DeFi is at the forefront of finance, and blockchain itself is finance.

This is acBTC founder Daniel Tang’s perception of the future of the entire blockchain industry. At present, many practitioners, including the author, believe that the future of blockchain must be finance. Then someone will definitely say: blockchain can empower many industries and make it more trustworthy, transparent and so on. Blockchain can indeed be applied in many other fields, but in terms of market size and practicality, the financial application scale is far greater than the sum of all other applications.

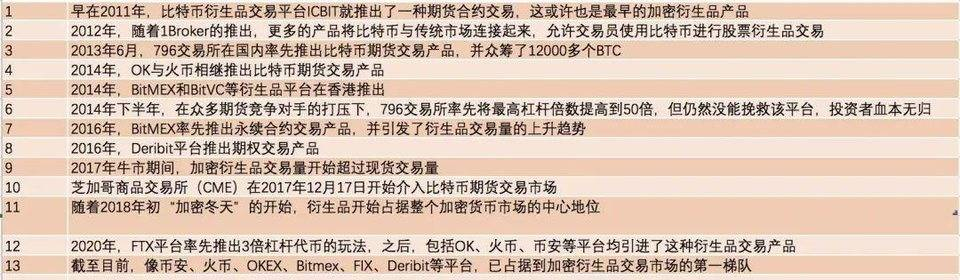

Why do you say that, we can see the financial genes of blockchain derivatives only by looking at the history of application development.

We found that the application of Bitcoin derivatives began to appear in 2011 and quickly reached perfection. In the past ten years, the value of Bitcoin has gone from 0 to 20,000 US dollars now, and there have been many ups and downs, and it almost died in the early days, which means that Bitcoin is inherently ultra-high risk. The reason why derivatives appeared in the traditional financial field very early is because many people are risk appetites-people would rather risk hanging their heads for 300% profits! It’s not fun to be long assets all the time, you should play some leverage, play some options and bets, in short, it’s that kind of excitement.

Before the ICO boom, there were many people who specialized in bitcoin-related financial business. At this time, derivatives were not the most popular way to play bitcoin. However, at this time, a product called perpetual contract appeared in the option contract. That is to say, people can push back the exercise/delivery time all the time, so that it becomes a complete speculative contract. This approach is extremely risky and almost unpredictable-because Bitcoin itself is not linked to the real economy, and Bitcoin itself is not linked to the real economy. The currency contract is priced again based on Bitcoin. However, it is such a crazy financial product that actually walked in the center of the stage during the bear market of the currency circle and became the new darling of players.

It can be found that in the "old world of great voyages" of the blockchain, high risks accompany all participants. It can be said that without the ultimate financial temptation of high risks and high returns, it is impossible for the blockchain to develop to the current level of technology. If we carefully review the key technological breakthroughs of the blockchain, they are all ultimately aimed at boosting the price of a certain value carrier (token): for example, the problem of expansion, which can greatly reduce the time for transactions to be confirmed, which will make the currency as a value transmission The medium is more efficient; in terms of smart contracts, it can allow data on the chain to be quickly modified and stored, if the data and storage rights on the chain are corresponding to tokens (now known, blockchain systems including aelf Introduced the token of the system performance category), from the perspective of the economic model, the faster the data is processed, the higher the demand for the corresponding token will be, thus boosting the currency price.

This kind of field that can instantly change the fate of an ordinary person has attracted countless individuals, and the tide of the times has also created a group of big names in the currency circle. This seems to be the most cutting-edge finance, but for a long time, in the eyes of traditional financial institutions, blockchain speculation is just "deteriorated finance" and cannot be brought out. But the emergence of DeFi has made institutions begin to seriously rethink the value of decentralization.

This year, with the explosion of DeFi, various institutions began to use tokens as part of their investment portfolios. Institutions are also greedy. They are the main force of this wave of DeFi profits. As big whales, they manipulate the market price and depth at will, causing retail investors to suffer a lot of losses. But at the same time, people's belief in DeFi's high-risk and high-yield has not decreased, but has increased significantly. It is against this background that more and more decentralized derivatives businesses have emerged.

Products such as liquidity mining, AMM, and smart pool can be forked by any developer. If you catch up with luck, you can make a lot of money. But this model cannot last long, because their essence is to create a "Ponzi economic model". Without the rise of their own currency prices, it will be difficult to start a new flywheel. Well, it’s not enough to keep DeFi going.

And just last month, with the entry of well-known tokens such as YFI and Sushi by institutions, DeFi practitioners realized that financial services have become more and more important. It can be said that who can design the best financial services, Whoever can win in the future DeFi market. In other words, technology was everything in the past, but now products are king.

Derivatives are financial business representatives that meet the tastes of most DeFi users. Decentralized derivatives are complex in composition and exquisite in design, making ordinary people daunting and elusive. The risk averse makes some money. From the perspective of financial engineering, there are always many people in the world who are extremely "risk-loving" and many people are "risk-averse". Financial engineering plays a role in grading financial products and selling them to users in a targeted manner. Moreover, many users are also institutions themselves, and they are inherently very risk-tolerant. These comprehensive factors have made complex financial services such as derivatives begin to appear in DeFi, and will gradually dominate the DeFi field. Recently, more and more DeFi projects have begun to absorb talents from the traditional financial field. Only by introducing professional financial services can DeFi meet the needs of more institutions and individuals.

On the other hand, remember Yearn's massively rapid merger? This is also a microcosm of specialization, because this approach expands the team size and forces all other DeFi projects to start paying attention to the team.

A person can make a good start, but a team can go a long way.

The founders of DeFi have begun to have this overall view. Although the world encourages all-rounders who understand both finance and blockchain technology, leading a team that includes financial talents and blockchain talents will allow the project to continue to develop and continue to provide stable and professional various class product

The DeFi field, or the blockchain industry, is becoming financially institutionalized. I believe that there will be many large blockchain financial companies in the future, specializing in decentralized financial solutions. Let us wait and see to welcome the "new world" of blockchain finance in the future!