2020 is an extraordinary year. For believers in cryptocurrency, Bitcoin has almost returned to $20,000 this year, and digital currency has ushered in new opportunities.

2020 also ushers in the beginning of a new financial era centered on "digitalisation". The central bank digital currency (CBDC) has officially entered the international financial market, and China is also intensively promoting its central bank digital currency (CBDC), digital currency electronic payment (DCEP) system (also known as "digital yuan") plans. With the launch of large-scale pilot projects of DCEP in Shenzhen, Xiongan New Area, Suzhou, Chengdu and other regions, the release of DCEP is imminent.

It has been hailed as China's most ambitious fintech solution to date, with some suggesting it could help China replace the dollar as the world's reserve currency. Since August, the news about the central bank’s digital currency has been very intensive, and its process has a tendency to accelerate its promotion. If it can be launched in a short period of time, it means that the People’s Bank of China will become the first central bank in the world to officially release a digital currency. This is conducive to the international circulation of renminbi and the settlement of international trade, and it is hoped that it will break the world monetary economic system dominated by the hegemony of the US dollar.

And the rise of DCEP is a mixed bag for advocates of cryptocurrencies like Bitcoin. On the one hand, this is an endorsement of the concept of digital currencies, and mainstream adoption of CBDCs could help drive wider adoption of crypto. On the other hand, the centralized nature of CBDC is completely opposite to the decentralized cryptocurrency such as Bitcoin. If DCEP is widely adopted, is it possible for it to replace Bitcoin, and where should Bitcoin go? Should we continue singing all the way or sink into the dust?

secondary title

Different Types of Digital Currencies

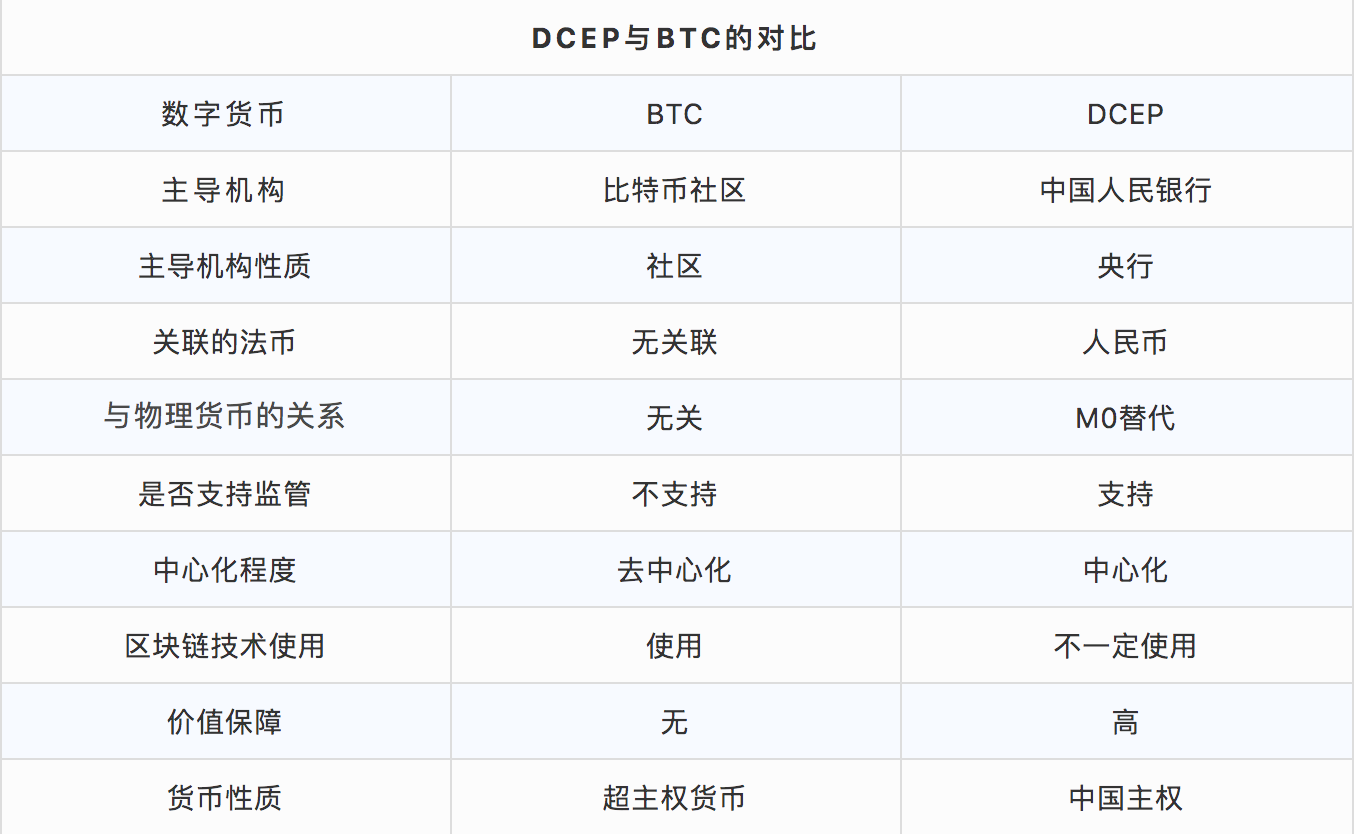

Regarding the comparison between DCEP and Bitcoin, let's first make a simple understanding through a picture:

