secondary title

What is hedging?

Hedging transaction means to carry out multiple transactions related to the market at the same time, in the opposite direction, and the profit and loss are balanced. A successful hedging transaction must meet the following two points:

1. No matter whether the market goes up or down, there will always be people who make money and lose money

2. Even after break-even, still make money

This sounds abstract, so let me give you an example:

A trader is a believer in ETH, long-term bullish on ETH, but in order to avoid taking too much risk, while long ETH, also short EOS in the same position.

Because the prices of mainstream currencies move in the same direction most of the time, when the market rises, the long position of ETH will make money, while the short position of EOS will lose money, and the opposite will happen when the market falls. When it falls, there is always a side of making money and losing money at the same time.

2020/10/1:ETH=$359.6、EOS= $2.58

2020/10/23:ETH=$415、EOS= $2.64

Assuming that the trader started to build a position on 10/1/2020, and at the same time long ETH and short EOS, both positions are $1,000, and on 2020/10/23, what is the total profit and loss of these two positions?

Position profit and loss are calculated as follows:

ETH long order profit and loss: $1000*(415-359.6)/415= $133.5

EOS empty order profit and loss: $1000*(2.58-2.64)/2.58= -$23.3

Total profit $133.5-$23.3= $110.2

After calculation, in 23 days, the profits and losses of the two positions were offset to earn $110.2, which is a successful hedging transaction.

The trader's wishful thinking is - as time goes by, ETH will only become more and more valuable relative to EOS. If the overall market rises, ETH will rise more than EOS, and if the overall market falls, ETH will fall more than EOS This is equivalent to shorting the EOS/ETH trading pair for a long time.

There are many variations of a similar strategy:

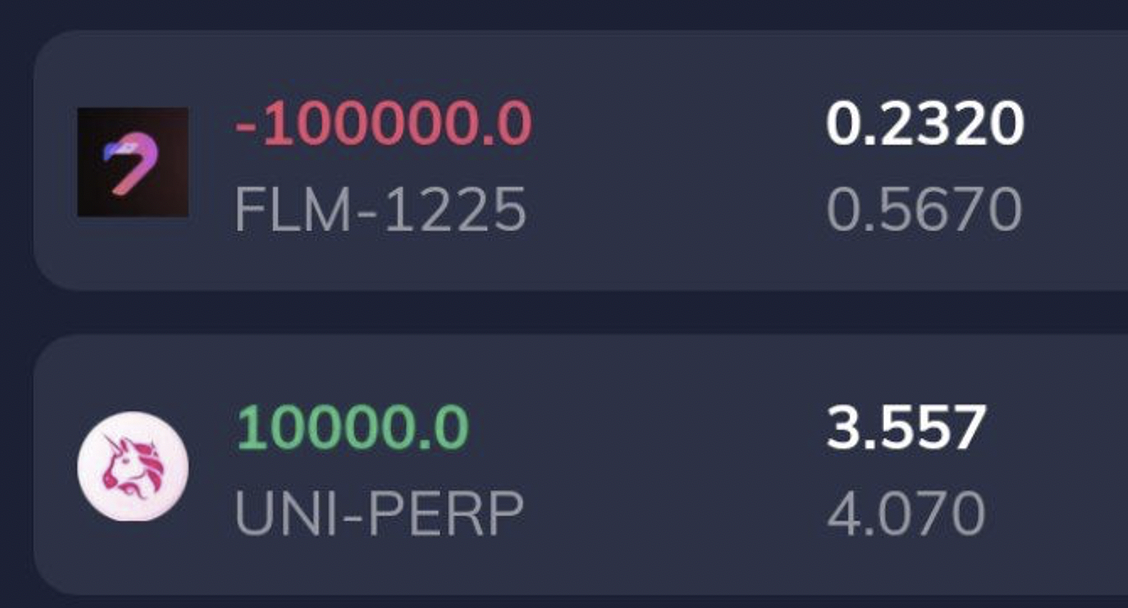

A trader believes that Uniswap will continue to dominate the DEX field, so he chooses to be long UNI and short SUSHI at the same time

A trader believes that the fork of BTC has no possibility of success, so he chooses to long BTC and short BCH

A trader thought that after OKEX’s thunderstorm, OKEX’s market share would shrink rapidly, while other exchanges would benefit, so he chose to be long EXCH (platform currency index) and short OKB at the same time

The advantage of hedging trading is that there is no need to guess the market ups and downs, as long as the core logic of the transaction is correct, there is a chance to make money.

