There is no perpetual binge.

On December 16, the night before, the price of Bitcoin quietly broke through $20,000.

If you are a veteran of the currency circle, you must know what this means. The price of Bitcoin has repeatedly tried to test the key position of 20,000 US dollars in the past one and a half months, but they all ended in failure. People's expectations have also swayed up and down like a roller coaster, and their hearts have been tense for a few weeks. All this is because: as more and more institutions buy bitcoin, people's prospects for bitcoin have become bright, and they have begun to speculate whether its price can break through the milestone number of 20,000. If it can break through, it must It will go down in the history books of the currency circle - because the price of Bitcoin has set a new historical record again, people's expectations will skyrocket.

We all know that institutions began to slowly increase the price of Bitcoin when the price was still at 12,000 US dollars. In this time window when the blockchain is generally recognized by the traditional mainstream financial industry, defi, the hyper-growth that grows wildly on Ethereum Strong species undoubtedly began to bring unlimited imagination and profit space to the financial industry. At the same time, the supervision of Bitcoin in various countries around the world has also begun to improve. The superposition of these three forces has made Bitcoin and even other non-air cryptocurrencies receive formal attention for the first time, and its industry environment has undergone a complete qualitative change. As Gu Yanxi, a researcher of blockchain and encrypted digital assets, said on December 17:

Sure enough, after the price of Bitcoin broke through 20,000 US dollars, its price even touched 24,000 US dollars within 1 day! People think that Bitcoin has really been fully recognized by the mainstream world - years of hard work by people in the blockchain industry have finally borne fruit. Various news related to it are also coming in a flood:

Bitcoin entered the top 20 Weibo search list and currently ranks 19th; The daily trading volume of Bitcoin options exceeded 1 billion for the first time; Giants such as JPMorgan Chase, Standard Chartered, Citigroup, Deutsche Bank and DBS Bank entered the cryptocurrency market; 94 of the top 100 coins by market value rose 5 and fell 1 level; The total amount of BTC contract positions in the entire network is as high as 3.82 billion US dollars; Bitcoin broke through 23,000 US dollars and entered the Weibo hot search list; ……

2020 is a nightmare period for various traditional industries, but it seems to be a super bull market in the currency circle, DeFi in the first half of the year, and the skyrocketing Bitcoin at the end of the year.

At this moment, various bigwigs in the circle have also made very optimistic imaginations about the future trend of Bitcoin:

Analyst K God: The current market has broken through the 20,000-dollar line. If it can stand firm, it is bound to usher in a sharp rise, and the historical law will be staged again; Meltem Demirors, chief strategy officer of CoinShares: From now on, the upward speed will be very fast, even if it reaches $35,000 in 3 to 6 months, I will not be surprised; Antoni Trenchev, co-founder of Nexo: We have a new watershed, and the next target integer mark is $30,000, which is the beginning of a new chapter for Bitcoin; Encryption analyst The Moon: Bitcoin below $50,000 is still cheap; Encryption analyst Joseph Young: When you realize that the largest asset managers are scrambling to enter the Bitcoin market, the market value of BTC is only 429 billion US dollars, and the supply crisis of BTC has already begun;

If he is a big investor, anyone would suggest him to hold it for a long time, but in fact it is true. According to the in-depth situation of coinmarketbook, it can be found that today's buying pressure (buy support) is $210658244, which is similar to the previous buying pressure, but the price No sharp drop was found, that is to say, large investors must be holding Bitcoin with a high probability, rather than pending orders.

But as a retail investor—that is, for the readers of this public account, it is not a very wise idea to hold it for a long time: because Bitcoin has only increased by about 100% in two months, which is similar to that of DeFi liquidity mining. In the times, the income of several times, dozens of times or even hundreds of times is completely incomparable. As long as the latter gets the gossip about the listing, there is a high probability of making a lot of money. Moreover, even if the price of Bitcoin continues to soar, it cannot avoid the possibility of a pullback.

When the price of BTC exceeded 24,000 US dollars, this wave of psychological pull came to an end, and then there was a short-term correction, and the price fell by more than 1,000 US dollars.

Waiting for a callback is indeed a good strategy, but we can also look at other currencies, because after all, Bitcoin is a barometer of the entire cryptocurrency field, and its price changes will affect many cryptocurrencies.

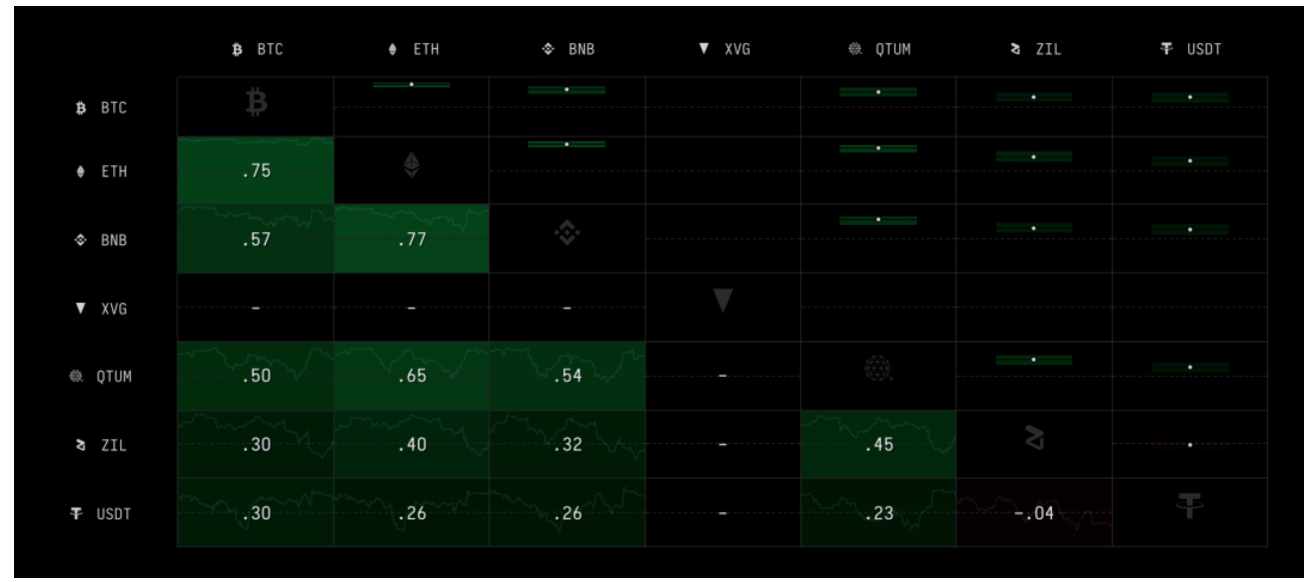

The website cryptowatch lists the correlations between various cryptocurrencies and Bitcoin price fluctuations. In the matrix shown in the figure, we can see that the closer the correlation is to 1, the more Bitcoin’s rise will affect the price of other currencies. price.

This article only represents the personal views of encrypted notebooks and does not constitute any investment opinions or suggestions.

This article only represents the personal views of encrypted notebooks and does not constitute any investment opinions or suggestions.