Today is a special chapter of the UDB briefing, the annual summary, we will look back on the past and look forward to the future. 2020 is a year of black swans flying around. People are in danger in uncertainty, but in crisis and crisis, there are opportunities in danger. In the midst of challenges, a country is rising and a name is being known to the world. I hope that we are all those who overcome danger and seize opportunities. Let's start our today's content directly.

2020 is very long. Since the outbreak of the new crown epidemic in Wuhan in 19 years, a total of 81.27 million new crown patients have been diagnosed worldwide, of which 1.77 million have unfortunately died. People all over the world are living in the heat of the water, whether it is work, travel or life, they are all suffering. It's been a tough, long year.

From a historical point of view, 2020 is very short, and the new crown epidemic is just a turning point of an era. In 2019, Xi Jinping's sentence: "The world is undergoing major changes unseen in a century", may perfectly sum up the next few decades. In the financial crisis of 2008, the strength of China's economy was fully demonstrated. Under the general environment of global economic recession, China's economy temporarily paused and started faster. From the financial crisis to the new crown epidemic, the world has seen China's determination to rise peacefully. In the face of the challenge of the new crown epidemic, the unprecedented unity of a nation has made the world unbelievable and made the Chinese themselves feel extremely proud.

We are aware that the economies of foreign capitalist developed countries are gradually falling into a predicament - starting from the rescue of quantitative easing in 2008, the European and American capital markets have entered an unprecedented expansion cycle, and the 12-year-long capital bull market is a reflection of the influx of liquidity into the capital market , is the epitome of the weakening impact of central bank policies on the real economy. Loose monetary policies in Europe, Japan and other regions and countries cannot enhance the vitality of the economy, so they have to enter the era of negative interest rates. The UK is considering joining the ranks of negative interest rates, while the US interest rate is also hovering at 0%. The first countries and regions to enter negative interest rates, so far no country can escape from it, we call it a negative interest rate black hole.

We realize that the political difference between capitalism and socialism has made Western countries hostile to us—we are stepping on the footsteps of Western countries, but we are going faster and more steadily than them. The rise of Chinese technology has sounded the alarm for Western countries , The blockade of Huawei's 5G technology seems to reveal the arrival of a new era.

The country has decided to implement an internal economic cycle. On the one hand, it uses the country's huge economic advantages to resist the blockade of China by Western countries. On the other hand, it tries to draw a clear line with Western capitalist economies that have major problems and challenges in the currency system.

From the economic internal circulation, to the financial internal circulation, to the national blockchain digital RMB DCEP, we have seen a rising China and the arrival of a new era.

Until then, the existing global monetary system will try to survive. The way to maintain it is to continuously provide more liquidity and print more money until the US dollar, as the global settlement credit currency, is like all credit currencies before the US dollar—— gradually loses all its value.

None of the investment themes in 2020 can be separated from the global monetary policy: the largest quantitative easing and stimulus bill in history caused the US dollar index to fall by 12.76% this year, and the US dollar fell by 6.27% against the RMB; Investors poured into the precious metal market. Gold rose 24.1% this year and silver rose 47.51%. This year, it has risen 70.67% from the March low;

Bitcoin, a digital gold operating in a completely independent digital currency system, has been enthusiastically sought after by global investors. The price performance of Bitcoin has broken most people's expectations, rising 617% from the low of $3,850 in March to 27,600 The U.S. dollar continues to be the best investment asset in the world.

Looking forward to 2021, the loose monetary environment will continue. The flood of US dollar supply symbolizes the weakening of world hegemony. All assets denominated in US dollars will continue to rise in an excellent environment. Gold, silver, Bitcoin, and stocks will all have Not bad performance.

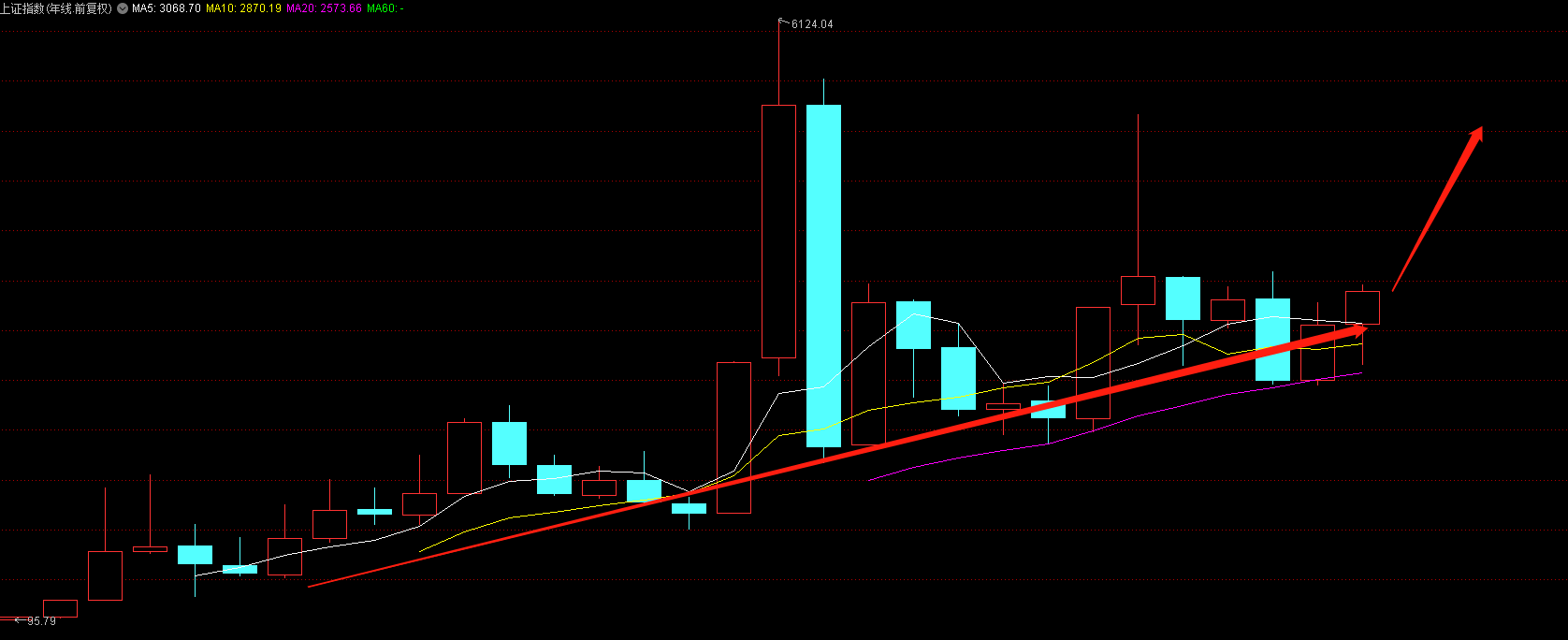

The rise of China has made the world optimistic about the value of the renminbi. As a country that is rising again and may dominate the world pattern in the next few decades, the inevitable siphon effect of wealth determines that the country needs more capital reservoirs. Compared with the real estate market, we More optimistic about the Chinese stock market.

Long-term rating: Overweight

Long-term rating: Overweight

Short-Cycle Ratings: Bitcoin Underweight, Small Cap Crypto Ownings

The new year is approaching, and we wish every investor can seize the opportunity that has never been seen in a century, and encourage each other