Not long after the order was placed, the DeFi sector fell sharply, but because UNI fell relatively less, it still made a profit after balancing the profit and loss.

secondary title

The key to successful hedging trading

The key to the success of hedging transactions lies in the correlation of asset prices in operation, which means that the direction of asset price changes must be generally consistent, so as to reduce the risk of transactions. No matter how the market goes, there will always be some positions that are profitable .

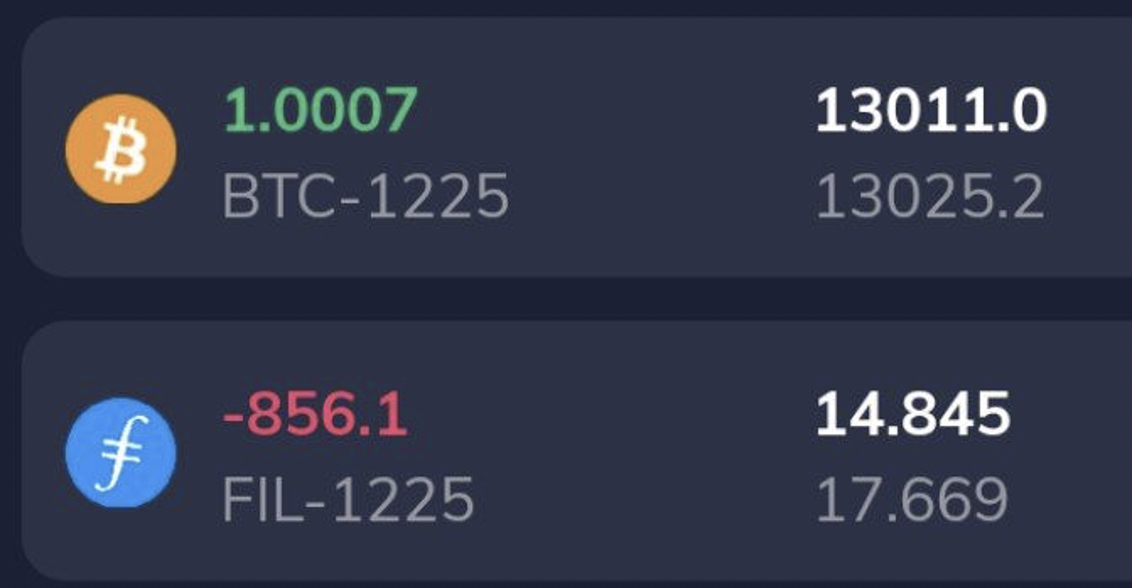

Applied to the currency circle, it is best to choose the currency of the same sector for hedging, because the currency of the same sector rises and falls in the same direction (the three examples mentioned above are all in the same sector), if no suitable target is found, The next best thing is to use BTC as a panacea, because all currencies in the currency circle have to look at the face of BTC. It can be said that all prosperity and all losses.

As a result, because FIL was too wasteful, BTC only pulled back slightly, but FIL had already released the flood, so the profit of short orders was much greater than the loss of long orders.

secondary title

Why choose FTX for hedging transactions?

FTX is currently the most suitable exchange for hedging in the entire currency circle. There is no one. There are 6 main reasons:

1. Trading is multi-to-many, with both perpetual contracts and delivery contracts, and the listing speed is extremely fast

2. Various index products (platform currency index, DeFi index, privacy currency index, etc.) are available, which is convenient for sector hedging

3. The cross-margin mode, the profitable position can make up for the loss of other positions in time, reducing the risk of liquidation, especially suitable for hedging transactions

4. Provide a variety of margin options

5. Built-in stylized trading module - Quant Zone, which can write various hedging strategies

If you haven't registered FTX yet, welcome to use the author's referral link:https://ftx.com/#a=BensonTW, in addition to the permanent 5% handling fee discount, you can also get an additional $25 handling fee discount coupon.

, in addition to the permanent 5% handling fee discount, you can also get an additional $25 handling fee discount coupon.

If you find my articles helpful, you are also welcome to subscribe to the author's Telegram channel: https://t.me/BensonTradingDesk, I will push articles on the channel as soon as possible.

secondary title

FTX Deposit Eventhttps://help.ftx.com/hc/zh-cn/articles/360051419571By the way, just recently, FTX held a recharge event: