see Ethereum 2.0 Phase 1 go live; Bitcoin will hit $50,000; Ethereum will hit $2,000; total amount locked in DeFi will exceed $150B, and 2021 will be DeFi A year of cross-chain bridges; with the development of Web3.0, value will be accumulated at the protocol layer instead of the application layer; second-layer solutions will explode; IPFS and Filecoin will become the focus of global attention; self-proclaimed "Ether The "Fang Killer" project will need to find a niche use case or risk being completely defeated; we will see the start of the crypto IPO mania; China will enable its Digital Currency Electronic Payment (DCEP); work while a dozen other countries are firmly pursuing digital currencies; we will witness the first significant areas of enterprise adoption of public chains; NFTs will become a major consumer use case for Ethereum; crypto VCs will explode; February 2021 , the world's largest derivatives exchange CME will launch Ethereum futures, which will clear the way for the establishment of Ethereum ETF.

At the same time, Yang Linyuan, managing partner of Dfund, said in an event that the cryptocurrency market in 2021 has the following factors worthy of attention: First, the governments of various countries continue to release water, and the world has entered an unprecedented era of negative interest rates. The migration of digital currencies; second, there will be more grayscale-like structured financial products anchored by digital currencies in the market; third, digital currency IPO cases similar to Coinbase will appear and blowout, ushering in the resonance of currency and stocks; The fourth is the launch of the super stable currency represented by the Chinese central bank DCEP and FACEBOOK DIEM, which will become a tower of Babel for digital currency at a certain moment.

On December 26, Yu Jianing pointed out in his keynote speech on "Five Major Trends of the Blockchain Industry in 2021" that since 2017, the implementation of industrial blockchains has been steadily advancing, and the value of blockchain-enabled industries has been fully verified. "Blockchain + finance" has initially formed a system. Alliance chain + finance is the development of financial technology, and public chain + finance is the development of DeFi distributed finance. In 2021, the era of industrial blockchain 2.0 is coming. Industrial blockchain 2.0 is equal to industrial on-chain + asset on-chain + data on-chain + technology integration + CBDC.

He believes that the five major trends in the blockchain industry in 2021 are: blockchain + will become the main battlefield for innovation and entrepreneurship, and any industry is worth reshaping with blockchain. For example, NFT is reshaping the cultural and creative industries; The key driving force for industrial digital transformation; technological integration changes the social form; asset chaining has become the general trend; opportunities for data elements to emerge.

In addition, many key technologies will exert further disruptive power in 2021 as governments, institutions and businesses draw new boundaries in the race for technological dominance, the World Economic Forum said in a report released. In the report, its author, Abishur Prakash, discusses the top 10 tech geopolitical risks for 2021 and provides an update on global tectonic shifts in the next geopolitics, including blockchain and many others.

He explained in an interview, “I see blockchain as the ‘rewiring’ of the world. Like the Internet, blockchain represents a platform that embraces all kinds of commerce, whether it’s national elections, financial Transactions are also the movement of sensitive information. But unlike the internet, which emerged in a largely unipolar world, blockchain emerges in a time of intense geopolitical competition."