Throughout this year's DeFi market, YFI and YFII can be regarded as the most industry-leading and representative projects, not only because of their hundreds-fold increase, but also because of their huge contribution to the DeFi operation mode and type, which greatly reduces the number of users. The threshold for participating in DeFi, while bringing higher returns to users, also brings higher liquidity to the industry.

Although the bubble of the explosive growth of the DeFi bull market has now burst, the story of DeFi is not over. Its development logic and market space have been fully verified by the market, and there will still be more high-quality projects growing in the DeFi ecosystem. Come out to help users obtain better quality decentralized financial services with lower barriers to entry, while creating more wealth effects.

Especially in the decentralized asset management agreement aggregator track represented by YFI, since the value capture mechanism of such projects is based on mainstream lending products, no matter how individual lending projects rise or fall, the asset management agreement can be built from scratch. It captures its value in all lending products and helps users obtain better lending rates.

In the future, the decentralized asset management agreement is likely to evolve into an asset flow entrance and fund precipitation platform in the DeFi field, further amplifying its strategic value and status.

Therefore, even when the DeFi boom is declining, there are still a steady stream of aggregator projects emerging in the market, such as Plouto, which has injected more confidence into the DeFi market.

It is understood that Plouto is an open decentralized digital asset management protocol, which connects digital currency investors and asset managers, and helps investors choose their own investment strategies according to their own risk preferences in a decentralized manner, realizing the realization of digital assets. appreciation.

The biggest feature of this project is the concept of an open treasury. In addition to standardized investment strategies, third-party asset managers and project parties are allowed to develop their own agreements and strategies, which are not managed by Plouto DAO, which can provide users with richer investment options. and potential earnings.

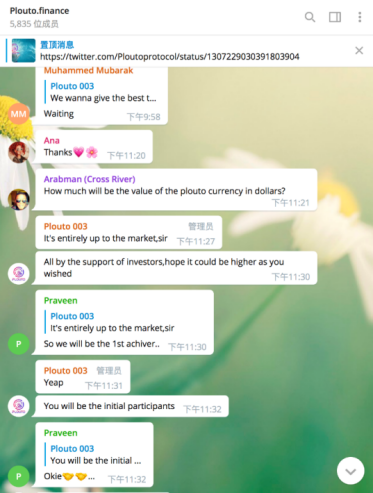

image description

A Telegram community of Plouto

In terms of the innovation of the business model, according to Plouto’s official Twitter introduction, the project creatively proposes the concept of an open vault on the basis of the regular treasury model of the asset management agreement, so that third parties do not need to redesign the asset strategy from the code layer, and can directly Quickly create your own asset management strategy on this protocol, especially when new underlying assets are born, which can help investors respond to market changes faster and enjoy the early mining dividends of emerging projects.

In addition, referring to the project roadmap announced by Plouto in overseas media, the project clearly will launch the function of cross-chain asset management in the future, that is, not only limited to the underlying assets of DeFi in Ethereum, but may also support Polkadot and other ecological underlying assets in the future Assets, which will undoubtedly stimulate the enthusiasm of the DeFi market on a larger scale.

In terms of the effectiveness of community governance, the Plouto project has also designed a complete decentralized governance mechanism, the code is open source, and the founding team was responsible for governance in the early days out of security and efficiency considerations. After that, it gradually transitioned to decentralized governance. PLU users can participate in major community governance matters such as electing administrators, reviewing/opposing/approving investment strategies, and whether to issue additional PLUs.

At the same time, according to foreign media reports, Plouto adopts the current popular and fair token distribution strategy. All tokens are 100% based on contribution distribution, and all are generated through pledge and liquidity mining. There is no private placement, no pre-mining, and no team distribution. The total circulation is 300,000, which further ensures the effectiveness of the project's decentralized governance mechanism.

It is reported that the Plouto project plans to officially start liquidity mining on the evening of September 26. Users can participate in mining through mainstream assets such as USDT and USDC. Considering the innovation and influence of the project, it is expected that a large number of users will participate in mining , It is possible to set off another upsurge in the DeFi market.

As for whether Plouto can become the next YFI-style project, Plouto still needs further testing from the market, but the DeFi innovation it has demonstrated has left a deep imprint on the industry and will help further promote the vigorous development of the DeFi market.