There is no doubt that DeFi is an explosive use case for blockchain.

In just three months, the total asset value locked in DeFi protocols has grown tenfold from $1B to nearly $10B. Yield Farming (Yield Farming) has greatly promoted the vigorous development of this trend, allowing a new project to attract hundreds of millions of dollars in liquidity in just a few days of being online. Perhaps nowhere is this more evident than when you swipe through Crypto Twitter and see a screen full of meme terms about DeFi — SUSHI, YAM, and PASTA are just a few of them.

Without further ado, the industry has come a long way since the CryptoKitties craze. Instead of relying on virtual cats to grow up, we will create a brand new financial system from scratch, a financial system that is completely owned by users, does not require permission and is extremely anti-fragile. However, all the progress at the application layer contrasts sharply with the lag at the protocol layer. These revolutionary DeFi applications all run on the same blockchain that was clogged with virtual cats in late 2017.

secondary title

Waiting for ETH 2.0

During the past two years of a deep bear market, the need for blockchain scalability seemed remote, and waiting for ETH 2.0 seemed like a safe bet. After all, highly scalable ETH 2.0, which relies on sharding and PoS, is only a year away from its planned delivery. But the delivery time was delayed. And it was postponed again. Therefore, today's situation has also been formed.

As the total value locked TVL in DeFi protocols has increased tenfold, the average gas fee has also increased from 10 Gwei to 100 Gwei. On the one hand, high fees show that Ethereum has achieved a good product-market fit. If users are willing to pay high fees to use the Ethereum network, the demand does exist. On the other hand, if gas fees rise further, most users will have to give up using the network.

The recent congestion caused by the transaction peak on Ethereum can provide us with a reference. On Sept. 2, gas fees on Ethereum reached an all-time high of 480 Gwei, meaning a basic ERC-20 transfer transaction costs about $10, not to mention more gas-guzzling DeFi transactions.

This may just be the beginning. If DeFi grows another tenfold (seems likely), the average gas fee could be as high as 1000 Gwei.

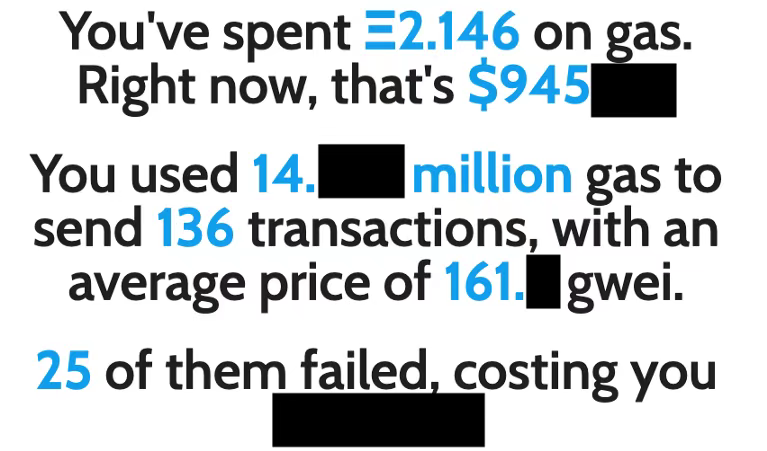

image description

Anonymous Ethereum user's miner fee payment within 7 days. Watch out for up to 25 failed trades!

For users who cannot afford to pay thousands of dollars in transaction fees, waiting is no longer an option. DeFi has made a claim to scalability…. But what if I told you right now that you don't have to wait any longer?

secondary title

Harmony is ETH 2.0

In 2018, Harmony started to solve the scalability problem of the protocol layer and independently developed an architecture similar to ETH 2.0. After 2 years of intensive development, we launched our mainnet with features including: sharding, delegation, EVM compatibility, $0.000,001 transaction fees and 5-second instant finality.

It can be said that we can completely match ETH 2.0.

