Editor's Note: This article comes fromBabbitt Information (ID: bitcoin8btc), Author: Fang Qinyu, released with authorization.

Editor's Note: This article comes from

Babbitt Information (ID: bitcoin8btc)

Babbitt Information (ID: bitcoin8btc)

The hot spot in the currency circle today belongs to Uniswap, which is beyond dispute.

Under the siege of SushiSwap and its imitators, Uniswap no longer swallowed, and finally issued its own token UNI.

The total amount of UNI is 1 billion, 40% is reserved for the team, investment, etc., and 60% is shared by the community - a quarter of which, 150 million, is airdropped to users, and three quarters are mined through liquidity. way to release.

"UNI said, I issued coins today, and gave a red envelope of 10,000 yuan to all the bosses who have taken care of the business before!" The community is boiling. Today is also a carnival day for UNI holders.

secondary title

I lost money by speculating on coins, but I made money with UNI

This wave of UNI airdrops is called "big wool" by investors. According to UNI’s airdrop plan, 15% of the airdrops will be allocated to Uniswap LPs, users, SOCKS redemption and holding users before September 1, of which 4.29% will be allocated to early LPs, and 10.06% will be allocated to 250,000 early users. Any address that has passed the Uniswap v1 or v2 contract can apply for 400 UNI, including 12,000 addresses that have been called but failed.

After Uniswap announced the issuance of the governance token UNI, centralized exchanges quickly launched UNI, while HBO (Huobi, Binance, OKEx) and Coinbase announced their launch on this day, which is of great significance and refreshed the launch of DeFI on large centralized exchanges. The speed of the currency can be called a milestone.

This also allows UNI to circulate in the secondary market very quickly. As of press time, data from coingecko shows that the highest price of UNI has reached $4.08 per piece, and the current price is $X per piece, an increase of more than 200% compared to the initial price at the opening.

A Fu (pseudonym) said that he received 400 UNI today, worth about 9,000 yuan, and he has sold them all. "Because I wanted to experience DEX, I signed up for Uniswap. As a result, I lost 1.5 (worth about) Ethereum." .In short, as long as you don’t speculate in coins, you’re really making money, and as long as you speculate in coins, you’ll be cut off.”

Afu experienced Uniswap around August 17. At that time, the unit price of Ethereum was about 3,000 yuan. Excluding Afu’s investment losses and handling fees, there was still a small profit for prostitution of UNI.

As long as the airdrop conditions of UNI are met, the same person can receive it repeatedly. Therefore, there is a joke: those who issue counterfeit currency on Uniswap can maximize their benefits in this airdrop, because these people have multiple wallet addresses.

In addition, according to Ethercan.io, the first address that received the most airdrops this time received about 1.15 million UNI, and the second place received about 910,000 UNI. At present, there are many transactions with a transfer amount of 400 UNI sent to Binance.

It should be noted that at 20:00 tomorrow night, Uniswap will start liquidity mining and open 4 initial liquidity pools ETH/USDT, ETH/USDC, ETH/DAI, ETH/WBTC, and each pool will contribute to LP allocates 5,000,000 UNI, 54 UNIs per pool per block, and these UNIs are not subject to vesting (cash out) or locking.

This means that more UNI will flow to the secondary market at that time. Today's 15% is just the beginning. Will UNI be just a flower blooming and a raging fire cooking oil?

secondary title

The SUSHI community is divided into two factions

There is an intriguing condition for receiving UNI, that is, users who have operated on Uniswap before September 1 can receive it. Therefore, some people interpret it as the issuance of UNI is a positive confrontation initiated by Uniswap against SUSHI.

However, SushiSwap did not appear on September 1st, but the popularity of SushiSwap rose sharply after September 1st, and the three major centralized exchanges listed SUSHI one after another on September 1st, and SushiSwap was lying on Uniswap on this day Vampire took away nearly $1 billion.

Perhaps September 1 does have a symbolic meaning. There is also YFI founder Andre Cronje who has a similar view. He tweeted that the birth of UNI may be in response to SUSHI: "This release of UNI is perfect in itself. It is a surprising release and review. But I Can’t help but feel like this release is just in response to SUSHI. Don’t let other people set the pace for you, go at your own pace.”

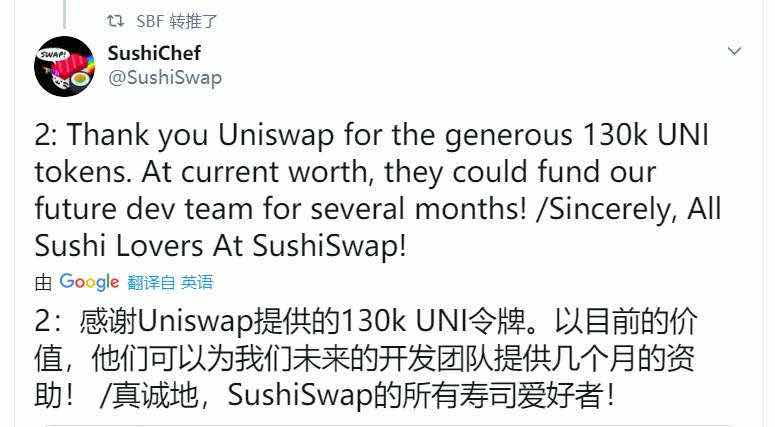

Interestingly, UNI, which was interpreted as being born against SUSHI, unexpectedly sent Sushiswap a sum of development funds.

Sushiswap, which claims to have no VC and no pre-mining, its founder NOMI’s limited fundraising channel is to sell developers’ shares, but NOMI returned the cash out funds last week under the pressure of public opinion, which made Sushiswap’s development team (on the surface) into Cooking without rice. This airdrop was a blessing to Sushiswap, and Sushiswap tweeted to celebrate: "Thanks to Uniswap for providing 130,000 UNI tokens. According to the current market price, this money can provide financial support for the Sushiswap development team for several months! Thanks to everyone 'Sushi' lover."

For the holders of SUSHI, they were split into two factions at the same time in the red envelope sent by Uniswap: fanaticism and sobriety.