From the figure, we can clearly find that both Bitcoin and DCEP are a form of digital currency, but they are issued by completely different entities. Bitcoin was initiated by an anonymous founder Satoshi Nakamoto. It does not rely on a specific currency institution to issue, but is generated through a large number of calculations of a specific algorithm. The Bitcoin economy uses a distributed database composed of many nodes in the entire P2P network to confirm and record all trading behavior.

DCEP was created by China's central bank, the People's Bank of China (PBoC), which aims to digitize the country's cash circulation. It is not a simple digitization of banknotes, but to replace banknotes and coins, change the form of the base currency, and allow The government has complete control over where every penny goes.

In terms of technology, Bitcoin is an encrypted currency based on cryptography and a decentralized transmission mode relying on blockchain technology.

DCEP does not actually use blockchain as part of its underlying technology. It uses a "binary operating system" in which the People's Bank of China is the only issuing database for DCEP.

Through comparison, we can have a simple understanding: the main difference between DCEP and virtual currencies such as Bitcoin is that the former has sovereign credit as an endorsement, while the latter does not. The essence of the central bank's digital currency is legal currency. In the legal currency environment, the central bank Not only the leader of currency issuance, but also a strong endorsement of the currency management system. Bitcoin is a currency management system of blockchain technology, and all use values and prices come from consensus.

secondary title

Will DCEP replace Bitcoin?

The answer is obvious, no. The reason is simple. As a legal currency, DCEP and Bitcoin belong to different levels and have different missions to be accomplished, so there is no absolute competition between them.

DCEP is RMB, it is a legal currency, its price is equal to its face value, and it will never fluctuate, so there is no value for speculation. This difference prevents DCEP from being directly compared with Bitcoin, which is known as "digital gold". , There is no such thing as DCEP replacing Bitcoin. Here, the encryption notebook reminds everyone that DCEP will not have any effect on improving the currency price in the short term. Many altcoins that claim to have cooperation with DCEP or cross-border finance are also trying to cut leeks. Please stay vigilant.

Although DCEP cannot replace Bitcoin in terms of value, it does not mean that DCEP has no impact on Bitcoin, and it may even pose a major challenge to Bitcoin.

One of the most notable features of DCEP is its centralized management, which runs counter to the decentralized Bitcoin. Although DCEP will also adopt a blockchain decentralization mechanism like a private digital currency, the issuance of DCEP will still adopt a "centralized" approach to control the direction of monetary policy serving the real economy and to prevent financial market volatility risks The method is to issue and control the central bank in a unified manner.

"Existing banknotes and coins are expensive to issue, print, return, and store. The circulation system has many layers, which is inconvenient to carry, easy to be forged, anonymous and uncontrollable, and there is a risk of being used for illegal and criminal activities such as money laundering. There is a need to go digital". This is one of the core reasons for the birth of the central bank's digital currency. By monitoring data and flow, it is more helpful for the central bank to carry out precise supervision and regulation, and to combat illegal and criminal activities such as money laundering. Although DCEP generation has inherent anonymity, encryption and decryption are monitored by the Chinese government according to law, and true anonymity does not exist.

Given that the ethos of Bitcoin is almost diametrically opposed to that of DCEP, it raises the question of whether China might try to suppress Bitcoin in order to promote the use of its own digital currency. Bitcoin investment currently has no clear legal basis to prove its legality in our country, and the Chinese government has historically taken a negative attitude towards this cryptocurrency, promoting the phrase “blockchain not Bitcoin” and banning all cryptocurrencies related to cryptocurrency in 2017. Transaction-related websites.

secondary title

Coexistence of BCEP and BTC

Fortunately for Bitcoin advocates, Chinese Bitcoin miners already dominate the Bitcoin network’s hash rate, and a complete ban on cryptocurrencies would be counterproductive, as it would remove China’s means of control over cryptocurrencies. For the digital currency market, only compliance and regulation can usher in good development opportunities.

A country can't actually ban Bitcoin. Taking a step back, DCEP would not have been born without Bitcoin. However, its centralized digital yuan is so different from Bitcoin that the two are likely to coexist rather than compete directly.

This article only represents the personal views of encrypted notebooks and does not constitute any investment opinions or suggestions.