secondary title

Harmony's DeFi Hackathon

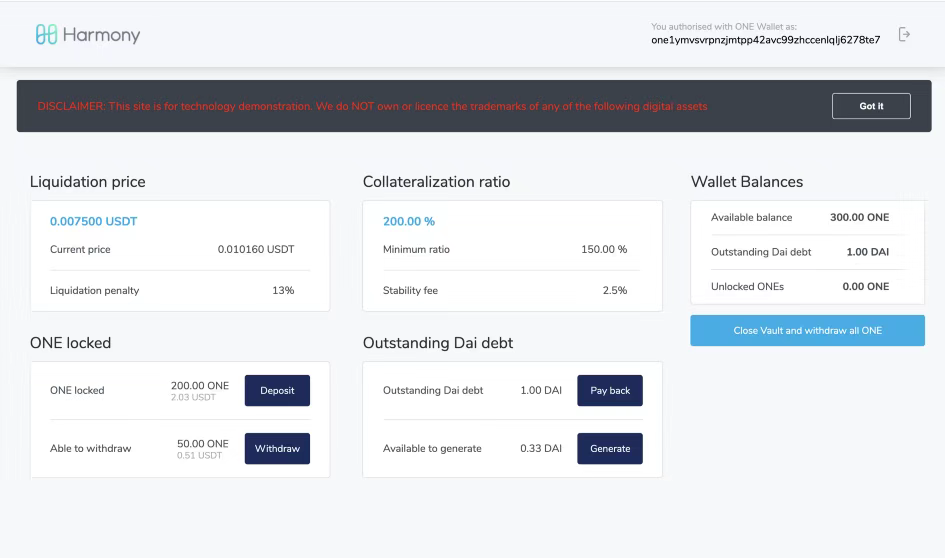

image description

Harmony MakerDAO user interface.

We forked the smart contracts of the original project, deployed them on the main network, built the front end and shared it with the community for product testing. The results speak for themselves.

First, our hackathon showed how easy it is to port smart contracts from Ethereum and deploy them on Harmony. Other than the required changes to the deployment and wallet interface, the Solidity code can be fully deployed with no other changes.

Second, our products also exhibit huge performance differences. 5 seconds to close the transaction is no longer a joke. I'm used to doing other things while waiting for Uniswap trades to settle, so seeing swaps settle instantly on Harmony Curve was incredible.

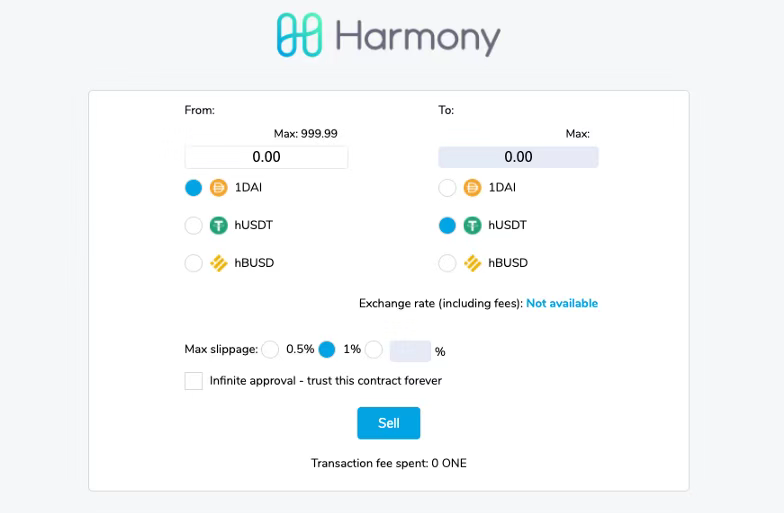

image description

Harmony Curve page

Thirdly, and most importantly, we demonstrate the potential for significant cost savings for users. After getting used to the fact that DeFi applications are slow and expensive, the sense of use of Harmony-based DeFi applications can be said to be very similar to the Web 2.0 experience—high speed and almost free.

I compared Balancer on Harmony to Balancer on Ethereum. Also inject funds into the liquidity pool as a user who is trading for the first time. The entire process requires the completion of 3 transactions, the first two transactions grant access to assets in the pool, and the third transaction adds assets to the pool. Here are some stats:

Joining a Balancer liquidity pool on Ethereum takes 16 times longer than on Harmony, and costs nearly 700,000 times less.

secondary title

What makes sharding unique

One comment we got was that Harmony's low cost was temporary because there weren't many users yet. In other words, if the current DeFi ecosystem migrates to Harmony, high miner fees are inevitable, and it is only a matter of time.

It is true that gas fees on Harmony will increase as more users join, but our sharding architecture solves the fundamental problem behind high gas fees: limited block space.

For any non-sharded blockchain like Ethereum, the supply of block space is fixed. This means that as more users join, you will be forced to compete with them for a fixed amount of transaction space, driving up gas fees. A sharded network like Harmony can increase block space by adding more shards. Therefore, if the gas fee continues to rise, it can be brought back to normal levels by adding capacity.

secondary title

Yes, we built a bridge!

