The DeFi ecosystem continues to evolve. In the last quarter of the first year of the DeFi outbreak in 2020, we saw another evolution: a step forward in the free market for decentralized lending.

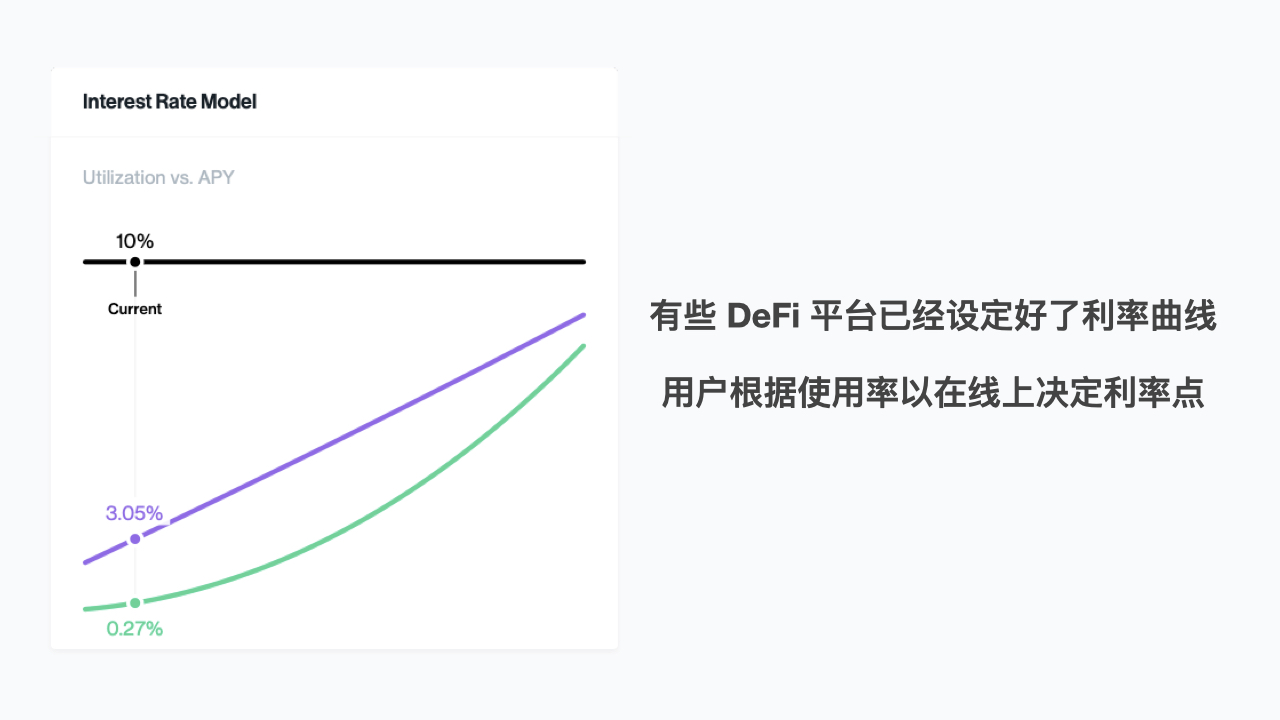

What is decentralized lending in the free market?In the early days of MakerDAO, the lending rate was determined by the team. On the Compound platform, the lending rate curve was determined by the team. From completely passive acceptance, users choose a point on the fixed interest rate curve, and the free game elements of the market begin to integrate into it. But this is still a long way from traditional finance where market participants completely let market participants decide on lending rates.

When the platform side adds restrictions in the lending market, the market cannot find a reasonable lending rate.The previous design of the platform limited the performance of the blockchain main network, so it was necessary to build a "simplified" version of the lending platform. At present, Uniswap, the most popular cryptocurrency exchange on Ethereum, is a "swap" rather than an "exchange" to be precise. It builds applications on the limited performance of the main network. The experience will reduce the platform function.

With the enhancement of blockchain performance, is the lending rate ready to return to free market pricing?The recently launched Vigor, a decentralized lending platform based on EOSIO, deserves attention. His founder, Andrew Bryan, has worked on Wall Street for more than 20 years. He has worked in Credit Suisse Investment Bank, Harvard Management Company and several hedge funds. His solution: algorithm! Andrew introduced Wall Street's most cutting-edge financial engineering algorithms into the platform. Based on the concept of traditional finance, he has made a completely free lending platform. The platform does not set lending rates or lending curves, allowing users to set prices freely and discover real ones through free market activities. The lending rate, as we mentioned above, leaves the pricing power to the free market to decide.

From MakerDao's platform pricing, to Compound's selective platform pricing, to Vigor's completely free market pricing, the change of active and passive pricing power of lending interest rates is the step-by-step evolution of decentralized lending.At present, traditional financial professionals have not yet stepped into the "half foot". Traditional financial institutions are still in the research period of cryptocurrencies. The attention of financial institution executives is still on the large transactions of large customers. Most institutions just arrange internships I spend part of my life doing blockchain research. Most of the Wall Street elite's assets are allocated to cryptocurrencies at most 0.5%, and they are rarely mentioned in social situations. Interestingly, Andrew also revealed that the Harvard Management Company, which manages the Harvard Endowment Fund, actually allocates and trades Bitcoin.

It can be seen that the traditional financial elites have not yet "attended" the field of encrypted assets, that is to say, there is no real competition for the regular army to enter the field.At this stage, perhaps the decentralized financial model driven by non-market factors can still survive, but it is definitely not a long-term solution.