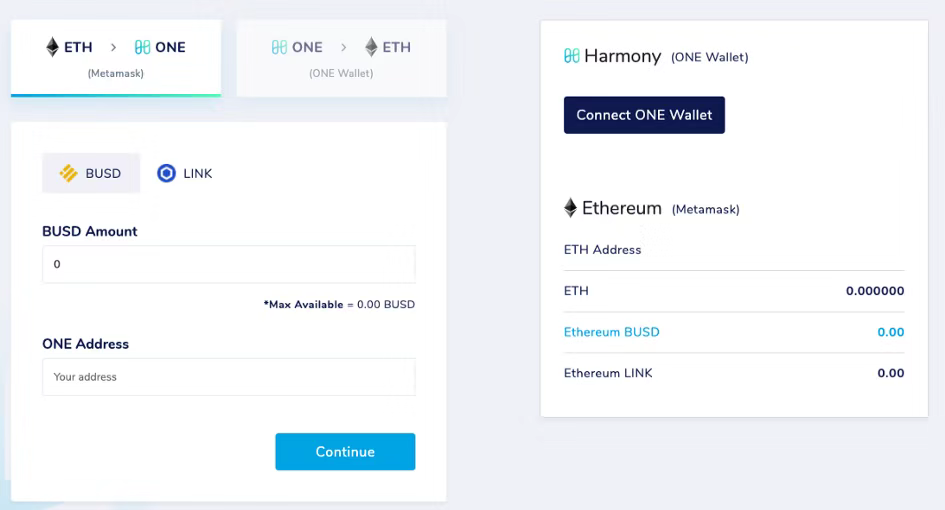

DeFi does not exist in a vacuum, it needs the assets of the entire ecosystem for transaction lending. In order to promote the development of Harmony's DeFi ecosystem, we have built a bridge to migrate ERC-20 assets on Ethereum to HRC-20 assets on Harmony.

image description

secondary title

Why is it indispensable

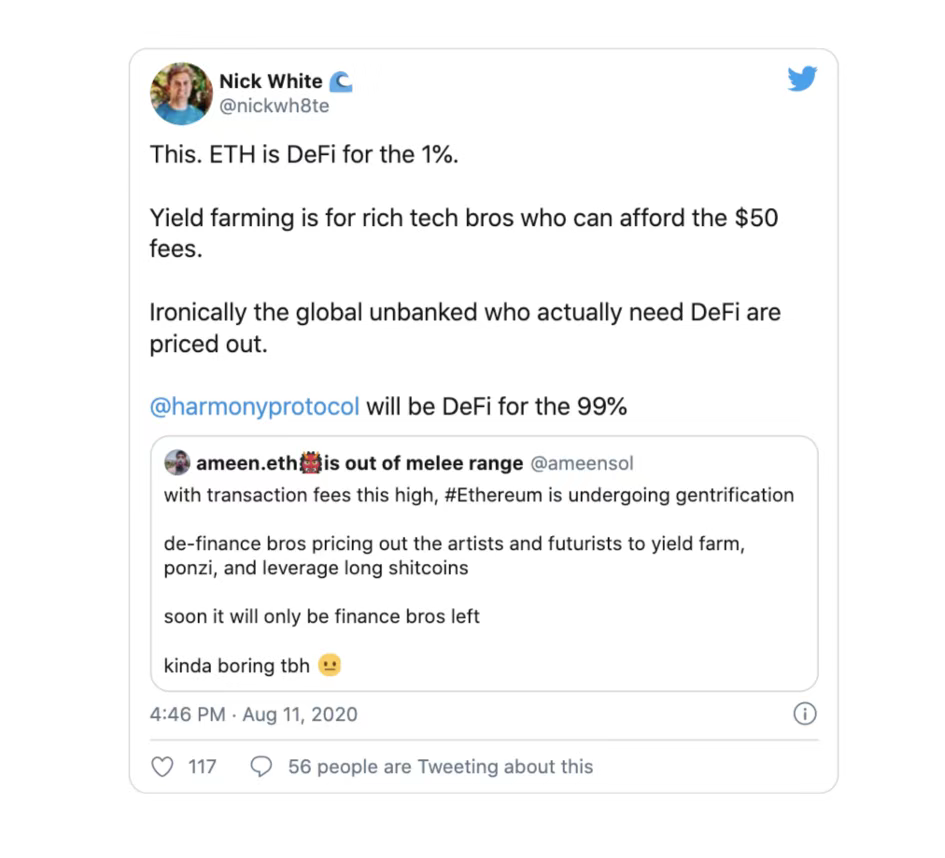

As the application scenarios and users of the DeFi protocol continue to increase, the miner fee will also continue to rise, leaving only room for the least cost-sensitive players—only "whale" level players can afford high costs, which will make ordinary Users stay away. This runs counter to the original intention of DeFi as an open financial system.

As much as DeFi proponents promote the idea of "no banks", they forget that the people who need DeFi most are those who do not have access to financial services-they can't afford $1, let alone $50 up.

secondary title

BUIDL on Harmony

our

ourEcological Fund Provides Over $7M in Grants to Developers Like You, there are already 12+ grantee projects being developed on our network. We look forward to your joining.